My Sunny and Warm Tax Haven

After spending a few days recently in the warmth of Miami, I always wonder why I do not live in ...

Tax Planning Opportunities with QSBS – “Packing” & “Stacking”

Section 1202 – An Overview Previously, we’ve discussed the historical context, shareholder/corporate qualification requirements, and common shareholder issues faced by ...

The Powerful Tax Savings of “Qualified Small Business Stock”

IRC Section 1202 provides one of the most powerful tax benefits in the U.S. Internal Revenue Code (IRC) to entrepreneurs ...

Basics of Federal Estate, Gift, and Generation-Skipping Transfer (“GST”) Tax – 2024 Update

The bad news is that there is a federal transfer tax on assets that you give away during life, at ...

Understanding New York’s Estate Tax “Cliff” – 2024 Update

In 2014, dramatic changes were made to New York’s gift and estate tax law. For many clients, the subject of ...

2024 Federal & State Estate and Gift Tax Cheat Sheet

Here we have provided a “cheat sheet” to keep in mind for 2024 federal estate, gift, and GST exemptions, as ...

Estate Planning in Light of Current Law: Your Questions and Our Answers – 2024 Update

This post will help you consider estate planning strategies in light of the current federal estate, gift and generation skipping ...

Mitigate New York’s Estate Tax Cliff with Smart Estate Planning and Gifting Strategies – 2024 Update

While the large increase in the federal estate tax exemption has provided many with federal estate tax relief, New Yorkers ...

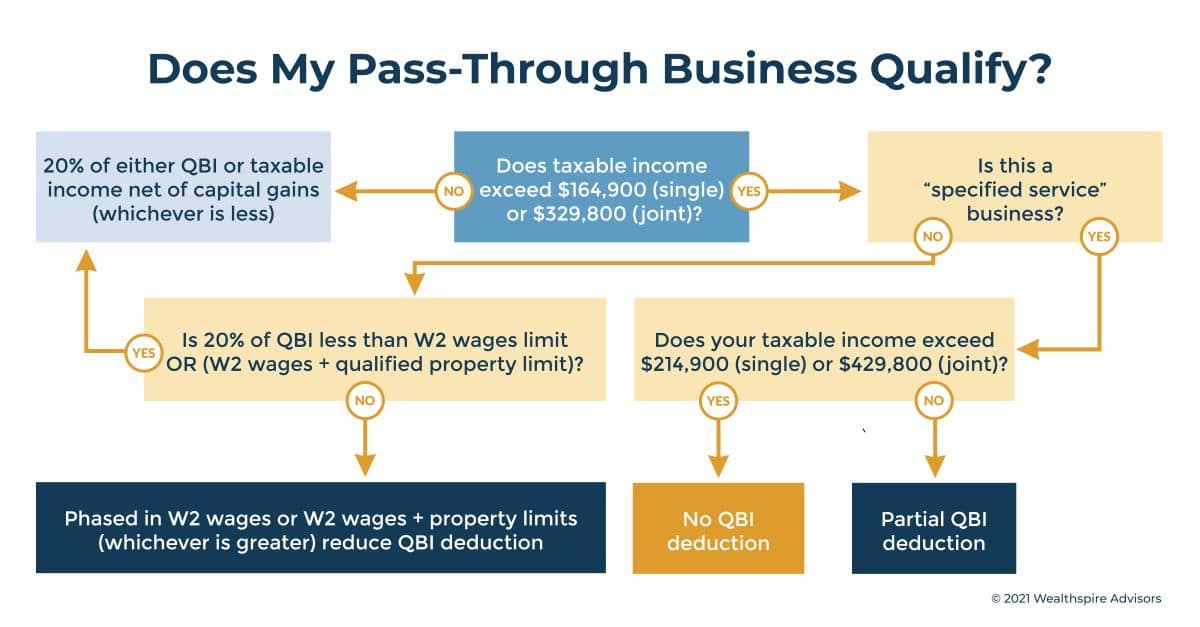

Qualified Business Income (QBI): Deduction May Create New Planning Strategies for Some Business Owners

The Tax Cuts and Jobs Act of 2017 introduced a 20% tax deduction focused on pass-through businesses. While the deduction ...