Section 1202 – An Overview

Previously, we’ve discussed the historical context, shareholder/corporate qualification requirements, and common shareholder issues faced by holders of Section 1202 stock, more popularly referred to as Qualified Small Business Stock (QSBS). IRC Section 1202 allows qualified shareholders to exclude from federal income tax the greater of: $10 million of realized capital gain, or 10 times the stockholder’s adjusted cost basis, upon the sale of QSBS in a calendar year. The requirements to qualify for this generous tax exclusion are numerous and should be discussed with experienced legal, tax, and financial advisory experts before any action is taken. As a brief refresher, below are the major shareholder and corporate requirements (each has important additional details to consider):

- Shareholder requirements

- Corporate requirements

- The ‘Qualified Small Business’ (QSB) must be a domestic C-corporation – and must be a C-corporation for substantially all of the taxpayer’s holding period.[iv]

- Aggregate gross assets of the QSB cannot exceed $50M before or immediately after the stock issuance. [v]

- The QSB must meet active business requirements and be a “qualified trade or business” – again for substantially all of the taxpayer’s holding period.

- This is generally satisfied if at least 80% of QSB assets are used in the active conduct of a “qualified trade or business”.[vi]

To better understand the tax planning opportunities available, it is helpful to look more closely at the actual wording of the greater of ‘$10 million / 10x Cost Basis’ exclusion under Section 1202(b)(1).

A Closer Look: $10 Million / 10x Basis Exclusion

Sub-paragraphs (A) and (B) of Section 1202(b)(1), which apply on a per taxpayer and per corporation basis, say that:

- “[the taxpayer’s eligible gain] shall not exceed the greater of:

- (A) – $10,000,000 reduced by the aggregate amount of eligible gain [realized in] prior taxable years and attributable to dispositions of stock issued by such corporation, or

- (B) – 10 times the aggregate adjusted basis of qualified small business stock issued by such corporation and disposed of by the taxpayer during the taxable year.”

The key phrases are italicized above. Sub-paragraph (A) says that the eligible gain is reduced by any gain taken in prior tax years, up to a maximum of $10 million. Therefore, once a taxpayer has excluded $10 million of realized gain in any year, he/she cannot exclude more gain (at least under sub-paragraph (A)! For this reason, the $10 million limit is often referred to as a cumulative limit. Taxpayers with very low cost-basis qualifying stock (i.e., founders shares) can find their gain exclusion limited by subparagraph (A).

- Example 1: John is the co-founder of an electric car company, founded in 2017. The company is a quick success as a competitor to cars dependent on gasoline and it ends up going public in 2022. After his six-month post-IPO lock-up expires, John sells some of his founder shares with $10,000 cost basis in 2023. Because 10x the cost basis of the shares sold is only $100,000, John is able to exclude only a maximum of $10 million of gain under Section 1202(b)(1)(A). If John sells more low basis shares in 2023, he can no longer exclude more realized gain.

Turning to sub-paragraph (B) from above, the important factor becomes the cost basis of the QSBS sold, and importantly, the total eligible gain is not reduced by any gain excluded in prior years. Sub-paragraph (B) is often referred to as an annual limit as a result. The cost basis of the stock sold is multiplied by a factor of 10, and if the product is greater than $10 million, the taxpayer can exclude that higher gain.

- Example 2: After selling founder shares with $10,000 cost basis in 2023, John decides to sell more shares the next year in 2024. He acquired these shares by exercising options in 2019 and paid $2 million upon exercise. John’s cost basis in the shares sold is $2 million, and he can exclude a total of $20 million of gain upon their sale in 2024 after holding them for five years ($2 million x 10 = $20 million).

It should be noted that for many successful company founders, shareholders, or early employees looking to utilize Section 1202 gain exclusion, their excluded gain will likely be maximized by the $10 million ‘cumulative limit’. Often, their total gain will not exceed $10 million so there is no additional gain to exclude. This is hardly a poor result! The remainder of this whitepaper discusses planning opportunities for those fortunate business owners with wildly successful companies and gains in excess of $10 million.

Maximizing the Cumulative Limit – “Stacking”

Because the cumulative $10 million limit applies on a per-taxpayer basis, a QSBS shareholder will need to create additional taxpayers to benefit from additional $10 million exclusions under subparagraph (A) of 1202(b)(1). This process of creating (or involving) additional taxpayers is referred to as “stacking”.

In general, the original QSBS shareholder must be the one to sell his or her shares to qualify for Section 1202 gain exclusion. However, some transfers, specifically gifts and bequests at death, are exceptions to this general rule.[vii] The recipient of the gift/bequest is considered to have the same cost basis and holding period as the transferor.[viii] Most importantly here for “stacking” purposes, the transfer must be to a separate taxpayer for federal income tax purposes. But the transfer need not be recognized as a completed gift for gift tax purposes. Whether the QSBS shareholder should make transfer(s) as a completed gift or not will depend on his/her estate planning goals, remaining federal gift and GST tax exemption, etc. Below is a (non-exhaustive) list of transfers that would qualify for additional cumulative $10 million limits:

- Individuals

- But not including the shareholder’s spouse[ix]

- Non-grantor Trust

- Incomplete Non-Grantor Trust (ING)

- Trust distribution to beneficiary other than grantor

Incomplete Non-Grantor Trusts (INGs) are self-settled asset protection trusts that can only be established in certain states (Nevada, New Hampshire, Alaska, etc.). INGs are useful for “stacking” purposes in the right situation, as they create an additional taxpayer as a non-grantor trust but are not considered to be a completed gift. Assets in INGs also typically avoid state taxation by the resident state of the grantor, though there are exceptions.[x] See the link above for more detail and frequently asked questions concerning INGs.

- Example 3: Recall John who sold some founder shares in 2023 with $10,000 total cost basis, allowing him to exclude $10 million of realized total gain that maximized his individual cumulative limit under Section 1202. Suppose that his remaining founder shares are transferred in 2022 to a New Hampshire ING Trust and also sold in 2023.[xi] The ING Trust is now able to exclude an additional $10 million of realized gain under its own cumulative limit.

Finally, note that absent from the list of transfers that allow for an additional $10 million cumulative limit is the intentionally defective grantor trust (IDGT), often considered the “bread and butter” of modern estate planning. The reason for this is simple: an IDGT does not create a separate taxpayer for federal income tax purposes (the grantor remains the taxpayer for the trust) even though the transfer itself is a completed gift for gift tax purposes.

Section 1202 and State Taxation

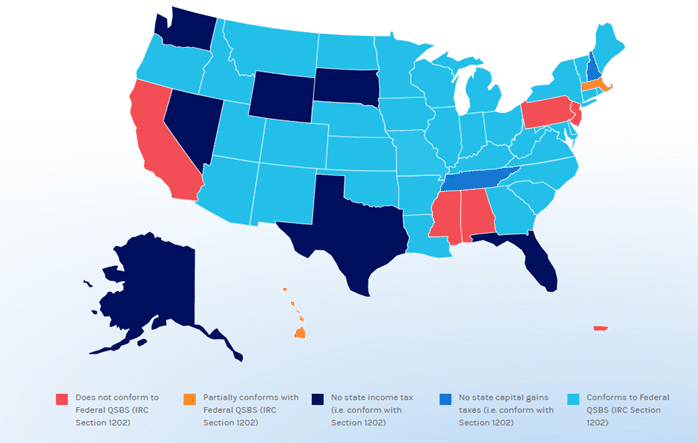

One other major concern involving “stacking” is the interplay of state taxes and Section 1202. Since Section 1202 is a gain exclusion applicable to federal income tax, each state must decide to conform with federal tax treatment, partially conform, or disregard federal tax treatment entirely. Fortunately, most states either fully conform to Section 1202, have no state capital gains tax, or have no state income tax at all. The exceptions are shown in light red/pink and orange in the graphic further below.[xii]

The non-conforming states include California, Pennsylvania, New Jersey, Alabama, Mississippi, and Puerto Rico. The partially conforming states are Hawaii, which offers a 50% Section 1202 exclusion from state tax, and Massachusetts, which has its own unique rules that, if met, will reduce the state capital tax rate applied to the gain from 5.3% to 3.0%.[xiii]

Source: QSBS Expert

Maximizing the Annual Limit – “Packing”

“Packing” refers to an intentional effort to increase cost basis of QSBS shares in order to receive a greater 10x basis annual exclusion per sub-paragraph (B) of 1202(b)(1). There are two main ways to accomplish this: (1) contributing cash or property in exchange for QSBS shares, and (2) selling both high-basis (non-eligible) QSBS in the same calendar year as low-basis (eligible) QSBS shares.

Contributing cash/property in exchange for QSBS shares works to increase cost basis specifically because those contributions are valued at their fair market value (FMV) on the date of the contribution.[xiv] It is important to note that any shares received as a result of the contribution would have their own new holding period. The contribution itself also needs to be done carefully in order to not exceed the $50 million aggregate gross asset test prior to and after stock issuance.[xv] Cash and/or property contributions can be useful for a business, originally structured as a partnership or S-corporation perhaps, that intends to “convert” to a C-corporation and contribute appreciated property. Of course, any such actions should be coordinated with qualified legal counsel.

Selling high-basis shares of any company in the same year as low-basis shares will intuitively increase the realized cost basis. However, why does this work to increase the 10x basis annual exclusion for Section 1202? It works because the 10x basis annual exclusion does not have to include only eligible QSBS shares held greater than five years.[xvi]

- Example 4: John would like to exclude more QSBS gain, but he already maximized his $10 million cumulative limit from prior sales. He now holds only founder shares from the company’s inception in 2017 with $10,000 of total cost basis and common shares with $2 million of total cost basis from an option exercise in 2023. He sells all his remaining shares the following year in 2024. John is able to exclude up to ~$20 million of QSBS gain as a result of increasing his basis of shares sold in 2024.

Conclusion – Order of Operations

Maximizing tax planning opportunities with QSBS is complex and should not be tackled alone. Coordination with experienced legal, tax, and financial advisory experts is critical. Every person will have different goals and objectives, and often the best decision in terms of tax minimization might not be the best decision when all factors are considered. Our role at Wealthspire Advisors is to help provide the objective guidance, organization, and expert coordination necessary to make sure your goals are truly met.