Jacob Even joins the team as SVP, Wealth Strategist – Tax Policy and Research

Jake joins the team with extensive knowledge and expertise in complex tax law. He specializes in advanced income tax planning, ...

5 Planning Steps to Consider Before Year-End 2022

As summer ends and we look toward the Fall, you should aim to maximize your opportunities to transfer wealth to ...

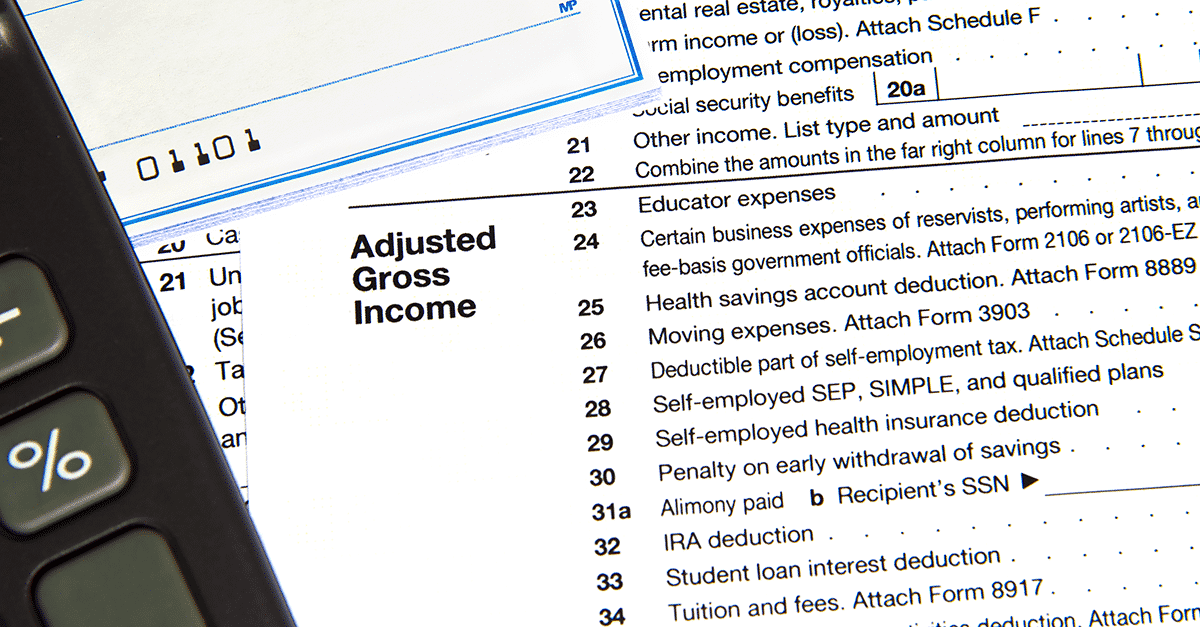

Adjusted Gross Income (AGI)

What Is Adjusted Gross Income? Adjusted gross income (AGI) is one figure used in the calculation of income tax liability. ...

Tax Proposals: Big Changes to Come

On November 3, the House Rules Committee updated the October 28 revised reconciliation bill for the Build Back Better Act – H.R. ...

Capital Gains

What are Capital Gains? Capital gains are the difference between a security’s purchase price and its selling price, when the ...