Financial Planning for Dentists: Navigating the Unique Challenges

In many ways, the dental profession is thriving and provides a rewarding career for entrepreneurs. Consider that the median pay ...

The Powerful Tax Savings of “Qualified Small Business Stock”

IRC Section 1202 provides one of the most powerful tax benefits in the U.S. Internal Revenue Code (IRC) to entrepreneurs ...

Tax Planning Opportunities with QSBS – “Packing” & “Stacking”

Section 1202 – An Overview Previously, we’ve discussed the historical context, shareholder/corporate qualification requirements, and common shareholder issues faced by ...

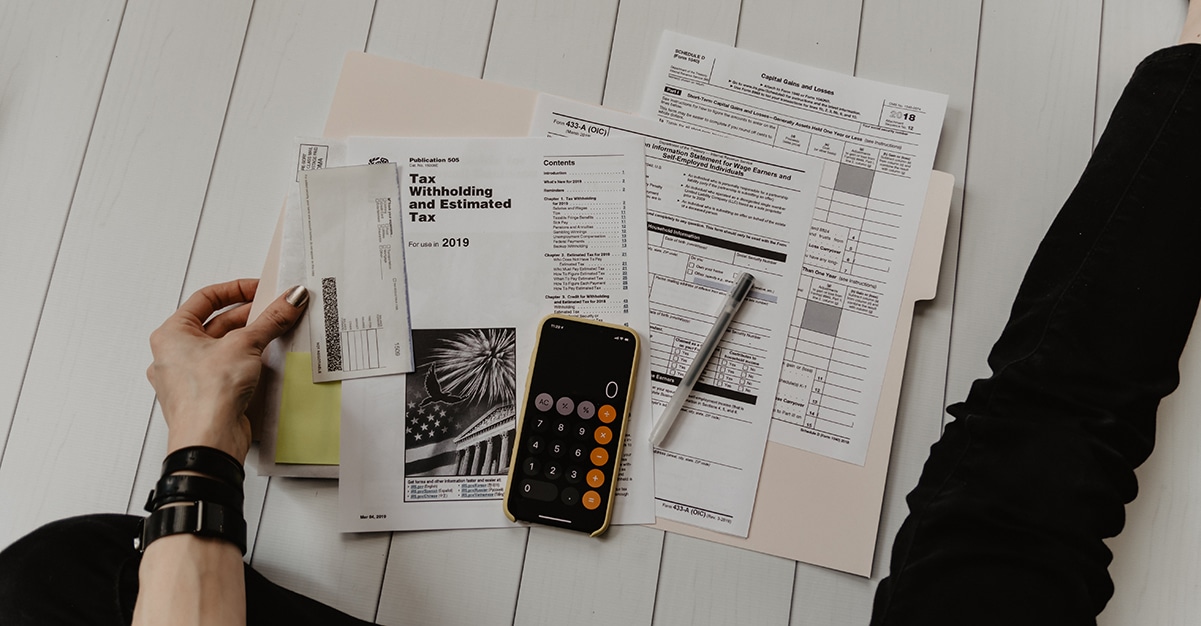

Qualified Business Income (QBI): Deduction May Create New Planning Strategies for Some Business Owners

The Tax Cuts and Jobs Act of 2017 introduced a 20% tax deduction focused on pass-through businesses. While the deduction ...

The Corporate Transparency Act: What Business Owners, LLCs, and FLPs Should Know

As we step into 2024, entity owners are facing a new regulatory landscape, significantly shaped by the Corporate Transparency Act ...

A “How To” Guide to Retirement Savings for the Self-Employed

In the past, I’ve received calls from clients who had already retired but decided to get back into the game ...

The Case for Exit Planning & Why I Earned My Certified Exit Planning Advisor (CEPA) Credential

In my wealth management practice, I focus on helping business owners and corporate executives achieve quality of life and financial ...

Brief Update: New Executive Order May Help Small Businesses

Last week, President Biden announced an executive order aimed at accelerating the country’s path out of the pandemic. There are ...

Paycheck Protection Program (PPP) and Employee Retention Credit (ERC) Updates

There has been an almost constant buzz over the past few weeks concerning various stimulus packages and potential tax code ...

Paycheck Protection Program (PPP) Loans: Round 2 Updates

The Small Business Administration (SBA) recently released more information regarding the second round of Paycheck Protection Program (PPP) loans as ...

Preparing to Sell Your Business: How to Optimize the Sale and Transition

We’ve worked with entrepreneurs over the years who have poured their hearts and souls into their businesses. And when the ...