Markets in 2 Minutes – April 2024

In the newest edition of Markets in 2 Minutes, Connor Darrell of the Investment Team discusses the relative attractiveness of ...

Markets in 2 Minutes – March 2024

In the newest edition of Markets in 2 Minutes, Emily Platt of the Investment Team examines the surge in credit ...

Markets in 2 Minutes – February 2024

In the newest edition of Markets in 2 Minutes, Emily Platt of the Investment Team reflects on the spike in ...

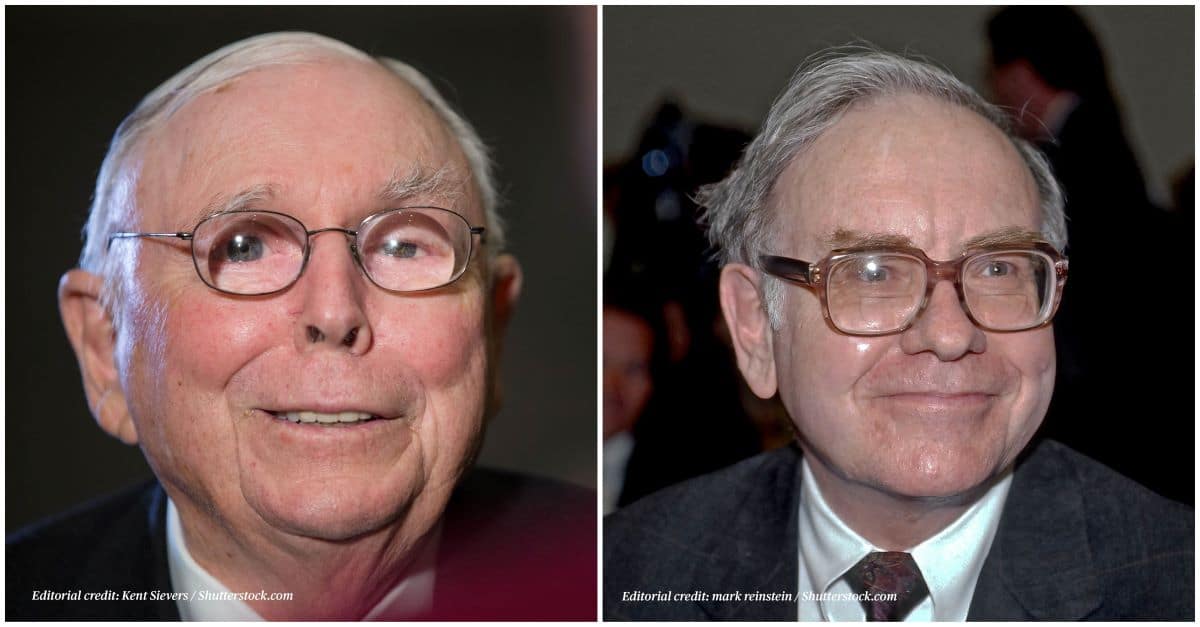

The Abominable No-Man and the Oracle of Omaha

The recent passing of Charlie Munger, Vice Chairman of Berkshire Hathaway, made us reflect on his and Warren Buffet’s successful ...

Winter 2024 Market Recap & Outlook

In our winter 2024 market recap and outlook, members of the Investment Team discuss what really happened in the markets ...

2023 4th Quarter Commentary: “A Welcome Return to Positive Performance”

Recap Last year was generally risk on in most asset classes, headlined by the S&P 500 up over 20%. Indices ...

2024 1st Quarter Commentary: “In a world drenched in pessimism, it pays to be optimistic.”

With so much emphasis placed on negative headlines, negative developments globally, and the ability to embrace one’s inner negativity, it ...