With so much emphasis placed on negative headlines, negative developments globally, and the ability to embrace one’s inner negativity, it oftentimes feels like it should pay to be negative. When it comes to investing, however, negativity rarely proves to be a winning formula.

The past 24 months have been an excellent test case of condensing an investment lifetime into a tiny window of pessimism. Investors continuously faced reports about bear markets, ever-rising inflation, deficits, the Federal Reserve rate hiking campaign, war(s), and fears around the rise of artificial intelligence (to name a few). Two years ago, we entered a time when more people Googled the word “recession” than in 2008 or March 2020, times when we were actually in a recession.

Yet, the S&P 500 Index returned 9.5% annualized from March 2022 through March 2024.

For better or worse, we live in an attention economy, and nothing captures attention like negative headlines or stories. Academics recently found that for an average length headline, each additional negative word increased the click-through rate by 2.3%. It becomes easy to understand why negativity proliferates.

The challenge for investors is that markets do not always coalesce around fear when given the benefit of time and patience. Case in point, during the last 30 years (March 1994 to March 2024), the S&P 500 returned 10.7% annualized. In the 30 years preceding that (February 1964 to February 1994), the S&P 500 returned an astonishingly similar 10.5% annualized.

Lest we think we live in unusual times, 1964-1994 was marked by the Vietnam War, Martin Luther King’s assassination, President Nixon’s resignation, departure from the gold standard, a Savings and Loan crisis, the three-mile island Nuclear Reactor meltdown, the Gulf War, Cold War, and Chernobyl (again, to name a few). The time was also bookended by two extraordinary events – the assassination of JFK in 1963 and the largest municipal bankruptcy on record until that point (Orange County in 1994).

If we transported back in time and optimized portfolios for all the things that could (or actually would) go wrong, we end up with a portfolio devoid of risk. Without the propensity for risk, an investor would’ve simply bought cash and forgotten about the other building blocks of their portfolio.

It also becomes too easy to find the reasons why not to invest, but just consider that in the last two years alone, the Nikkei stock index in Japan reached a new all-time high for the first time since 1989, U.S. gross domestic product exceeded $27 trillion, and foreign holdings of U.S. debt hit the highest ever despite expectations to the contrary. Perhaps the most important development is that savers are no longer being penalized. In the era of zero interest rates from 2009-2018, there was limited utility in placing money in a bank account or money market fund. Savers were not paid and there was little in the way of reward.

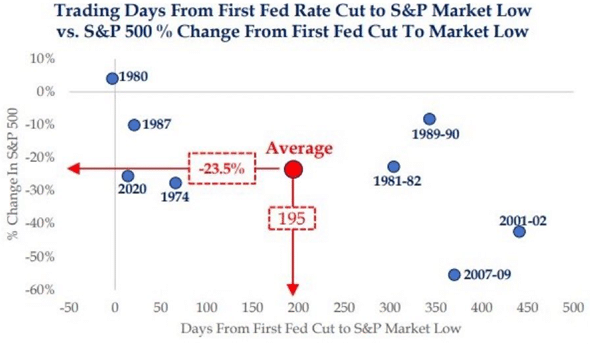

Which brings us to present day. It’s become commonplace for investors to sit around debating whether the Federal Reserve will or will not cut interest rates this year, with cheers for an interest rate cut growing louder on the belief that it will propel equity markets to further heights. Reality tells us something very different, though. Over the last 50 years, when the Fed has cut interest rates, it tends to be a function of concerns about the economy slowing or an indication that the financial sector is under stress. On average, the S&P 500 falls 23.5% over the 195 trading days after the first cut. Whether investors realize it or not, that outcome is perhaps not the one they are cheering for, and the swell of negativity is once again leading them down the wrong path.

Source: Barchart

On March 27th, famed economist, psychologist, and Nobel prize winner Daniel Kahneman passed away.

In his book, Thinking, Fast and Slow, Kahneman wrote, “Flawed stories of the past shape our views of the world and our expectations for the future. Narrative fallacies arise inevitably from our continuous attempt to make sense of the world.” Kahneman knew that investors were constantly searching for meaning in the little details of each day. That search for meaning leads investors to extrapolate even the smallest detail into an overarching narrative, one that is oftentimes grounded in concerns and worries about what comes next.

Does this ultimately argue for being blindly optimistic? No, but if we acknowledge the truths that Kahneman studied for decades, it can ultimately unlock an important advantage for investors – patience and resilience. Kahneman realized we are all human and the human predisposition towards negativity leads investors to emphasize loss avoidance above all else. In doing this, investors struggle to consistently hold the portfolio that allows for achieving one’s financial goals while avoiding reactionary pitfalls born from the constant drumbeat of negative news permeating our thoughts each day.

Markets

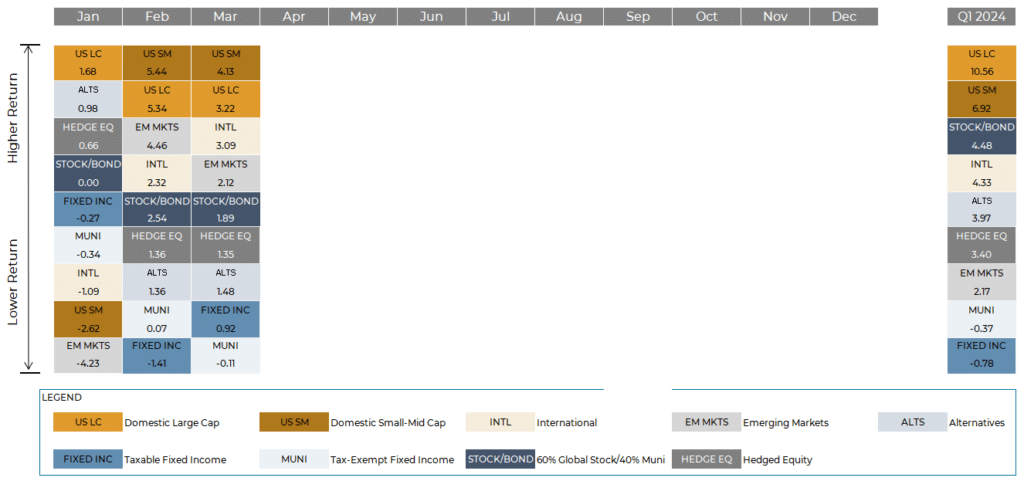

Source: Morningstar and Bloomberg Finance L.P. (data as of 3/31/2024)

- Equity markets carried forward the positive momentum from 2023 into the start of 2024. While the Magnificent 7 remained en vogue, there was divergence amongst the constituents for the first time in a while. Tesla and Apple, for example, encountered stumbles despite Nvidia, Amazon, and others still doing well. The fundamental picture is improving as earnings expectations were sliding lower in the first half of 2023 but have been on a steady path higher in the last nine months. Improved earnings prospects carried Small-Mid Cap (Russell 2500) stocks to a 6.9% gain.

- International markets fell behind the U.S. (developed +5.7%, emerging 2.1%). China in particular continued to struggle, though Brazil also gave back a portion of last year’s gains.

- Bond markets posted a mixed start for the year with rising interest rates acting as a headwind for higher quality bonds and tightening credit spreads serving as a tailwind for riskier segments of fixed income. Markets entered 2024 pricing nearly seven interest rate cuts from the Federal Reserve, though those expectations tempered quickly in February and March on strong labor markets and signs that the economy remained healthy. By the end of the quarter, markets priced fewer than three cuts for 2024.

- Alternative investments lagged stocks but beat bonds while riding the wave of improved risk appetite in the first quarter. Hedge funds generated positive performance, led by rising equity prices and strength in credit markets. Commodity markets ended the quarter mostly flat, though there was divergence among underlying constituents such as cocoa performing particularly well while areas like natural gas trended lower.

2024 1st Quarter Commentary: “In a world drenched in pessimism, it pays to be optimistic.”

With so much emphasis placed on negative headlines, negative developments globally, and the ability to embrace one’s inner negativity, it ...