Recap

Last year was generally risk on in most asset classes, headlined by the S&P 500 up over 20%. Indices tracking Small and Mid-Cap U.S. companies were up in the mid-high teens, while international equities ended the year at similar mid-teens returns. Growth stocks bested value stocks in the U.S., though not overseas. The risk on sentiment spilled over to fixed income where riskier fixed income (high yield, floating rate loans) outperformed “core” fixed income (treasuries, U.S. Investment Grade corporate bonds), though both segments finished up between 5-10%. Away from traditional assets, commodities fell, though significant dispersion existed within the likes of Crude (down -12%) and gold (+13%).

A Late Year Run

Most or all of the positive performance for traditional asset classes came in the last two months of the year. A late October Fed pause and the Treasury’s announcement of the makeup of future debt issuance were deemed to be favorable to risk assets, causing stocks to rise and bond yields to fall with the corresponding rise in bond prices. We had a good years’ worth of equity and fixed income performance during these last two months, leading a reasonable client to ask if we simply pulled forward returns from 2024 into 2023. When we think about forward returns, we normally start by looking at valuation for equities and starting yields for fixed income. Both suggest at least decent medium-term portfolio level returns. Within equities, outside U.S. Large Cap stocks, especially those growth stocks typified by the Magnificent 7, equity valuations are actually reasonable. Small Cap Price-to-Earnings levels (P/E) are below average and median levels for the last ten years (S&P 600 Small Cap current P/E of 16.3 vs. 10-year median of 25.1), as are international stocks (MSCI EAFE index’s 14.9 current vs. 10-year median of 16.3). Those Magnificent 7 stocks returned 107% in 2023, leaving their P/E level at a heady 35x earnings.

This time last year, we commented that there was finally yield and income to be had in fixed income. While yields fell from their October highs, they ended 2023 right where they started, leaving us optimistic that fixed income can continue, as in 2023, to be a robust contributor to a balanced portfolio’s performance. One word of caution – spreads in the riskier satellite fixed income (those same high yield bonds and loans) fell vs. the risk-free Treasury benchmarks last year, offering less of a buffer if the long-anticipated recession comes, leading to company bankruptcies and discounts on their bonds.

We previously remarked that each of 2020, 2021, and 2022 offered markets that were “unprecedented” in their own way and that the first half of 2023 was instead more normal. Was the S&P 500’s 2023 gain of 24% a continuation of this unprecedented run? Over the last 35 years, the S&P 500 has compounded at 10.6% per year. It may surprise most people that only six times (17%) in these 35 years has the S&P returned between 5% and 15%. Widen the range to 0% to 20%? Sill only 40% of the time. This is a point we have made before – markets seldom return the “average” – the bookends of exceptionally strong performance or negative performance are more the norm than the exception.

As with all year-end letters, we could point to plenty of potential storm clouds. We will certainly spill more ink on things that we know are coming – the 2024 elections, the path of inflation, and what is in store for the Federal Reserve – and we will likely come across other questions that we do not even envision at this point. But we want to end with an optimistic reflection regarding things closer to our core value proposition to clients and what we can control – tax-loss harvesting and access to investments.

We routinely seek tax-loss harvesting opportunities for our clients, both in the portfolio we manage as well as in the Separately Managed Accounts (SMAs) we recommend. A reminder that tax-loss harvesting is the process of rebalancing portfolios by realizing capital losses and replacing sold positions with similar but not identical securities to maintain desired allocations, subject to wash sale rules. By purchasing similar investments, you can still benefit when the markets recover. Some SMAs are specifically used for this purpose, while with others we actively ask our managers to seek out opportunities to realize losses. Beyond SMAs, our teams routinely look for tax-loss opportunities with the traditional mutual funds and ETFs our clients invest in. In a year like 2022, one would expect significant opportunities for realizing losses, which there were, but even in 2023, when most asset classes had robust returns, we and our SMA managers realized tens of millions of dollars of losses for our clients.

Regarding availability to investments, we point primarily to alternative investments in private equity and private credit where access has radically improved over the past decade. Strategies and managers historically only accessible by the largest institutions are now more available to many of our clients. While regulators still mandate minimum net worth requirements in many cases, asset managers are increasingly developing new products for wider audiences. To be clear, there are many reasons why such investments may not be appropriate even for those who are allowed access (complexities, uncertainty of cash flows, tax reporting, to name a few), but the fact that institutional quality solutions are more readily available is a positive going forward.

To recap, most client portfolios finished 2023 with decidedly positive performance. We begin 2024 with reasonable equity valuations in most areas and more typical fixed income yields which provide the basis for constructive portfolio returns. While we are conditioned to not be alarmed by the unprecedented or get off plan because of it, we will be happy with the long run expected returns of our blended portfolios. Most financial plans can be accomplished with the average, and though we know the average is rare in any given year, time, rebalancing, and sticking to a plan have a good track record of reaching the intended destination.

Markets

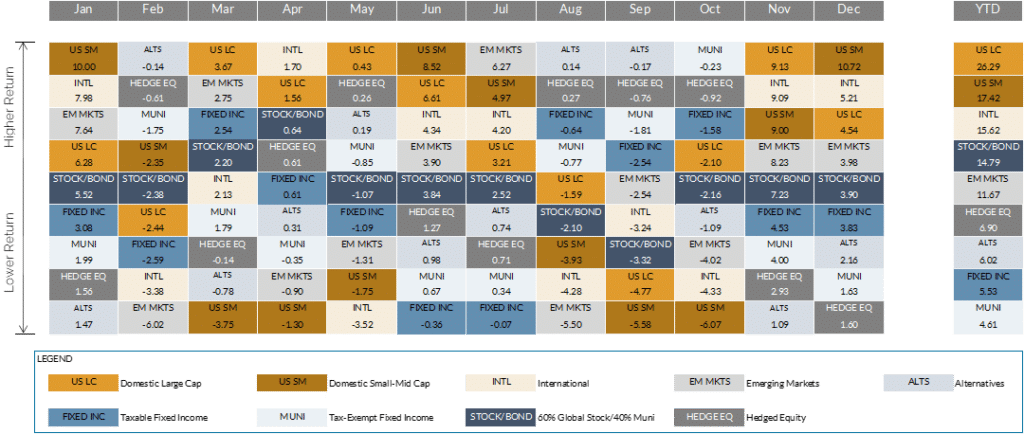

Source: Morningstar and Bloomberg Finance L.P. (data as of 12/31/2023)

- Equities across the globe jumped in Q4, bringing returns of Large Cap U.S. stocks north of 25% and the rest of the globe in the mid-teens. Earnings and revenue growth look like they will be modest for calendar year 2023 (we are still seeing Q4 numbers roll in), meaning that much of the strength came from multiple expansion. Fortunately, fundamentals were trending in a positive direction into the year-end. The Magnificent 7 were the ultimate winners in 2023. That said, the November/December rebound of Small-Mid Cap (Russell 2500 +13.3% in Q4) helped those stocks close some of the gap.

- Overseas markets also bounced strongly in Q4 (developed +10.5%, emerging +7.9), bringing the calendar year into the teens. Chinese markets were a notable negative outlier, with stocks down more than 10% in dollar terms. Many stocks with significant sales exposure to China also lagged. One nuance of overseas markets continues to be the style divide. In the U.S., growth trounced value by a sizable margin in 2023 (it was the opposite in 2022). In overseas markets, lacking in Magnificent 7, value continued to top growth, as it has since the onset of the COVID outbreak.

- After a rough Q3, bond markets rebounded strongly in Q4, eliminating YTD declines. The story was a combination of Fed pause (and multiple cuts in 2024) and presumption of softer landing. Anything with interest rate exposure rallied on the news with the 10-year treasury yield dropping from an October peak of 5% to less than 3.9% by year-end. For context, the 10-year started the year at ~3.75% and ended at just under 3.9%. Not much change if one only looks once per year. Despite the duration move, which was more of a positive for core bonds, higher yielding strategies ultimately led for the year. Coupon clipping was the primary driver, but we also saw spreads come down. This would have surprised many earlier in 2023, as we saw several major bankruptcies in the U.S. and abroad.

- Alternative investments did okay in Q4 and delivered solid returns for the year, with those overweight credit and equity exposure leading returns. The exception was commodities. After leading returns in 2022 (+16%), commodities were a major laggard in 2023 (-7.9%).

2024 1st Quarter Commentary: “In a world drenched in pessimism, it pays to be optimistic.”

With so much emphasis placed on negative headlines, negative developments globally, and the ability to embrace one’s inner negativity, it ...