There is always something to be uncertain about and one does not have to look very hard to find negative headlines. This is part of why investing can seem so difficult, even in periods of relative calm. It becomes even more challenging during times of elevated turmoil.

Having a well thought out investment plan and portfolio that aligns with your goals can help you stay the course. Part of this preparation includes understanding and accepting that a certain level of risk must be taken.

Those who have the discipline to stick with their plan tend to be the most successful investors. Over time, they are rewarded by not overreacting or constantly making changes.

The Nature of Risk

Why even take on risk in your investment portfolio? Quite simply, it is a requirement if you are looking to grow your assets – risk and return are tied at the hip in investing. By taking on more risk, you stand to lose more money if the investment does poorly, but you also have the potential to make far more money if it works out well.

There are numerous factors that influence the risk of a particular investment and they can change over time. Because of this, there are a few different ways to define what the word “risk” really means. For the sake of this article, we will view risk in the somewhat traditional lens of volatility, which essentially measures how much investment values are likely to swing up or down.

Your risk tolerance can evolve over time, but it’s important to determine a reasonable baseline to hold onto first. Without this, you are far more likely to succumb to your emotions and overreact at a time when you shouldn’t. Making small adjustments as your situation evolves is reasonable, but you want to avoid making wholesale changes during times of duress. Selling your investments in a market downturn can result in severe and permanent losses.

Every person inherently has their own varying emotional ties to risk tolerance in their life, and that extends to investing. To determine an appropriate amount of risk to take, it’s important to consider your personal financial situation while also accounting for your own emotional ability to stomach volatility.

Risk Capacity

Risk capacity is the amount of risk you can financially afford to take. Or put another way, it could be considered the amount of risk you need to take in order to meet your financial goals. It should act as a constraint, keeping you from taking on too much or too little risk. Risk capacity considers different variables such as your timeline, income, portfolio size, and financial goals. It’s important to remember that no single one of these variables will control your risk capacity. Instead, all the variables should be taken into consideration to arrive at the bigger picture.

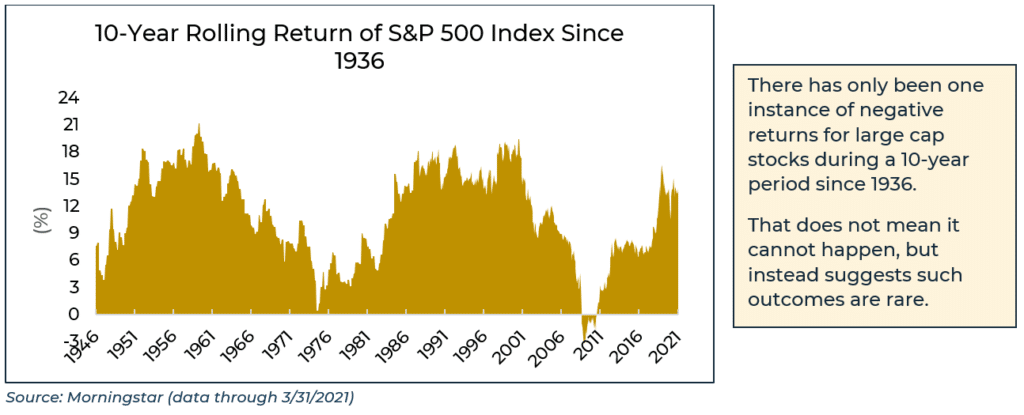

- Age/Timeline: Generally speaking, the longer you keep your money in the market, the more risk you can stand to take. This amount of time may depend on age or how many years you have until you need the funds for spending. While equity markets can have large swings in any given year, the historic trend has been upwards. Likewise, longer time periods tend to increase the chance of market returns being positive.

- Income: Having sustained income outside of the portfolio can lead to more flexibility with your investment strategy. If the income can be used to cover spending needs without having to rely on the portfolio, then short-term market fluctuations are less important. Having a reliably high income might then offer the ability to take on more risk.

Considering future income amounts can also play a role in risk capacity. Someone who is transitioning to a new job or going part time and expects a salary cut may want to take on less risk in their investments if they believe there might be an increased chance of needing to draw from the portfolio in the near future.

- Portfolio Size: Like income, having a larger portfolio might allow one to better withstand downturns. This is all relative however, as having a “large” portfolio might not help as much if spending needs are high. Likewise, a “small” portfolio that does not need to be tapped into because spending needs are low might be in great shape to withstand temporary shocks to value.

- Financial Goals: Financial goals are highly individual. Someone who already has a large enough portfolio to meet their needs might want to focus on capital preservation. In this case, perhaps all that is necessary is to take on only enough risk to ensure the portfolio keeps pace with inflation so that living expenses can be met.

For someone else, the goal may be to own a beach house, travel every winter of retirement, and have money to pay for grandchildren’s education. In that case, a more aggressive approach might be necessary to have a high enough return to meet the numerous spending goals. You must first try to define what you want and then determine the amount of risk necessary to achieve your goals.

Willingness to Take on Risk

In addition to understanding how much risk you should take to meet your goals, you should also assess your personal attitude towards taking risks.

For most people, the pain coming from a loss exceeds the satisfaction that comes from a gain. This is true for many aspects of life and can be more pronounced when it comes to money.

With this in mind, the “how well do you sleep at night” factor should not be minimized. If you lie in bed worrying about your portfolio after seeing the value drop, then you are probably taking on too much risk. On the other hand, you do not want to be taking on so little risk that you are constantly upset by not keeping pace with equity markets.

Recent market performance can also have an influence on your risk tolerance and is something to be aware of. Many people slowly start to feel more comfortable taking on additional risk after they have seen the markets do well over an extended time period. They are lured into a sense of complacency and believe that what has been happening recently will continue indefinitely. This can lead them to believe they have a higher risk tolerance than they actually do.

Naturally, most people want to take on more risk when the markets are doing well and less risk when they are doing poorly, but it’s notoriously difficult and practically ineffective to try and time the markets. Long-term success is better achieved by having the right risk profile independent of current market conditions.

When you are evaluating what you can personally handle, it might be useful to revisit your thoughts and behavior during previous periods of volatility. During the Coronavirus-inspired market plummet in early 2020, how did you feel? Were you comfortable with the investment strategy you had in place? Did you pull your money from your investments out of fear?

It’s safe to say that everyone was worried during this time, but what action you ultimately took (or did not take) says more about your ability to tolerate risk. If panic caused you to sell while the markets were down, then perhaps having been in a more conservative allocation prior to the event would have protected you from realizing losses. This is why it’s so important to assess your risk tolerance before things go awry.

Arriving at Your Risk Tolerance

Taking the time to gauge both your risk capacity and personal willingness to take on risk will allow you to better understand your true risk tolerance. This isn’t an exact science and there is an art to this process – a perfect answer does not necessarily exist.

There can also be times when your risk capacity and risk tolerance might not match up. For instance, you could be fairly a cautious person but have financial goals that require a lot of growth. This might necessitate taking more risk with your investments or revising your goals. Ultimately, you will need to balance this as best as possible.

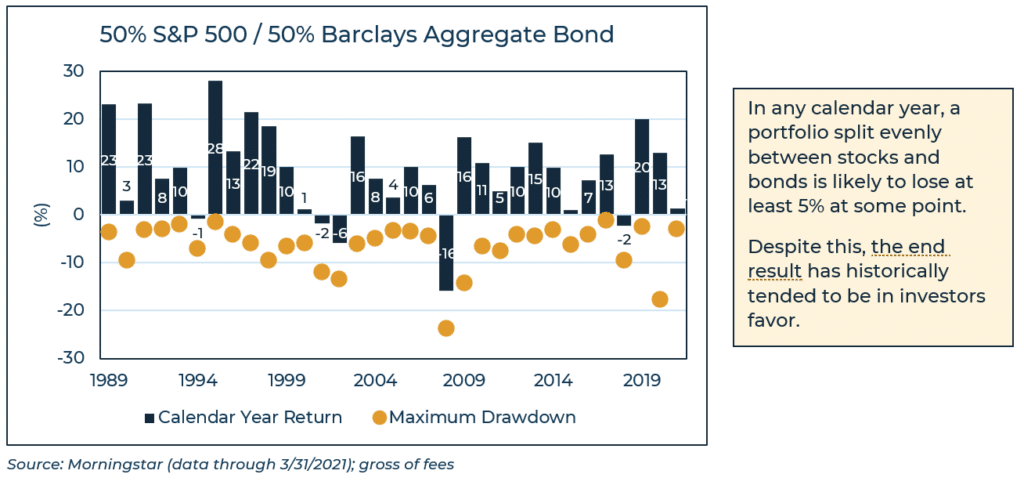

Investors should also keep in mind that that highly diversified portfolios can lose value frequently. Again, this is somewhat the inherent nature of risk and return.

If you don’t put any thought into aligning your strategy with your risk tolerance, then you might put yourself at the biggest possible risk – not meeting your goals. A financial advisor can help you determine an appropriate risk tolerance. Perhaps more importantly though, an advisor can provide valuable reassurance when it’s needed most to help you stick with your plan.