It would be avant-garde if we had ChatGPT write this quarterly letter. Alas, we did not. Humans still write this (for now!). Speaking of things that are not happening, we take comfort in writing a quarterly letter without need to use the word “unprecedented.” Each of the calendar years 2020, 2021, and 2022 were rife with events and markets which best were characterized as such. Fast forward to mid-2023 and the overriding sentiment is one of markets healing – equity valuations mean revert and interest rates do not go up forever. Markets have rallied from their 2022 levels. Anecdotally, when speaking with advisors and clients, we see this best when clients look at their Performance Report and zero in on their portfolio’s “Last 12 Months” performance figure. Most clients are pleasantly surprised given the pain of recent memory. That is, for as unprecedented (apologies) as last year was, especially in fixed income markets as we highlighted repeatedly, financial assets have begun to heal.

With half of the year complete, equity markets have exhibited generally robust returns. In a refrain that sounds similar to much of the last few years, large cap stocks have bested small caps so far in 2023, growth has outperformed value, and U.S. domestic stocks have outpaced international equities. In fixed income, the general risk on environment has lifted the riskier “satellite” fixed income (think high yield bonds and leveraged loans) over the more interest rate sensitive “core” fixed income (government and investment grade corporate bonds). Like with equities, most of fixed income is positive year-to-date.

We read commentary and analysis from many sources. One we came across recently encouraged investors to “Keep it simple,”[i] that the interest rate increases which made fixed income investing painful in 2022 are now offering the kinds of yields that do not require exotic strategies or implementations to generate attractive returns. It is a point we have made ourselves often recently. Current fixed income Capital Markets Assumptions (CMAs) used in our asset allocation framework and financial planning tools suggest fixed income will return the same over the medium term as we estimated equity to return just a year ago. Obviously with fixed income, your path to such long-term returns comes with a much lower volatility profile. This is not a call to significantly change asset allocation, as equities are still assumed to return more than fixed income over the life of most clients’ financial plans, but just a recognition that after more than a decade of near-zero rates, fixed income offers a far more compelling risk/return profile for many. Depending on the amount of credit risk a client is willing to take, the amount of interest rate exposure desired, and the need for or ability to give up some liquidity, total returns of a fixed income portfolio from 3% to high single digits could be constructed.

Another thought-provoking piece, this one from McKinsey[ii], the global consultancy, laid out four medium-term economic and market scenarios. Interestingly and by way of contrast, when we generate portfolio expectations with our CMAs, they are generally “bottoms up” – we form our view on all major equity and fixed income asset classes, on inflation and what cash will earn, and roll them up to portfolio level return and risk expectations. This McKinsey piece instead looked “top down,” identifying four distinct economic and investing regimes through the year 2030: 1) a continuation of the current heightened inflation, with interest rates higher for longer, 2) a return to a low inflation/low growth world like in the decade leading up to the COVID pandemic, 3) a balance sheet reset akin to Japan in the 1990s-2000s, and 4) an Artificial Intelligence/Inflation Reduction Act fueled boost in productivity. We backed into their return expectations given the four scenarios. We would characterize two of the scenarios as “fine” for asset prices, one good and one bad. We are reassured that in aggregate our bottoms up portfolio expectations are in line with their top-down scenarios.

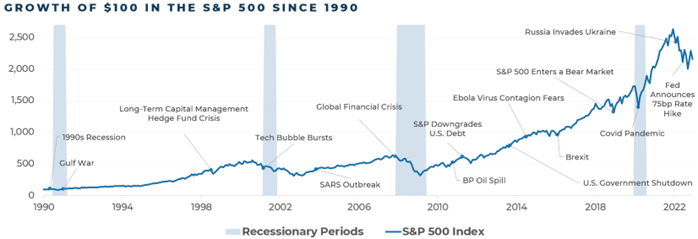

Events continue to remind us that negative news and forecasts garner far more “clicks” in financial media than the mundane and the likely. Two recent such events come to mind – the angst around the debt ceiling and the debate around a pending recession. The debt ceiling drama captivated many pockets of financial news for months, and it resolved itself in what was always the most likely outcome. Separately, recession calls have been made for the better part of the last 18 months. Even at our own Advisor Summit in April of last year, a very well-known market commentator speculated that “we may even be in a recession now.” Fast forward over a year, and still no recession. These latest concerns reminded us of the chart below – that looking at the long trajectory of markets, what were instances of acute market stress and nervousness fade with the benefit of history:

Source: Morningstar (data through 12/31/2022)

To be clear, we are decidedly not Pollyannaish. As always, risks to the markets and the economy abound. Beyond the ever-present global tensions (in this case China, Russia) we would highlight the continued stubbornly elevated levels of inflation which may necessitate the Federal Reserve to raise rates further or at the least keep them “higher for longer” in response. Given that the U.S. Treasury market is the foundational asset class against which most others are measured and valued, that eventuality likely would have ramifications across markets and the economy. Additionally, somehow we are a short 16 months away from the next presidential election. With the White House and each of the two Houses of Congress seemingly up for grabs, we should begin to witness the jockeying, prognosticating, and handicapping.

As always, your advisor and the Investment Team stand ready to talk about this and any other concern, and whether your asset allocation is best positioned given your financial goals.

Markets

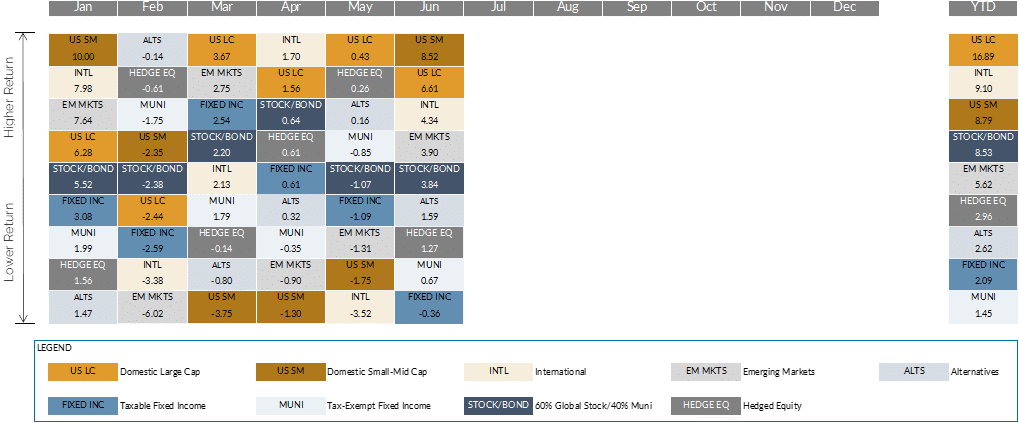

Source: Morningstar and Bloomberg Finance L.P. (data as of 6/30/2023)

- Equities extended the rebound that began in the fourth quarter of 2022. The S&P 500 Index finished the first half of 2023 up nearly 17%. A mere seven companies (Apple, Microsoft, Nvidia, Amazon, Meta, Alphabet, and Tesla) contributed to about three-quarters of the gains, leaving the rest of the market relatively flat. Easing inflation concerns and indications that the U.S. economy continues to show strength helped offset another increase in interest rates. A top and growth-heavy market resulted in stark performance differences between tech-adjacent sectors and most others, contributing to a widening valuation gap between value and growth stocks.

- International stocks lagged the U.S. but are still up this year. Compared to the concentrated winners in the U.S., performance overseas is more balanced. In fact, when looking at an equal-weight index, with each stock getting the same weighting, international stocks outpaced the average U.S. stock in the first half of 2023.

- Bond markets fell slightly in Q2 but maintain an overall gain for 2023. The Federal Reserve raised interest rates by 0.25% in May but opted for a “hawkish pause” in June, keeping rates unchanged. With the rally in risk assets, we saw modest credit spread tightening throughout June. This helped higher yielding strategies outperform during the quarter. Spreads are now back to levels last seen before the regional banking crisis that began in March. Corporate balance sheets remained relatively strong, despite some uptick in default rates.

- Alternative investments finished in between equities and fixed income in Q2. Hedged equity strategies leaning into a value bias over growth struggled. Others, however, looking to monetize other premia, did well with a subset benefiting from a notable decline in volatility. Absolute return and other non-correlated strategies held up reasonably well, with the exception of macro and more commodity-oriented strategies.

[i] https://www.kkr.com/global-perspectives/publications/mid-year-update-2023

[ii] https://www.mckinsey.com/mgi/overview/the-future-of-wealth-and-growth-hangs-in-the-balance#at-a-glance

2024 1st Quarter Commentary: “In a world drenched in pessimism, it pays to be optimistic.”

With so much emphasis placed on negative headlines, negative developments globally, and the ability to embrace one’s inner negativity, it ...