Content originally published by, and used with permission from, Fiducient Advisors LLC.

Most experienced nonprofit board and committee members understand the importance of good governance practices. The Investment Policy Statement (IPS) is one of the most vital governance documents, serving as a guide for both current and future committee members. This document should reflect the specifics of each organization, including its mission, needs, goals, and guidelines for oversight. Every nonprofit should maintain an IPS, but one organization’s IPS can often look very different when compared to another’s. Regardless of how this document is structured, the most effective Investment Policy Statements should address the following items.

Introduction and Purpose of the Investment Policy Statement

The IPS should begin by illustrating the purpose of the fund, using specific details. While the purpose could be as simple as “to support and promote the mission, growth, and general welfare” of the organization, it may be appropriate to consider including additional objectives, such as:

- Assisting the committee/board in fulfilling its fiduciary duties

- Conveying the fund’s purpose, investment objective, strategy, and constraints

- Assigning roles and responsibilities of the Committee, investment consultant, and other relevant parties

- Establishing a decision-making framework

Statement of Objectives

After clearly delineating the IPS’s purpose, include specific goals to elaborate on the investment objective(s) which further support the policy statement’s reason for existing. Questions to ask when providing the statement of objectives include:

- Is the objective to achieve a minimum return equal to inflation plus spending over time, or something different?

- Is the time horizon perpetual, long-term, or something else?

- Are there any secondary objectives, such as prudently diversifying to mitigate risk or maintaining sufficient liquidity to meet obligations?

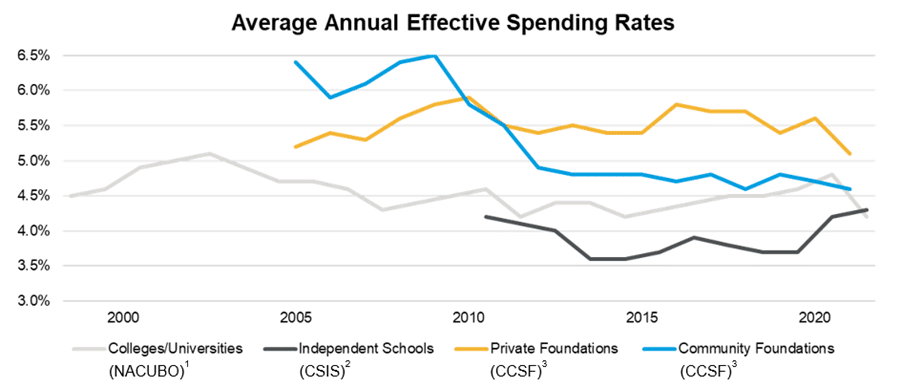

Spending Policy

Clearly articulate and define the fund’s spending policy. This may include a determination of how spending is calculated, whether it is a percentage of assets at a specific point in time or an average over a specific period of time, and the circumstances in which the board/committee may deviate from the policy.

More importantly, if there is a not a current spending policy, the committee/board should prioritize developing one. Doing so requires thorough deliberation on the following considerations:

- What are the historical and potential future spending patterns and potential inflows?

- What is a reasonable assumption or range of spending?

- How does that range impact the ability of the organization to fulfill its mission, both short- and long-term?

- Is the spending rate sustainable?

- Is the investment strategy aligned with the anticipated cash flows to maintain corpus for an extended period of time?

Sources cited at the end of the article.

Roles and Responsibilities

The IPS should summarize all roles and responsibilities of relevant parties based on the organizational structure in place while ensuring that responsibilities for the key roles are correctly and cogently defined. Mapping of vital roles and responsibilities should minimally include the following five key tasks:

- Reviewing and approving the Investment Policy Statement

- Determining investment objectives and constraints

- Selecting asset allocation targets

- Selecting investment managers

- Executing trades

Liquidity Constraints

Adequate liquidity is critical to meeting organizational spending and operational requirements; therefore, it is a best practice to define the minimum required liquidity in the IPS. This exercise is particularly important for portfolios that use illiquid alternative investments, such as private equity. Conversely, it is likely less critical to address this issue in portfolios invested solely with daily liquid mutual funds (so long as the Committee is not contemplating future changes to that structure).

Ideally, this section of the IPS should define the minimum percentage of the portfolio that should be invested into specific liquidity categories, such as:

- Daily to monthly liquidity

- Greater than monthly and up to one year

- Greater than one year

The table below shows an example of guidelines that may be used to define acceptable portfolio liquidity ranges:

| Category | Market Value Guideline | Liquidity Description |

| Liquid | No less than X% | Daily to monthly |

| Semi-Liquid | No more than Y% | Greater than monthly and up to one year |

| Illiquid | No more than Z% | Greater than one year |

Investment Guidelines and Constraints, Including ESG/Mission-Aligned Considerations

If any asset classes, investment strategies, or investment manager structures are intended to be entirely prohibited from investment, define those restrictions in this section of the IPS. If no constraints exist, consider stating there are no prohibitions against any asset class, strategy, or structure if it meets certain criteria. For instance, no prohibitions might be enacted provided the following criteria is qualified:

- The investment is intended for the sole purpose of advancing the fund’s objective.

- If the investment would be appropriate given the fund’s investment strategy.

- If such an investment is consistent with the fund’s liquidity constraints.

This is also an appropriate section of the IPS to state any other considerations, including ESG (Environmental, Social, and Governance) or Mission-Aligned Investing criteria, if utilized.

Asset Allocation Framework and Rebalancing

Asset allocation is commonly considered as the primary determinant of performance. Therefore, the IPS should reference the role of diversification among asset classes, strategies, and investment managers to pursue the fund’s objectives. Establishment of an asset allocation framework and any necessary rebalancing must take into consideration the following:

- If asset allocation ranges or targets have been established for investment categories/asset classes, those should be detailed in an appendix to the policy – with the appendix location referenced in this section. Using an appendix makes future updates simpler, often avoiding the need to formally approve a full change to the policy itself.

- Include a reference to the rebalancing strategy here as well, specifying that the allocation will be monitored to determine whether rebalancing is warranted.

- Also, state how contributions and withdrawals will be treated, including whether they will be used as a means of rebalancing.

Investment Manager Selection

In this section, list the criteria the committee/advisor will consider during the selection process. Beyond simply evaluating historical performance alone, which can be misleading if used as the only proof point, consider these factors:

- Historical risk/volatility vs. appropriate benchmarks

- Historical adherence to stated objectives and processes

- Depth of resources and quality of personnel

- Appropriateness of diversification

- Reasonableness of fees

Ongoing Evaluation and Manager Termination Guidelines

Before stipulating the best practices in evaluation and termination of managers, reflect on the following important questions:

- How will the committee/advisor review investments once they are implemented?

- Are the investment managers still satisfying the original selection criteria, and are they still appropriate?

Include examples of events that may trigger termination, such as:

- Illegal or unethical behavior on the part of the manager

- Failure to follow investment guidelines

- Turnover among key personnel

- Change in investment style or strategy

- Insufficient infrastructure to keep pace with asset growth

- Significant increase in expenses or fees

- Performance-related concerns

Proxy Voting

If no custom proxy voting criteria is used, convey a message in this section as shown below:

- Each investment manager is responsible for – and empowered to – exercise voting rights on behalf of the client.

- Each investment manager shall vote proxies in the best interest of the client.

If custom ESG or Mission-Aligned proxy voting criteria are utilized, describe that in this section as well.

Other Important Considerations

- State at the beginning of the document when it was most recently approved (month, day, year) and by whom (e.g., the committee or the board). The date will often coincide with a committee or board meeting, and the minutes of that meeting should reflect that it was approved or adopted.

- Be sure that actual practices are consistent with the language used in the IPS. If not, either follow the process as described or change the IPS language to remain consistent. This may seem obvious, but it is actually common for processes and Investment Policy Statement language to not be aligned.

- Some details may be necessary; however, it is generally best to avoid unnecessary specificity when drafting the Investment Policy Statement. Consider using terms like “periodically” instead of a specific frequency (like quarterly) whenever possible, especially if that action will not occur every quarter. Similarly, consider using words like “may” instead of “will” when describing potential actions that could be contemplated. The document should provide meaningful guidance while also allowing sufficient flexibility for the committee/board to fulfill its responsibilities.

We believe strong governance practices often lead to successful investment outcomes when applied consistently over time. Thus, crafting an Investment Policy Statement that includes these crucial elements helps develop an enduring foundation upon which any nonprofit can successfully build and foster throughout that journey.