As a partner in a private equity (PE) firm, you have a financial interest in the fund that comes in two parts: a capital interest and a carried interest. The capital interest grants you important ownership and distribution rights, but it does not have much potential to increase in value. The carried interest, on the other hand, is a speculative investment that could be worth multiple times its initial value if the fund is successful. Given these attributes, carried interest can be an attractive asset to transfer outside of your taxable estate, like to a trust for benefit of your children or grandchildren.

Can I gift only my carried interest?

You cannot gift only your carried interest in the fund. Section 2701 of the Internal Revenue Code has specific rules that apply to these types of transfers. If you gift only your carried interest, the IRS can say you still control the fund because you kept your capital interest. This means you would have to gift a proportional amount of all fund interests, which could use more gift tax exemption than desired. There is a safe-harbor approach called a “vertical slice” gift, but another potentially more attractive alternative exists. You can sell a carried interest derivative (or option) to a third-party entity or individual, transferring only the economic benefit of your carried interest and avoid IRC Sec 2701 issues.

What is a carried interest derivative?

A derivative is a contract between two or more parties. Its value is derived from the value of something else, often a financial asset like a stock, currency, or commodity. If you buy a derivative, you have the right to payment based on a future event or series of events. A carried interest derivative is a specific type of derivative that bases its value on your carried interest. It is settled with cash, meaning the buyer is paid in cash when the contract ends.

The carried interest derivative allows you to transfer wealth to the buyer based on how well the carried interest performs over time. This does not require you to transfer the carried interest itself. Because the contract is settled with cash, you can avoid the IRC Sec 2701 issues mentioned earlier.

How is a carried interest derivative structured and valued?

The derivative contract should last long enough to capture most of the expected gains from the PE fund, but not tied to the life of the fund itself. Usually, the term is between 7 to 10 years or the seller’s death, whichever comes first. At the end of the contract, the buyer will get a final payment based on carried interest distributions over the term and the fair market value (FMV) of the carried interest at settlement. You can also have more than one payment date (i.e., an initial payment date(s) and a final payment date).

The contract can be customized to meet various client wealth transfer goals. For example, it can include a “hurdle” rate that the carried interest must exceed in value over the contract term before paying anything upon settlement. The contract can also include a “split” of profits (i.e., 50% to the original seller, 50% to the buyer) once the hurdle is exceeded, and it can specify a “max cap” to the option buyer to limit the ultimate amount of wealth transferred. It is usually beneficial to include a hurdle rate, even a small one, to add legitimacy to the transaction structure.

The purchase price for the contract is based upon the current FMV of the carried interest at sale, the contract term, the expected volatility of the carried interest, and any hurdle, split or cap included in the terms. A longer contract term will increase the price, while higher hurdle, cap, or profit split amounts would reduce the price. An attorney who specializes in this area of trust and estate planning should draft the contract, and a qualified appraiser should determine and document the derivative’s FMV. Both are essential to ensure the sale is respected as an arms-length transaction.

What are the benefits and considerations of a carried interest derivative sale?

The major benefits of a carried interest derivative sale include:

- Your carried interest is never transferred, so the punitive gift valuation rules of IRC Sec 2701 do not apply. The contract is cash-settled, so the buyer receives cash at settlement.

- A vesting schedule will not cause valuation issues, because the carried interest is retained. This can be a downside of “vertical slice” gifts.

- Rev Ruling 98-21, issued in 1998, held that a gift of an unvested employee stock option was not a completed gift until the option’s exercise was no longer conditional on additional services from the employee.

- While it is not definitive that the revenue ruling would apply to a gift of carried interest, a conservative assumption would be that such gift(s) are only completed at each vesting date.

- Remaining gift/GST tax exemption is leveraged, and exemption “loss” is minimized should the fund prove unsuccessful.

- Because the transaction uses a derivative tied to the return of your carried interest, not the carried interest itself, the valuation will be lower. Any hurdle or maximum cap would further reduce the value.

- There is also no need to make additional gifts or loans to make capital calls, which can be more expensive in a high or rising interest rate environment (due to increasing AFR rates applied to loans).

- Because it is a private contract, the terms can be tailored to fit individual wealth transfer goals.

- A hurdle rate can be included, a split of profits can be specified, and a maximum cap can be set to limit the ultimate amount of wealth transferred.

Considerations of a carried interest derivative sale include:

- You might not have enough money to pay the other party in full when the contract is settled.

- This could happen if the fund does better than expected, your own investments do poorly, you leave the fund early, or if you owe money back to the fund (clawback provisions).

- If necessary, you could instead pay with other assets or with a promissory note.

- While it is likely to use more gift tax exemption, a “vertical slice” gift (direct transfer of your carried and capital interests) is likely to transfer more wealth if the fund is successful.

- This might be a good option since the amount you can give away without paying gift tax will remain historically high through the end of 2025.

- The IRS might question how much your carried interest, or the contract is worth.

- If they challenge the valuation, you might have to use more of your exemption or pay gift tax if insufficient exemption remains.

- However, a similar risk exists with “vertical slice” transfers. Expert counsel and a qualified appraiser should be involved to consider and mitigate these risks.

- If you die or get divorced before the contract terminates, there can be punitive income tax and cash flow consequences.

What are the steps to implement a carried interest derivative sale?

Step One

You need to decide who will buy the contract. A trust is often a preferable choice because it provides more control and flexibility. If you use an intentionally defective grantor trust (IDGT), you can get additional income tax advantages since the grantor (you) pays the income taxes directly. This allows the trust assets to grow completely tax-free outside of your taxable estate, and the income taxes you pay are not considered gifts or counted against your gift tax exemption. If you want to leave the contract to your grandchildren, you also should allocate GST tax exemption to the trust.

Step Two

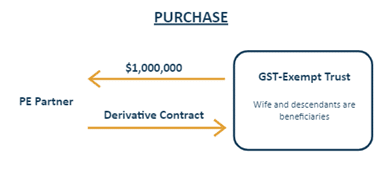

Next, a third-party (preferably an IDGT) will buy the contract from you, using cash to pay for some or all the carried interest value. If a new trust buys the contract, you will need to fund it with an initial gift to provide liquidity. This will require some exemption use, but it should be a modest since the contract is worth less than the carried interest itself.

Step Three

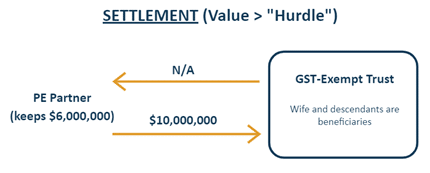

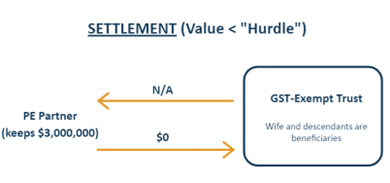

Finally, at the end of the contract term, if the contract is successful, the trust will pay you the sum of the distributions you received and the carried interest FMV at settlement. This payment is gift and GST tax-free, allowing you to transfer significant dollars outside of your taxable estate without paying transfer tax! If the contract fails, you do not owe the trust anything. You will have used some exemption, but less than you would have with a “vertical slice” gift.

- Example: David is 50 years old and has started a PE fund with other business partners. To encourage investment from limited partners, they have implemented a four-year vesting schedule for their carried interest. David recognizes that carried interest is a valuable asset to gift, but he wants to maintain control and liquidity while still transferring wealth to his children and future grandchildren.

- David creates carried interest derivative contract with the help of his advisory team and attorney. The contract has an 8-year term and includes a “hurdle” amount of $4 million and a “cap” of $10 million in value that can benefit the counterparty. After an appraiser determines the contract’s value at $1 million, David’s GST-exempt IDGT trust, which he set up and funded the previous year, purchases the contract for $1 million.

- Result #1: After eight years, David’s carried interest has distributed $9 million to him and is now worth $7 million. At settlement of the contract, the combined value of the distributions and the carried interest exceeds the $10 million “cap”. David owes the trust $10 million in cash or future carried interest distributions and keeps $6 million. The $10 million of value received by the trust transfers to beneficiaries free of gift and GST tax, except for the initial $1 million David gifted to the trust.

- Result #2: Eight years later, the distributions to David and carried interest value total $3 million. He owes the trust nothing, because the distributions received plus value at settlement did not exceed the $4 million hurdle. He wastes $1 million of gift and GST tax exemption. But if David instead made a “vertical slice” gift, the use of exemption would have been greater.

Conclusion

A carried interest derivative sale can help you benefit both yourself and current/future family members. This is especially important since the gift and GST tax exemptions are historically high but will reduce by ~50% at the end of 2025 (under current law). Although the transaction may be complicated and require the help of experts, the advantages can outweigh the effort and cost.