After years of positive market performance, newer investors are seeing for the first time that markets do not go up in a straight line. While we saw a correction in March of 2020 when the start of COVID spooked markets and investors, the recovery was swift. We are now seeing more volatility, so clients are asking, “What should I do?”

Stay the Course

Creating and sticking to a financial plan – a road map of where you are and want to be financially – will keep you from making knee jerk moves in response to market volatility and declines. It’s impossible to time the market. No one knows where the top of the market is, and when a correction occurs, no one knows where the bottom of a market will be. It is possible to start pulling money out of an up market only to watch it rise further. It is also possible to start putting money into a down market only to watch it go lower. Establishing a financial plan will help you see the big picture, set both short-term and long-term goals for your investments, and keep you focused on meeting those goals no matter the market volatility.

Your financial plan should lay out your personal financial goals, your needs, your wants, your current balance sheet, your investments, and all your assets. It will show how your assets are currently allocated (categorized) and whether the current asset allocation will allow you to meet your goals. Working with a wealth advisor, investors can put together an investment strategy that utilizes the correct asset allocation for your specific circumstances and goals. Your plan should take into consideration your liquidity needs, risk tolerance, tax implications, concentration of stock, and your time horizon. It should consider the effects of inflation of goods and services, education, and healthcare, all of which have been rising.

Staying focused on your goals will help during periods of financial turmoil. It will keep you from reacting out of fear or being greedy when things are looking good. It can provide peace of mind and position you to meet your financial future based on sound financial principles rather than from being hopeful or lucky. A wealth advisor can be a great partner for making an informed reassessment of your portfolio after a market adjustment in order to ultimately reach your investment goals.

Invest for the Long Term

Everyone talks about a long-term time horizon, but what does that mean exactly? For starters, if you are going to need your assets in the next few years, allocating 100% of your investments to stocks is probably not a good idea. In the short-term, the markets can move in the wrong direction, and you may risk losing much needed funds due to the volatility of the market.

Money that will be needed in the next five years should be kept in safer investments that will fluctuate less, preserve your capital, and be more liquid. This should cover your current expenses and any credit card debt.

The goals that you must fund in the medium term – in the next 5-10 years – should follow a more balanced approach with some of the investments in riskier assets that will move with the markets and some that will be safe and will preserve capital should the markets correct.

Goals that are 10+ years in the future can be invested in a more aggressive fashion, as you will have time to recover if the markets decline for an extended period of time. The longer your investment horizon, the more one can take on equity market risk. Ten years or more will allow your investments to endure some instability, recover from loss, and grow steadily in the long run.

Don’t Miss the Market’s Best Days: Stay Invested Through the Bad to Experience the Good

When the markets get volatile, investors may feel tempted to sell before things get even worse. Don’t commit this common investing mistake. In reality, the data shows that investors who try to time the market, jumping in and out to avoid bad days of trading, end up missing out on the market’s best days.

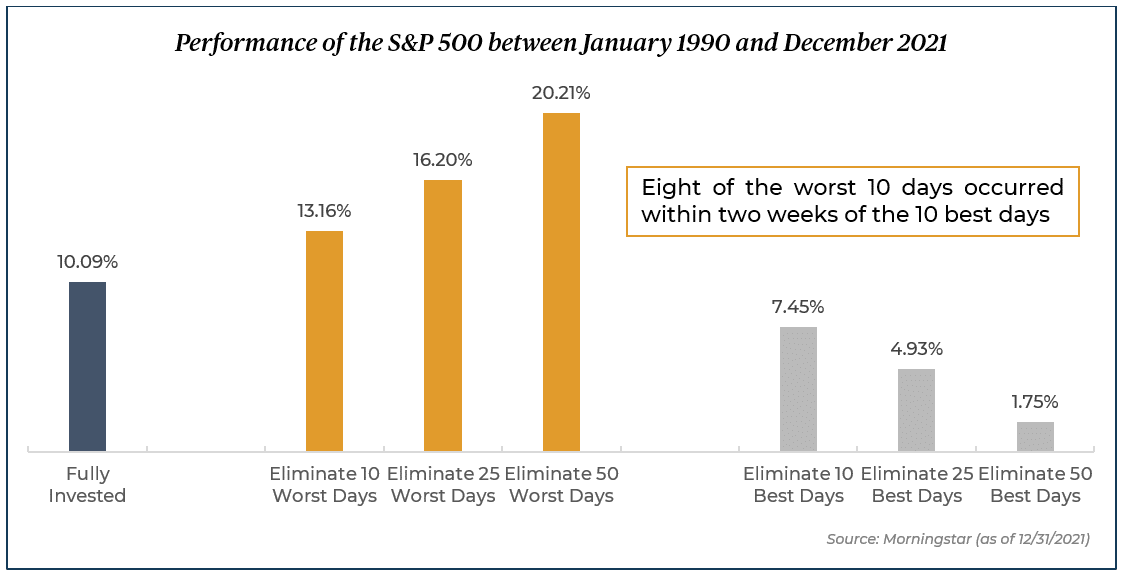

The following chart illustrates this point.[i] If you knew exactly when to jump out and eliminate the worst days, it would improve your returns. However, missing just the best 10 days in the market from January 1990 through September 2021 would have provided a return 2.64% lower. Missing the best 50 days by trying to time when to jump back in would have provided a paltry 1.75% return. More interestingly, 8 of the worst 10 days occurred within 2 weeks of the 10 best days. Being able to predict when to get out and when to get back in would have had to happen within 2 weeks! Conversely, staying invested during the market’s ups and downs would have produced a positive return, gaining 10%. Staying invested, even in times of great market anxiety, is the best long-term strategy for any investor.

Investors Should Have Cash Saved for Expenses and Emergencies

Investors Should Have Cash Saved for Expenses and Emergencies

Every responsible investor should have cash on the side to cover all immediate expenses and a fund for emergencies. There is no clearly defined magic number for the amount of money one should hold onto on the side. However, most people will want to have 3-6 months’ worth of income to cover personal and/or family expenses. To be sure, budget for all recurring monthly expenses, including housing, food, utilities, transportation, debt, healthcare (including insurance), and any other regular personal spending. Anything you would cut out of your budget in the case of an emergency does not have to be included – vacations, entertainment, non-essential expenses. Having an “emergency fund” will help you sleep at night when markets are in correction mode, and you see your investments take a temporary drop.

Those who have excess cash can have a little fun “playing” the market or trying to time it – with a caveat.

Some people enjoy the thrill of trading and thinking they can time the market. For those, it is important to ask the question, “if you were going to a casino, how much would you be willing to lose?” The reason to ask that is that trading is speculative, just like a casino. Someone wins and someone loses. When they have the number that they’re willing to lose, they can segregate that money into “play money.” That is the money they can use to speculate. That money should not be considered in their overall financial plan. If, one day, they make money on their trading, they can go out and splurge on something or add it to their nest egg in the financial plan.

As financial advisors, we are comfortable knowing that their nest egg is safe and that they are allocated correctly for their personal circumstances.

Remember to Revisit Your Financial Plan

As life changes (marriage, divorce, inheritance, sale of a business, market moves), it is necessary to revisit your plan. For example, if you have a 50% stock and 50% bond allocation and stocks have increased dramatically so that your portfolio is now 60% stocks and 40% bonds, it is important to rebalance the portfolio back to the 50/50 allocation to maintain your risk profile and stay on track for your goals.

If you do not have a financial plan in place, contact the Wealthspire team to get started. If you do have a plan, make sure you revisit it periodically after any life events. And should the markets make large moves, your Wealthspire team members are great partners to help you make an informed reassessment of your portfolio to ultimately reach your investment goals.

Investors Should Have Cash Saved for Expenses and Emergencies

Investors Should Have Cash Saved for Expenses and Emergencies

2024 1st Quarter Commentary: “In a world drenched in pessimism, it pays to be optimistic.”

With so much emphasis placed on negative headlines, negative developments globally, and the ability to embrace one’s inner negativity, it ...