Markets in 2 Minutes – June 2022

It’s been three decades since stocks and bonds have been down simultaneously, proving to be a tough year for investors. ...

Price/Earnings Ratio (P/E Ratio)

P/E Ratio Meaning The Price/Earnings Ratio (P/E Ratio) is a ratio used by investors to help evaluate how cheap or ...

Real Estate Investment Trust (REIT)

What is a REIT? A Real Estate Investment Trust, or REIT, is a pooled investment that invests primarily in income-producing ...

Health Savings Account

What Is a Health Savings Account? A Health Savings Account, or HSA, is an account that offers individuals covered by ...

Markets in 2 Minutes – May 2022

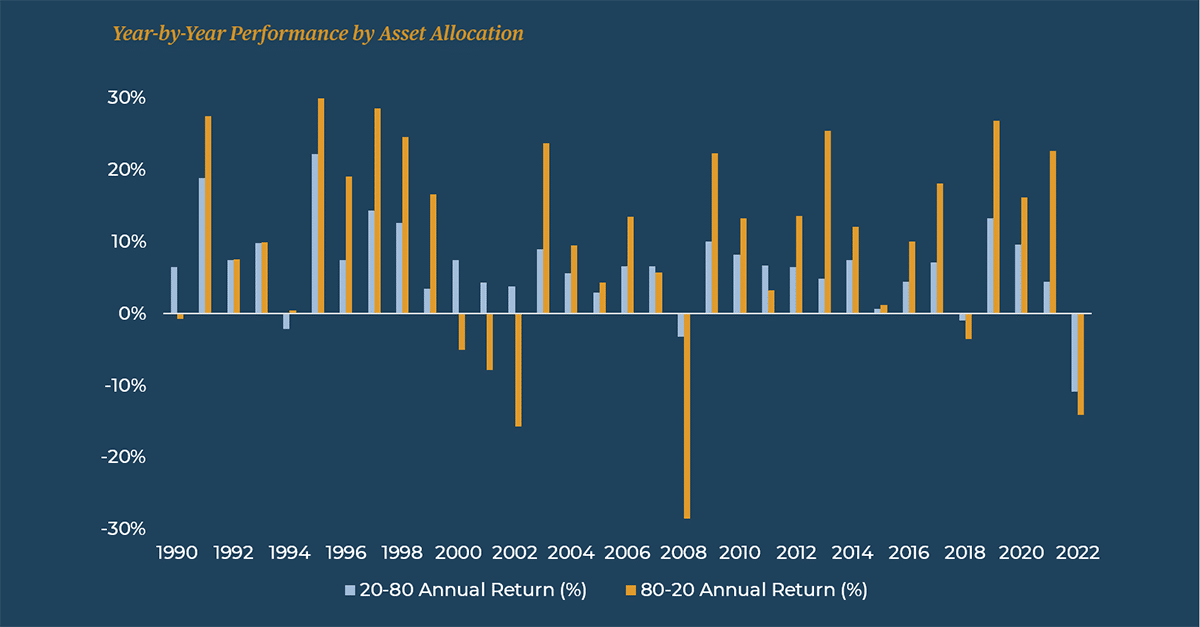

Whether you’re a more conservative or aggressive investor, you’ve likely experienced similar levels of loss in your portfolio so far ...

The One Thing the Market (Almost) Never Does

Amid the seemingly endless volatility in the U.S. stock market, it may surprise you to know that we have a ...

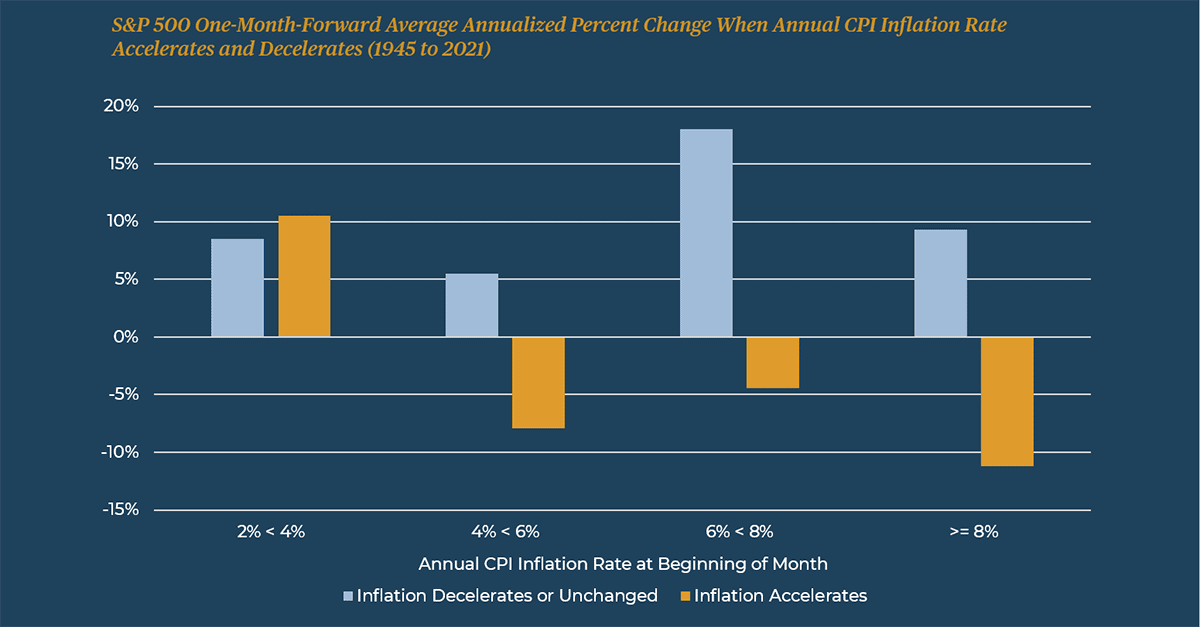

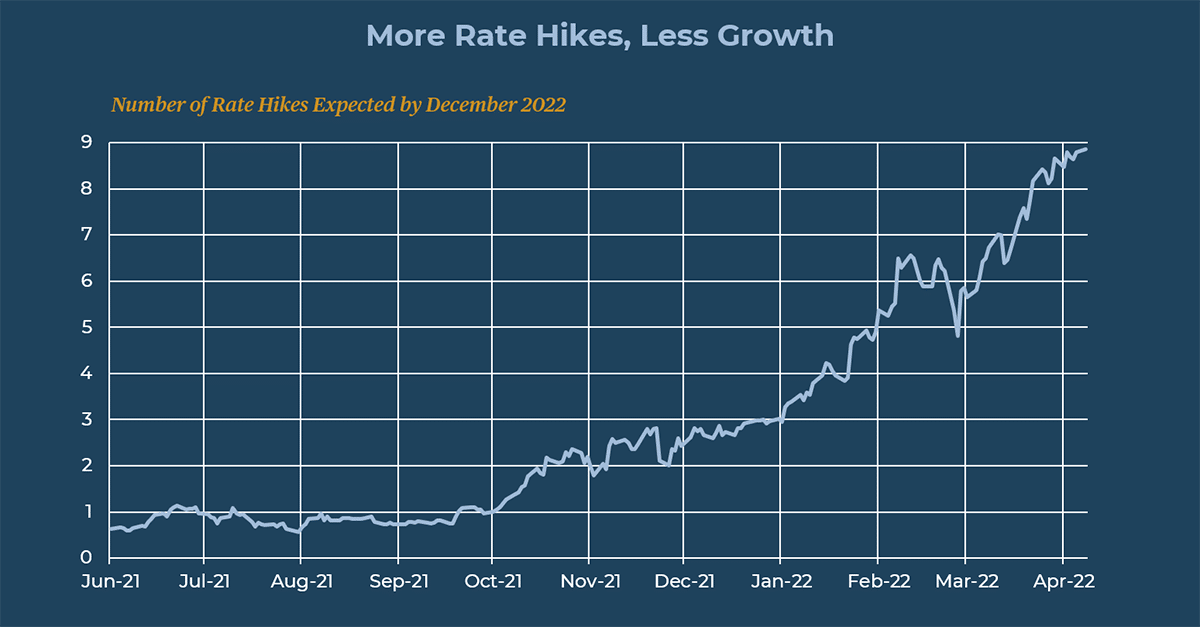

Markets in 2 Minutes – April 2022

Fixed Income and the Fed Funds Rate – in this month’s edition of Markets in 2 Minutes, Emily Platt of ...