Despite EVERYTHING that has gone wrong in the past 5 years – wars, pandemic, inflation, political unrest, bull markets, bear markets and corrections – the US stock market has managed annual gains of 14.9%/year and indeed is up 21.8% on the year in 2023. For our latest webinar, let’s consider WHY US stocks have done so well in recent years on the way to answering, “What can we expect for the next 5 years?”

Transcript

David Edwards:

Good evening. I’m David Edwards, advisor with Wealthspire Advisors, currently in Columbia County, New York, about 100 miles north of New York City. Buff Parham of Parham Associates is in Kiawah Island, South Carolina, where it was stormy earlier today. And that same storm will be over my head later tonight. But for now the power is still on. Buff, how are you doing tonight?

Buff Parham:

Very well. High and dry.

David Edwards:

High and dry. You mentioned that the road was flooded to your island and the internet was out, but at least you’ve got your backup on your phone.

Buff Parham:

Exactly. Thank you, T-Mobile hotspot. Speaking of hotspot, I see a fire behind you.

David Edwards:

Very toasty. Yes, very toasty.

Buff Parham:

Nice, nice.

David Edwards:

So let us jump right in.

Tonight I want to do more than just the year in review. Instead, I want to consider the past five years on the way to answering this important question. “What can we expect from our investments over the next five years?”

Since 2019 we have endured several wars, a pandemic, inflation, political unrest both domestic and abroad, bull markets, bear markets, and corrections.

Let’s go back to 2018. 2018 was a negative year for stocks and bonds because investors were worried about a recession in China that year, and also because the Federal Reserve continued a policy of raising interest rates from 3/8% in 2016, peaking at 2.5% in 2019. As we have said on many occasions, the primary drivers of stock market returns are company revenues, company earnings, and interest rates. Stalled earnings and interest rates left the S&P 500 down 4% in 2018.

2019 was a rebound year with the S&P 500 gaining 32%. Earnings recovered when investors realized that no China recession would occur. Meanwhile, the Fed cut interest rates from 2.5% to 1.5%, so double support for stock prices.

2020 set up to be an average year with average expected returns. But then COVID. The stock market initially sold off 35% from March to May. However, investors quickly realized that COVID killed people but left companies alone.

Indeed, certain companies thrived during the pandemic. For example, revenues soared at Amazon because we needed to shop from home, while Apple soared because we needed to get iPads for our kids’ school.

The Federal Reserve cut interest rates to zero, and the US Treasury flooded the US economy with cash grants to families and forgivable loans to businesses. The stock market recovered all losses by the end of September and closed out 2020 with gains of 18%. Bonds gained 8% that year.

The rally continued into 2021, led by the FAANG stocks, Facebook, Apple, Amazon, Netflix, and Google. The S&P 500 gained 29%, but small and mid caps lagged, up only 15%.

Meanwhile, bonds fell 2% in 2021. So some concentration that year in one sector of the S&P 500, larger stock market not doing so well.

By the end of ’21, the S&P 500 hit an all-time high, but the Federal Reserve had become concerned about inflation, which peaked at 9% that year.

Over the next 18 months the Fed raised rates at the fastest pace in Federal Reserve history, from 0% to 5%. The last time interest rates were as high as 5.5% was 2007, and before that in 2000. Meanwhile, earnings growth cooled in ’21. So not surprisingly, the S&P 500 fell 18% in ’22, small caps fell 20%, and bond prices fell 13%. 2022 was a miserable year all around.

But, after every bear market comes a bull market. For 2023, the S&P 500 is up 25%, small caps are up 15%, international developed markets are up 17%, emerging markets are up 7%, and bonds are up 5%.

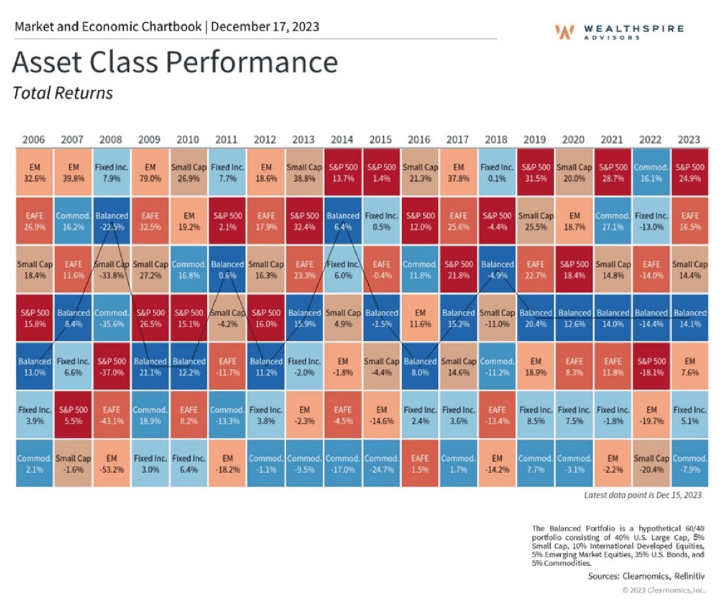

This chart shows how different asset classes have performed over the last 25 years:

Despite a generally good year all around, we’ve heard some frustration from our clients this year wondering why their portfolio is not up 25% this year. The answer is that our clients are generally invested in balanced portfolios, a mix of large cap, mid cap, and small cap US companies, international developed and emerging stock markets, bonds, and cash. Such a portfolio is up 14.2% this year, which is well above the 6% to 8% we think is a reasonable projection.

Over the past five years in both bull and bear markets, the S&P 500 has managed annual gains of 50% a year, which is double the 25-year annual return of 7.5%. Why do we even bother investing in anything but the S&P 500, which has done so well these past five years?

We can think of other occasions where the S&P 500 did not perform. For example, from 2000 to 2009 the annual return of the S&P 500 was 0.0%. A dollar invested in 2000 was worth a dollar in 2009. Along the way, however, the stock market had lows and highs.

When the stock market was high, as in 2007, we took money out of the S&P and put those funds in other sectors, international stocks and bonds. While the S&P was flat for a decade, the balanced portfolio still delivered gains, which enabled us to meet our clients’ needs for funds to support, for example, their retirement draw. For us, the purpose of investing is not to meet or beat an index such as the S&P 500. The purpose of investing is to ensure that money is always there when clients need it.

Buff Parham:

David, while we know that a handful of stocks drove the market – the S&P 500 – up 25% for 2023, it’s obviously impossible for that to happen again. So given that, what should be our asset allocation strategy for 2024 and beyond?

David Edwards:

It has been an interesting year for stocks. I’m going to take a few minutes to describe what I mean by large cap, mid caps, and small caps, what I mean by growth and value, and also why the S&P 500 may not be as good an index as we’d like it to be.

In general, we all know what are large capitalization companies. On the growth side, examples would be Apple and Amazon. On the value side, it would be JP Morgan, Johnson & Johnson, and McDonald’s. Growth companies are growing very rapidly, generating lots of cash, but pay no dividends and have generally volatile stock patterns. Value companies are growing more slowly, still generate a lot of cash, actually are giving some of that cash back to investors as dividends. The value stocks have a less volatile price patterns than the growth stocks. So generally speaking, we put half of our money into growth and half of our money into value, and rebalance annually.

In addition, beyond the S&P 500, which is the large cap index, there are many other companies. For example, we always think of Amazon as a well-known large cap company, but there are two companies that Amazon is very dependent on. One is called Zebra, the other is called Sealed Air. These are small cap companies, they’re not household names, but Amazon couldn’t exist without either because Sealed Air makes the pillows that go into the Amazon packages and Zebra makes the barcoding machines that make Amazon even able to function in the first place.

Generally speaking, small cap companies have a bigger opportunity to gain in stock price because they’re smaller and can grow faster.

Right now, for example, Apple has a market capitalization of $3 trillion. If the stock price of Apple doubled, that would take the market capitalization to $6 trillion.

But what miracle product does Apple have in the pipeline that could create so much value? We understand about iPads and we understand about iPhones, but Apple has not had a new hit product in a decade. Apple’s just recycling and upgrading current products.

So Apple makes me very anxious as an investor. I’ve been a net seller of Apple over the last decade even if the price has gone up.

Now, what is particularly interesting about 2023 is how uneven the S&P 500 has grown. Seven stocks, Google, Amazon, Apple, Facebook, which is now known as Meta, Microsoft, Nvidia, which is both a chip making company and an AI company, artificial intelligence company, and Tesla are up an average of 52%. Nvidia alone is up 200%. So that’s seven stocks driving all of the gains in the S&P 500 in 2023.

There are 493 other companies in the S&P 500. Those stocks are down 2% on average. At this point those seven companies account for 25% of the market cap of the S&P 500. What’s the concern? Well, first off, should we just dump every stock that we own and only own those seven? No. The history of the stock market is that whatever stock or sector is doing really well this year tends to do badly next year.

Buff Parham:

Turning to the macro picture, while the jury still may be out, it looks as if the Fed’s approach to bringing down inflation is actually working. Should we expect any reduction in interest rates over the first half of next year?

David Edwards:

As I mentioned before, the Fed raised rates from 0% to 5.5% in 18 months. That was the fastest pace of interest rate increases in the history of the Federal Reserve, which runs back to about 1910, more than 100 years.

The risk of raising interest rates so far, so fast is that you drive the economy into recession. And all last year the drumbeat was, “Watch out for the recession, watch out for the recession, watch out for the recession.”

I was a little more sanguine about the state of the economy than most people because I was always keeping track of the employment statistics. What’s the rate of unemployment? How many jobs are being created? Are real wages going up?

Despite all of the worries about the economy going into recession, what I saw was the unemployment rate staying low, between about 3.5% and 3.9%. The participation rate going up, people getting off the sidelines and going back to work for the first time in a while. Real wages going up for the first time since about 2000.

What that data means is that the salary increases that people were getting were growing faster than the cost of food, rent, and energy, the things that people have to spend money on each day.

Also, the most impressive rate of new jobs creation ever in U.S. history, about 4 million over the last three years. We’ve never grown jobs that fast before. It’s been 32 straight months of jobs increases.

Without the average American falling in despair because they couldn’t make a living, where’s this recession coming from? That got us to the end of 2023 with no recession.

Earlier this week the Federal Reserve announced that they were definitely done with raising interest rates any further, and the Fed mentioned they might drop rates three times in ’24.

The stock market loved that information. Company earnings are on the upswing, interest rates are supposed to come down next year, those are things that the stock market loves. And that information took the Dow Jones Industrial Average to an all-time high last week, and the S&P 500 is within a couple of percent of an all-time high.

We have all the good news from ’24 already. So where does that leave us for next year? Well, it probably leaves us in the high single digits for the growth in the S&P 500.

There one more trend to make note of. Remember I mentioned that seven stocks were doing super well, 493 stocks weren’t doing anything at all?

Buff Parham:

Uh-huh.

David Edwards:

In the last couple of weeks more of the OTHER stocks are starting to rise in price. We have to see if this trend will continue, but what it might mean is that next year is a year where the small cap and mid-caps outperform after lagging the large caps in this year.

Also, not only are we getting interest rate returns or interest yields between 4% and 5% in our bonds, so we’re getting paid on bonds for the first time since 2008, but actually if rate cuts materialize towards the end of the year and interest rates come down, bond prices will come up. So we might have a year of, let’s say 7%, 8%, 9% gains in stocks. We might have a year of 4%, 5%, 6% gains in bonds. Keep to our balanced portfolios, and our clients will do fine.

Buff Parham:

You’re thinking in terms of maybe a second wave of high performers that are more interest rate sensitive?

David Edwards:

Yes. The large cap stocks, the Googles, Amazons, Apple generate so much cash that the companies never borrow money. Banks, on the other hand, do borrow money, but also they lend money. So banks are actually getting a little bit of a spread now – net interest margin, which we haven’t seen in a while. Mid-caps and small cap companies tend to use bank financing more than just their own cash flow, so those companies tend to gain more from falling rates.

What about five years from now? Well, I would love to say that I have a perfect crystal ball five years from now, but I don’t. What I do know is that a lot of things will go wrong, whether it’s more war, whether it’s another pandemic. This year it’s COVID, RSV, and flu are all making a comeback.

And maybe it’s climate change. Maybe the storm that we’re getting tonight is just typical of storms we’ll get every week. But as long as companies continue to do their jobs, as long as people go to work every day to try and make more hamburgers at McDonald’s or more drugs at Eli Lilly or lend more at JP Morgan, company earnings are going to go up, interest rates will do what they do, portfolio value will continue to rise, and we will continue to take care of our clients.

Buff Parham:

You answered my last question. I think I get your drift in terms of recession and a reasonably positive outlook for the economy going forward.

David Edwards:

Yes, yes and yes.

It is a few days before Christmas and I don’t think we have any questions tonight. We will give everybody a chance to get back to getting ready for opening their gifts, or I guess wrapping their gifts. We’re at the wrapping stage. Everybody will get back to wrapping.

Buff Parham:

And tending their fires.

David Edwards:

Oh, wait, we did get one question at the buzzer. “What happens to the market if we become an autocratic country?”

Buff Parham:

Oh, boy.

David Edwards:

I said at the start of our webinar that in the past five years we have endured political unrest both domestic and international. Do you remember not caring at all about the presidential process until about eight weeks to go?

Buff Parham:

Yeah, pretty much.

David Edwards:

I don’t really think I paid any attention to presidential politics until maybe the last 15 years. And what has happened now is that we’re now in a continuous election process that starts the new cycle one day after the current cycle ends.

Buff Parham:

Never stops.

David Edwards:

I used to spend a lot of time breaking down the Republican platform for the economy versus the Democratic platform for the economy. But I’ve stopped because the Republicans don’t seem to have a platform any more.

I’d like to say that Trump will definitely not win in 2024, but right now he has a reasonable chance of winning. And what’s amazing to me is that when you poll average Americans, they think that Republicans do a better job at the economy than the Democrats. And yet the last several Republican administrations, so that’s Trump, Bush 43, George W. Bush, and Bush 41, George Herbert Walker Bush, all ended in recession, while the last administrations of Obama in 2016 and Bill Clinton in 2000 ended in expansion.

And I kind of like Biden-omics. It doesn’t come trippingly off the tongue, but I like what has happened with the economy in terms of bringing back jobs from overseas, expanding our green capabilities here in the US, trying to build more chips here domestically rather than relying on Taiwan, which is under risk from China.

I like where the economy is right now and I hope it continues. But I do not have a prediction right now about who’s the next president going to be. And I will say this. Even if it is an autocrat who’s running the country, as long as company revenues keep going up, company earnings keep going up, interest rates do what they do, the stock market will keep growing.

Well, Buff, you have a pleasant evening. I’m glad you weathered the storm.

Buff Parham:

Thank you, sir.

David Edwards:

This fire is very warm for me. I think we’ll get the storm overhead tonight, but we’ll be okay as well. Good night.

Buff Parham:

Happy holidays.