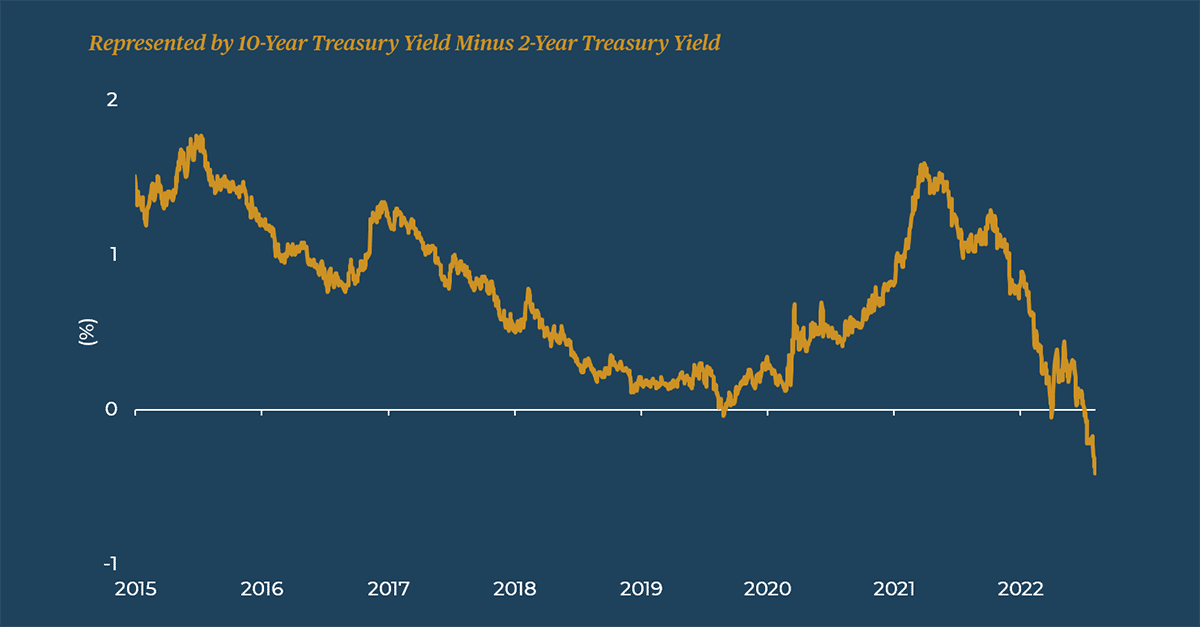

Markets in 2 Minutes – August 2022

With recent headlines focusing on inflation and the strong rebound in equities, Connor Darrell of our Investment Team highlights two ...

Striking the Balance: 10 Tips for Managing Burnout While Building Your Career

Like millions of folks around the world, my life took a complete turn in April of 2020. Within seven days, ...

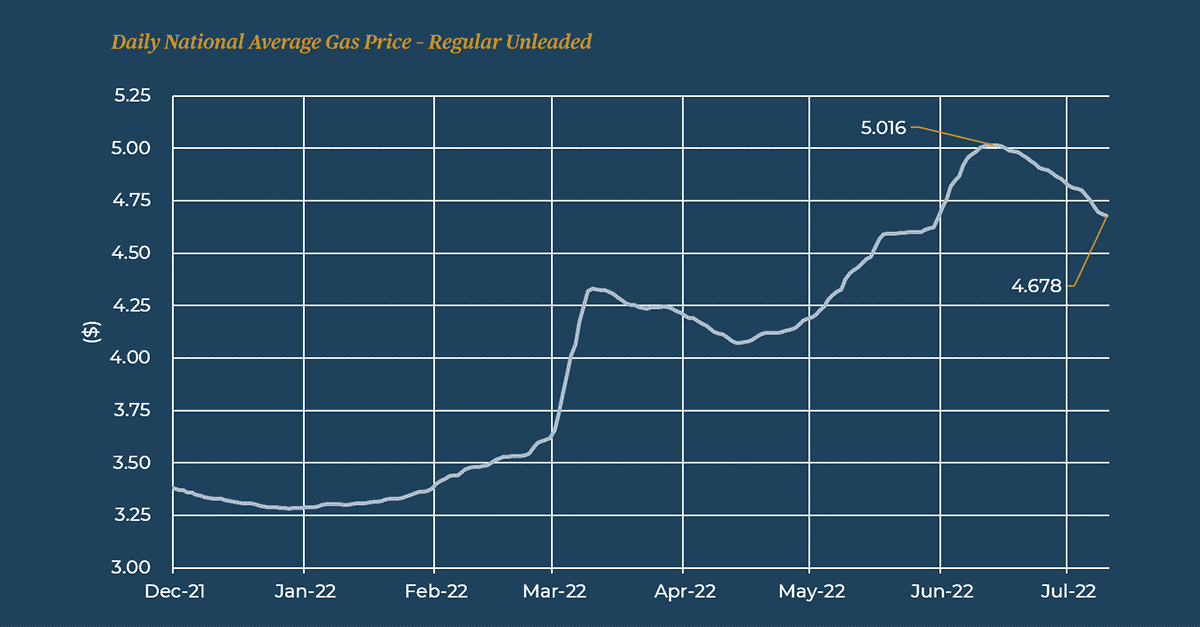

Markets in 2 Minutes – July 2022

The heightened prices of retail gas and crude oil have been felt acutely in recent months. In the newest edition ...

Summer 2022 Market Recap & Outlook

There have been lots of headlines over the last six months, so what’s top of mind for our Investment Team? ...