In this letter:

- We take a break from the U.S. to focus on markets overseas by looking at a dated jigsaw puzzle.

- A discussion of how some rules of thumb need to adjust with changing market composition.

- China, and how it may not fit several emerging market prerequisites (growth and demographics).

- Europe and Japan are changing, just very slowly.

- A few notes on the debt ceiling and inflation.

In my experience, kids love a geography puzzle. Give them a jigsaw of the U.S. and it will not take long for them to point to Florida, where the alligators live, Arizona, home of the roadrunner, or New York, and the Statue of Liberty. Off the coast of Southern California many puzzles often show Shamu, the famous orca from SeaWorld. Unknown to most kids, however, is that the original Shamu died some 50 years ago. SeaWorld has actually phased out the show altogether toward a new experience and yet, the image will continue to be synonymous with the West Coast for at least another generation.

Zoom out a little and it becomes clear that we often think about the rest of the world in similar, and sometimes dated light. To a degree, that’s because the pictures on jigsaw pieces take a long time to change. For example, a common refrain during the recent inflation shock is: shouldn’t we buy more emerging markets since they outperformed in past commodity spikes? That may have been true when materials and energy comprised nearly 40% (now less than 15%) of the benchmark in 2008, but now things are different. China is now nearly 40% of emerging benchmarks, while also being the largest consumer of most commodities. This same dynamic translates to assumptions on demographics. Emerging markets are supposed to have more economic growth and younger populations. That is also not necessarily the case anymore, which we will show below. We have a preconceived notion of certain regions, countries, and industries. While many of those notions are very much true, we tend to overlook shifts that take decades to develop. We also think that the short-term can easily dislodge long-term.

China

Let’s start with China. It may surprise investors that the average portfolio has about as much exposure via sales from large U.S. companies into China as it does to Chinese companies themselves (in most cases less than 3% for even the most aggressive portfolios). This is to say that recent headlines surrounding China’s intervention into several locally listed stocks and industries has limited impact on the average US investor. In fact, companies with China sales exposure continue to outperform those without it over the past year. What it does show, however, is that just because China has expressed varying levels of openness to capitalism, they still approach their economy from a very different perspective than Western nations. It is a unique puzzle piece that looks different depending on the country’s latest 5-year plan. For a while, plans supported commodity consumption, investment, and growth. Over this time, the conventional emerging market stock did well. China’s latest 5-year plan (2021-2025) moves away from this. There is focus on self-reliance in science and technology and directives on quality, not quantity, of growth. This means lower growth targets that may change year to year. All of this translates to more flexibility for stringent regulation in strategically important areas, which, importantly is nothing new. They have done so many times over the past 50 years.

The lower growth is not only self-imposed today, but an artifact driven by decades of demographic mistakes. How can the most populous country in the world not have enough people? China has long had issues with its one-child policy and the ramifications for future growth, but it took several decades for those to really hit home. China’s birth rate is currently 1.3 children per woman. To keep the population stable in China, that number needs to rise to 2. The U.S is at 1.7, but we also have net inbound migration, something China cannot claim.[i] A recent study showed China’s population potentially halving over the next 45 years if the birth rate does not change. That may be slightly hyperbolic but is still worrying. China abandoned its one-child policy in 2016, replacing it with a two-child limit. It didn’t work. In May of 2021 they raised the limit to three. They need more children, and one step is to make it cheaper to have children. So, being a country that can do such things, they recently went after the for-profit education sector and (effectively overnight) turned them into not-for-profits. This, to a degree, may be more telling than their government going after strategically important tech/data companies, or those that raise the ire of the politburo in the press or overseas. Demographics matter over the long haul, and China understands that. The corresponding equity markets have evolved to reflect that as well, with companies thriving on domestic consumption rather than export driven growth. A more people-centric vs. growth-centric policy is in the cards, changing the picture on the jigsaw puzzle piece. For a bit more color on China’s history of intervention and party goals, see our final thoughts at the end of this letter.

Europe

Off to the old world of Europe. The basic economic jigsaw piece for Europe shows poor demographics, old world industries dominated by banks, and constant wrangling of countries in times of distress trying to make heads or tails of monetary/fiscal policy. Many of those remain true, but there too we are seeing slow but accelerating changes. Within the European stock market, the proportion of banks has come down tremendously from near 25% going to less than 8% today.[ii] In fact, technology stocks now represent a larger part of the universe than banks for the first time ever. The second notable piece is that European stocks are even more globally exposed than the U.S., benefiting from more positive demographics trends outside of the block. Per the monetary/fiscal stalemate, like China, the digital transformation of Europe has become a key priority of policymakers across the EU. Recently we saw more than 20% of the EU Recovery and Resilience facility (comparable to U.S. COVID backstops) dedicated to supporting technology initiatives.[iii] Europe is also at the forefront of an accelerating move by investors toward more sustainable companies. Money flows into sustainable equity funds have been well documented, helping reduce financing costs for those that meet the ever-changing definition. We are now seeing that in fixed income as well, with the average financing cost of companies that issue green bonds continuously falling relative to traditional corporate debt in Europe and the U.S.

Japan

Last we come to Japan. Its jigsaw piece still shows a country that hasn’t recovered from the bursting of the bubble some 30 years ago. Thirty years of marginal economic growth, low interest rates, and fiscal/monetary missteps leave a lasting image. That said, even Japan is showing new tricks. The introduction of Abenomics in 2012 brought reforms in Japan long popular in the U.S. and Europe, specifically, increasing the money supply, boosting government spending, and attempting to enact reform that would make Japanese companies more globally competitive. The 2014 Stewardship code was quickly followed by the 2015 Corporate Governance code. Both helped to reinforce the importance of the shareholder by helping to offset the long-standing Japanese cross-ownership structures of keiretsu.[iv] It is going to take a fair amount of time for these (and subsequent revisions) to ultimately improve governance in Japanese companies, but there has already been progress in capital allocation decisions and shareholder-friendliness. Profit margins recently hit 20-year highs, and although revenue growth remains harder to come by, earnings have continued to improve.[v] Some important changes have also helped Japan partially fight off the demographic headwinds historically attributed to the country. Female labor force participation has risen from 63% to 73% over the past 10 years.[vi] The country is also showing a net positive migration rate over the past eight years, something that needs to expand even more to help offset declines in local demographics.[vii]

Most of the above reflect changes that happen over decades and are mostly ignored by news because there is nothing very new about them. But in the context of long-term investment horizons and understanding how they may or may not impact portfolios, these are often more relevant than any short-term headline. In certain areas, the U.S. has enjoyed structural and demographic privileges compared to these regions for some time. In retrospect, this has likely contributed to U.S. outperformance over many nations over the past decade. Yet, while this advantage may continue in some cases, overseas economies are not sticking with the static picture printed on their jigsaw piece. Many markets are evolving toward new economies and working on mitigating demographic risk. This is raising the bar on competition with the U.S., and if the capital market assumptions we are seeing from the industry are to be believed, raising the return expectations of international stocks.

Markets

Markets Decelerate

Markets Decelerate

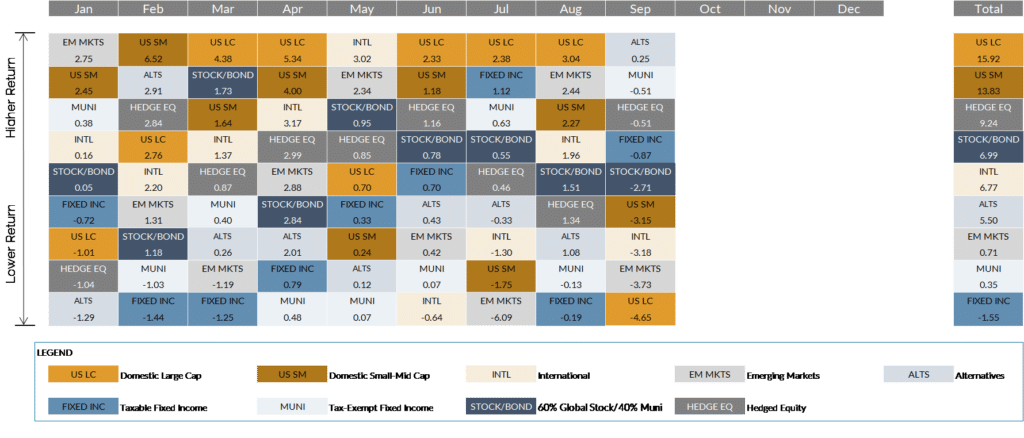

- Equity markets finally took a step back in Q3 after a very strong first half of the year. The S&P 500 rose less than 1% while small-mid, international, and emerging markets finished in the red. The prevalence of the delta variant, U.S. political gridlock, and Chinese market interventions all played a role in tempering optimism, while also reversing some of the tailwinds for value stocks relative to growth over the past year.

- Fixed income markets were effectively flat in Q3 after a strong Q2. With the credit outlook for municipal bond issuers much stronger than feared fifteen months ago and prospects of higher taxes, demand for municipal bonds remained very strong, resulting in their outperformance vs. the Barclays Aggregate bond index thus far in 2021. More credit sensitive satellite fixed income (e.g., high yield bonds and bank loans) continued to beat more interest rate sensitive core fixed income as the hunt for yield showed no signs of abating. Funds exposed to Treasury Inflation Protected Securities (TIPS) remain amongst the strongest performers year-to-date.

- Many alternative investments topped stocks and bonds for the quarter, with those that maintain low equity exposure outperforming, especially ones with exposure to credit, commodities, and/or volatility trades.

A Few Parting Thoughts

- Debt Ceiling – By the time this letter goes out, there will likely be a delay or resolution to the latest debt ceiling fight. Going back 80+ years, the debt ceiling in the U.S. has been lifted more than 100 times. The battles have become significantly more acrimonious over the past decade, but we have managed to raise it every single time regardless of the composition of the executive and legislative branches. The debt ceiling debate is not as simple as headlines often show because inability to raise the debt ceiling does not necessarily mean a U.S. debt default. The Treasury is capable of directing inbound dollars into interest payments, while delaying payments on such things as Social Security, Federal wages, etc. This is not a popular move for either party, but it has fewer long-term ramifications than a technical/real default on U.S. debt. For context, the U.S. has technically defaulted on its debt before, most recently in 1979 when the Treasury was temporarily unable to make payments on bonds maturing in the spring of 1979 due to a last second debt ceiling raise by Congress meeting back-office processing delays. The result then was a 0.60% pop in T-bill rates that resolved itself over a few months. We will likely avoid 1979 at least for a few months, but we are seeing the return of the trillion-dollar coin idea, last discussed in the 2011 and 2013 debt ceiling debates. That is a gateway drug to Modern Monetary Theory, which we discussed in a prior letter, so hopefully it just stays a news distraction.

- Inflation – Until recently, the U.S. has experienced more inflation than Europe due to COVID-related bottlenecks. Many of these such as used cars, lumber, hotel prices, and other “transitory” areas have started to normalize. The big inflation question going forward will be the sustainability of rising housing prices. Reminder that U.S. housing is not directly incorporated in CPI, but indirectly through a mechanism called Owners’ Equivalent Rent (OER). OER tends to lag housing prices but is on the upswing, and something worth monitoring. One area where the U.S. has avoided inflation (at least on a comparative basis) is in energy costs. For context, natural gas prices in the U.K. were nearly 400% higher in the first nine months of the year and are now trading at nearly 5x the level of U.S. natural gas. Oddly, we can thank U.S. bureaucracy for some of that. The U.S. has one of the most robust and uninterrupted geological survey records going back more than 100 years. Every advancement in drilling technology can and has been reapplied to older fields allowing for more efficient collection. This helped the U.S. officially become a net exporter of hydrocarbons in 2021. Previously we were net exporters of refined fuels but are now net exporters for the broader set. Europe still depends on Russia for more than 50% of its natural gas supply but is now importing more and more liquified natural gas from the U.S.

- A Bit More on China – China joined the UN in 1971, the same year the original Shamu died. Since then, policies of Den Xiaoping, Jian Zemin and Hu Jintao have altered the global view of the Chinese economy, ultimately resulting in its entry into the WTO in 2001. Early Xi Jinping continued Western friendliness, helping the renminbi join an exclusive club of currencies at the IMF in 2016 (previously USD, yen, euro, and pound) in special reserve status. All of this was done with an eye toward specific economic growth targets. The openness helped China become a global powerhouse, but they never fully abandoned Mao, which brings us to today. Much of the headlines these days in China reflect the government’s intrusion into several sectors as well as questions about how it will handle the debt issues of Evergrande, one of the largest real estate companies in the country. There are precedents for how China chooses to resolve these – mostly ringfencing the company, supporting transition of assets and/or responsibilities, or just a flat-out bailout. They did the same thing with Anbang and HNA quite recently, but the history of such intervention goes back a long way. Contrary to those headlines, China is not abandoning global markets. They are pushing hard to make the renminbi a global reserve currency. They will also likely premier their own cryptocurrency during the upcoming winter Olympics domestically before unleashing it onto the world. In other words, despite a China-centric agenda, they are not going into isolation mode or a stance that would severely restrict foreign capital flow into the country. What they have been doing behind the scenes is trying to diversify from USD-denominated trade through direct arrangements and bilateral swap agreements (basically commitment to exchange currencies at a specified rate with more than 35 nations). This allows China to be less U.S.-dependent and less U.S.-friendly, a stance that is unlikely to change any time between now and China’s 20th party Congress in 2022. That is when Xi Jinping will officially take on a third term (previously impossible until he cleared the way for a lifetime position). Rhetoric will be almost exclusively China-first over this time, with the only potential compromises with the U.S. coming from climate or worsening of COVID variants.

[i] Source: South China Morning Post. https://www.scmp.com/news/china/science/article/3150699/chinas-population-could-halve-within-next-45-years-new-study

[ii] Source: MSCI

[iii] Source: European Commission. https://ec.europa.eu/info/business-economy-euro/recovery-coronavirus/recovery-and-resilience-facility_en

[iv] Keiretsu is a Japanese term referring to a business network made up of different companies, including manufacturers, supply chain partners, distributors, and occasionally financiers. They work together, have close relationships, and sometimes take small equity stakes in each other, all the while remaining operationally independent. Translated literally, keiretsu means “headless combine.” (Source: Investopedia)

[v] Source: Yardeni, MSCI

[vi] Source: World Bank. https://data.worldbank.org/indicator/SL.TLF.ACTI.FE.ZS?locations=JP

[vii] Source: Bloomberg

Markets Decelerate

Markets Decelerate

2024 1st Quarter Commentary: “In a world drenched in pessimism, it pays to be optimistic.”

With so much emphasis placed on negative headlines, negative developments globally, and the ability to embrace one’s inner negativity, it ...