In this letter:

- A discussion of Modern Monetary Theory.

- While interest rates are back up, the rebound in risk-assets continues domestically and abroad.

- Global context regarding debt, deficits, interest rates, and inflation.

Re-reading what we wrote last year at this time, it is amazing to see how much has changed, but also more importantly, how much has stayed the same. We ended last year’s letter with this:

“We are entering a unique period where it is getting harder to lean on precedent. Like it or not, the fiscal and monetary policies enacted today, and the associated backstopping of the economy and asset-prices will translate into evolving debates about Modern Monetary Theory (MMT) and the long-term ramifications of debt, deficits, and markets…”

So, with another round of stimulus underway and multi-trillion-dollar infrastructure spending up for debate, we wanted to touch on a topic that seems to pop up more often in client questions these days – Modern Monetary Theory (MMT). Why is this coming up more? One of the central pillars of the theory is that national deficits for a small group of countries do not matter. That if a country, like the U.S., has monetary sovereignty and as long inflation remains in check, it can spend as much money as it needs to reach full employment. And it would not have to issue debt to do so. That is the kicker. It can print it. One can see how such an idea can find supporters. Some happy with what amounts to a blank check, others happy that debt and taxes do not (at least initially) have to rise.

First a few disclaimers. Despite seeing it more frequently in print and from a select group of politicians, MMT is still very much a fringe idea. It has been dismissed by traditional Chicago and Austrian schools of economics and denounced by most politicians in power today. There is even a toothless House proposal (H. RES. 1049) bouncing around Congress since last July aiming to:

“…condemn Modern Monetary Theory and recognizing that the implementation of Modern Monetary Theory would lead to higher deficits and higher inflation.”

The second disclaimer is the misnomer that MMT is somehow a new idea. MMT has its origin dating back hundreds of years, with Chartalism and Functional Finance in the early 20th century contributing to the body of work. We outline some notable differences from current economic orthodoxy below, but we encourage anyone interested in its evolution to click through the links above. The third disclaimer is that we are not going to go through each theoretical pillar of the concept. We will, however, touch on the history and human components here, as well as whether we are already practicing MMT at the end of the letter.

Without further ado, adherents to MMT believe in the following (please understand this is not designed to be an exhaustive list):

- Countries and governments that issue their own fiat currency (and also have most of their debt denominated in said currency) can never run out of money. Alan Greenspan is often quoted – “There’s nothing to prevent the federal government from creating as much money as it wants and paying it to someone.” As a reminder, the big difference from how things operate today is that MMT’ers do not support more debt to accomplish this. In fact, many are quite opposed to Quantitative Easing and debt-financed spending because they believe it ultimately does not work. MMT supports printing instead.

- Another cornerstone of MMT is its job guarantee model. That is, to ensure full employment in times of economic hardships, those who would have lost their private sector jobs would gain federally funded jobs. As the economy picks up, those people would rejoin the private workforce.

- This is all done, in theory, with an eye toward inflation. The thought is that creating money alone does not cause inflation but that spending when the economy is at full capacity and employment does. MMT supporters are actually quite vocal about controlling inflation, though the “how” is quite different from today. Taxes, instead of being a mechanism to fund government operation and spending, would become the mechanism for reducing an overheated economy and inflation. In other words, it requires governments to have the discipline to raise taxes when prices are accelerating too fast.

First, it should be no surprise this is a far departure from both the U.S. and global modus operandi. Above and beyond the immediate visceral reactions we hear (and occasionally blurt-out ourselves) to any of the above points, the global monetary system (which is still very much reliant on the U.S. dollar and U.S. debt) is not setup to have a reserve currency attempt such a feat. If we try to extrapolate the myriad scenarios and implications of what might happen, it will take many more pages than this letter provides, so we will not attempt it here.

There really is no precedent for a reserve currency trying to pull this off. Historical examples of countries with open-ended printing capabilities were for non-reserve currencies. For those countries, printing discipline often dissolved in times of stress. In many cases, the lack of discipline brought inflation: e.g., Germany and Austria post WWI, China and Hungary in the 1940s, Brazil in the 1980s and 90s, Zimbabwe during the late 2000s, and Venezuela in the late 2010s. Interestingly, one of the better examples of an MMT variant working (for a time) was in China. The country has a history of paper money going back to the 10th century. About 800 years ago, the Song dynasty had a near 100-year run of monetary stability but ultimately succumbed to over-printing. They tried higher taxes to combat the problem, but it eventually resulted in extreme devaluation of the huizi in the 13th century. The dynasty fell soon thereafter.

Proponents of MMT hope to achieve the same goals as traditional economists: ensure growth and reduce unemployment while controlling inflation. Unfortunately, above and beyond the structural questions such an approach raises, it also depends on human discipline. As we know, history is littered with the undisciplined and it is very hard to find governments willing to make the hard decisions. Under the current system it’s managing spending in the context of long-term debt and deficits. Under MMT, it would be finding leaders willing to raise taxes in times of inflation.

Markets

Risk Rewarded

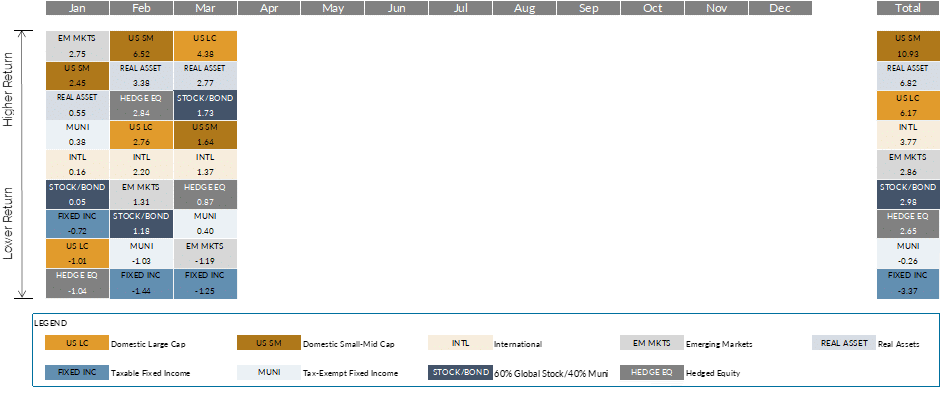

- Risk assets continued to benefit from a combination of improved underlying earnings fundamentals, stimulus, liquidity, and vaccine progress. In equities, “reopening” sectors led returns, with energy, financials, and industrials up double digits in U.S. markets and smaller cap stocks outperforming large. Overseas, developed markets topped emerging, with China and Brazil in the red.

- Potentially a bigger story was in the fixed income markets where interest rates continued to back up. The 10-year Treasury ended the quarter yielding 1.7%, ~0.8% higher than the start of the year, while shorter term bonds remained anchored near 0%. The Fed continued to telegraph no rate hikes until 2023, though the market is now pricing in potentially two rate hikes that year. Rising long-term rates are in part attributable to growing inflation expectations, which rose from ~2.0% at the start of the year to ~2.4% by quarter end. Much of that expectation is front loaded as we are coming off very low price levels from a COVID-related drop a year ago. Rising rates were generally punitive across the fixed income spectrum, though lower quality bonds tended to hold up better thanks to tightening credit spreads.

- Municipal bonds held up better as demand continued to be robust in the face of lower supply of new issuance, which is typical of this time of the year and prospects for higher taxes. The delay in tax-day in 2021 also postponed seasonal selling of existing municipal bonds.

- Alternative investments were very much bifurcated during the quarter. Those with more equity exposure (particularly those long value/short growth) did quite well. On the opposite side of the spectrum, strategies more focused on the fixed income space with interest rate risk exposure and bond exposure overseas struggled.

Haven’t We Already Embarked on MMT?

An immediate question accompanying MMT concerns is whether it is already here. First, it was quantitative easing (QE). Now it is COVID-related Fed largess and multi-trillion-dollar fiscal packages. Debt-to-GDP has never been higher. The prevailing thought is as follows – as the U.S. becomes progressively more indebted, lenders will require higher interest rates on that debt to offset expectations of inflation, or worse, to compensate against concerns of U.S. solvency. This was the default response from pundits when U.S. debt was downgraded by rating agencies in 2013.

The real data of the last 40+ years shows the exact opposite. Japan is the poster child of over-indebtedness with government debt-to-GDP rising to nearly 240%. Yet, even as the government not only purchased their own debt but also REITs and other assets, interest rates and inflation continued to fall (occasionally below zero). The Eurozone is not much different, with a debt-to-GDP now at ~100%, and interest near zero with very little inflation in sight. The U.S., at ~130%, is somehow well below Japan, but we too have seen rates decline over this period (even after the downgrade). The backup in the 10-year Treasury yield since last summer is notable, but really only brings us back to the level of Q1 of 2020 and still near all-time lows. If we look at public and private debt, the numbers are even more stark (~700% debt-to-GDP in Japan, ~500% in Euro area, and ~400% in the U.S.). Some economists explain this phenomenon as a debt overhang. The more we borrow, the less GDP the incremental dollar generates. As we have seen over the past 40 years, pops in deficit spending offer a few quarters of GDP boost, which subsequently diminishes.

When we see a significant increase in money supply, one would expect that money to translate into more lending and spending (and thus potential inflation), and while this is the case initially, we have seen the velocity of money (the number of times money moves from one entity to another) continue to decline. For all this money to generate inflation, it must move through the system/economy more quickly (think of it as lending begetting spending, begetting more lending, etc.). This can still happen if the yield curve continues to steepen, making it even more compelling for banks to lend. Think of how compelling it is for a bank to give you 0% on your deposits and lend at 6%, versus still giving you 0% but lending at just 3%. For now, however, that money is finding its way into assets rather than traditional inflation numbers. We remind folks that asset prices are not a part of government definitions of inflation via CPI or PCE – we will have a more in-depth piece on the poor definition of inflation in the coming months.

If you ask whether what we are doing right now is consistent with the pillars outlined by MMT, the answer is, at least for now, no. We remain on the path of issuing finite-term interest-bearing debt to pay for our deficits (instead of, for example, 0% no term debt). That said, this is not a topic that can be easily swept under the rug. The line between traditional approaches and MMT may blur further in the coming years, requiring constant vigilance and diligence on the part of investors.

2024 1st Quarter Commentary: “In a world drenched in pessimism, it pays to be optimistic.”

With so much emphasis placed on negative headlines, negative developments globally, and the ability to embrace one’s inner negativity, it ...