Summary

In recent days, financial and social media have been buzzing with warnings of a potential “lost decade” for stocks and a looming “market reckoning” for bonds. Notably, Goldman Sachs has cautioned that the S&P 500 may experience slower growth, while prominent investor Paul Tudor Jones predicts a financial crunch tied to unsustainable government spending.

While these headlines are designed to grab attention — whether for internet clicks or television ratings — they often overlook critical underlying data. Although no one can predict the future with certainty, both perspectives reinforce our long-standing belief in the power of a diversified portfolio to navigate the unpredictable challenges ahead.

Stocks on a Road to “Nowhere”

On the equity side, there are warnings that the S&P 500 may deliver a 3% annualized total return in the next decade, translating to a 1% real return over that time. Factors such as high valuations, market concentration, possible economic contraction, corporate profitability, and interest rates are fueling the concerns. Not shared in headlines was additional commentary in the analysis that:

- Bonds are likely to outperform large cap stocks

- Non-market cap weighted investments (i.e., the non-Magnificent 7) may outperform by 2% to 8% annualized.

Both conclusions are non-trivial yet fail to grab headlines

While we agree that equity valuations, particularly for the largest U.S. companies, are high, we disagree with the notion that valuations alone will drive stocks to stagnate. Over the long term, equity markets are driven by changes in valuations, earnings growth, and dividends. As long as earnings and dividends continue to grow, that offers support for stocks to offset the impacts of elevated valuations. Current dividends for the S&P 500 are at 1.3% annualized, and earnings growth over the next decade is expected to be between 5-6% per year. Historically, U.S. companies have consistently grown earnings by 6.5% per year over the last century.

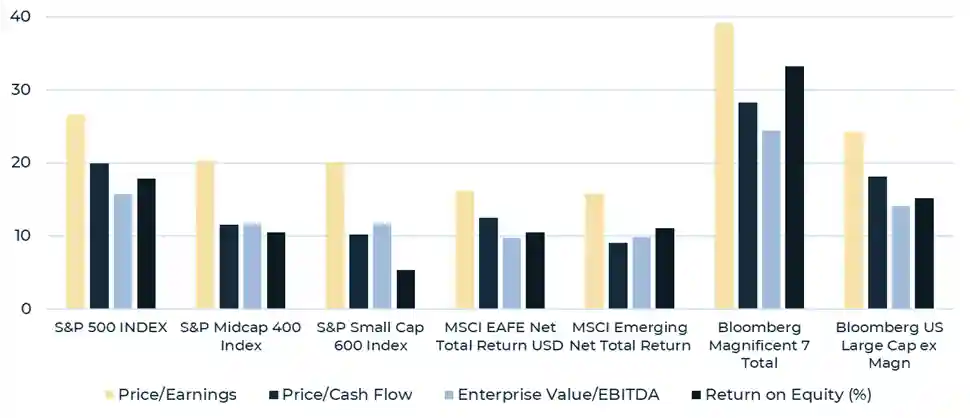

We are long standing proponents of being cognizant that the price you pay matters when it comes to owning any investable asset. Higher prices translate to lower future returns, and vice versa. Mega-cap stocks, while commanding high valuations, also deliver historically high earnings, return on equity, and revenue growth rates. While some degree of mean reversion may occur, this is far from a repeat of the 1999-2000 tech bubble, where fundamentals were entirely disconnected from stock prices. For example, the “Magnificent 7” stocks currently boast a return on equity of over 30%, while the rest of the S&P 500 sits at roughly half that figure.

Source: Bloomberg Finance, L.P. (data as of 10/22/2024)

We utilize valuations as a guardrail to protect against potential disappointment in the future, which reinforces the importance of diversifying away from the top of the market. Including value stocks alongside growth, small-, and mid-cap stocks, as well as international investments can provide balance. As one example, small cap stocks were hit hard by rising funding costs in 2022 and continue to trade at a discount to their own history and relative to larger counterparts.

While focusing on the largest U.S. companies was a successful strategy over the past decade — and may continue to be in the near term due to the rise of artificial intelligence and its associated productivity gains — there are ample opportunities elsewhere in the market. Ignoring these opportunities in favor of a single market narrative removes valuable context about other segments of portfolios that remain undervalued. Additionally, U.S. Real GDP continues to expand at a remarkable 3% year-over-year, defying expectations of a slowdown. If this trend persists, a decade of no returns in U.S. equity markets seems unlikely.

What About Bonds?

Paul Tudor Jones takes a different stance, suggesting that bonds face a Minsky Moment of higher government spending contributing to a sudden selloff in government debt markets. Tudor Jones specifically says, “We are going to be broke really quickly unless we get serious about dealing with our spending issues.” Later in the conversation, it is shared that there are plenty of solutions, including TCJA tax cut expirations, raising payroll taxes, increasing the corporate tax rate, increasing individual tax rates, means testing on Medicare, and raising the age of Social Security, to cover just a few.

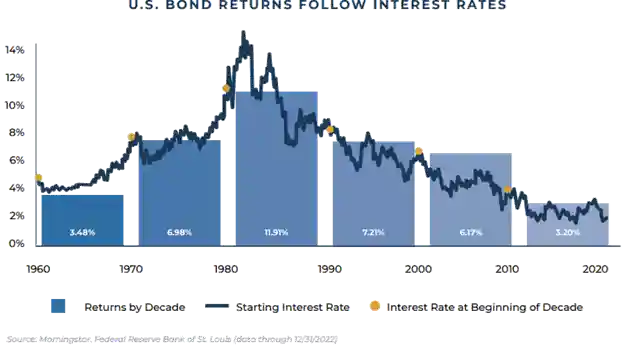

While concerns about fiscal sustainability are valid with recently large federal deficits ($1.8 trillion in fiscal 2024 or 6.4% of GDP) in a time of economic strength and growing federal debt (124% of GDP) on the U.S. balance sheet, the reality for investors is that higher yields present opportunities. As history shows, starting yields have been a strong predictor of future returns for fixed income investors, even during periods of inflation and economic fluctuation.

The U.S. remains in a privileged position with its status as the reserve currency of the world, which offers a great deal of flexibility to navigate higher levels of debt and fiscal spending. There is a potential for bond markets to force the hand of the government if yields on government debt ultimately move higher, but from the standpoint of investors, higher yields are good news, particularly for those individuals with a bias towards saving. The low to zero interest rate period from 2009-2021 meant investors began to embrace more risk within their portfolios through increased equity exposure to generate returns. We are now returning to a backdrop of balanced portfolios offering the opportunity to achieve financial goals with potentially lower imbedded risk.

Conclusion

While alarming headlines can be hard to ignore, they often fail to capture the full picture. A diversified portfolio remains one of the most effective ways to navigate uncertain markets. Whether it’s concerns about stocks facing a “lost decade” or bonds bracing for a reckoning, history shows that spreading investments across asset classes offers a more stable path forward. As always, maintaining a long-term perspective and staying focused on fundamentals will be key in helping clients achieve their financial goals, regardless of the challenges that lie ahead.

Wealthspire Advisors LLC, Fiducient Advisors LLC, Wealthspire Retirement, LLC dba Wealthspire Retirement Advisory, and certain other affiliates are separately registered investment advisers.

Past performance is no guarantee of future results. Different types of investments involve varying degrees of risk. Therefore, there can be no assurance that the future performance of any specific investment or investment strategy, including the investments and/or investment strategies recommended and/or undertaken by Wealthspire Advisors, or any non-investment related content, will be profitable, equal any corresponding indicated historical performance level(s), or prove successful. No amount of prior experience or success should be construed that a certain level of results or satisfaction will be achieved if Wealthspire Advisors is engaged, or continues to be engaged, to provide investment advisory services.

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results.

This material should not be construed as a recommendation, offer to sell, or solicitation of an offer to buy a particular security or investment strategy. The information provided is for informational purposes only and should not be relied upon for accounting, legal, or tax advice. While the information is deemed reliable, Wealthspire Advisors cannot guarantee its accuracy, completeness, or suitability for any purpose, and makes no warranties with regard to the results to be obtained from its use.