The recent passing of Charlie Munger, Vice Chairman of Berkshire Hathaway, made us reflect on his and Warren Buffet’s successful investing over the years. And although this missive will not be a tribute to “The Abominable No-Man” or the “Oracle of Omaha,” and regardless of your affinity for Charlie and Warren in general, their common-sense approach to investing provides learning opportunities for us all.

If you have read enough investor letters from Berkshire Hathaway’s annual report (which we are guilty of), you know that Charlie and Warren tended to repeat several important investing concepts (we all tend to repeat things as we get older), from keeping it simple, to not following the herd, to their limited belief in forecasting, and perhaps most importantly, to having appropriate long-term holding periods and a great deal of patience. Some of our favorite quotes from them both are below:

- “Mimicking the herd invites regression to the mean.”

- “The world is full of foolish gamblers, and they will not do as well as patient investors.”

- “Successful investing takes time, discipline, and patience. No matter how great the talent or effort, some things just take time.”

- “Calling someone who trades actively in the market an investor is like calling someone who repeatedly engages in one-night stands a romantic.”

- “What we learn from history is that people do not learn from history.”

In today’s environment of X (the app formerly known as Twitter), CNBC and other round-the-clock news/entertainment sources, the pace and complexity of investing has grown substantially. When those around you are picking the latest and greatest investments, churning portfolios in trying to predict where markets, or interest rates, or corporate earnings are headed next, human nature makes it difficult to stay disciplined. Even many professional investors will make unnecessary portfolio changes to justify their fees, follow the crowd, prove their intelligence, or just show that they are doing something with client money.

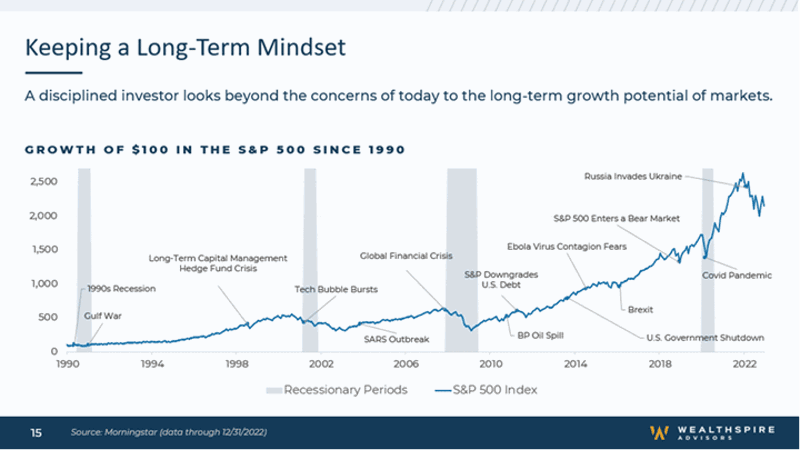

Looking back at the Dow Jones Industrial Average (which was first calculated in 1896), of the twenty best market days of all time, sixteen were during the Great Depression, one was a few days after the market crash of 1987, and two were during the 2008 financial crisis. Missing these days significantly reduced long-term returns, and most investors who missed them were those who sold out (and just as importantly, stopped buying) after stocks crashed and everyone around them panicked. History has shown that those who try to avoid losses consistently end up missing even larger gains.

- “Over the long term, the stock market news will be good. In the 20th century, the United States endured two world wars and other traumatic and expensive military conflicts; the Depression; a dozen or so recessions and financial panics; oil shocks; epidemics; and the resignation of a disgraced president. Yet the Dow rose from 66 to 11,497.”

- “This economic creation will deliver increasing wealth to our progeny far into the future. Yes, the build-up of wealth will be interrupted for short periods from time to time. It will not, however, be stopped.”

- “I’ll repeat what I’ve both said in the past and expect to say in future years: Babies born in America today are the luckiest crop in history.”

There will always be intelligent sounding reasons to consider selling out of the markets, or to be a bit pessimistic about the future.

Even though markets continue to go up over time, those who respond to events negatively are judged as more intelligent than those who respond positively. While pessimism often sounds profound, optimism is often viewed as naïve or uninformed. Mostly bearish pundits like Jeremy Grantham, John Hussman, or Nouriel Roubini are celebrated for their thought-provoking insight. At the same time, Wharton Professor Jeremy Siegel is often ridiculed as a perma-stock-bull, blindly cheering for higher markets since the early 1980s (yet, since 1980, the S&P 500 Index has increased 11.6% per year). Unfortunately, it seems that few care about long-term positives when someone is warning about The Next Great Depression.

Although the psychology behind this is beyond the scope of today’s musings (look to our other commentary, “Beyond Wealth: Integrating Financial Planning and Investor Behavior” for more on that topic), let’s just summarize it as being part of human evolution. Any being that treats threats more urgently than opportunities has a better chance for survival and reproduction.

- As Warren Buffet said, “You do things when the opportunities come along. I’ve had periods in my life when I’ve had a bundle of ideas come along, and I’ve had long dry spells. If I get an idea next week, I’ll do something. If not, I won’t do a damn thing.”

One issue of being a bit pessimistic in investing is that it often requires action, whereas being more optimistic generally implies staying the course. Now, do not confuse discipline with disinterest, or that you should never make portfolio changes. This is not about doing nothing for the sake of doing nothing, but about doing nothing in those times when it will most likely help you avoid making a big mistake. The Abominable No-Man put it well:

- “You only have to do a very few things right in your life so long as you don't do too many things wrong.”

- “There needs to be a good reason for every move you make in your portfolio. Successful long-term investing is about learning to turn down many more investment ideas than you accept.”

You will be missed, Charlie, but not forgotten.

Wealthspire Advisors LLC, Fiducient Advisors LLC, Wealthspire Retirement, LLC dba Wealthspire Retirement Advisory, and certain other affiliates are separately registered investment advisers.

This material should not be construed as a recommendation, offer to sell, or solicitation of an offer to buy a particular security or investment strategy. The information provided is for informational purposes only and should not be relied upon for accounting, legal, or tax advice. While the information is deemed reliable, Wealthspire Advisors cannot guarantee its accuracy, completeness, or suitability for any purpose, and makes no warranties with regard to the results to be obtained from its use.

Please Note: Limitations. The achievement of any professional designation, certification, degree, or license, recognition by publications, media, or other organizations, membership in any professional organization, or any amount of prior experience or success, should not be construed by a client or prospective client as a guarantee that he/she will experience a certain level of results or satisfaction if Wealthspire is engaged, or continues to be engaged, to provide investment advisory services.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Past performance is no guarantee of future results. Different types of investments involve varying degrees of risk. Therefore, and there can be no assurance that the future performance of any specific investment or investment strategy (including the investments and/or investment strategies recommended and/or undertaken by Wealthspire Advisors, or any non-investment related content, will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. No amount of prior experience or success should be construed that a certain level of results or satisfaction will be achieved if Wealthspire Advisors is engaged, or continues to be engaged, to provide investment advisory services.