“There are decades when nothing happens, and there are days when decades happen.” That timeless adage feels especially apt in 2025. Since January, we’ve witnessed sweeping developments in tariffs, tax policy, immigration, and geopolitics - each significant on its own, but together, they’ve compressed the pace of change into mere days and weeks. For investors, it has been both exhilarating and exhausting. In this letter, we’ll unpack the key themes shaping the current landscape, separate signal from noise, and discuss how to remain grounded when the world feels anything but.

The Paradox of Progress

One of the most frequent questions we’ve heard from advisors and clients this year is deceptively simple: “Why do markets keep going up despite all the troubling headlines?” In a world flooded with information and quick takes, sometimes the simplest answers hold the most truth: markets tend to rise when economies grow. And rise they have – through September, the S&P 500 notched 34 new all-time highs, a testament to resilience amid uncertainty.

But it’s not that investors are ignoring risk. Far from it. This year has offered no shortage of reasons to worry - new tariff regimes reshaping trade flows, debates over the “One Big Beautiful Bill Act” (OBBBA), labor market softening, and the occasional government shutdown. Add in speculation about U.S. dollar debasement, and you have all the makings of a classic “wall of worry.” Yet alongside those fears, we’ve also seen innovation, productivity growth, and an economy that keeps humming. So, which narrative wins – the one about rising risk or the one about enduring growth? The answer, as always, depends on your horizon.

In the short term, markets follow sentiment. Over 3-, 6-, or 12-month horizons, they can be buffeted by politics, headlines, and momentum. But over the long run, markets tend to track the path of economic expansion and corporate profits. And for now, most data still point toward growth extending into 2026. What’s powering that growth? Two key forces: consumers and artificial intelligence.

Consumers remain relatively confident. The labor market has softened at the edges with job openings down and wage gains moderating, but household balance sheets are still healthy, and wage growth continues to outpace inflation. Meanwhile, the AI boom is fueling one of the most significant capital expenditure cycles we’ve seen in decades, spilling over into manufacturing, healthcare, logistics, and finance. In short: America is spending again, not recklessly, but productively.

If 2024 was a year of transition, 2025 has been a year of acceleration. The U.S. has re-embraced industrial policy, while tariffs on sectors such as manufacturing, energy, and technology are reshaping supply chains. For companies, this environment is shifting domestic production towards a political and economic priority.

At the same time, the debate around taxes and the OBBBA has added new wrinkles for investors. The bill’s incentives around manufacturing and infrastructure are intended to spur capital investment, but components could weigh on sentiment if implemented unevenly. For now, markets are taking it in stride, betting that the growth impulse outweighs the fiscal drag that may eventually accompany the OBBBA.

Investors have largely grown accustomed to operating in an environment of chronic uncertainty. The pattern is familiar: a spike in volatility, followed by a quick normalization. The global economy continues to adjust imperfectly, but adaptively.

Stagflation: Ghosts From the Past?

Which brings us to another recurring question – are we entering a stagflationary cycle?

The term itself has a fascinating history. It was coined in 1960s Britain by Iain Macleod to describe a rare combination of stagnant growth and rising prices. The concept gained traction in the 1970s, when the U.S. experienced double-digit inflation, weak productivity, and oil-price shocks. Between 1975 and 1985, the core Personal Consumption Expenditures (PCE) index averaged nearly 7% and unemployment hovered above 7.5%. Today, numbers are very different. Core PCE inflation is 2.9% and unemployment is 4.3%. Growth is positive, productivity is rising, and wages are growing faster than prices, not slower. If anything, we’re in an environment of reflation, not stagflation.

That said, inflation is not fully tamed. The path from 9% CPI down to a sub-3% core PCE has been the “easy” part; moving the rest of the way toward the Fed’s 2% target will be more challenging. Stickier categories such as housing and services remain stubbornly high. But rather than signaling a return to the 1970s, today’s inflation reflects an economy that’s simply too warm, not one that’s broken. For a deeper dive into why inflation has psychological impacts, see our piece, “Puncturing Inflation.”

Dotcom 2.0 Rises

Of all the themes defining this year, Artificial Intelligence (“AI”) stands at the front of the pack. We’ve written on how AI is reshaping markets and portfolios (see our other two pieces in the series here and here), and expect that story will continue to evolve. We do not expect to know whether the AI cycle will manifest into the next industrial revolution or whether it is the next great bubble for the American economy, but what we can offer is perspective.

In just the last quarter, the scale of investment accelerated dramatically. Nvidia announced plans to invest $100 billion in OpenAI. A new partnership between OpenAI and AMD secured massive chip supply deals. Meanwhile, the U.S. government surprised markets by taking a 9.9% stake in Intel, signaling that AI infrastructure is a strategic national priority. This offers other implications that we will cover in another missive.

For seasoned investors, this interconnected ecosystem brings to mind echoes of the late 1990s. Back then, telecommunications equipment companies lent to telecom operators, who in turn recycled that money back into buying more equipment. The circularity inflated valuations until it didn’t.

So, is AI the next dot-com bubble? Not yet. While there will undoubtedly be speculative excess, today’s technology giants bear little resemblance to the unprofitable startups of 1999. The modern technology and AI leaders are cash-flow machines with strong balance sheets, limited debt, and returns on invested capital that would make most CEOs jealous. If the late 1990s were built on hype, today’s cycle is being built on utility with measurable productivity gains, automation efficiencies, and real capital investment.

Still, investor discipline is key. The line between innovation and mania often becomes clear only in hindsight. The prudent investor recognizes that secular transformations can be both wildly profitable and deeply cyclical. In other words, AI may indeed rhyme with past eras of technological revolution - but it doesn’t have to repeat their mistakes.

We always encourage a thoughtful approach to investing, one that blends an understanding of economic cycles, market sentiment and valuations. AI offers the potential for transformational change with investor sentiment reflecting the possibility of a new renaissance in productivity growth. Discipline will remain critical however, as market valuations for larger companies in the US are undoubtedly high and forward looking returns may not be as easily achieved as those in recent years.

Markets

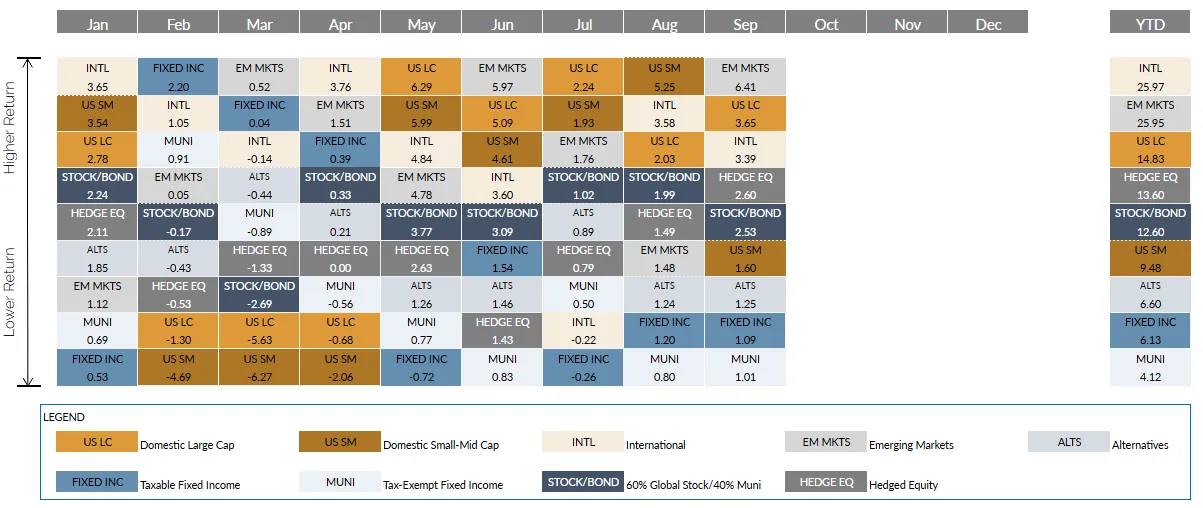

Source: Morningstar and Bloomberg Finance L.P. (data as of 9/30/2025)

- Stock markets remained strong in the third quarter, with the S&P 500 index up 8% and 14.8% YTD. Growth stocks generally led the way thanks to positive trends in AI capital spending. Small cap stocks rebounded in the third quarter, seemingly the beneficiary of interest rates falling and better expectations for economic growth.

- Bond markets were up throughout the third quarter as markets priced in lower interest rates. In September, the Federal Reserve wound up cutting rates for the first time since 2024, citing a slowdown in labor markets being enough to warrant the reduction. Markets anticipate the Fed Funds rate will fall to 3.0% by the end of 2026. The 10-year yield finished the quarter at 4.15%, down from 4.23% at the end of the second quarter. Municipal bonds rebounded in the quarter with an especially strong September and are up 1.8% for the year.

- In conjunction with broad appetite for risk taking, credit spreads continue to be historically tight. High yield bonds are up 7.3% this year, while investment-grade corporates returned 8.1%. Asset-backed securities (both liquid and illiquid) continued to offer relative value, with more room for spread narrowing.

- Commodity markets were higher in the third quarter on easing concerns about the economy and a reacceleration in growth expectations. Agricultural prices dropped in most areas, with food prices declining and coffee rising. Within the energy complex, crude and gas prices rose, but an ongoing supply excess in natural gas led to its price being down. Precious metals prices were up across the board on U.S. dollar debasement worries and increased purchasing by central banks.

Wealthspire Advisors LLC, Fiducient Advisors LLC, Wealthspire Retirement, LLC dba Wealthspire Retirement Advisory, and certain other affiliates are separately registered investment advisers. ©2025 Wealthspire Advisors

This information should not be construed as a recommendation, offer to sell, or solicitation of an offer to buy a particular security or investment strategy. The commentary provided is for informational purposes only and should not be relied upon for accounting, legal, or tax advice. While the information is considered to be reliable, Wealthspire Advisors cannot guarantee its accuracy, completeness, or suitability for any purpose, and makes no warranties with regard to the results to be obtained from its use. If the reader chooses to rely on the information, it is at reader’s own risk.

Past performance is no guarantee of future results. Different types of investments involve varying degrees of risk. Therefore, there can be no assurance that the future performance of any specific investment or investment strategy, including the investments and/or investment strategies recommended and/or undertaken by Wealthspire Advisors, will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. No amount of prior experience or success should be construed that a certain level of results or satisfaction will be achieved if Wealthspire Advisors is engaged, or continues to be engaged, to provide investment advisory services. Wealthspire Advisors is neither a law firm, nor a certified public accounting firm, and no portion of its services should be construed as legal or accounting advice. Moreover, you should not assume that any discussion or information contained in this presentation serves as the receipt of, or as a substitute for, personalized investment advice from Wealthspire Advisors. A copy of our current written disclosure Brochure discussing our advisory services and fees is available upon request or at www.wealthspire.com. The scope of the services to be provided depends upon the needs and requests of the client and the terms of the engagement. Please Remember: If you are a Wealthspire Advisors client, please contact Wealthspire Advisors, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently.

Wealthspire Advisors and its representatives do not provide legal or tax advice, and Wealthspire Advisors does not act as law, accounting, or tax firm. Services provided by Wealthspire Advisors are not intended to replace any tax, legal or accounting advice from a tax/legal/accounting professional. The services of an appropriate professional should be sought regarding your individual situation. You should not act or refrain from acting based on this content alone without first seeking advice from your tax and/or legal advisors.

Certain employees of Wealthspire Advisors may be certified public accountants or licensed to practice law. However, these employees do not provide tax, legal, or accounting services to any of clients of Wealthspire Advisors, and clients should be mindful that no attorney/client relationship is established with any of Wealthspire Advisors’ employees who are also licensed attorneys.