Writing a quarterly letter in the wake of a tariff announcement feels like an exercise in April foolishness. Markets are moving fast, and no doubt they’ll shift again before this reaches your inbox. A quick disclaimer—we’re not here for political hot takes; there's plenty of that elsewhere. Most questions now concern policy, tariffs, the U.S. dollar (‘USD’), and the market impact. We will touch on those and related topics below, but first a quick recap.

U.S. equity markets surged post-election and continued to hit all-time highs. Historically, and maybe surprising to some, equity highs beget higher highs. At the same time, the USD was up versus most major currencies, and bonds were up after a rough start to the fourth quarter of last year. This came to an abrupt halt mid-February, when policy uncertainty transitioned into certain uncertainty. Equities sold off, the dollar weakened, but core bonds continued higher. The S&P, and large cap growth stocks in particular, are now off double digits from their peaks and investors are flocking toward the safety of Treasuries.

The administration indicated that it is pursuing a tariff policy to re-shore industrial production (especially for supply chain resilience of critical defense/industrial bases), correct perceived long-standing trade/tariff imbalances, and raise revenue. There is not much precedence of tariff policy being implemented in the modern financial era, leaving markets without a satisfactory answer for what this brings, but the presumption is that the administration is following the “carrot and stick” approach – the carrot referring to promising rewards in exchange for cooperation, and the stick referring to the threat of undesired consequences. We obviously started with the stick.

Tariff Stick

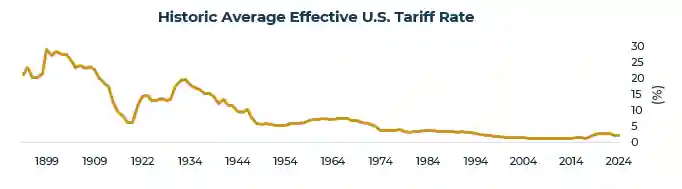

It was seven years ago around this time, and under a different banner, when we penned a missive titled “Protectionists Hide in Your Wallet” which can still be read here. That piece outlined a historical rhythm in U.S. trade policy, from cycles of protectionism (Founding–1830, 1860–1935) to those of relative openness (1830–1860, 1935–today). Tariffs once funded government operations in the pre-income tax era, as it was easier to collect money at a few ports than from millions of individuals.

Politically, increases to tariffs often came at an electoral cost. When then Chair of the House Ways and Means Committee William McKinley raised duties to nearly 50% in 1890, Republicans lost 93 House seats in the mid-terms, one of the largest swings in history. The 1930 Smoot-Hawley Tariff deepened the Depression, fueled a Democratic sweep, and eventually, the New Deal. Of course, policy can be reversed. McKinley himself won the presidency in 1896 amid an economic collapse, driven more by overbuilding, bank failures, and a gold standard panic than tariffs alone.

Source: Bloomberg Finance L.P. (data as of 12/31/2024)

The recent tariff announcement was telegraphed, but the magnitude caught most off guard. It was all stick. Presumed exemptions were pulled, and proposed duties were largely above 20%, affecting most trade partners. Early estimates peg the direct hit to U.S. GDP at 1–2%, though the ripple effects, especially retaliatory tariffs, remain a wild card. Smaller trade partners will feel the pain more acutely. If this escalates, it may take serious stimulus to keep global growth on track, as we have not seen U.S. tariffs this broad in almost a century. The last two comparable episodes (the 1890s and 1930s) ended poorly for the economy and markets. If, instead, there’s progress for bilateral agreements, the damage may be contained. Until then, expect CEOs to stay cautious, capital spending to slow, and growth to soften.

Greenback

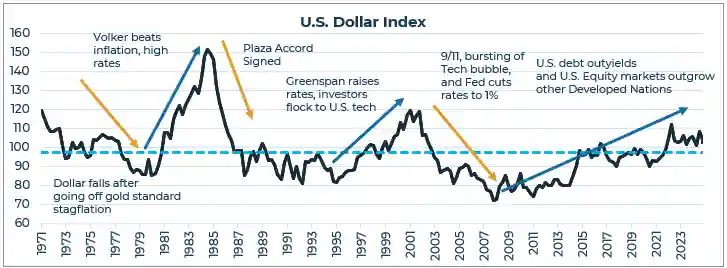

A common question we receive gets more specific: “How do tariffs affect the dollar, especially with key allies who are also major lenders?” Unlike the 2017 China tariff announcement, where the dollar rose immediately after, the dollar weakened this time around. That is not the common reaction. An IMF study of tariffs for 151 countries between 1963 and 2014 showed that currencies of the tariff-implementing countries tended to appreciate.

To level set, the U.S. enjoyed (or suffered, depending on who you ask) global reserve status since Bretton Woods was instituted in 1944. Then, the USD was pegged to gold, and other major currencies pegged to the USD. Even when we went off the gold standard in 1971 and went full fiat (not the car), we kept reserve status. Today, the dollar makes up nearly 60% of global official central bank reserves, accounts for 80%+ of FX transactions, and underpins nearly half of global cross-border loans, debt securities, and trade invoicing.

There is one reasonable analogue of fiat USD behavior in times of tariff threats, and that’s the Plaza Accord. Signed in September 1985, it was a coordinated effort by the G5 (U.S., U.K., West Germany, France, and Japan) to weaken the USD, and correspondingly strengthen the yen and deutsche mark. The U.S. was sick and tired of trade deficits (sound familiar?), which were in part blamed on a strong USD. The greenback appreciated by nearly 80% from the start of the 1980s thanks to Paul Volker’s high interest rates.

Source: Bloomberg Finance L.P. and Wealthspire Advisors LLC (data as of 3/31/2025)

The coordinated move worked. While one might have expected rampant inflation, that didn’t materialize. The S&P rose 17.2% in Q4 1985, +18.7% in 1986, and despite the “Black Monday” crash in October, the S&P was up 5.3% in 1987. During those same windows, bonds were up 7.8%, 15.3%, and 2.8%, respectively, while inflation annualized 3%. The parallels aren’t perfect, but there are similarities. Inflation in 1985-1987 was held in check by a drop in oil prices, something that is also happening now. We are also in a period of USD strength (+40% since The Global Financial Crisis) thanks to the U.S.’ higher-than-the-rest yields. Interest rate differentials are finally narrowing, which may help explain the recent retreat in the dollar. For the time being, the dollar is right around its long-term average. Despite declining direct foreign sovereign ownership, broader international ownership of USD has not meaningfully diminished.

Where are the Carrots?

The administration used carrots before and is doing so again, via specific tariff exemptions, delays, and talks of offsets. Deregulation in energy and banking, for instance, could be another tailwind. Scrapping Basel III could free up nearly $2 trillion globally. Of that, there is $500+ billion in freed up capital in U.S. banks alone. Infrastructure is also back on the table, with bipartisan appeal and real economic multipliers: transportation, grid upgrades, and manufacturing incentives. Taxes will be another lever, with research & development (R&D) expensing and investment credits already floated, with others to come.

Still, U.S.-grown carrots alone won’t suffice. We’re seeing signs of a global easing cycle: central banks in Europe, Canada, and Asia are pausing or signaling cuts. The Fed has shifted expectations, too. None of this is certain, but flexibility, clarity, and coordinated offsets would go a long way toward calming markets.

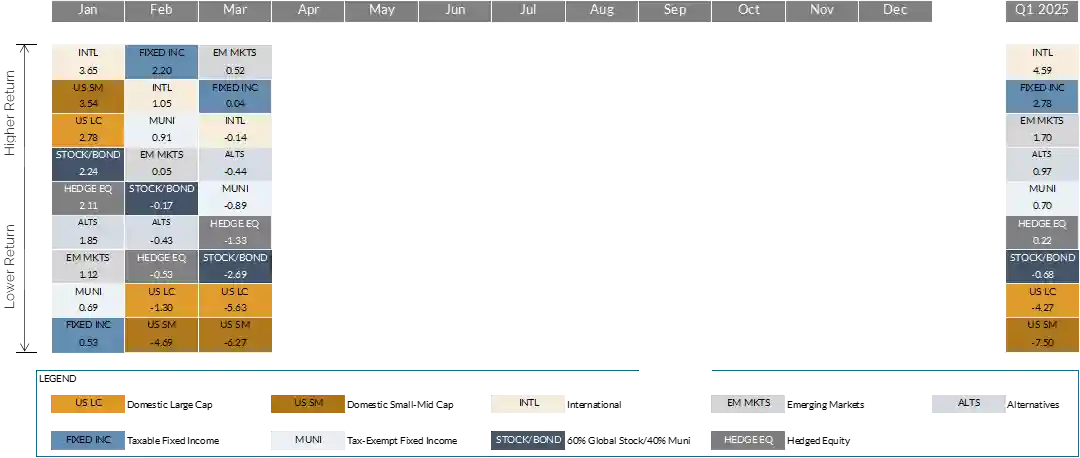

Diversification Working

One silver lining is that diversification is performing its intended task. Unlike the 2022 inflation shock, this time bonds are working. Foreign equities are outperforming U.S. markets, and core bonds have posted gains thanks to the flight to quality. We’ve noted before that bond yields became more compelling after the interest rate increases that occurred in 2022. Now, there’s not just yield, but room for rates to fall.

As always, we urge against knee-jerk reactions. The situation remains very fluid, and risk of missteps are high, but history also shows that the worst and best market days tend to cluster. We are not recommending portfolio changes in response to recent volatility for the time being. In the interim, volatility brings potential rebalancing and tax loss-harvesting opportunities.

Markets

Source: Morningstar and Bloomberg Finance L.P. (data as of 3/31/2025)

- January started strong for U.S. equity markets, but momentum quickly reversed in February and worsened in March. The “Magnificent Seven” were anything but, falling nearly 16% in the first quarter. Value stocks and dividend payers outperformed, reversing multi-year trends. Small-cap stocks struggled as tariff and growth concerns weighed more heavily on lower-margin companies. Overseas, performance was much stronger, especially in developed markets, where dollar weakness boosted returns. European nations led the way, with the U.K., France, and Germany each gaining 10% or more. Currency effects were less impactful in emerging markets, as many are directly or indirectly pegged to the USD. China and Brazil led the pack there, both returning over 14% in USD terms.

- The equity sell-off drove investors toward the relative safety of core taxable bonds in Q1. For the first time in a while, Treasuries outperformed corporate investment-grade, high yield, and floating-rate bonds. Interest rate risk was rewarded, particularly in high-quality taxable bonds. Markets began pricing in more rate cuts for 2025, a trend that accelerated during the volatile early days of April. The 10-year Treasury yield fell to 4.2% from 4.6%. In contrast, high quality was not rewarded in municipal bonds, where BBB-rated issues slightly outperformed A+ rated ones. With Muni-to-Treasury ratios still low, tax-exempt bonds drew less demand during the risk-off quarter.

- With dividend-paying stocks performing well and interest rates trending lower, public REITs and infrastructure held up better than broader U.S. equities. Illiquid credit strategies had mixed results: those more exposed to high-yield corporate credit underperformed, while strategies focused on asset-backed and mid-market lending saw solid returns. In commodities, dollar weakness fueled a rally in precious metals (gold and silver rose more than 18%). Elsewhere, returns varied widely. Natural gas led the way, up 31%, while crude oil was roughly flat (and sold off sharply in April). Tariff risks and related retaliation concerns left many domestically produced commodities flat or down (e.g., corn, cotton, soybeans, wheat), while heavily imported commodities surged (e.g., coffee +23%, copper +25%).

Wealthspire Advisors LLC, Fiducient Advisors LLC, Wealthspire Retirement, LLC dba Wealthspire Retirement Advisory, and certain other affiliates are separately registered investment advisers.

This information should not be construed as a recommendation, offer to sell, or solicitation of an offer to buy a particular security or investment strategy. The commentary provided is for informational purposes only and should not be relied upon for accounting, legal, or tax advice. While the information is considered to be reliable, Wealthspire Advisors cannot guarantee its accuracy, completeness, or suitability for any purpose, and makes no warranties with regard to the results to be obtained from its use. If the reader chooses to rely on the information, it is at reader’s own risk.

Past performance is no guarantee of future results. Different types of investments involve varying degrees of risk. Therefore, there can be no assurance that the future performance of any specific investment or investment strategy, including the investments and/or investment strategies recommended and/or undertaken by Wealthspire Advisors, will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. No amount of prior experience or success should be construed that a certain level of results or satisfaction will be achieved if Wealthspire Advisors is engaged, or continues to be engaged, to provide investment advisory services. Wealthspire Advisors is neither a law firm, nor a certified public accounting firm, and no portion of its services should be construed as legal or accounting advice. Moreover, you should not assume that any discussion or information contained in this presentation serves as the receipt of, or as a substitute for, personalized investment advice from Wealthspire Advisors. A copy of our current written disclosure Brochure discussing our advisory services and fees is available upon request or at www.wealthspire.com. The scope of the services to be provided depends upon the needs and requests of the client and the terms of the engagement. Please Remember: If you are a Wealthspire Advisors client, please contact Wealthspire Advisors, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently.

Wealthspire Advisors and its representatives do not provide legal or tax advice, and Wealthspire Advisors does not act as law, accounting, or tax firm. Services provided by Wealthspire Advisors are not intended to replace any tax, legal or accounting advice from a tax/legal/accounting professional. The services of an appropriate professional should be sought regarding your individual situation. You should not act or refrain from acting based on this content alone without first seeking advice from your tax and/or legal advisors.

Certain employees of Wealthspire Advisors may be certified public accountants or licensed to practice law. However, these employees do not provide tax, legal, or accounting services to any of clients of Wealthspire Advisors, and clients should be mindful that no attorney/client relationship is established with any of Wealthspire Advisors’ employees who are also licensed attorneys.