In the spring of any presidential election year, questions roll in about party, policy, the growing political divide, and what that means for capital markets. What would various political scenarios mean for stocks? What happens if a particular tax policy proposal becomes law? Although situation and scenario-specific, in most cases, we do not urge action related to investments and asset allocation, but often will suggest action related to tax and financial planning.

History shows us that there is no right answer to what mixture of Democrats or Republicans in the White House or Congress will yield better investment returns. Even if we have seen enough cases when a split Congress and White House reflected something statisticians would call significant, performance differences have been marginal at best. Blue and red waves are rare, and therefore not statistically backed, but it may surprise you that in the times we had such waves, performance of U.S. equities was stronger than during divided governments.

The takeaway from these exercises is always the same – staying invested outpaces party timing. The U.S. has operated under a divided government almost 70% of the time going back 125 years (Republicans had full control 13% of the time while Democrats the other 17%), and during those windows, stocks rose seven out of every ten years. Therefore, waiting for one’s party to gain control can be financially punitive.

Furthering the case, changes in tax regimes rarely translate to discernable market behavior. In the 22 instances (going back to 1950) where markets faced an increase in taxes (either income, corporate, or capital gains), only two years were flat to negative (1969 and 1970). As tax hikes are not always punitive, tax cuts are not always cheered. Markets rallied with the passage of the Tax Cuts and Jobs Act 2017 (TCJA); however, when capital gains taxes were cut in 1981, the S&P fell more than 20% over the year. Markets do not always follow a preset formula when it comes to taxes. Even when we see corporate tax cuts, which filter down to company bottom lines and therefore improve company fundamentals and theoretically stock price, markets are more subject to the state of the economy (GDP growth, inflation dynamics, employment, interest rates, etc.) and its ramifications for future earnings growth.

Why go back to only 1950 and not 1900 like we have for political parties? That’s in part because consistent income taxes did not come around until the passage of the 16th amendment in 1913. That year also brought capital gains taxes, though they did not top 10% until the start of the roaring 1920s. Dividends went through a complicated history of taxation between 1909 and 1954 (largely not taxed for most of that period). Thereafter and until 2003, when they found a lower rate, they were taxed as ordinary income rates. Lastly, corporations did not pay federal tax until 1909, and it was not until 1918 that they paid more than 10%.

Now for the action. We do not know what the probability of a tax-regime change is in the current environment, and we may not know for many months after the election. A party split generally translates to little tax change, and from the perspective of long-term planning, is a bit easier to navigate than a color wave. That does not mean that one should stay idle. The baseline assumption is that unless we see proactive congressional/executive support, the TCJA of 2017 will say goodbye at the end of 2025. Changes will follow, and many of them will have a cost (but not all). As a refresher, let’s break down some of the most impactful provisions for individual taxpayers:

- Individual Income Tax Rates – The TCJA gave most of us a little break, but when it expires, tax rates are going up to their previous levels. The current brackets of 10%, 12%, 22%, 24%, 32%, 35%, and 37% will increase to 10%, 15%, 25%, 28%, 33%, 35%, and 39.6%. Additionally, the income levels for the brackets will decrease slightly, which generally increases taxes.

- Standard Deduction – If you’ve been taking advantage of the $29,200 standard deduction (for married folks filing jointly), enjoy it for just a little while longer. After 2025, it’ll shrink back to about half of that.

- Personal Exemptions – Remember the personal exemption? It’s been suspended since the TCJA took over, but it’s coming back to give your tax return a little bit of a boost. Although, with an AGI phaseout that will reduce/eliminate this benefit, it will be a non-factor for many taxpayers.

- State and Local Tax (SALT) Deduction – If you live in a high-tax state, the SALT cap has been costly. Currently, you can only deduct $10,000 of state and local taxes (income and real estate for example) regardless of how much you actually paid. After the TCJA sunsets, the cap is going away.

- Alternative Minimum Tax (AMT) – The AMT thresholds were raised in the TCJA, so fewer people were subject to it. After 2025, the AMT will come back for more taxpayers.

- Mortgage Interest Deduction – Currently, if your mortgage is under $750,000, you can deduct the interest. After 2025, the limit goes up to $1 million.

- Estate and Gift Taxes – The estate tax exemption is set at $13.61 million right now, but after 2025, it drops in half.

- Qualified Business Income Deduction (Section 199A) – Small businesses have been getting a 20% deduction on pass-through income, but after 2025, that’s going away.

- Pease Limitation – The Pease limitation, which reduces the value of itemized deductions for high earners, will come back after 2025.

- Marriage Penalty – The TCJA gave married couples some relief, but after 2025, the “marriage penalty” returns. As a reminder, the marriage penalty is when a household’s overall tax bill increases due to a couple marrying and filing taxes jointly.

The above sunsets translate into planning conversations ranging from state-tax dynamics, estate planning, charitable gift timing, asset location, IRA conversions, and many more. We encourage clients to work with their advisors well ahead of the impending sunsets.

Per broader market impacts, we point to the start of this piece. We also note that not all cuts are sunsetting. The lower corporate tax rates (reminder that they went from 35% to 21%) would have to be proactively changed. One last point on a question we get surrounding potential taxes of unrealized cap gains. First, from everything we see, hear, and read, this looks like a very low probability scenario. Second, it may surprise many that only 25% of U.S. stocks are owned in taxable U.S. accounts. The rest are owned by various flavors of foreign investors (roughly 40%), retirement/defined benefit plans (roughly 30%), insurance products, non-profits, and the like. That does not mean a change like that would not be material, but it may not be to the degree that many fear.

Markets

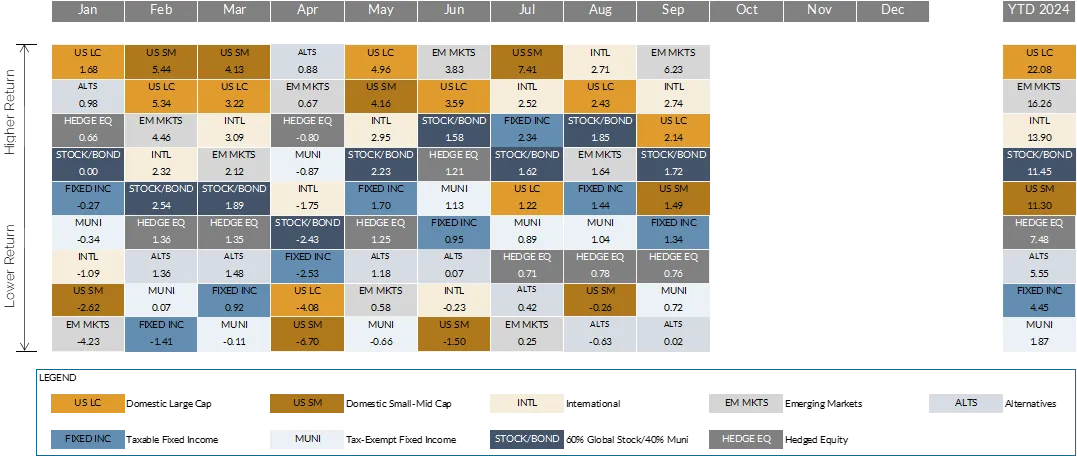

Source: Morningstar and Bloomberg Finance L.P. (data as of 9/30/2024)

-

July brought some change to equity markets, with the megacap tech temporarily taking a back seat to U.S. small and international stocks. An early August carry-trade related shock in Japan, which sent global stocks lower, the Nikkei tumbling, and the yen rocketing back, was short-lived. Most global markets finished the quarter in positive territory, with U.S. small, mid, developed international, and emerging markets topping the S&P 500. Though megacaps took a back seat, they remained in the car. The Magnificent Seven still rose 5.4% in Q3.

-

China stocks jumped +23.7% in Q3 (largely in the last three weeks of September) after the country announced a stimulus package aimed at monetary policy, real estate, and the stock market. A big theme heading into the fall is the market presuming a dovish path for interest rates in the U.S. That expectation helped the more indebted who could potentially refinance cheaper (e.g., small-mid Cap stocks) and those who benefit from a weaker dollar (e.g., non-U.S. stocks).

-

Even before the Fed cut rates by 0.5%, markets began anticipating an aggressively dovish central bank in the coming quarters, helping bonds rebound strongly in Q3. The Bloomberg Aggregate Index rose more than 5% for the quarter, bringing YTD returns well into positive territory. Municipal bonds rose as well (+2.7%). The 10-year treasury finished September yielding just under 3.8%, continuing the roller coaster that had it as low as 3.6% and as high as 4.7% thus far in 2024. The bounce in core bonds did little to upset continued strength in satellite fixed income. High yield bonds rose 5.3% while bank loans rose 2.1%. Both remain ahead of core taxable bonds YTD. High yield municipals rose 3.2% during the quarter, extending their lead relative to core municipal bonds for the year.

-

The Fed cut and presumed dovishness also helped other risk assets. More levered areas like real estate and infrastructure saw some stability, with public leading private for the quarter. Private credit strategies put up another solid quarter, with fixed rate areas outperforming floating. In the commodities space, it was another quarter of haves and have nots. Crude oil and natural gas prices fell more than 10% in Q3, offset by a comparable rise in select precious metals and softs (e.g., coffee and sugar).

Wealthspire Advisors LLC, Fiducient Advisors LLC, Wealthspire Retirement, LLC dba Wealthspire Retirement Advisory, and certain other affiliates are separately registered investment advisers.

This information should not be construed as a recommendation, offer to sell, or solicitation of an offer to buy a particular security or investment strategy. The commentary provided is for informational purposes only and should not be relied upon for accounting, legal, or tax advice. While the information is considered to be reliable, Wealthspire Advisors cannot guarantee its accuracy, completeness, or suitability for any purpose, and makes no warranties with regard to the results to be obtained from its use. If the reader chooses to rely on the information, it is at reader’s own risk.

Past performance is no guarantee of future results. Different types of investments involve varying degrees of risk. Therefore, there can be no assurance that the future performance of any specific investment or investment strategy, including the investments and/or investment strategies recommended and/or undertaken by Wealthspire Advisors, will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. No amount of prior experience or success should be construed that a certain level of results or satisfaction will be achieved if Wealthspire Advisors is engaged, or continues to be engaged, to provide investment advisory services. Wealthspire Advisors is neither a law firm, nor a certified public accounting firm, and no portion of its services should be construed as legal or accounting advice. Moreover, you should not assume that any discussion or information contained in this presentation serves as the receipt of, or as a substitute for, personalized investment advice from Wealthspire Advisors. A copy of our current written disclosure Brochure discussing our advisory services and fees is available upon request or at www.wealthspire.com. The scope of the services to be provided depends upon the needs and requests of the client and the terms of the engagement. Please Remember: If you are a Wealthspire Advisors client, please contact Wealthspire Advisors, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently.

Wealthspire Advisors and its representatives do not provide legal or tax advice, and Wealthspire Advisors does not act as law, accounting, or tax firm. Services provided by Wealthspire Advisors are not intended to replace any tax, legal or accounting advice from a tax/legal/accounting professional. The services of an appropriate professional should be sought regarding your individual situation. You should not act or refrain from acting based on this content alone without first seeking advice from your tax and/or legal advisors.

Certain employees of Wealthspire Advisors may be certified public accountants or licensed to practice law. However, these employees do not provide tax, legal, or accounting services to any of clients of Wealthspire Advisors, and clients should be mindful that no attorney/client relationship is established with any of Wealthspire Advisors’ employees who are also licensed attorneys.