The curse of living in interesting times has continued at the start of 2023 with the intersection of banking running headfirst into the clutches of the “artificially” intelligent future. Relative to last year, the first 45 days of this year felt normal by most comparisons, though we quickly came to learn there were new concerns lurking in the background.

For those who may not have seen, within the span of only a few short days, two banks – Silicon Valley (SVB) in California and Signature Bank in New York – were shuttered by regulators. Several things came as a surprise in these closures, most notably the speed at which it happened and the overall size of the banks. Also interesting was the fact that these were the first FDIC-backed bank closures since 2020, a nearly three-year window during which people had forgotten about the boring old bank sector.

For a banking sector that was thought to have cleaned up its act post-2008, SVB goes down as the second largest bank by assets to have ever failed in the U.S., behind only Washington Mutual in 2008, while Signature Bank is the third largest bank failure.

Not only was the size of the banks surprising, but so too was the rapid pace at which this evolved. Given the digitization of account openings and the ability to transfer deposits with the click of a button, depositors attempted to withdraw $42 billion in only one day. By the following morning, another $100 billion was requested for withdrawal. SVB held deposits of $175 billion at the start of the year. As someone phrased it, “It wasn’t a bank run. It was a bank sprint.”

The bank run that took place in the first quarter was alarming, but we want to remind people that the nature of the recent events in the sector stands in stark contrast to what happened in 2007 and 2008. During the global financial crisis, concerns on stability of banks were based on the credit quality of the underlying assets and too much leverage. Today, leverage is lower and credit quality is higher. SVB also had a unique role in lending to the private equity and venture capital ecosystem that should likely limit the notion of broader contagion and risks to everyday consumers.

The biggest question now is whether this is the proverbial canary in the coalmine that manifests itself into a credit crisis akin to what was experienced in 2008. For that, we will only know the answer with the passage of time. There is reason to think the bank sector is on firmer footing than 15 years ago and numerous industry watchers are not seeing the direct similarities. The potential ramifications for the broader economy are likely to be more straightforward as banks will step back from lending activities until signs of stability re-emerge. Tighter lending should slow economic activity and bring forth the oft discussed concerns about a recession. In the “bad news is potentially good news” category, though, this may solve for one battle the Federal Reserve has been tackling – inflation. A slowing economy should go hand in hand with slowing inflation, much to the happiness of investors, shoppers, and the Federal Reserve.

Here Comes the Robot Army

At that same time as banks were going through the age-old problem of depositor flight, we received confirmation that no one should assume they know exactly what the future holds. ChatGPT, an artificial intelligence (AI) powered chatbot launched by OpenAI, gained more than 100 million users in less than two months, believed to be the fastest service to ever gain such a milestone.

AI is designed to be the computer equivalent of human intelligence with faster response times, complex problem-solving skills, and a never-sleep mentality. The impact to date has been relatively marginal, but we increasingly see signs that AI is touching all industries from healthcare to computer programming to financial services. In some cases, the effect has been minimal, but in others there is clear evidence AI has the potential to fundamentally change the industry as we know it.

Clients often ask, “How do I get exposure to AI and the impact it will have on our future economy?” For that, the answer is both simple and complicated. Leading companies are attuned to the AI industry and are actively investing in its future success. Those companies are the household names that so many of us have become familiar with and would expect to be involved in this industry.

However, the complicated part is that we simply do not know where AI technology is going and can’t be certain of the net impact across our economy over a long horizon, as with most things. Trying to invest in the unknown future that AI will bring speaks to why we think broadly diversified portfolios have the best potential to capture a lot of the good developments (AI), some of the bad (banks), and help investors stay away from making poor decisions predicated on performance chasing or attempting to predict a future that is inherently unpredictable.

Markets

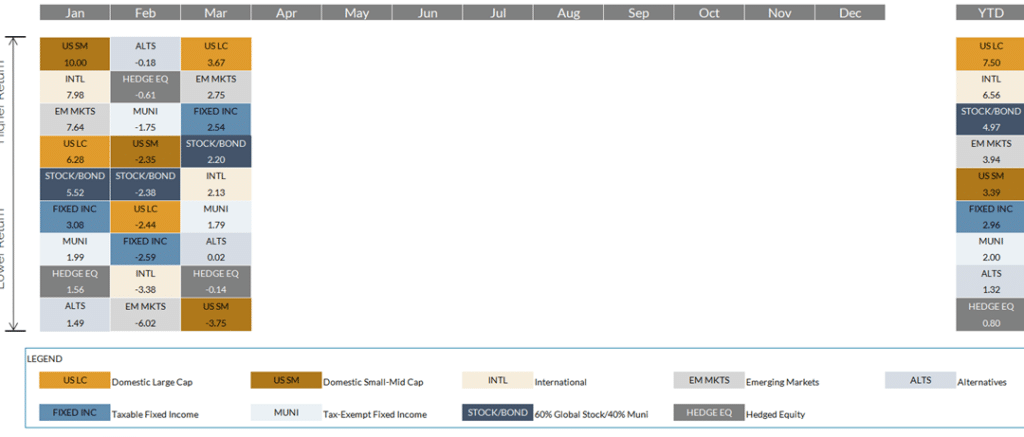

Source: Morningstar and Bloomberg Finance L.P. (data as of 3/31/2023)

- Equities extended the rebound that began in the fourth quarter of 2022. The path was hardly smooth, though, with news of banking concerns causing a quick reversal in market optimism. The S&P 500 Index had been up nearly 10% in February, before losing those gains entirely. The final two weeks of March brought a recovery which saw the index finish up by 7.5%. Market observers are closely watching the upcoming earnings season to see if consumers are beginning to pull back from the strong spending that was in place post-2020.

- International markets performed similarly to the U.S., with an early quarter rally nearly gone by mid-March after news emerged that Credit Suisse (CS) was facing problems mirroring those of banks in the US. Swiss regulators stepped in to ensure that Credit Suisse would not go bankrupt, eventually leading to the acquisition of CS by fellow Swiss bank UBS. With regulators’ willingness to support the transaction and absorb losses on behalf of UBS, markets felt as though the issue would not have wider ranging implications. Overseas stocks rallied into quarter-end as a result.

- Bond markets carved a separate path in the quarter and despite further interest rate increases from the Federal Reserve, bonds closed the quarter with gains for the second consecutive time. This was primarily related to a softening of expectations for future rate increases once news of stress in the banking sector emerged. At the end of February, markets were pricing in a Fed Funds rate of 5.5% for year-end 2023. However, the events that transpired in March now leave markets expecting a rate of “only” 4.3%. As we discussed earlier, less bank lending may lead to softer economic growth and continue the recent deceleration in inflation that began in mid-2022. Those would all be welcome developments in the eyes of the Federal Reserve and limit the need for the Fed to perpetuate its aggressive rate hiking cycle.

- Alternative investments largely participated alongside the rebound in stocks and bonds. Equity based strategies generally reflected performance of U.S. and International stock markets, as well as the underlying growth and value biases inherent in their portfolios. For less market-sensitive strategies, there was a bit of underperformance with many managers expecting higher interest rates and thus positioning for that outcome. With rates falling rapidly in March, managers were negatively impacted and experienced losses.

2024 1st Quarter Commentary: “In a world drenched in pessimism, it pays to be optimistic.”

With so much emphasis placed on negative headlines, negative developments globally, and the ability to embrace one’s inner negativity, it ...