Recap

In a continuation of the first quarter, stocks and bonds struggled to find any sort of traction in the second quarter, leading to one of the roughest six-month starts to a calendar year on record. As stewards of client capital, we understand how difficult and challenging these last six months have been and we continue to work to ensure portfolios are properly positioned for successful outcomes over the long term. Markets have gone through numerous ups and downs over the course of centuries. No matter how often an investor goes through the bad times, it never feels especially comfortable. There is no easy path to wealth creation or preservation, and we should all recognize that volatility is a byproduct of the human impact on markets.

Contributing to this year’s volatility have been two particular headlines – inflation and central bankers’ responses. We will discuss inflation in this letter given its uncomfortable persistence over the past 18 months and touch upon the Federal Reserve’s ability to respond (or not) accordingly. As we have written previously, though, inflation is a tricky topic to understand and trying to package it into an easy framework is exceedingly hard. A complex set of circumstances collectively brought us to today and the unwind is not going to be straightforward.

Long Forgotten, High Inflation is Here…to Stay?

2022 will largely be defined by one topic (at least thus far) – inflation. Earlier in the year, we explored inflation in our blog, “Puncturing Inflation,” in which we discussed it being incredibly hard to measure, to understand, and to control. There was some vindication to that stance recently when the Federal Reserve’s own Chair Jerome Powell said, “We understand better how little we understand about inflation.” Truer words have possibly never been spoken. With that preface, let’s at least discuss how we arrived here, what we see happening, and what might occur in the quarters ahead.

Many of the seeds of today’s inflationary pressure were originally planted in early 2020 as the government sought to stem economic collapse during the initial COVID-related closures. The response funneled more than $2 trillion of stimulus into the economy through the Coronavirus Aid, Relief, and Economic Security (“CARES”) Act. The goal was to provide relief to businesses, families, and individuals impacted by the closures, job losses, and reduction in economic activity. It was, in part, a necessary support mechanism and lifeline for the economy. That’s when things started to get complicated.

When the initial wave of business and school closures abated, individuals returned to work and life with newly replenished bank accounts and a determination to spend money on years’ worth of delayed purchases. Consumers began spending on stuff like we had never seen previously – cars, homes, furniture, bikes, boats, RVs, and on, and on, and on. Companies were completely unprepared for the demand acceleration and found themselves responding from a position of weakness without sufficient supply to satiate demand. For corporate America, there was an added complication. Dependence on China as a manufacturing hub became untenable due to strict COVID protocols causing plant and port closures for weeks at a time.

There was ultimately only one real path to slow demand – raise prices. For most of 2021, prices increased at a fast pace without seemingly any impact on consumer demand. But it was generally accepted that as companies ramped production and adjusted supply chains to account for closures in China, there would be an easing of prices. That is finally beginning to occur with companies like Target, Walmart, Home Depot, and others citing a jump in inventories as a reason for upcoming sales and price reductions. That is one of the few good developments recently.

However, we are now also seeing the inflation picture broadening out to services (healthcare, landscaping, travel, etc.) and other areas of the economy (housing) that will be harder to predict with less obvious ways to reconcile through simple increases to production. That is where the Federal Reserve comes in – with no obvious solution to control prices at large, the Fed relies on the most basic policy at its disposal, raising short-term interest rates and shrinking its balance sheet. The Fed began raising interest rates at aggressive increments over its recent meetings and hopes that rapidly tighter financial conditions will do the trick.

As is often the case, we do not yet know what comes next. The price of “stuff” like used cars, clothing, and home furnishings is rolling over or at least decelerating, but the offsetting role of services, food, fuel, and housing expenses will make the path forward uncertain. The Fed is attempting to correct years of easy monetary policy in a short window and there are no certainties on whether they will be successful.

All of this leads to one question that we read about over and over and over – is recession the only solution to tamping down inflation? Time will tell. What we do understand is that recessions are inevitable and there is little likelihood of the next recession being similar to prior ones. Consumers, corporations, and municipalities have a financial picture that is healthier today than possibly ever entering a contractionary environment. A primary concern with recessions is that they are accompanied by significant job losses. That doesn’t seem as inevitable this go around, simply because corporate profits are the highest ever and companies have a financial buffer for the moment. There is also another more subtle difference – tech companies have been the initial source of layoffs, but the size of those workforces is naturally smaller given the high levels of productivity inherent in the businesses.

In previous recessions, companies had no choice but to enact severe layoffs to preserve cash flow. Are companies that struggled to fill jobs since March 2020 really going to be inclined to undertake widescale layoffs at risk of not being able to find those workers again? Thus, if layoffs only gradually pick up and corporate balance sheets remain strong, the next recession will look different than those of the recent past.

Recessions and inflationary cycles aren’t destined to impact markets and the economy with the same ferociousness that we witnessed during the tech wreck in 2000 or the global financial crisis in 2008. When the economy went into an eight-month contraction in the early 1990s, the average person on the street may never have noticed considering that less than 2% of the labor force experienced job losses and stocks were positive throughout the entire time. That recession was followed by a ten-year expansion that lasted until 2001.

We will leave everyone with a conclusion from the “Puncturing Inflation” blog that continues to hold true – the next time you hear a chattering head talk about “inflation,” your new immediate response should be “It’s not that simple.” You could also swap “inflation” for “recession” to understand that economic predictions with an infinite number of permutations are exceedingly difficult and making such prognostications is a thankless task. Is there evidence that certain parts of the inflation picture may have “peaked” in the spring? Possibly. Is a recession lurking off in the future? Absolutely (but nobody knows when). As we discussed, there is a long way until we know exactly what happens and it will require patience to find out what comes next.

Markets

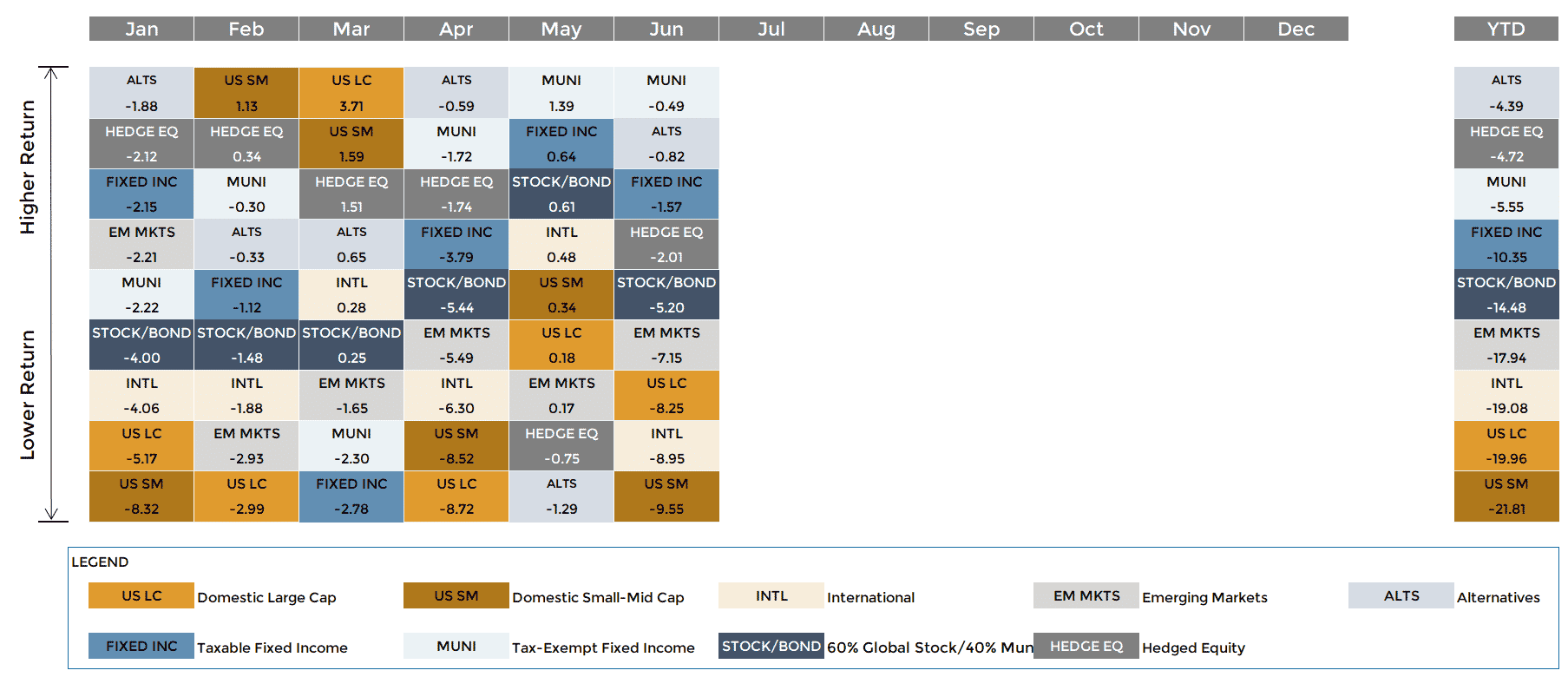

- Equity markets are off to one of the most difficult six-month starts to a calendar year in more than five decades. Concerns about war, inflation, tighter financial conditions, a persistently acrimonious political climate, and the potential for a recession have contributed. Corporate earnings have shown limited signs of slowing despite the headlines, and much if not all the drops in stock prices reflect multiples contracting. Across market cap, performance is comparable, with small and mid-cap stocks only slightly ahead of the S&P 500 index year-to-date.

- Overseas stocks outperformed given higher commodities exposure in many of those markets, but one caveat applies. Outperformance occurred on a local-currency basis and after accounting for the strength of the USD, most international markets finished with similar performance to U.S. counterparts.

- Fixed income, particularly core bonds, have remained under pressure and have not re-asserted their status as a safe haven. The more interest rate exposure (aka duration), the more penalized. There was a glimmer of positivity during May as the Aggregate Bond Index gained 0.6% for the first monthly gain this year, but that quickly reversed course in June. As we discussed during last quarter’s letter, the further yields rise, the better the forward return opportunity becomes, and that gives us reason for optimism within our fixed income allocations. Losses across fixed income were generally smaller than the first quarter. Within municipal bonds, higher quality outperformed with AAAs outperforming BBBs. The taxable space also rewarded higher quality in the second quarter, in contrast to the outperformance of non-investment grade bonds that was seen in 1Q.

- Alternative investments were largely exposed to similar risk factors as equity and fixed income, leading to performance reflecting that reality. Strategies with higher net exposures captured the market’s downside while strategies that were nimble across asset classes without a directional bias showed better performance.

2024 1st Quarter Commentary: “In a world drenched in pessimism, it pays to be optimistic.”

With so much emphasis placed on negative headlines, negative developments globally, and the ability to embrace one’s inner negativity, it ...