Recap

A reasonable person could sit here at the end of 2021 and have a sense of Groundhog Day – like last year at this time, COVID is dominating headlines and impacting the way we live, work, travel, and socialize. On the positive side, we also have equity markets generating robust performance. In fact, in 2021, the S&P 500 returned greater than 15% for the third straight year – you have to go back to the dot-com boom in the late 90s to see such consecutive performance, and besides then, no other time since 1940. We will recap some of 2021’s broader market themes below, as well as address some common questions we have heard frequently from clients of late.

Equity Market

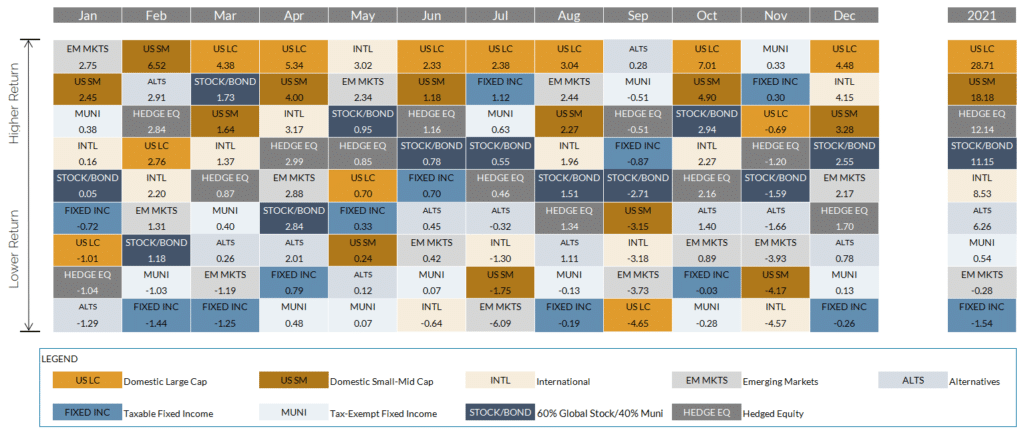

Canvassing the major equity market indices, the frequently cited S&P 500 has outperformed virtually any other common equity index in 2021. U.S. large cap stocks bested small and mid-cap, and while the gap between growth stocks and value stocks significantly narrowed vs. 2020, the former once again outperformed the latter. And for the fourth consecutive year, international equities lagged U.S. equities, a theme we will pick up on below.

Financial pundits have spilt much ink over the last 18 months on the COVID “work from home trade” vs. the “re-opening trade.” In many ways, this simply restates the growth vs. value debate, as the stocks that would populate either of the work from home or growth trade include fast-growing, typically tech-enabled companies. Think Zoom, Peloton, or Microsoft with its now ubiquitous Teams application. The names grouped in the re-opening or value camp would include entertainment and travel stocks. If markets anticipated long-dated interest rates would rise due to re-opening increasing inflation, investors could group financial stocks in with this re-opening trade. A popular view coming into 2021 argued overweighting this value/re-opening trade at the expense of the growth or work from home theme. And that was, in fact, the correct trade through early March with the Russell 1000 Value index up 9% YTD at that point vs. -5% for the Russell 1000 Growth. But that outperformance completely reversed itself and then some by year-end. This provides yet another example of why we remain decidedly long-term and strategic in our investing approach – doing more “trading” or “tactical” reallocation requires 1) correctly timing the entry point of the trade, 2) correctly timing the unwind of the trade, and 3) for our typical client, ensuring that taxes realized do not outweigh the benefit of the trade. And for the last eighteen months, correctly reading the epidemiology tea leaves proved helpful.

Fixed Income

Coming into 2021, many financial commentators expected fireworks in fixed income due to an increase in expected volatility in the levels of interest rates and increased market reaction to the impact of inflation. Depending on the sector, 2021 left fixed income performance muted and on either side of zero. The year’s modest rise in rates have left core, interest rate sensitive fixed income largely with a loss. The most widely referenced benchmark for core U.S. fixed income, the Bloomberg Barclays Aggregate Index, returned -1.5%, negative for only the second time since 2000. More credit sensitive satellite fixed income benefitted from the general risk on environment to deliver mid-single digit positive numbers as credit spreads continue to bounce along historically low levels. Finally, municipal bonds saw continued robust demand in anticipation of higher marginal taxes in the near future, leading them to slightly outperform core taxable fixed income.

Inflation and “Why Not Just S&P?”

Questions from clients have coalesced around two primary topics of late. First, inflation – “Is it transitory and what should I do from an asset allocation standpoint?” We have been in the transitory camp for months, primarily influenced by what the markets are saying and pricing in. Namely, markets typically price longer term interest rates (10-year, 30-year bonds) as a slight premium to expected inflation. With both levels below 2%, it appears markets do not expect runaway inflation. Since 2000, the U.S. Government has issued bonds where the coupon flexes up or down with inflation. Known as TIPS (“Treasury Inflation Protected Securities”), comparing their price with the price of a “nominal” or regular U.S. Treasury bond of the same maturity can tell us more explicitly what the market expects regarding inflation. Currently, each of the 5-, 10-, and 30-year “breakeven” inflation levels from this comparison show that the market expects between 2-3% inflation. Again, higher than we have experienced over the last few years, but much lower than the recent headline levels of 5-7%. For clients wishing to position their portfolios for an expectation of higher inflation, we would suggest shortening interest rate duration in fixed income, ensuring your equity portfolio has not creeped too much into the “growth” camp (which likely would underperform in a rising interest rate environment), and perhaps including some real assets in the portfolio, such as real estate.

Finally, we hear clients asking versions of “Why do I own any equities other than the S&P 500? It always outperforms everything else!” As referenced above, yes, in 2021 it outperformed international equities as well as mid- and small-cap U.S. equities. We have noted the impressive cumulative outperformance of domestic stocks vs. international equities over the last decade and understand why clients would wonder why they own any equities besides this winner. We would suggest considering a few things. First, from recent history, such one-way sentiment usually portends a coming change in regime. The often cited “Death of Equities” cover of BusinessWeek magazine in 1979 ushered in the multi-decade bull market in stocks which, in many ways, has not ended 40+ years later. Or emblematic of the euphoria of the era and with the Dow Jones Industrial Average trading around 10,000 in 1999, the book Dow 36,000 suggested a continued meteoric rise. That iconic index peaked at 14,000 before the Global Financial crisis, bottomed during it at 6,500 and, yes, as we blogged about when it happened earlier this year, finally made it to 36,000 some 22 years later. When opinions regarding financial markets tilt so decidedly in one direction, history has generally suggested something different will occur. Putting more concrete numbers on the case for a continued balanced approach to equity allocation, we look to valuations. Whether we look at price to earnings, price to book, or price to cash flow, international equities as measured by the MSCI All Country World Index excluding the U.S. currently trades at levels 37%, 62% and 58% cheaper than the S&P 500, respectively.

Further, we can look at what “smart people” are currently thinking and saying about what to expect in various equity markets. These are known as Capital Markets Assumptions (CMAs) and they play a vital role in the financial planning engine we use with clients. To a firm (Vanguard, JP Morgan, Bank of New York, etc.), virtually everyone predicts international equity markets to outperform domestic markets on any timeframe (5-, 10- or 30-years). Finally, a point we have made recently, the concentration of the top holdings in the S&P 500 has increased to historic levels of late. Specifically, the top ten stocks of the S&P 500 by market capitalization currently comprise over 30% of the index itself for the first time, up from a 17% weight just six years ago and even exceeding the 26% from the peak of the dot-com boom. So, overweighting the S&P 500 at the expense of other U.S. market cap stocks or international stocks means concentrating in an index which itself is increasingly concentrated. Yes, Apple, Microsoft, Google, Amazon, Facebook, and Tesla may continue their historic runs, but keeping a more balanced equity allocation will still leave you participating in such performance while better positioning yourself should such leadership change.

Markets

After taking a breather in Q3, equities rallied into year-end with the S&P 500 rising 11% during the quarter. U.S. small-mid cap and developed international markets also finished the quarter up, though failed to keep up with large cap stocks. The aforementioned style rotation in large cap which ultimately resulted in comparable returns between growth and value did not persist through small and mid-cap stocks. There, we saw significant deviation in favor of value stocks, with more cyclical areas like energy leading the charge. Overseas, dispersion came from emerging markets where Indian-based companies topped Chinese firms by more than 40% in 2021, with the latter implementing reforms that punished several publicly traded sectors.

- A flat quarter brought an end to a tough year for fixed income markets. As we mentioned previously, taxable core bonds posted a rare negative return in 2021 thanks to a backup in longer term rates earlier in the year. Municipal bonds held up a bit better thanks to record investor demand. Despite a bit of weakness in Q4, credit sensitive satellite fixed income (e.g., high yield bonds and bank loans) beat more interest rate sensitive core fixed income in 2021 as the hunt for yield showed little signs of abating. Funds exposed to Treasury Inflation Protected Securities (TIPS) were amongst the strongest performers for the year. Interestingly, as we heard overtures by the Fed toward impending rate hikes, one thing stood out. Going back to 1962 (including going off gold standard, oil embargo, inflation ahead of Volker), we have not had one period where yields on longer dated bonds (e.g., 10-year Treasury) rose more than the Fed Funds rate.

- Alternative investments performance for the quarter and year could be summed up by the level of equity and fixed income exposure. Those with longer equity exposure and value tilts (in smaller cap U.S. and overseas) outperformed, whereas those with more fixed income exposure (especially interest rate risk and non-USD debt) lagged.

After taking a breather in Q3, equities rallied into year-end with the S&P 500 rising 11% during the quarter. U.S. small-mid cap and developed international markets also finished the quarter up, though failed to keep up with large cap stocks. The aforementioned style rotation in large cap which ultimately resulted in comparable returns between growth and value did not persist through small and mid-cap stocks. There, we saw significant deviation in favor of value stocks, with more cyclical areas like energy leading the charge. Overseas, dispersion came from emerging markets where Indian-based companies topped Chinese firms by more than 40% in 2021, with the latter implementing reforms that punished several publicly traded sectors.

After taking a breather in Q3, equities rallied into year-end with the S&P 500 rising 11% during the quarter. U.S. small-mid cap and developed international markets also finished the quarter up, though failed to keep up with large cap stocks. The aforementioned style rotation in large cap which ultimately resulted in comparable returns between growth and value did not persist through small and mid-cap stocks. There, we saw significant deviation in favor of value stocks, with more cyclical areas like energy leading the charge. Overseas, dispersion came from emerging markets where Indian-based companies topped Chinese firms by more than 40% in 2021, with the latter implementing reforms that punished several publicly traded sectors.

2024 1st Quarter Commentary: “In a world drenched in pessimism, it pays to be optimistic.”

With so much emphasis placed on negative headlines, negative developments globally, and the ability to embrace one’s inner negativity, it ...