In this letter:

- Monetary and fiscal policy remain very accommodative, translating to elevated valuations across markets.

- A new industry catchword for 2021.

- Risk tolerance should not be forgotten when times are good.

As financial asset classes continue to exhibit strong risk on characteristics, there is emerging tension between the fuel supporting such risk taking (strong) and the valuations of both equities and fixed income (expensive). The Federal Reserve remains exceedingly accommodative, both by keeping rates at zero and by purchasing vast amounts of the issuance of Treasury bonds. The market seeks clues as to when these stances will change via an increase in the Fed Funds rate or a “tapering” of the security purchase. Most agree the former is a late 2022 or early 2023 event and the latter is an early 2022. As such, the Fed remains supportive of the risk on rallies. Fiscal policy will likely continue to march arm in arm with the Fed in supporting risk assets. While the question remains whether there will be one bipartisan infrastructure package or a second focused on “human infrastructure”, the final spend in either case is likely to be measured in trillions.

This monetary and fiscal support meet head on with the current level of valuations. There are many equity valuation metrics investors use – e.g., price to earnings, price to cash flow, price to book value, overall market equity value to the GDP of the country, etc. Virtually all such metrics are at or near historically high levels. Valuations in fixed income typically are discussed in terms of the difference between the yield on the bond/portfolio vs. a risk-free Treasury bond of similar maturity (the “spread”) and yield per unit of duration (interest rate risk). Those, too, are at or near the most expensive levels on record.

2021 (So Far) In One Word

If the most used word describing financial markets in 2020 was “unprecedented,” then 2021’s is “transitory,” used often in the debate around whether the current rise in inflation will be temporary or longer lasting. Like the tension noted above regarding large support vs. equity valuations, this debate, too, has historically strong forces on either side: an economic re-opening, pent up demand fueled with historic levels of savings, and supply chain bottlenecks suggest longer lasting and higher levels of inflation vs. the disinflation-suggestive high levels of federal and corporate indebtedness, aging population, and technological advances. This debate has important implications for us as asset allocators. As long-time clients will attest, we are never going to go “all-in” on a certain view of the future, but we will make sure we have exposure to those areas we think will benefit from such view. We have published a few pieces recently arguing we come down more in the transitory camp, thus we will remain with our constructive view of fixed income and keeping them at an intermediate duration. In addition, we maintain our exposure to both growth and value stocks, as the period of higher inflation should support the cyclical, “opening up” value stocks, while the ultimate transitory nature of it should eventually see growth stocks resume their leadership.

Tensions in financial markets always resolve themselves, sometimes simply through the passage of time and sometimes more quickly due to increased volatility. We suspect resolving the two tensions noted above will as well. We believe there is a decent chance of higher volatility than what has been observed over the last year. Thus, as we frequently do, we remind you to talk with your advisor about your asset allocation. Many financial firms and commentators have noted that equity allocations across individuals and households are at historically high levels. Perhaps there are good reasons your equity allocation is high because of your personal history: maybe you can afford to take more equity risk, perhaps you now realize in a post-COVID period that you are going to spend less so you need less income from other asset classes, or maybe you truly believe there is no alternative (“TINA”) given what fixed income yields currently. But we would urge you and your advisor to remind yourselves what March 2020 felt like and extrapolate what a similar drawdown would do to your current portfolio.

Markets

While Stocks Rise, Yields Stall

While Stocks Rise, Yields Stall

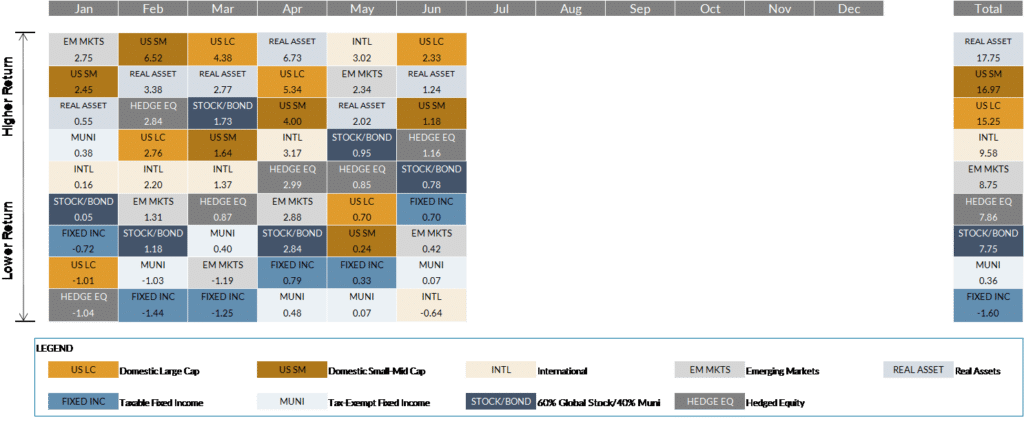

- Equity markets continued their remarkable march upward in the second quarter of 2021, with the S&P500 advancing 8.5% (now up +15.25% YTD), small-mid cap stocks lagged large cap stocks, though even they were positive by ~5% in the quarter (+16.97% YTD). International stocks similarly trailed U.S. stocks, but also positive by +5% (+9.58% YTD).

- Fixed income enjoyed a bounce back from Q1’s negative performance with the Bloomberg Barclays Aggregate index +1.8% in the quarter, though still negative YTD. With the credit outlook for municipal bond issuers much stronger than feared twelve months ago and prospects of higher taxes, demand for municipal bonds have remained very strong, resulting in their outperformance vs. the Barclays Aggregate bond index. More credit sensitive satellite fixed income (e.g., high yield bonds and bank loans) continued to beat more interest rate sensitive core fixed income as the risk on mindset propelled these lower rated bonds.

- Alternative investments were mixed during the quarter. As growth rebounded vs. value the last three months, many funds with equity exposure on the opposite end of that trade gave back some of the strong performance from Q1. Strategies more focused on the fixed income space did better, especially those with exposure to credit and EM debt.

While Stocks Rise, Yields Stall

While Stocks Rise, Yields Stall

2024 1st Quarter Commentary: “In a world drenched in pessimism, it pays to be optimistic.”

With so much emphasis placed on negative headlines, negative developments globally, and the ability to embrace one’s inner negativity, it ...