At A Glance

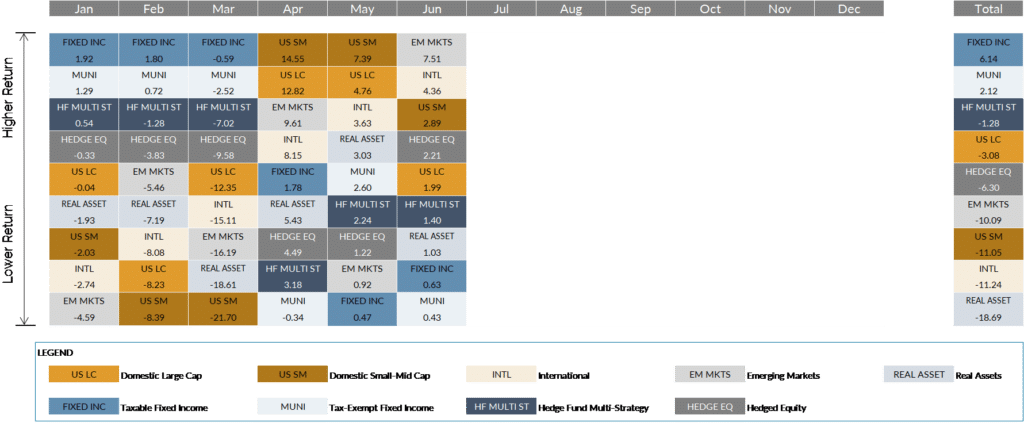

- Volatility from the first quarter bled into the second, though this time to the upside. Equity markets staged a strong rally in Q2 2020 with US markets up anywhere from 15%-25% and international markets slightly behind but still up double digits. The long-anticipated rotation from growth stocks into value showed some fits and starts in Q2, but growth stocks still ended Q2 ~25% ahead of value YTD.

- Fixed Income markets rallied as well, especially the riskier credit markets that suffered heavily in Q1 2020.

- The continued dissonance between the strength of the financial markets and the worsening COVID-19 virus confounds many.

- Municipal bonds rebounded after a very tough March. With the help of central bank support volatility abated with a resumption in new issuance and slowing investor outflows.

- After serving as a ballast in Q1, Treasuries took a back seat to more credit exposed areas of the market in the second quarter. Investment grade corporate bonds, for example, rebounded nearly 9% in Q2. Lower quality credits also rebounded with areas like bank loans, and high yield corporates helped by unfreezing liquidity. Treasury Inflation Protected Securities (“TIPS”) also performed, with market inflation expectations rising from less than 1% at the end of the quarter to 1.3% by quarter end.

- Alternative investments put up reasonable numbers in Q2. Those with significant equity exposure performed well, though any still overweight value stocks continue to struggle. Strategies with tilts to lesser liquid parts of the fixed income market also rebounded though remain in the red for the year.

- If you are primarily concerned with meeting your financial goals, the rise and fall in the markets counter-intuitively often have opposite effects on 1) your portfolio’s value and 2) the subsequent chance of you meeting these goals. We have increasingly been pointing this out and it may help to temper the emotions of simply looking at your portfolio value, good or bad.

The end of the second quarter, much like the end of Q1 2020, was characterized with superlatives: fastest, steepest, quickest, to name a few. Yet, we would be tone deaf if we did not acknowledge the human toll the pandemic has had on you, our employees and our families. First and most importantly, we hope your health, physical and otherwise, is at least OK and trending better.

We touched on a number of themes in last quarter’s letter and many still resonate, perhaps none more so than “The markets do not equal the economy.” It confounds many that equity markets are much closer to their all-time highs than the March lows, despite virus caseloads rising and at an increasing rate. Real-time data on spending, reservations, travel seems like it has paused its recovery. Fixed Income markets reflect similar dynamics – high grade “core” fixed income is back to its best levels and more credit-oriented “satellite” fixed income likewise are well off their worst levels in March. Yet here we are.

While we did not predict the rapid recovery in financial markets (in fact we never make short term predictions), our general advice remains to stay the course and rebalance into significant market moves. Of course, there always are many good reasons to change your risk profile higher or lower. To name a primary one we have articulated in the past: you have enjoyed a ten-year bull market and can now meet your financial goals while taking less market risk. And we applaud our clients as it seems they largely either stayed the course or chose a new risk profile from a position of strength. A recent article from Wall Street Journal’s Jason Zweig makes a similar point, writing: “To be an intelligent investor is to recognize that you’re in a lifelong struggle for self-control….[so] if you made it to June 30 without changing your investment plan, congratulations.”

Speaking of Reassessing your Goals

In our 2019 Year End letter, we made the suggestion to reexamine your risk profile in light of the phenomenal market returns we witnessed in 2019. Though we had not had significant declines in recent years, we cautioned that they do and will happen and so examine how you would feel and act after a material decline. The market’s Q2 rebound from Q1’s lows offers a similarly good opportunity for such reexamination. Deciding to de-risk now, after the market rebound, is much more tenable than doing so earlier in the year. If your first trip on the roller coaster was not an enjoyable one, you are not obligated to withstand a second ride.

A point we have increasingly been making is the self-mitigating nature of:

- market returns and

- capital market assumptions (“CMAs”)

There is a demonstrable pattern of CMAs coming down after significant rallies in equity markets and going up after a decline. We saw this play out earlier this year – the significant decline in equity markets in the first quarter (bad for your portfolio) were met with significantly higher CMAs as of 3/31/2020 vs. 12/31/2019 (good for your ability to meet future goals).

So these two factors tug in opposite directions – how do they net out? It depends on one’s specific financial and investment goals, timing of your future spend, savings rate, etc. but we discovered that despite the stomach churning declines earlier this year, as counter-intuitive as it seems, many clients with long investment horizons actually had a higher probability of meeting their goals as of 3/31/2020 than they did as of the end of 2019. At the very least, higher CMAs provided a mitigating effect to the lower portfolio values.

We have lived through multiple years’ worth of events these last six months. We are warmed and motivated by our continued engagement with you, our client. We take to heart our role as a steward of meeting your financial goals. We expect continued volatile financial markets and we stand ready to have the heart to heart conversations you have come to rely on us for. Please reach out if we can provide any guidance or comfort.

Markets

Other Notes and Takeaways

Other Notes and Takeaways

- We have written several pieces during this period of market volatility. The latest, “Equity Investing Since the Dawn of Covid-19” – touches investment horizon, earnings, and the ever-growing fiscal and monetary backstop.

- Speaking of backstops, Europe is quickly making up ground on the +trillion stimulus of the U.S. The EU’s combined monetary and fiscal stimulus is now looking like it will be well north of a trillion Euro. In addition, the virus seems to be contained for now in most of Europe. If interested in any particular nation more on their response can be found on the IMF site. As a percentage of their respective economy, Japan is in the lead with a financial response > 20% of GDP.

- Unemployment numbers remain very high despite a recent decline in temporary layoffs. In the U.S., temporary layoffs still outnumber permanent 3:1, and permanent layoffs are still well below the levels reached during the Great Recession. That said, with the extension of unemployment benefits set to expire this summer, the expectations are toward another bout of stimulus targeting workers.

- Interestingly, the strongest equity market year-to-date (in local currency terms) is actually China (up almost 15% through 6/30), where tariff, COVID-19, and general global geopolitical headlines have failed to keep local investors away.

Other Notes and Takeaways

Other Notes and Takeaways

2024 1st Quarter Commentary: “In a world drenched in pessimism, it pays to be optimistic.”

With so much emphasis placed on negative headlines, negative developments globally, and the ability to embrace one’s inner negativity, it ...