As the year draws to a close, investors should be aware of the potential capital gains distributions that mutual funds and certain ETFs often make around this time. These distributions can have a significant impact on an investor’s long-term wealth.

Think of your investment accounts as a monetary pipeline, where cracks can drain your assets, leaving you with less than you could have accumulated. Taxable capital gains distributions can be a large drag on portfolio performance over time. With proper planning, investors can minimize the impact of capital gains distributions and preserve more wealth.

Understanding Capital Gains Distributions

Capital gains distributions are primarily a concern with mutual funds, so they should be the focus of your tax planning; capital gains distributions from ETFs tend to be less of an issue. A capital gains distribution arises when a mutual fund manager sells securities in the portfolio for a gain. Shareholders of the mutual fund then receive that gain as a dividend, typically at the end of the year. Investors can either receive the distribution as cash or reinvest it to purchase more shares.

Not all distributions are equal, with some mutual funds kicking out more capital gains than others. The frequency of trading within the fund, as measured by the turnover ratio, is a helpful indicator of whether a fund is more or less likely to distribute capital gains. For example, many active mutual funds will exhibit higher turnover because the fund manager is utilizing market trends and economic data to buy and sell securities with the goal of raking in more return. Fund managers of passive mutual funds and exchange-traded funds (ETFs) trade less frequently (low turnover ratio) and can be expected to make very few (if any) capital gains distributions.

How to Know if You’ll Receive a Distribution

As the end of the year approaches, fund managers will begin to post estimated capital gains distribution information on their websites. The estimates typically include the total amount of the distribution, the distribution as a percentage of net asset value (NAV), and the payout date. Managers will also share information with respect to how the distribution will be categorized for tax purposes (Long-Term or Short-Term).

There are a few key dates to keep in mind concerning capital gain distributions:

- Record Date: The cutoff date to own shares for receiving distributions.

- Ex-Dividend Date: The first day you can purchase shares without receiving the distribution.

- Payable Date: The date when the distribution is paid out to shareholders.

Investors looking to avoid a capital gains distribution should sell a fund before its record date. Even if an investor has only very recently purchased the mutual fund, they will still receive the distribution — and the associated tax liability — if they hold the fund on the record date.

Impact on Net Asset Value (NAV)

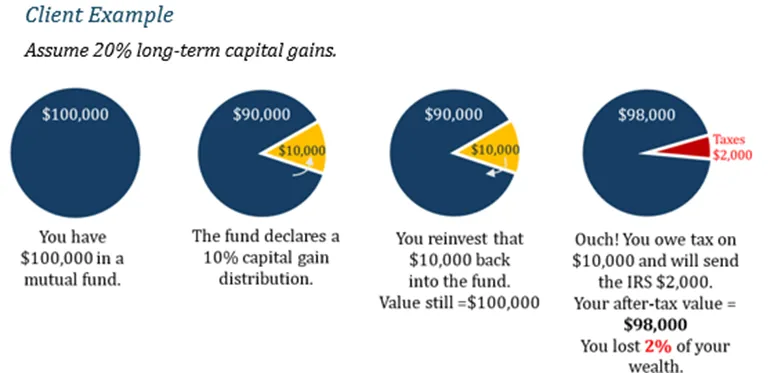

After a capital gains distribution, the fund’s price (NAV) will decline by the amount of the distribution. This happens because the fund is returning capital to investors, and those funds are subtracted from the overall portfolio. This decline is a normal part of the distribution process and should not be a cause for concern.

If an investor chooses to reinvest the distribution back into the mutual fund, they will own the same total dollar amount of the fund, but their investment is spread across more shares at the new, lower price. It is important to remember that distributions do not affect the fund’s total return, which accounts for both the initial and ending values, including any distributions.

Tax Implications of Capital Gains Distributions

The tax impact of capital gains distributions depends first on where the mutual fund is held — whether in a tax-advantaged account or a taxable account. In tax-advantaged accounts like IRAs or 401(k)s, taxes are typically only due when you withdraw funds, so capital gains distributions are not a concern.

Capital gains distributions from a fund held in a taxable account create a less favorable tax situation for investors. Taxes are due for the year the distribution is paid, regardless of whether the money is reinvested in additional shares. Investors should be aware that the taxation of mutual fund distributions depends on how long the underlying assets in the fund were held before being sold.

- Long-Term Capital Gains: When a mutual fund sells an asset that it has held for more than one year, the resulting distribution is generally taxed at long-term capital gains rates of 0%, 15%, or 20%, depending on your taxable income. These rates tend to be more favorable than ordinary income tax rates.

- Short-Term Capital Gains: If a mutual fund sells an asset it has held for one year or less, the resulting distribution is considered short-term capital gains. These are taxed at your ordinary income tax rates, which may be higher than long-term capital gains rates, depending on your income level.

So, how can investors avoid a big tax hit on returns? There are a few different strategies that investors can utilize to minimize their tax bill and take better control of the timing of tax liabilities.

Tax-Efficient Strategies

Asset Location

At Wealthspire, we take a comprehensive approach to investing, strategically allocating assets across accounts with varying tax treatments to maximize after-tax returns.

Tax-inefficient investments, such as high-income bond funds and actively managed equity funds, could be held in tax-deferred accounts like IRAs and 401(k)s. Bond funds generate interest income that is taxed at ordinary rates, and actively managed funds typically have higher turnover, leading to more taxable capital gains.

Tax-efficient investments, including passive equity funds and municipal bond funds, could be held in taxable accounts. Passive equities usually have lower turnover, leading to fewer taxable capital gains distributions, and municipal bonds (in most cases) pay interest income that is exempt from federal income tax, as they are issued by state and local governments.

Strategically allocating investments across different account types is essential for minimizing tax implications and enhancing long-term portfolio returns.

Tax-Loss Harvesting

Tax-loss harvesting is the process of offsetting capital gains with capital losses. When you sell an investment at a loss, you can use that loss to offset capital gains from other investments, including mutual fund distributions. It is important to be mindful of the wash sale rule, which disallows the tax benefits of a loss if you repurchase the same or an identical security within 30 days. Consulting with a financial professional is the best way to ensure the proper execution of this strategy.

Timing Considerations

Timing investment purchases or sales can help with tax efficiency, but it is important to balance this approach with a long-term investment strategy. Investors can avoid capital gains distributions for the tax year by purchasing a mutual fund just after the distribution date (ex-dividend date). In other cases, our advisors may recommend selling the fund before the distribution occurs (pre-record date).

This may be the strategy advised in one of the two cases:

- The client would realize a capital loss by selling the mutual fund.

- The estimated capital gains distribution passed on would generate a higher tax bill than selling the fund.

With many factors to weigh when navigating mutual fund purchases and sales, partnering with a financial expert is essential for proper execution, as this is not a one-size-fits-all strategy.

Focus on the Big Picture

Tax implications are important, but they should not be the primary driver of investment decisions; the overall investment strategy and long-term goals should remain the focus. Capital gains distributions can present opportunities to meet spending needs, pursue gifting goals, reinvest for future earnings growth, or rebalance your portfolio. A long-term financial plan charts a path that is both financially optimal and personally fulfilling.

Sources:

https://www.fidelity.com/bin-public/060_www_fidelity_com/documents/mutual-funds/Cap-Gains-Q-A.pdf

https://www.morningstar.com/funds/what-you-need-know-about-capital-gains-distributions

https://www.investopedia.com/terms/c/capitalgainsdistribution.asp

https://www.fidelity.com/learning-center/wealth-management-insights/mutual-fund-distribution-taxes

Wealthspire Advisors LLC, Fiducient Advisors LLC, Wealthspire Retirement, LLC dba Wealthspire Retirement Advisory, and certain other affiliates are separately registered investment advisers.

This material should not be construed as a recommendation, offer to sell, or solicitation of an offer to buy a particular security or investment strategy. The information provided is for informational purposes only and should not be relied upon for accounting, legal, or tax advice. While the information is deemed reliable, Wealthspire Advisors cannot guarantee its accuracy, completeness, or suitability for any purpose, and makes no warranties with regard to the results to be obtained from its use.

Wealthspire Advisors and its representatives do not provide legal or tax advice, and Wealthspire Advisors does not act as law, accounting, or tax firm. Services provided by Wealthspire Advisors are not intended to replace any tax, legal or accounting advice from a tax/legal/accounting professional. The services of an appropriate professional should be sought regarding your individual situation. You should not act or refrain from acting based on this content alone without first seeking advice from your tax and/or legal advisors.

Certain employees of Wealthspire Advisors may be certified public accountants or licensed to practice law. However, these employees do not provide tax, legal, or accounting services to any of clients of Wealthspire Advisors, and clients should be mindful that no attorney/client relationship is established with any of Wealthspire Advisors’ employees who are also licensed attorneys.

Please Note: Limitations. The achievement of any professional designation, certification, degree, or license, recognition by publications, media, or other organizations, membership in any professional organization, or any amount of prior experience or success, should not be construed by a client or prospective client as a guarantee that he/she will experience a certain level of results or satisfaction if Wealthspire is engaged, or continues to be engaged, to provide investment advisory services.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.