Losing a loved one is always difficult, and navigating the estate administration process can feel overwhelming. As a beneficiary, you may have questions about when you will receive your inheritance, what to expect during probate, and how estate decisions are made.

This guide focuses on estate administration via the probate process. However, it’s important to note that not all assets go through probate. Living trusts, retirement accounts, and life insurance policies typically pass directly to named beneficiaries, bypassing probate altogether. This guide will primarily address assets that are subject to probate, but we encourage you to consult with your estate’s Executor or trustee if you are receiving non-probate assets.

Understanding the Estate Administration Process

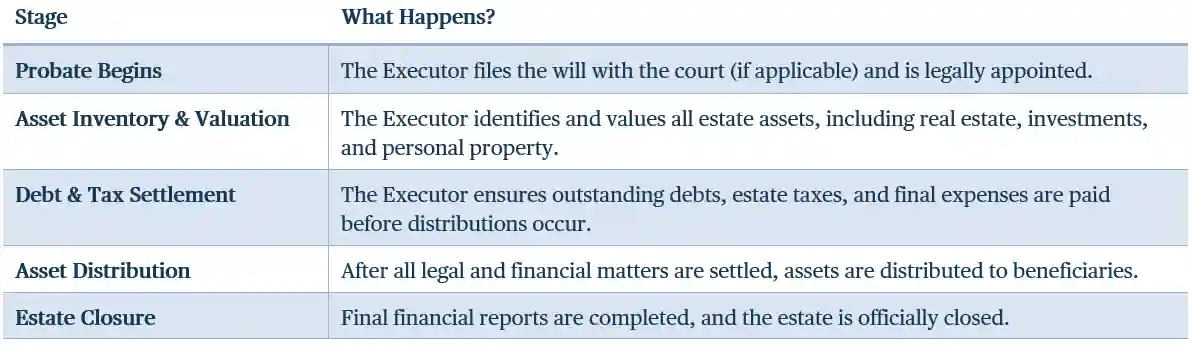

Estate administration is a multi-step legal and financial process that ensures assets are distributed according to the deceased’s wishes or state law (if no will exists). Below is an overview of what to expect.

Key Stages of Estate Administration

Estate Assets vs. Non-Probate Assets

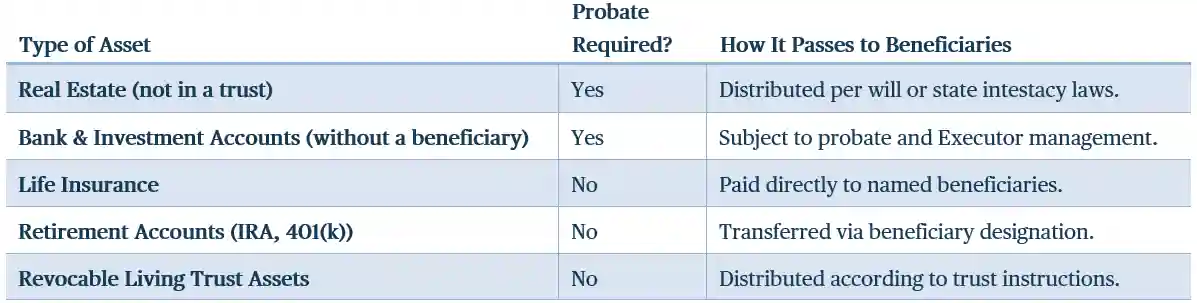

Not all assets pass through probate. Here’s a brief distinction between estate assets (which go through probate) and non-probate assets (which transfer directly to beneficiaries):

Understanding this distinction can help beneficiaries set realistic expectations about which assets they will receive and when. Generally, assets that do not have to go through probate are available to beneficiaries faster than assets that are subject to the probate process.

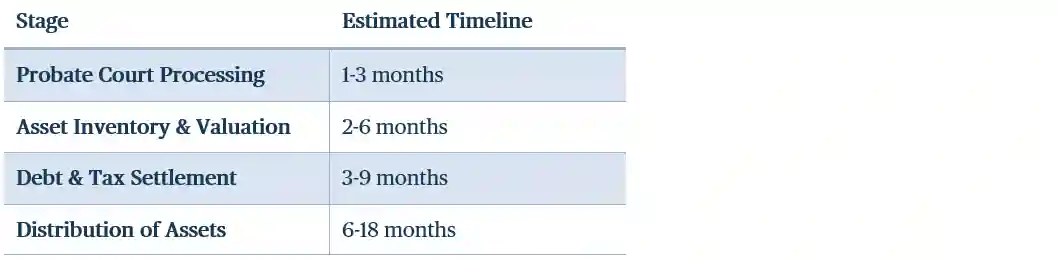

Timeline: When Can I Expect to Receive My Inheritance?

While every estate is unique, the average timeline for estate settlement is 6-18 months, depending on complexity.

Delays may occur if:

- There are disputes among beneficiaries.

- Assets like real estate or private business interests need to be liquidated.

- The estate is subject to estate taxes.

Common Beneficiary Concerns & How to Address Them

Why is the process taking so long?

- Probate and estate administration involve court approvals, creditor notifications, and tax filings, all of which take time.

- Executors have a legal obligation to ensure debts and taxes are settled before distributing assets. If they don’t take these steps, they may be held personally liable for unpaid debts of the Estate.

How will I receive my inheritance?

- Cash distributions are typically sent via check or wire transfer.

- Investment assets may be transferred directly to a beneficiary’s brokerage account in-kind or liquidated.

- Real estate or personal property may require additional legal work before ownership is transferred.

Do I have to pay taxes on my inheritance?

- In most cases, inheritances are not subject to income tax. However:

- If you inherit an IRA or retirement account, required distributions may be taxable.

- Some states impose inheritance taxes based on the beneficiary’s relationship to the deceased.

- Capital gains taxes may apply if you sell inherited assets at a higher value than their step-up basis.

What if I disagree with the Executor’s decisions?

- Executors have a legal duty to act in the best interest of the estate and all beneficiaries.

- If you have concerns, request a copy of the estate’s accounting records and speak with an attorney.

Your Role as a Beneficiary

While the Executor manages the estate, beneficiaries should:

- Stay informed – Request periodic updates on the estate’s progress.

- Be patient – Understand that estate settlement is a detailed legal process that takes time, and much of the delay is going to be outside of the Executor’s control.

- Communicate concerns professionally – If you have questions, reach out to the Executor respectfully and make your concerns known.

- Plan for your inheritance – Consider tax implications and financial planning strategies.

Wealthspire’s Role in Estate Administration

At Wealthspire, we help Executors and beneficiaries navigate estate settlements by:

- Managing estate liquidity & investments, ensuring financial stability during probate.

- Providing tax-efficient distribution strategies, minimizing tax burdens on beneficiaries.

- Offering beneficiary education & financial planning, helping you make informed decisions about your inheritance.

If you have questions about the estate administration process or need assistance with planning your inheritance, contact me today.

Wealthspire Advisors LLC, Fiducient Advisors LLC, Wealthspire Retirement, LLC dba Wealthspire Retirement Advisory, and certain other affiliates are separately registered investment advisers. ©2025 Wealthspire Advisors

This information should not be construed as a recommendation, offer to sell, or solicitation of an offer to buy a particular security or investment strategy. The commentary provided is for informational purposes only and should not be relied upon for accounting, legal, or tax advice. While the information is considered to be reliable, Wealthspire Advisors cannot guarantee its accuracy, completeness, or suitability for any purpose, and makes no warranties with regard to the results to be obtained from its use. If the reader chooses to rely on the information, it is at reader’s own risk.

Wealthspire Advisors and its representatives do not provide legal or tax advice, and Wealthspire Advisors does not act as law, accounting, or tax firm. Services provided by Wealthspire Advisors are not intended to replace any tax, legal or accounting advice from a tax/legal/accounting professional. The services of an appropriate professional should be sought regarding your individual situation. You should not act or refrain from acting based on this content alone without first seeking advice from your tax and/or legal advisors.

Certain employees of Wealthspire Advisors may be certified public accountants or licensed to practice law. However, these employees do not provide tax, legal, or accounting services to any of clients of Wealthspire Advisors, and clients should be mindful that no attorney/client relationship is established with any of Wealthspire Advisors’ employees who are also licensed attorneys.

Please Note: Limitations. The achievement of any professional designation, certification, degree, or license, recognition by publications, media, or other organizations, membership in any professional organization, or any amount of prior experience or success, should not be construed by a client or prospective client as a guarantee that he/she will experience a certain level of results or satisfaction if Wealthspire is engaged, or continues to be engaged, to provide investment advisory services, nor should it be construed as a current or past endorsement of Wealthspire Advisors by any of its clients or a third party. Registration of an investment advisor does not imply that Wealthspire Advisors or any of its principals or employees possesses a particular level of skill or training in the investment advisory business or any other business.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.