For those with an Individual Retirement Account (IRA) and a commitment to charitable giving, there is a hidden gem in retirement planning: the Qualified Charitable Distribution (QCD). Whether you’re currently 70½ or older, approaching that age, or guiding family members through smart retirement giving strategies, QCDs can provide thousands (often tens of thousands) worth of tax savings. This strategy is especially valuable for retirees who do not itemize deductions, as it provides a tax benefit regardless of deduction status.

The rules governing retirement accounts have shifted dramatically in recent years due to the passage of the Setting Every Community Up for Retirement Enhancement (SECURE) Act in December 2019 and its follow-up, SECURE Act 2.0 in December 2022. While these laws were promoted as improvements, many savers and retirees have faced new challenges such as higher taxes for heirs, complications with trusts, and tighter distribution timelines. Despite these less favorable changes, one bright spot remains – the benefits of QCDs are still intact and continue to offer a powerful, tax-smart giving strategy for IRA owners.

QCDs are a great tool, but if you haven’t heard of them before, it’s because they aren’t widely discussed. In fact, QCDs are relatively new. This valuable provision only became a permanent part of the tax code a little more than 10 years ago. First introduced in 2006 as a temporary provision, QCDs allowed individuals over age 70½ to donate up to $100,000 per year directly from their IRA to a qualified charity without paying income tax on the amount given. Congress repeatedly renewed this temporary provision until QCDs became permanent in 2015.

So, what exactly is a QCD?

A Qualified Charitable Distribution (QCD) is a direct transfer of funds from your IRA to a qualified charity. Money leaving your IRA via a QCD is not considered a taxable distribution, eliminating any income tax that would have otherwise been owed on a regular withdrawal. To qualify for a QCD, the donation must go directly to a qualified 501(c)(3) public charity recognized by the IRS. Common examples include religious institutions, non-profit animal welfare organizations, and much more.

Is a QCD right for you?

QCDs can be a beneficial part of your overall financial plan, especially if any of the following circumstances apply to you:

- You are already giving to charity or want to start.

- You do not need your entire RMD for living expenses.

- You want to reduce your taxes in retirement through lowering your Adjusted Gross Income (AGI).

- You are already giving cash to loved ones (e.g., adult children, nieces, nephews) who make their own donations, so it could be worth considering QCDs to directly assist with their charitable giving.

What about my Required Minimum Distribution (RMD)?

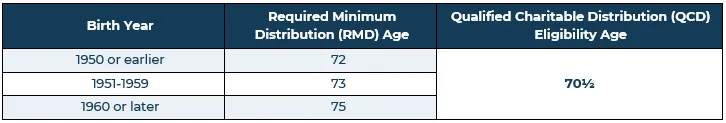

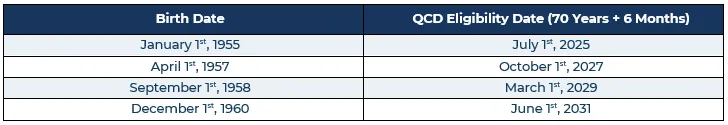

If you make a QCD from your personal retirement account, it can count toward all or part of your Required Minimum Distribution (RMD) for the year. If your QCD exceeds your RMD, the excess amount cannot be carried over to subsequent years. The SECURE Act 2.0, enacted in December 2022, increased the age when a retirement account owner is subject to RMD rules. Fortunately, the QCD eligibility age is still 70½. Here are the differences between RMD age and QCD eligibility:

Who is eligible for a QCD?

To use a QCD, you must be at least 70 years and 6 months from your date of birth. While you may have heard that the starting age for RMDs has shifted, the age for QCD eligibility has remained unchanged at 70½. It’s important to note that even if an individual turns 70½ in a given year, they must wait until the exact eligibility date to make a QCD. A distribution made even a day too early will not qualify. Here are some examples of when QCD eligibility begins based on birth date:

What types of IRAs can be used for QCDs?

QCDs can only be made from certain types of IRAs. Eligible IRAs include Traditional IRAs, Rollover IRAs, SEP IRAs and SIMPLE IRAs (but only if they are inactive, meaning no employer contributions in the same year), and Inherited IRAs (Beneficiary IRAs) (please note that the account owner must still be age 70½ or older, and QCDs from your personal retirement account cannot satisfy the RMD for an inherited retirement account and vice versa). Non-eligible IRAs include Roth IRAs (no RMDs during your lifetime, withdrawals typically tax-free), 401(k), 403(b), and other employer-sponsored retirement plans (unless rolled into an eligible IRA first), and Active SEP or SIMPLE IRAs (if contributions are still being made).

Benefits of QCDs

There are several compelling reasons why QCDs might make a worthwhile addition to your financial plan:

- Lower Taxes: A QCD directly reduces taxable income which can lead to a lower overall tax bill.

- Medicare Surcharge Reduction: In some cases, Medicare surcharges will decrease or be prevented from increasing.

- Satisfies Your RMD: If you’re 70½ or older and subject to RMDs, a QCD can count toward your required annual withdrawal without the associated tax hit.

- Simple Process, Expert Guidance: Advisors like the ones on our team can arrange for the funds to go directly from an IRA to the charity, simplifying the process.

- No Minimums, Generous Maximum: Whether you give smaller donations throughout the year or one larger annual donation, the benefits are the same.

Common Misconceptions About QCDs

Here are a few common misunderstandings that we’ve heard about QCDs:

- "I already give to charity, so I don’t need this." Think of a QCD as a tax-free method to make the same charitable donations you’re already making. QCDs lower your taxable income directly, even if you don’t itemize, offering a unique tax advantage.

- "I thought I had to take my RMD first." A QCD can count toward your RMD but only if done correctly and on time, ideally by instructing your custodian to send funds directly to the charity before other distributions. Planning ahead is key.

- "I’m not wealthy enough for this to matter." You don’t need to give a huge amount to benefit. Even smaller QCDs can reduce taxes and make a meaningful impact.

- "I’ll just leave my IRA to my kids." That’s generous, but new rules like those put in place by the SECURE Act mean most beneficiaries must empty inherited IRAs within 10 years, which can create a big tax bill for them. QCDs can help reduce that future burden.

Partner with Your Advisor to Optimize Your Charitable Impact

If you’re interested in using a QCD, we can walk you through it step by step:

- Discuss Your Goals: Determine what causes matter to you and how much you’d like to give. Confirm you meet the age and account requirements.

- Identify Your Eligible IRA and Charity: Select a qualified 501(c)(3) charity, whether it’s your local church, alma mater, or organizations supporting causes from animal welfare to veterans’ well-being.

- Coordinate with Your IRA Custodian: An advisor can help you request the QCD and ensure the check goes directly to the charity.

- Completion Deadline: The QCD must be completed by December 31st to meet your RMD requirements.

- Keep Records: Obtain acknowledgement from the charity and keep confirmation from your IRA custodian.

- Tax Reporting: Your IRA custodian will send you a Form 1099-R showing the total distributions made from your IRA that year, which should be reported on Line 4a. However, the taxable amount reported on Line 4b can be reduced by the amount of your QCD.

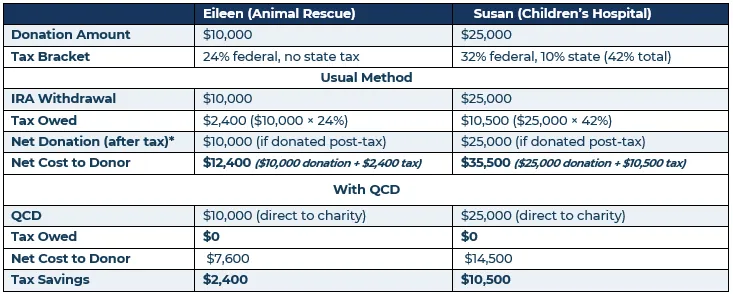

See the Difference: QCDs in Action for Animal Rescue and Children’s Health

Example 1: Eileen’s QCD to an Animal Rescue Organization

Eileen, age 72, lives in a state with no income tax and is in the 24% federal tax bracket. She wants to donate $10,000 to her favorite animal rescue. By making this gift as a QCD directly from her IRA, Eileen excludes the $10,000 from her taxable income, saving $2,400 in federal taxes ($10,000 × 24%). She was born in January 1953 and is not subject to an RMD until she turns 73 in 2026. So, while she’s eligible to make a QCD, it may be prudent to make the donation in January 2026 (if possible), which would reduce (or eliminate) her RMD. With these tax savings, Eileen can keep the $2,400 she would have paid in taxes, reducing her net cost of giving, or use her tax savings to increase her donation, making an even greater impact without increasing her out-of-pocket expenses.

Example 2: Susan’s Donation to a Children’s Hospital Using a QCD

Susan, age 75, is in the 32% federal and 10% state tax brackets, for a combined rate of 42%. Her RMD is $40,000 but she plans to give $25,000 to a children’s hospital. By making this donation as a QCD from her IRA, Susan fulfills the majority of her RMD (note that best practice is to facilitate QCDs before any other distributions. In Susan’s case, she should make her $25,000 QCD, then take a $15,000 distribution to satisfy the remainder of her RMD). She also excludes the $25,000 from her taxable income, saving $10,500 in taxes ($25,000 × 42%). With these tax savings, Susan can keep the $10,500 she would have otherwise paid in taxes, making her charitable giving significantly more affordable, or use the tax savings to amplify her donation, furthering her support to the children’s hospital at no additional net cost.

In both scenarios, QCDs give Eileen and Susan the flexibility to either retain their tax savings or enhance their charitable giving, allowing them to maximize both their philanthropy and financial benefits.

*Assumes donors still donate the full amount after paying taxes, which is less efficient than using a QCD.

Conclusion

Qualified Charitable Distributions are an exceptional strategy for charitably inclined retirees over age 70½. If you are not yet 70½ but are charitably inclined or planning for future giving, you might want to consider Donor Advised Funds. While not as straightforward as QCDs, they offer their own set of tax benefits and can be a great tool to centralize your charitable giving.

If you'd like to discuss a strategy for your charitable giving, we invite you to request a complimentary consultation.

Wealthspire Advisors LLC, Fiducient Advisors LLC, Wealthspire Retirement, LLC dba Wealthspire Retirement Advisory, and certain other affiliates are separately registered investment advisers. ©2025 Wealthspire Advisors.

This material should not be construed as a recommendation, offer to sell, or solicitation of an offer to buy a particular security or investment strategy. The information provided is for informational purposes only and should not be relied upon for accounting, legal, or tax advice. While the information is deemed reliable, Wealthspire Advisors cannot guarantee its accuracy, completeness, or suitability for any purpose, and makes no warranties with regard to the results to be obtained from its use.

Wealthspire Advisors and its representatives do not provide legal or tax advice, and Wealthspire Advisors does not act as law, accounting, or tax firm. Services provided by Wealthspire Advisors are not intended to replace any tax, legal or accounting advice from a tax/legal/accounting professional. The services of an appropriate professional should be sought regarding your individual situation. You should not act or refrain from acting based on this content alone without first seeking advice from your tax and/or legal advisors.

Certain employees of Wealthspire Advisors may be certified public accountants or licensed to practice law. However, these employees do not provide tax, legal, or accounting services to any of clients of Wealthspire Advisors, and clients should be mindful that no attorney/client relationship is established with any of Wealthspire Advisors’ employees who are also licensed attorneys.

Please Note: Limitations. The achievement of any professional designation, certification, degree, or license, recognition by publications, media, or other organizations, membership in any professional organization, or any amount of prior experience or success, should not be construed by a client or prospective client as a guarantee that he/she will experience a certain level of results or satisfaction if Wealthspire is engaged, or continues to be engaged, to provide investment advisory services, nor should it be construed as a current or past endorsement of Wealthspire Advisors by any of its clients or a third party.

Registration of an investment advisor does not imply that Wealthspire Advisors or any of its principals or employees possess a particular level of skill or training in the investment advisory business or any other business.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.