Experienced investors understand the value of diversification and appreciate the importance of spreading risk globally, across equities, fixed income, real estate and beyond. For affluent U.S. investors, an additional layer of strategic diversification has gained importance, jurisdictional diversification. This approach involves placing assets under the legal and regulatory frameworks of more than one country, rather than concentrating all wealth within the U.S. financial system. It not only addresses market volatility but also helps mitigate domestic legal and political risk.

In recent years, growing geopolitical uncertainty has driven more investors to look beyond conventional diversification strategies. At Wealthspire Advisors, we recognize this shift and are committed to assisting our clients identify investment solutions in non-U.S. jurisdictions. This enables clients to expand their legal and geographic footprint, enhancing flexibility and discretion while remaining aligned with U.S. tax and regulatory standards.

What Is Jurisdictional Diversification?

Jurisdictional diversification refers to strategically holding assets in different legal systems to reduce exposure to country-specific risk. Unlike traditional diversification which spreads investment across asset classes or regions, this approach aims to limit the concentration of legal and political oversight in a single jurisdiction.

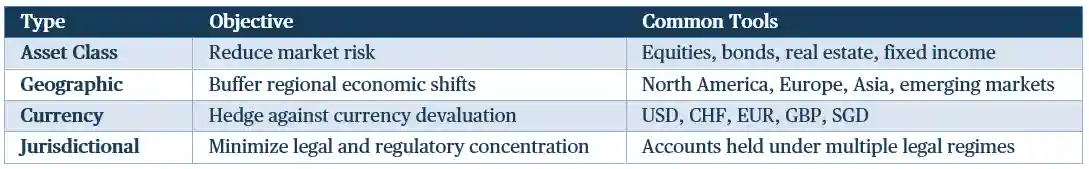

Comparison with Other Diversification Strategies:

Investing in international ETFs via U.S. brokers may offer geographic reach, but assets remain within the U.S. legal system. Jurisdictional diversification takes the next step by physically placing assets abroad subject to different laws and protections.

Consider a U.S. investor who maintains all their investment and cash holdings within domestic institutions. During a period of heightened geopolitical tension or global market dislocation, U.S. financial markets may experience temporary restrictions, such as delays in international wire transfers, trading halts, or regulatory responses affecting liquidity. By maintaining a portion of assets in a well-regulated foreign jurisdiction, the investor retains immediate access to capital outside the U.S. financial system, allowing for flexibility, uninterrupted planning, and the ability to respond strategically to evolving conditions.

Legal and Regulatory Considerations

U.S. investors must remain fully compliant when establishing foreign accounts. Key reporting obligations include:

- Foreign Account Tax Compliance Act (FATCA) – Requires disclosure of foreign assets exceeding certain thresholds. Foreign institutions must report U.S.-held accounts.

- Foreign Bank and Financial Accounts Report (FBAR) – Required if total foreign financial accounts exceed $10,000 at any point during the year (FinCEN Form 114).

- Statement of Specified Foreign Financial Assets (Form 8938) – Filed with the IRS if foreign holdings exceed defined thresholds.

Wealthspire Advisors works closely with legal and tax professionals to ensure clients navigate these requirements smoothly.

How to Set Up a Foreign Investment Account

Opening a foreign account involves planning, documentation, and selecting the right jurisdiction. Key steps include:

- Choose a Stable Jurisdiction – Prioritize political neutrality, legal protections, and financial infrastructure.

- Work with a Compliant Institution – The institution must adhere to U.S. FATCA regulations and provide transparent account administration.

- Complete Documentation – Includes verified ID, source-of-funds declaration, IRS Form W-9, and due diligence materials.

- Understand Fees and Minimums – Foreign institutions may require significant initial deposits and charge administrative or management fees.

- Coordinate with an Advisor – Wealthspire Advisors acts as a liaison, guiding account setup and integrating the structure into clients’ broader financial plans. In the face of global instability and shifting regulatory climates, our solution offers a stable foundation for clients seeking greater jurisdictional balance and long-term continuity.

Investment Options for Jurisdictional Diversification

Several vehicles are suitable for holding assets abroad:

- Foreign Brokerage Accounts – Access to international markets with multi-currency functionality.

- Offshore Mutual Funds or ETFs – Broader exposure, though some may trigger PFIC reporting obligations.

- Precious Metals Held Overseas – Gold or silver stored in secure vaults in stable jurisdictions.

- Foreign Trusts or Foundations – Used for estate planning and asset protection and require specialized structuring.

Risks and Considerations

Jurisdictional diversification offers key advantages, but it also introduces new variables:

- Currency Risk – Exchange rates can affect returns.

- Regulatory and Political Risk – Though mitigated by jurisdiction selection, sudden changes are possible.

- Complexity – Foreign accounts add reporting and oversight obligations.

- Liquidity – Some assets held abroad may be harder to liquidate quickly.

Wealthspire Advisors helps clients evaluate and manage these considerations with proper due diligence and planning.

Best Practices for Affluent Investors

To implement jurisdictional diversification effectively, high-net-worth investors should adhere to several key principles:

- Work with advisors experienced in international finance and compliance

- Prioritize transparent, well-regulated jurisdictions

- Maintain rigorous documentation and reporting discipline

- Integrate international holdings into estate, tax, and investment strategies

- Review structures annually to adapt to changes in law or client circumstances

With Wealthspire Advisors, clients have a long-term strategic partner in navigating the complexity of cross-border wealth management.

Our Solution

To meet growing demand for cross-border strategies, Wealthspire Advisors can assist clients in identifying jurisdictions offering political stability, investor protections, and discretion.

Key Benefits of This Relationship:

- Jurisdictional diversification is anchored in a legally secure environment

- Full compliance with U.S. regulations (FATCA, FBAR)

- Multi-currency capabilities and flexible investment choices

- High service standards and ongoing oversight

From initial onboarding through long-term account management, we support clients at every step, ensuring both ease and regulatory alignment.

Conclusion

Jurisdictional diversification provides high-net-worth investors with another layer of resilience, extending both the geographic footprint and legal context of their wealth. By leveraging the advantages of international banking, investors can reduce concentrated exposure while enhancing long-term financial stability.

Wealthspire Advisors helps clients navigate the complexities of international investing while maintaining control, clarity, and confidence.

In today’s increasingly complex and unpredictable global environment, jurisdictional diversification is more than just a financial tactic, it is a forward-looking response to growing geopolitical and legal uncertainty, and a meaningful addition to a resilient wealth strategy.

Wealthspire Advisors LLC, Fiducient Advisors LLC, Wealthspire Retirement, LLC dba Wealthspire Retirement Advisory, and certain other affiliates are separately registered investment advisers. © 2025 Wealthspire Advisors

This material should not be construed as a recommendation, offer to sell, or solicitation of an offer to buy a particular security or investment strategy. The information provided is for informational purposes only and should not be relied upon for accounting, legal, or tax advice. While the information is deemed reliable, Wealthspire Advisors cannot guarantee its accuracy, completeness, or suitability for any purpose, and makes no warranties with regard to the results to be obtained from its use.

Please Note: Limitations. The achievement of any professional designation, certification, degree, or license, recognition by publications, media, or other organizations, membership in any professional organization, or any amount of prior experience or success, should not be construed by a client or prospective client as a guarantee that he/she will experience a certain level of results or satisfaction if Wealthspire is engaged, or continues to be engaged, to provide investment advisory services.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.