As parents, you want the best for your kids, and for many families, that includes a college education. But while most parents understand that college is expensive, few truly grasp just how complex and nuanced the financial picture has become. The sticker price is just one part of the puzzle. If you’re planning for your child’s education, here are a few critical—and sometimes surprising—realities to keep in mind.

1. College Costs Are Rising Faster Than Inflation… Still

Yes, we’ve been hearing this for decades, but it’s worth repeating: the cost of attending college has increased at a rate far outpacing normal inflation. Some public universities have seen tuition rise over 500–1,000% in the past 30 years. And no, that’s not a typo.

But rising costs aren’t just about tuition. The total “cost of attendance” includes room and board, fees, travel, textbooks, and even those late-night pizza runs. It’s common to see totals ranging from $30,000 to $80,000 per year.

So, what does this mean? If you have young kids and haven’t run the numbers lately, it’s time. Waiting until their junior year of high school to investigate college costs is like checking airfare the day before spring break—you’ll be shocked at the price.

2. The FAFSA Isn’t the Magic Wand Some Parents Hope It Is

Many parents assume that filling out the FAFSA (Free Application for Federal Student Aid) is a golden ticket to college affordability. While it’s a necessary step in unlocking financial aid, it’s far from a guarantee, and how your financial picture is assessed may surprise you.

Here’s how it works: when you fill out the FAFSA, the government calculates your Student Aid Index (SAI)—an estimate of how much your family can afford to pay for college. This number is based on a combination of income and assets, and the formulas used aren’t always intuitive. Let’s break it down:

- Parent income is heavily weighted. After certain deductions, a portion of your income—potentially up to 47%—can be considered available to pay for college. This doesn’t mean you’re expected to write a check for half your income, but it significantly affects your eligibility for need-based aid.

- Parent assets are also counted, though to a lesser degree. About 5.64% of non-retirement assets (like savings, investment accounts, and 529 plans held in the parents’ name) are factored in.

- Student income and assets, on the other hand, are hit much harder. 50% of student income and 20% of student assets are considered available for college costs. If your child has a sizable savings account or works part-time, it could reduce their eligibility for aid more than expected.

- Grandparent assets aren’t reported on the FAFSA, fortunately. As of last year, the former “financial aid trap” of counting distributions from grandparent-owned 529s as income to the student is no longer in effect.

3. The “Best” College May Not Be the Best Financial Fit

This one might sting a little: the most prestigious or well-known school isn’t always the right choice financially or academically. Colleges are businesses and highly strategic about enrollment and aid offers.

Colleges are now the largest source of scholarship money, far more than private organizations or community foundations. And they award these dollars based on their need to round out a class. That means they might offer generous merit aid to a student who’s academically strong for that school, even if that same student wouldn’t stand out at a more selective institution. It’s also worth being realistic about the growing difficulty of getting into name-brand schools. Many well-known universities have seen their acceptance rates plummet as applications soar, meaning even strong students are often turned away. At the same time, these schools may offer limited merit aid because they don’t need to compete for students. In contrast, lesser known but academically strong institutions often provide more generous scholarships and a more personalized experience. Prestige matters, but fit and financial feasibility should matter just as much.

4. Test Scores and “Demonstrated Interest” Still Matter

There’s been a lot of debate about whether the SAT and ACT are still relevant. While some schools have gone test-optional, many are quietly shifting back to requiring scores, or at least considering them if submitted. And for schools that offer merit aid, higher test scores can mean thousands in savings.

Beyond academics, schools are increasingly looking at “demonstrated interest.” This includes whether your child visited campus, opened emails from the school, or attended virtual sessions. Yes, they track all of that. And yes, it can influence both admissions and scholarship dollars. If your student has a dream school, ensure they’re engaging with it in measurable ways.

5. The Transfer Trap: Hidden Costs and Wasted Credits

Here’s a stat that surprises almost every parent: roughly 38% of college students transfer at least once. While sometimes necessary, transferring can come with major downsides like lost credits, delayed graduation, and other additional costs. Choosing the right-fit school the first time can save tens of thousands in the long run.

That means looking beyond just the major or the campus tour. Consider the teaching style, the academic support resources, and the flexibility for students who change majors (because around 80% do). Fit isn’t just a buzzword—it’s a financial strategy.

Same Income, Different Outcomes: A Tale of Two Families

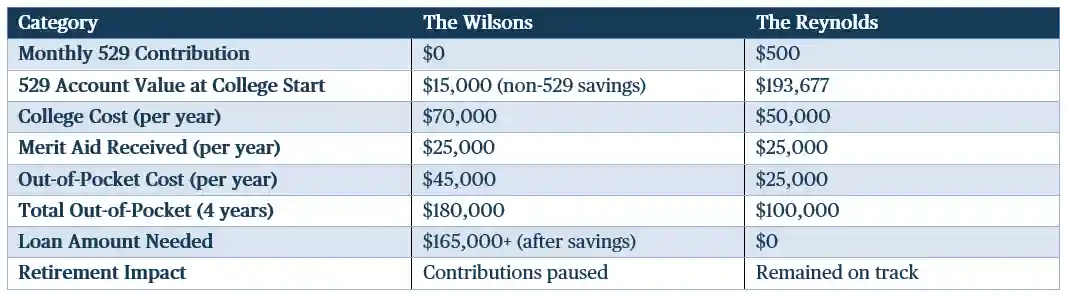

Let’s imagine two families: the Wilsons and the Reynolds. Both families live in the suburbs, earn $150,000 per year, and have two children. Their living expenses are nearly identical—mortgage, groceries, car payments, even vacations. Both sets of parents want to help their kids graduate from college without being buried in debt, but their approaches couldn’t be more different.

Family A: The Wilsons – “We’ll figure it out when we get there.”

- Never opened a 529 or any other designated college savings account.

- Saved sporadically, with about $15,000 total set aside by the time their oldest hit senior year.

- Never reviewed how the FAFSA evaluates income and assets.

- Their son, Jake, applied to several top-tier private schools, assuming need-based aid would help.

- He got into a $70,000/year school with only $10,000 in merit aid.

- The Wilsons took out Parent PLUS loans for the rest—over $50,000/year, or $200,000+ over four years.

- Their second child, Emma, is two years behind, and they’re already feeling tapped out, plus their retirement contributions are on pause.

Family B: The Reynolds – “We planned with intention.”

- Contributed $500/month to a 529 plan starting when their kids were young.

- With consistent saving and compounding, their account grew to about $193,000 by the time college started.

- Their daughter, Lily, also a high achiever, applied to a mix of schools where she would stand out academically.

- She chose a university with a $50,000/year cost that offered her $25,000/year in merit aid.

- Their out-of-pocket cost was $25,000/year, or $100,000 total.

- The 529 plan easily covered her four-year education and left room to support their second child as well, with no loans or disruption to retirement.

- Here’s a clear, side-by-side comparison of the Wilsons and the Reynolds families to illustrate how early planning—and consistent saving—can make a dramatic difference in the college funding experience:

The Reynolds family contributed a total of $108,000 over 18 years into their 529 plan through consistent $500 monthly contributions. This reinforces how steady, long-term planning not only makes college more affordable but can also generate nearly $85,000 in investment growth thanks to compounding at a 6% return.

Final Thoughts

Saving for college is important, but planning for college is critical. A 529 plan alone won’t solve for rising costs, unexpected transfers, or lack of merit aid. What’s needed is a proactive, informed approach that treats college like the major investment it is. That means starting the conversation early, asking hard questions, and choosing schools strategically, not just emotionally.

As a financial advisor, I often remind parents that it’s not just about affording college, it’s about affording life afterward, too. Student debt can burden your child’s future—and yours—if you’re co-signing loans or tapping retirement savings to help.

The good news? With the right planning, you can find colleges that are both a great fit and a smart financial decision. But it all starts with awareness. Reach out to a member of our team to see how we can help you get started!

Wealthspire Advisors LLC, Fiducient Advisors LLC, Wealthspire Retirement, LLC dba Wealthspire Retirement Advisory, and certain other affiliates are separately registered investment advisers. © 2025 Wealthspire Advisors

This material should not be construed as a recommendation, offer to sell, or solicitation of an offer to buy a particular security or investment strategy. The information provided is for informational purposes only and should not be relied upon for accounting, legal, or tax advice. While the information is deemed reliable, Wealthspire Advisors cannot guarantee its accuracy, completeness, or suitability for any purpose, and makes no warranties with regard to the results to be obtained from its use.

Please Note: Limitations. The achievement of any professional designation, certification, degree, or license, recognition by publications, media, or other organizations, membership in any professional organization, or any amount of prior experience or success, should not be construed by a client or prospective client as a guarantee that he/she will experience a certain level of results or satisfaction if Wealthspire is engaged, or continues to be engaged, to provide investment advisory services.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.