Investing isn’t about chasing trends or picking the latest hot stock — it’s about building a strategy that can withstand different market environments and keep you aligned with your long-term goals. A resilient portfolio is crafted intentionally, with diversification, risk management, and disciplined maintenance at its core.

This past summer, Wealthspire hosted a series of educational webinars aimed at helping investors deepen their understanding of key financial concepts. One of these sessions, “Investing 201: Beyond the Basics,” expanded on the foundation laid in our earlier webinar on the basics. In this blog, we’ll revisit several of the core topics covered in the webinar, with an additional blog to come that will explore the remaining concepts. You can watch a replay of the session here.

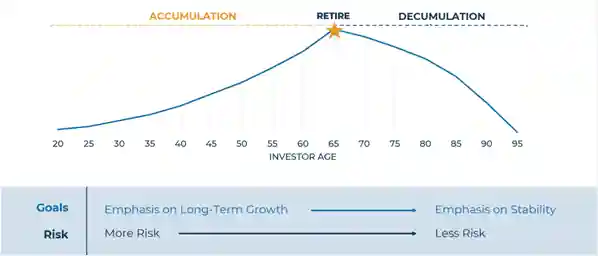

Life Stage Considerations: Accumulator vs. Decumulator

Before diving into portfolio fundamentals, it’s essential to understand how your life stage and risk tolerance shape your investment strategy. The right mix of assets for someone just starting their career will look very different from someone entering retirement. There are two primary life stages:

- Accumulators: These are individuals actively earning income and saving for the future. With a longer time horizon and ongoing earnings, accumulators can better absorb market volatility. Short-term fluctuations are less disruptive, allowing them to focus on long-term growth.

- Example of an Accumulator:

Meet Alex, a 35-year-old marketing director living in Chicago. Alex and their spouse are raising two young children and contributing regularly to their retirement accounts. With 25+ years until retirement, Alex’s portfolio is tilted toward growth-oriented investments like stocks. Occasional market dips don’t derail their strategy, as they’re focused on building wealth over time and have a stable income from salary.

- Example of an Accumulator:

- Decumulators: These individuals rely on their portfolio to fund living expenses, typically in retirement. The focus shifts from growth to preservation and income stability. Because withdrawals occur regularly, market declines can have a lasting impact, making risk management and diversification critical to sustaining long-term goals.

- Example of a Decumulator:

Meet Jamie, a 68-year-old retired teacher living in North Carolina. Jamie receives monthly income from Social Security and a modest pension but still relies on their retirement savings to supplement living expenses and fund travel. Their financial plan emphasizes stable cash flows and income-generating assets like bonds. Because Taylor is no longer earning a salary, market downturns could affect their ability to maintain their lifestyle and long-term financial security.

- Example of a Decumulator:

Framing your financial life in terms of accumulation vs. decumulation is a helpful first step in understanding your current life stage. However, it’s not a rigid rule. Ultimately, what matters most is that your investment portfolio reflects your comfort level with risk and aligns with your long-term financial goals. Whether you're building wealth or drawing from it, your strategy should be tailored to your unique circumstances.

Diversification: More Than Owning a Mix of Investments

Diversification is more than simply holding a variety of investments. It means combining assets that behave differently under various market conditions so that each plays a specific role in your portfolio. To summarize:

- Stocks provide long-term growth potential.

- Bonds offer stability and income.

- Alternatives such as real estate or commodities can add another layer of diversification.

The effectiveness of diversification depends largely on correlation — the degree to which assets move together. Lower correlation between assets helps reduce overall risk and smooth out volatility. Revisiting the life-stage framework of accumulation versus decumulation, it’s clear that diversification takes on different roles depending on where you are in your financial journey.

In decumulation, broad diversification and low correlation between asset classes help reduce the risk of having to sell investments at depressed prices during market downturns. When multiple asset classes decline at the same time, meeting spending needs can become more difficult. During accumulation, a longer time horizon and consistent income from employment reduces the dependence on portfolio assets. This makes short-term volatility and asset class correlation less of a concern, allowing for a focus on growth. There’s no one-size-fits-all approach to asset allocation. The right mix depends on your life stage, financial goals, and how your assets interact with one another.

Measuring Risk: Standard Deviation and Max Drawdown

Understanding risk metrics helps you evaluate whether your portfolio matches your comfort level and objectives.

Standard deviation measures how much an investment’s returns vary from its average. For example, a standard deviation of 10% means that, in most cases (roughly two thirds of the time), the investment’s returns will fall within 10 percentage points above or below its average return.

- A higher standard deviation means greater volatility and larger swings in value.

- A lower standard deviation means steadier, more predictable returns.

Max drawdown measures the largest percentage decline an investment or portfolio experiences from its highest point (peak) to its lowest point (trough) before a new peak is reached. It captures the worst historical loss during a specific time frame and shows how deep and prolonged a downturn can be.

For example, if your portfolio grows to $100,000 and then falls to $70,000 before recovering, the max drawdown is 30%. This means at one point, you were down $30,000 from the peak. Max drawdown helps you understand the potential severity of losses during market stress and can guide how much risk you’re willing and able to take on.

Rebalancing: Keep Your Plan Aligned

Portfolios drift over time as markets move. For example, a 60/40 stock-to-bond mix can become 70/30 after a strong equity rally, increasing risk in the portfolio. Rebalancing restores your target allocation and ensures your portfolio continues to reflect your intended risk level. To summarize, rebalancing matters because it can:

- Maintain your chosen risk profile,

- Encourage systematic “buy low, sell high” behavior,

- And prevent unintended concentration in one asset class.

Rebalancing can be done manually, but many investors benefit from having it handled automatically. If you work with a financial advisor, your portfolio is likely reviewed and rebalanced regularly to stay aligned with your goals. Similarly, many 401(k) plans offer automatic rebalancing features that can be set to adjust your allocations on a quarterly or annual basis, helping keep your retirement strategy on track without requiring constant oversight.

Bringing It All Together

Building a resilient portfolio starts with staying grounded in the fundamentals and adapting as your life evolves. The key principles include:

- Knowing Where You Stand: Your financial strategy should reflect your current life stage, whether you’re accumulating wealth or drawing from it.

- Diversifying with Purpose: Reduce risk by combining assets that behave differently across market conditions.

- Defining Your Comfort Zone: Understanding risk helps guide decisions and keeps your strategy aligned with your personal limits.

- Staying in Balance: Rebalancing ensures your portfolio evolves with market changes and your shifting goals.

Ultimately, long-term success comes from consistency. Stick to your plan, revisit it regularly, and make thoughtful adjustments as your goals and needs change. By focusing on these foundational principles, you’ll be better equipped to navigate uncertainty and stay on track toward long-term success. If you are unsure whether you’re an accumulator or decumulator, properly managing diversification of your portfolio, or would like to speak to a member of our team, please feel free to schedule a call here.

Wealthspire Advisors LLC, Fiducient Advisors LLC, Wealthspire Retirement, LLC dba Wealthspire Retirement Advisory, and certain other affiliates are separately registered investment advisers. © 2025 Wealthspire Advisors

This material should not be construed as a recommendation, offer to sell, or solicitation of an offer to buy a particular security or investment strategy. The information provided is for informational purposes only and should not be relied upon for accounting, legal, or tax advice. While the information is deemed reliable, Wealthspire Advisors cannot guarantee its accuracy, completeness, or suitability for any purpose, and makes no warranties with regard to the results to be obtained from its use.

Past performance is no guarantee of future results. Different types of investments involve varying degrees of risk. Therefore, there can be no assurance that the future performance of any specific investment or investment strategy, including the investments and/or investment strategies recommended and/or undertaken by Wealthspire Advisors, or any non-investment related content, will be profitable, equal any corresponding indicated historical performance level(s), or prove successful. No amount of prior experience or success should be construed that a certain level of results or satisfaction will be achieved if Wealthspire Advisors is engaged, or continues to be engaged, to provide investment advisory services.