The 60/40 portfolio – a mix of 60% U.S. Large Cap Stocks and 40% U.S. IT Government Bonds – has long been regarded as a simple and effective investment strategy. The allocation values balance, leveraging equities for capital appreciation and bonds for income and stability. This allocation has historically provided solid risk-adjusted returns while minimizing the impact of market volatility. However, shifting market dynamics have tested its resilience, raising headlines about how well it still holds up in today’s evolving landscape.

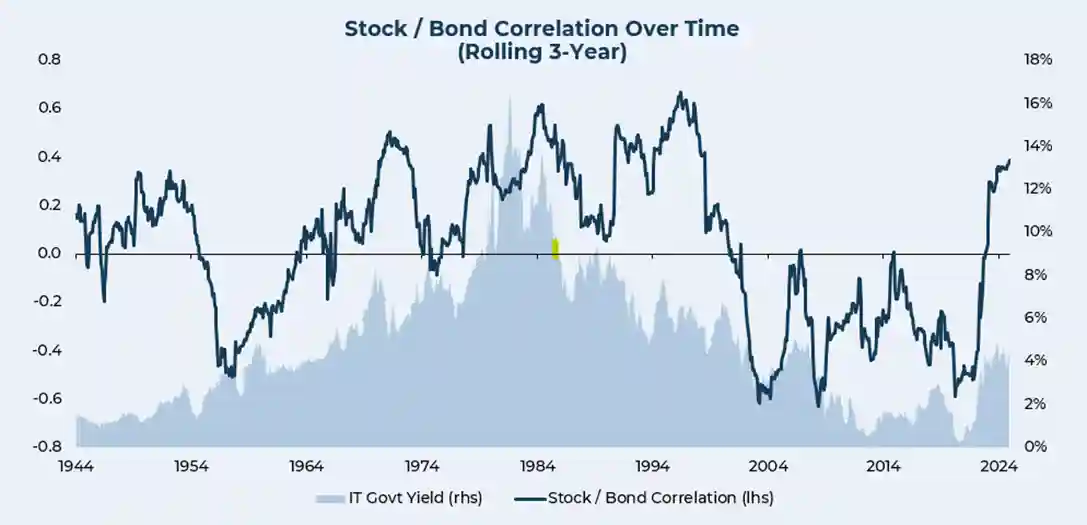

The long-standing advantage of the 60/40 strategy is the historically low correlation between stocks and bonds. Correlation can be understood as the relationship in which two investments move together. For proper diversification, a low or even negative correlation is favorable. The increasing correlation between stocks and bonds since 2022 brings the basis of the 60/40 strategy into question. This is an understandable doubt if we were to assume that stock-bond correlations are static, but this is not the case.

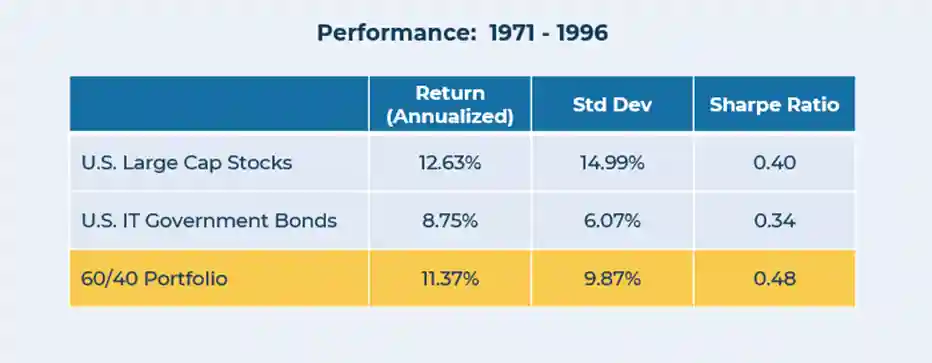

Looking at stock-bond correlations over time, we can see that correlations for the last two decades had been largely negative. It wasn’t until the market shock of COVID-19 and ensuing rise in interest rates that we saw the relationship between stock and bond prices become more closely tethered. Using history as a guide, we can see that bonds have been more correlated with stocks during periods of elevated interest rates. One such period of elevated correlation between stocks and bonds lasted from 1971 to 1996, and it just so happens that this period also experienced higher interest rates than any other over the past 80+ years. Over this time, the average stock-bond correlation was 0.32 and reached a high of 0.67.

Present day investors can take solace in the fact that despite higher correlations during this period, the 60/40 portfolio still outperformed on a risk-adjusted basis, demonstrating the strategy’s resilience.

Rather than abandoning the strategy, investors can focus on refining it to enhance resilience and their long-term objectives. Incorporating alternatives or expanding the allocation into other parts of the market can strategically help you reach your goals. While the 60/40 portfolio may not be the portfolio for every investor, it has a long history of delivering balance and resilience in a variety of market environments. As such, its resilience over the long run makes it a compelling strategy for many. Investors would be well served to remain disciplined and avoid giving up on a balanced approach that has delivered on its promise for many decades.

Wealthspire Advisors LLC, Fiducient Advisors LLC, Wealthspire Retirement, LLC dba Wealthspire Retirement Advisory, and certain other affiliates are separately registered investment advisers. © 2025 Wealthspire Advisors

This material should not be construed as a recommendation, offer to sell, or solicitation of an offer to buy a particular security or investment strategy. The information provided is for informational purposes only and should not be relied upon for accounting, legal, or tax advice. While the information is deemed reliable, Wealthspire Advisors cannot guarantee its accuracy, completeness, or suitability for any purpose, and makes no warranties with regard to the results to be obtained from its use.