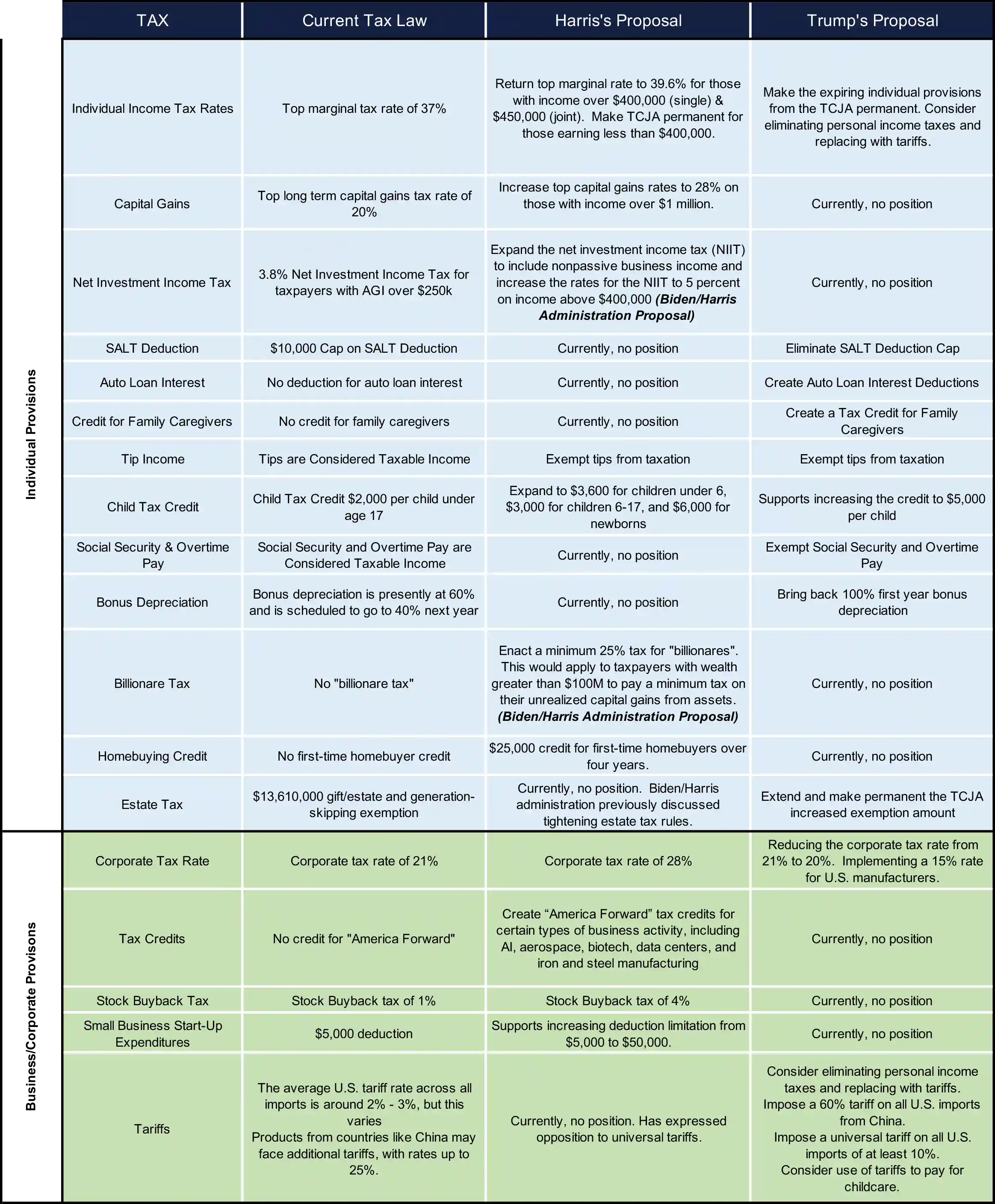

Tax policy has remained a continued focus for both Vice President Harris and former President Trump as we near the election and the conclusion of their campaigns. Changes to tax policy can have far-reaching implications for individuals, families, and businesses. We have prepared a comprehensive chart below that outlines current tax law alongside proposed tax plans from Vice President Harris and former President Trump. This chart was compiled using information from each candidate’s publicly available tax policies as well as provisions they have each discussed on the campaign trail. Also indicated on the chart are provisions proposed by the Biden/Harris Administration and not explicitly by the Harris campaign.

Comparing Tax Policy

Preparing for Potential Changes

It is always important to note that changes to tax laws require an extensive legislative process. Any proposed adjustments must pass through Congress, where they face debate, revisions, and approval by both the House and Senate before becoming law. While the proposals provide a glimpse into potential changes, there are no guarantees that they will come to fruition. While legislative outcomes are highly uncertain, it is important to remain informed of potential changes that could ultimately impact your personal situation.

Sources

https://taxfoundation.org/blog/harris-unrealized-capital-gains-tax

https://www.eisneramper.com/insights/tax/tax-policy-comparison-0924/

https://taxfoundation.org/research/federal-tax/2024-tax-plans/

https://kamalaharris.com/a-new-way-forward/

https://evolvedtax.com/blog/harris-vs.-trump-tax-plans-2024-presidential-election

https://taxfoundation.org/research/all/federal/kamala-harris-tax-plan-2024/