In my wealth management practice, I focus on helping business owners and corporate executives achieve quality of life and financial freedom. For some time now, I have been interested in exit planning for business owners. This interest led me to engage with other advisors and business owners as a Tri-State member of the Exit Planning Exchange and to obtain my CEPA (Certified Exit Planning Advisor) credential from the Exit Planning Institute.

As CEPA professionals, we think of exit planning as a roadmap for fulfillment in our clients’ business and personal lives. We want to help our client entrepreneurs create transferable businesses, so they can unlock the value of what is almost always their most valuable asset. The private companies that our business owner clients build become better and stronger due to the exit planning process, long before an exit. The goal of exit planning is value creation, as well as higher current income for the owner. In short, savvy business owners need exit planning, and exit planning is simply a good business strategy.

Exit planning does not only mean business readiness for an exit, which is of fundamental importance, but also personal readiness, as the sellers of a private company will need a sound financial plan to maintain the lifestyle to which they were accustomed while running their business and earning income directly from it. The goal is to emerge financially independent from the business. Finally, fulfillment in business and personal life also means having a plan for “what’s next?” The next act should be the best act, and it will be, as long as deep thought and planning is given due attention.

Exit Planning Facts and Figures

As part of the Exit Planning Institute’s (EPI) CEPA Masterclass, I learned thought-provoking facts and stats about the attitudes and readiness of business owners: 76% of owners plan to transition over the next 10 years. This represents 4.5 million American businesses, and over $10 Trillion in wealth.[i] The Exit Planning Institute’s State of Owner Readiness Survey (2013) showed that 99% of business owners agreed that “having a transition strategy is important both for my future and for the future of my business.” Unfortunately, the EPI has found that 79% of owners have no written transition plan, 49% have done no planning at all, and that 94% have no written plan for their personal “third act.”[ii] Knowing these statistics, is it a surprise that 80% of businesses that are put on the market do not sell?[iii] Additionally, many private businesses are family owned and run. Yet the Family Firm Institute tells us only 30% of family-owned businesses transition to the second generation, 12% make it to the third, and only 3% go down to the 4th generation or further.[iv]

While these numbers are not particularly encouraging, I am convinced that with proper focus and what Christopher Snider, CEO of the Exit Planning Institute, calls “relentless execution,”[v] the business owner can achieve a successful transition, where personal and business goals are accomplished to the benefit of the owner and other stakeholders. Moreover, Snider writes about exiting a business in expansive terms in his book, Walking to Destiny: 11 Actions an Owner MUST Take to Rapidly Grow Value & Unlock Wealth – “Exit doesn’t have to be an end-all, be-all. You could sell outright. You could stay in the business and just take chips off the table. Exit can be what you want if you plan for it.”[vi]

Exit Planning is Business Strategy

The overriding theme in Walking to Destiny, which Snider repeated during his Master Class, is that “exit planning is simply good business strategy.”[vii] The fundamental idea is that an owner should spend a significant amount of time working on their business, not only in their business. Snider paraphrases Michael Gerber, who said much the same in his insightful book for all business owners and entrepreneurs, The E-Myth Revisited: Why Most Small Businesses Don’t Work and What to Do About It.

The following concepts from Snider’s book and the CEPA Masterclass I found to be the most impactful in terms of how advisors can serve entrepreneurial clients: Value Acceleration, Three Legs of the Stool, the Four Cs, and Three Numbers You Want to Know.

Value Acceleration

Exit planning is a strategic business tool used to focus the company on maximizing business value, while integrating the owner/ shareholder’s personal business objectives. The Exit Planning Institute process is called “the Value Acceleration Methodology™,”[viii] a process focused on protecting and growing business value, ultimately leading to an increased sales price. The upshot of the process is that success in exit planning includes the personal and financial aspects. Said Snider, “To effectively achieve results, it’s not just the value of your business you need to manage. You need to manage your personal value and financial net worth as well.”[ix]

We should pause on the notion of protecting the business. Protecting means lessening business, financial, and personal risks, which together creates value, as valuations are also related to risks that a potential buyer thinks are (or are not) associated with the business they will buy. Snider goes further and introduces the idea of the Five Ds: Death, Disability, Divorce, Distress, and Disagreement. He asserts that a business owner has a 50% chance of being hurt by one of these Ds,[x] which while sobering, underscores the importance of protecting precious business assets.

Returning to the core tenets of the Value Acceleration process, think of value as a function of sustainable cash flows and expected rate of return, adjusted for risk. The cash flows the business produces need to be sustainable and predictable, and the business that produces these cash flows must be transferable. In brief, the big ideas in Value Acceleration are to sell at the right price, sell to the right buyer, and to sell at the right time.

Moreover, the Value Acceleration process aligns business, personal, and financial goals – the “three legs of the stool” discussed below. In Value Acceleration, the three legs are combined in a “master plan”[xi] which puts the owner and the owner’s family at the center of the process. The bottom line is to maximize the value of the business, make sure the seller is personally and financially ready to obtain the highest level of net proceeds, and ensure they have a plan for their “next act.”[xii] As advisors, we employ teams[xiii] to help the business owner sustain momentum throughout the process, and we create and deploy a roadmap for success. The process leads to a significant increase in business value, monetization of that value, as well as personal and financial readiness and fulfillment.

Three Legs of the Stool

A successful exit plan has three legs: maximization of transferrable business value, ensuring that the owner is financially prepared, and prioritizing the creation of a plan for “what’s next?”. The “three legs of the stool” help business owners exit in the best possible way, personally and financially fulfilled. For me, exit planning is personal, as I grew up in a family of entrepreneurs. Unfortunately, I saw people close to me, including my father, somewhat unhappy after they were no longer running their businesses. I came to believe that personal planning should not take place after a business sale; preparation is key not only to maximize business value, but also for personal financial readiness and a focus on the seller’s “next act.” My studies and understanding of holistic exit planning launched me on my journey to take this deeper intellectual dive by studying and testing for my CEPA credential.

Four Cs

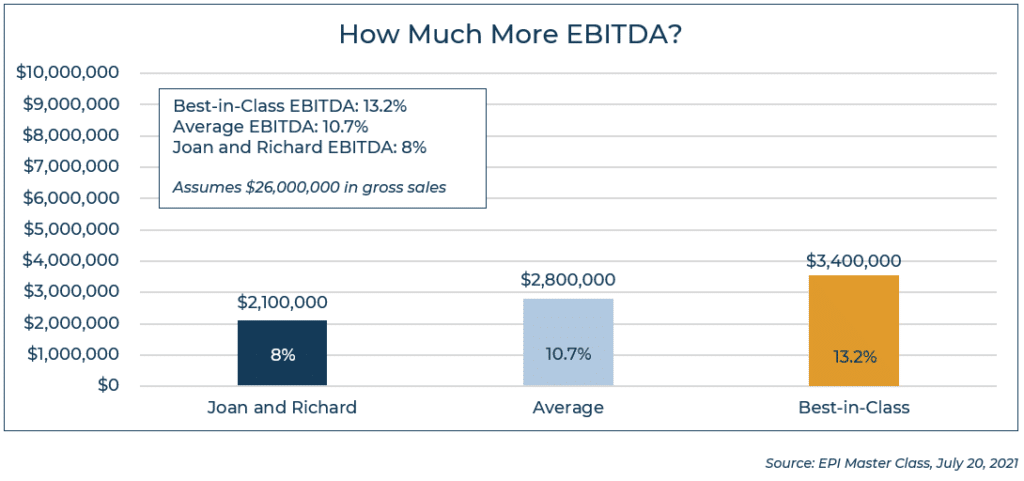

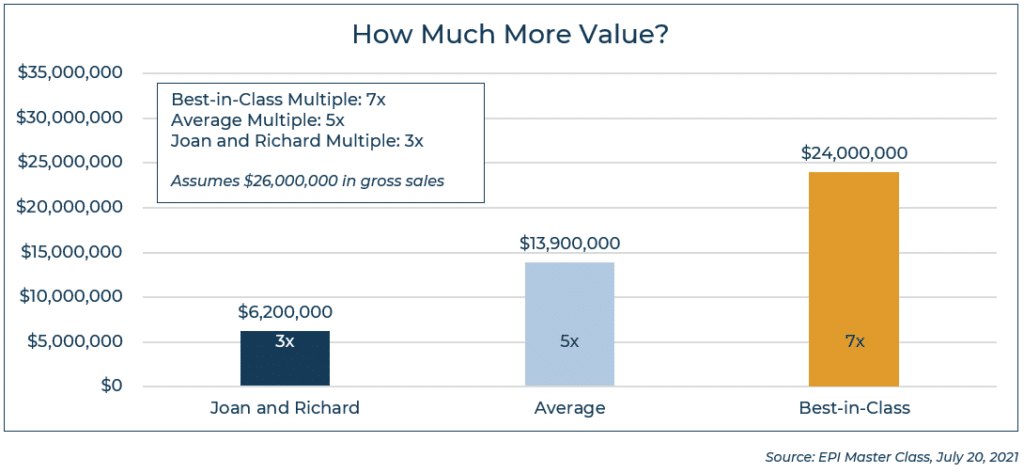

Value is built by raising the business’s EBITDA (a cash flow measure: Earnings Before Interest, Taxes, Depreciation and Amortization) and improving where the business resides in the “multiple range” for its industry.[xiv] The multiple is “the number assigned by the private capital market to the value of your tangible and intangible assets and the risks associated to your business.”[xv] The Four Cs are intangible assets, or “knowledge capitals”[xvi]: Human Capital, Structural Capital, Customer Capital, and Social Capital. These Four Cs are crucial for the business owner to understand, as enhancing intangible assets is essential to raising business valuation.

At the EPI Master Class, and in Snider’s Walking to Destiny,[xvii] much emphasis is placed on the distinction between a business’s tangible and intangible assets. While accounting systems are well positioned to offer updated information on tangible assets (e.g., cash, marketable securities, real estate, manufacturing plants, vehicles), the true drivers of a business’s attractiveness are intangible assets: human capital – people’s talent, competency, tenure, experience, management skill, etc.; customer capital – customer relationships, contracts, transferability of relationships, recurring revenue, etc.; structural capital – the business’s infrastructure, it’s systems and tools, knowledge that is documented and transferable; and, finally, what Larry Bossidy and Ram Charan, in Execution: The Discipline of Getting Things Done, call a company’s “Social Operating System,”[xviii] which includes immense value in a brand and culture (social capital).

Three Numbers You Want to Know (the Three Gaps)

I end with the important idea of what the Exit Planning Institute calls, “the three numbers every business owner should know”: The Wealth Gap, Profit Gap, and Value Gap.[xix] The first deliverable in the Value Acceleration Methodology™ is what Snider calls “The Triggering Event.” The triggering event is a business valuation that is correlated to personal, financial, and business assessments.[xx] In short, we are looking for the facts — not, “what I think my business is worth”, but a rigorous analysis that identifies the “Three Numbers You Want to Know.” Based on this rigor, we establish and deploy the specific actions the teams will execute to protect, build, and harvest value – again, a roadmap for success.

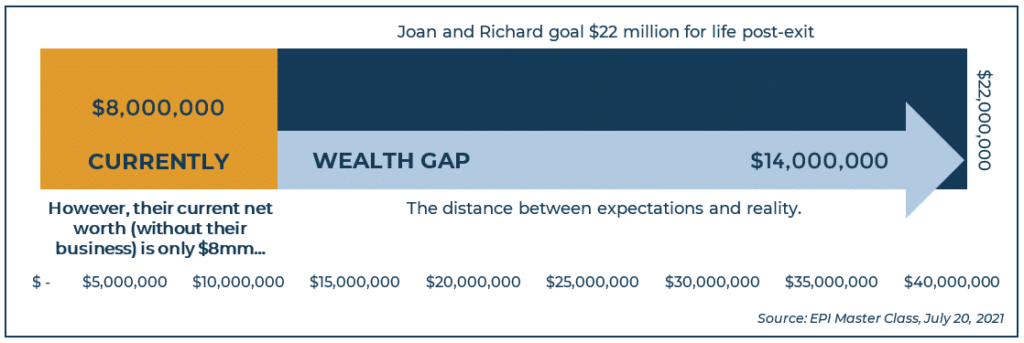

The Wealth Gap is all about expectations versus reality. To offer a hypothetical example, Joan and Richard have personal and financial goals for their post-business retirement lives. To meet these goals, we conclude that they need $22 million to provide for themselves, their family, and their charitable intentions. Yet, outside of their business, they have $8 million in current net worth. The only way to close the wealth gap of $14 million is to harvest the wealth in the business.

Conclusion

Conclusion

I am proud of my CEPA accreditation. My readings and studies during my CEPA journey better prepared me to serve our current and prospective business owner clients. Exit planning is a path to fulfillment in business and personal life and allows for the full harvesting of the fruits of one’s labors. By delineating the actions needed to progress through the exit planning process and executing them relentlessly with a core team of advisors, the business owner not only attains a successful business exit and personal gratification, but also their family, employees, investors, and other stakeholders will benefit. The paradigm shift from working in one’s business to working on one’s business leads – long before the actual exit – to both a more valuable business and higher income from the superior, growing private business that is being built. Finally, exit planning is excellent ongoing business strategy which enables the business owner to lay claim to an immensely satisfying future and a life of significance.

Suggested Further Reading

- Claudio Fernandez-Araoz, Sonny Iqbal and Jorg Ritter, “Leadership Lessons from Great Family Businesses”, Harvard Business Review (April 2015)

- Larry Bossidy and Ram Charan, Execution: The Discipline of Getting Things Done (2002)

- Peter G. Christman, The Master Plan: Exit Strategy for Successful Business Owners: Discover a Strategic Planning Formula for Maximum Company Value, Strong Asset Protection and Work-Life Balance (2015)

- Jim Collins, Good To Great (2001)

- Stephen R. Covey, The Seven Habits of Highly Effective People (1989)

- Thomas William Deans, Every Family’s Business: 12 Common Sense Questions to Protect Your Wealth (2009)

- Michael E. Gerber, The E-Myth Revisited: Why Most Small Businesses Don’t Work and What To Do About It (2004)

- Richard E. Jackim and Peter G. Christman, The $10 Trillion Opportunity (2005)

- Christopher M. Snider, Walking to Destiny: 11 Actions an Owner MUST Take to Rapidly Grown Value & Unlock Wealth (2016)

- Wallace D. Wattles, The Science of Getting Rich (originally published in 1910)

Conclusion

Conclusion