Whether you’re early in your career, raising a family, or preparing for retirement, building a thoughtful budget is one of the most effective ways to gain control over your financial life. But let’s be honest: the word “budget” doesn’t exactly excite most people. It’s often associated with restriction, sacrifice, or tedious spreadsheets.

At Wealthspire Advisors, we like to think of budgeting differently. A budget isn’t about what you can’t do, it’s about intention. It’s about aligning your money with your values and priorities, creating flexibility for life’s surprises, and making sure your financial goals are not just dreams, but plans in motion.

Why Budgeting Matters

Many people believe budgeting is only necessary when money is tight. But a budget is the cornerstone of any healthy financial plan, regardless of income level. It helps you:

- Understand where your money is going

- Create space for saving and investing

- Identify areas of overspending or misalignment

- Prepare for emergencies and opportunities

- Reduce financial stress and increase confidence

The Three-Stage Framework: Understand, Organize, Execute

A simple yet effective approach to budgeting follows a three-stage framework: Understand, Organize, and Execute. This method helps break the process down into manageable steps and encourages intentional decision-making around how you use your money.

1. Understand Your Cash Flow

Start by taking inventory. Look at your past 3–6 months of bank statements and credit card transactions. This exercise will help you identify patterns in your income and spending. You can also use a budgeting app or website that automatically categorizes your recent expenses and purchases.

Some key questions to ask:

- What are your fixed expenses (e.g., rent/mortgage, insurance, debt payments)?

- What are your variable expenses (e.g., groceries, travel, entertainment)?

- Are there any recurring subscriptions or “leaks” you’ve forgotten about?

The goal here isn’t to judge or restrict, it’s to gain clarity. You can’t improve what you don’t understand.

2. Organize by Category and Priority

Once you know your cash flow, begin organizing it into categories. It can be helpful to first identify your “wants” versus your “needs.” These are also known as discretionary (wants) and non-discretionary (needs) categories.

Common non-discretionary expenses include:

- Housing and utilities

- Transportation

- Groceries

- Debt payments

- Insurance

- Childcare or education

- Savings and investments

Common discretionary expenses include:

- Entertainment and lifestyle

- Dining out

- Travel

- Gifting – personal or charitable

After categorizing, prioritize. Which expenses are essential? Which are value-adds? Which are negotiable or unnecessary? If you find categories or spending patterns that feel at odds with your values or long-term goals, identify what changes you may need to implement. This is where intentional decision-making begins.

3. Execute and Adjust

With a structure in place, you can move into execution – defining and creating your budget. This doesn’t have to mean creating a complex spreadsheet (though that works for some!). Budgeting apps, automated savings tools, and online bank categorization features can simplify the process.

Importantly, this isn’t a “set it and forget it” situation. Your budget should evolve with your life. Reviewing it monthly or quarterly helps you stay accountable and adjust as your income, expenses, or goals change.

Saving Smarter: Short-, Medium- & Long-Term Goals

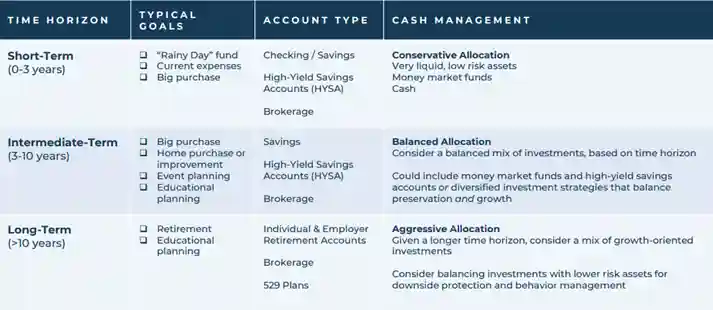

When it comes to savings goals, they can be broken down into three clear buckets, each with its own timeline and strategy:

- Short-Term (0–2 years)

- Examples: Emergency fund, next month’s bills, upcoming trip

- Best accounts: High-yield savings, checking accounts

- Goal: Liquidity and security, not growth

- Medium-Term (2–10 years)

- Examples: Down payment, car purchase, wedding

- Best accounts: High-yield savings, brokerage accounts that hold money market funds or more conservative assets (like bonds)

- Goal: Balanced allocation; some growth, limited risk

- Long-Term (10+ years)

- Examples: Retirement, college savings for children

- Best accounts: 401(k), Roth IRA, Traditional IRA, 529 plans, brokerage accounts holding riskier assets like stocks

- Goal: Maximize growth potential, leverage tax advantages, ride out volatility

A diversified portfolio is important – meaning exposure to different asset types (stocks, bonds, international markets, etc.) – to reduce risk and optimize performance over time.

The chart below shows a general idea of how to think about your goals-based cash flow management:

Common Budgeting Mistakes and How to Avoid Them

It’s important to mention that even well-intentioned budgets can go off track. Here are some frequent missteps we discussed and how to steer clear:

- Being Too Restrictive: An overly strict budget can lead to burnout and binge-spending. Leave room for fun and flexibility.

- Ignoring Irregular Expenses: Don’t forget about quarterly insurance payments, annual memberships, holiday gifts, or travel. These can derail your budget if not accounted for. Consider utilizing an automated savings strategy to prepare for these expenses before they’re due!

- Failing to Track: A budget without follow-through is just a wish. Use apps or calendar reminders to check in regularly.

- Succumbing to Lifestyle Creep: This involves increased spending on non-essential items when one’s income increases without adjusting retirement and short-term savings. To help prevent creeping spending patterns, focus on increasing automated savings as your income grows. Pay yourself first!

- Not Adjusting Over Time: Your life changes, so your budget should too. Whether it’s a new job, a move, or a new baby, revisit your plan after major life events.

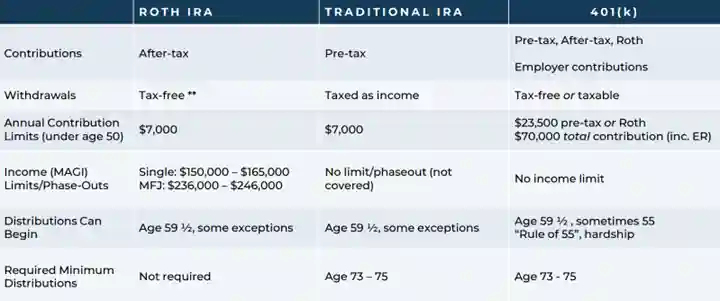

For a retirement accounts cheat-sheet, see graphic below:

(Source: IRS Information as of 2025)

From Budgeting to Planning: What Comes Next?

Budgeting is often the first step in a larger financial planning journey. Once you have clarity on your income and spending, you can begin to:

- Build or replenish an emergency fund

- Pay down debt faster

- Start or increase contributions to retirement accounts

- Save intentionally for large goals (buying a home, funding college tuition, launching a business)

- Explore charitable giving strategies

In short, budgeting gives you the foundation to live the life you want, today and in the future.

Final Thoughts: Progress Over Perfection

Let us leave you with one simple reminder: budgeting isn’t about perfection. It’s about progress.

Every small step toward financial awareness and intentionality makes a difference. Whether you’re revisiting your budget for the first time in years or building one from scratch, you’re taking control of your financial future, and that’s something worth celebrating.

If you’d like to dive deeper, we encourage you to connect with a Wealthspire advisor for a one-on-one conversation. Your financial journey is personal. We’re here to help you navigate it with confidence.

Explore More:

Wealthspire Advisors LLC, Fiducient Advisors LLC, Wealthspire Retirement, LLC dba Wealthspire Retirement Advisory, and certain other affiliates are separately registered investment advisers. © 2025 Wealthspire Advisors

This material should not be construed as a recommendation, offer to sell, or solicitation of an offer to buy a particular security or investment strategy. The information provided is for informational purposes only and should not be relied upon for accounting, legal, or tax advice. While the information is deemed reliable, Wealthspire Advisors cannot guarantee its accuracy, completeness, or suitability for any purpose, and makes no warranties with regard to the results to be obtained from its use.

Wealthspire Advisors and its representatives do not provide legal or tax advice, and Wealthspire Advisors does not act as law, accounting, or tax firm. Services provided by Wealthspire Advisors are not intended to replace any tax, legal or accounting advice from a tax/legal/accounting professional. The services of an appropriate professional should be sought regarding your individual situation. You should not act or refrain from acting based on this content alone without first seeking advice from your tax and/or legal advisors.

Certain employees of Wealthspire Advisors may be certified public accountants or licensed to practice law. However, these employees do not provide tax, legal, or accounting services to any of clients of Wealthspire Advisors, and clients should be mindful that no attorney/client relationship is established with any of Wealthspire Advisors’ employees who are also licensed attorneys.

Please Note: Limitations. The achievement of any professional designation, certification, degree, or license, recognition by publications, media, or other organizations, membership in any professional organization, or any amount of prior experience or success, should not be construed by a client or prospective client as a guarantee that he/she will experience a certain level of results or satisfaction if Wealthspire is engaged, or continues to be engaged, to provide investment advisory services, nor should it be construed as a current or past endorsement of Wealthspire Advisors by any of its clients or a third party.

Registration of an investment advisor does not imply that Wealthspire Advisors or any of its principals or employees possess a particular level of skill or training in the investment advisory business or any other business.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER®, and CFP® (with plaque design) in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.