All of today’s largest, blue-chip companies began as the small start-ups of yesterday. Some created entirely new industries, like Google and Netflix, or drastically altered them, like Tesla and Rivian. Most, if not all, grew to become the names we recognize today through equity-based compensation, enriching their founders, executives, and early employees alike (along with investors). A key part of equity compensation, particularly for earlier stage companies, is incentive stock options (ISOs).

Incentive Stock Options (ISOs) – Defined

ISOs give employees the right, but not obligation, to purchase company stock at a hopefully lower grant price[1], compared to the fair market value (FMV) at the future point of exercise. This gap between the higher FMV at exercise and lower grant price is referred to as the bargain element. If the value of the bargain element is positive, the option is referred to as being “in the money”. ISOs are valuable not only to the extent of the bargain element, but also from the potential the underlying stock could continue to increase in value over time. In other words, the full value of an ISO is its intrinsic value, or how much it is “in the money”, plus its time value remaining until expiration.[2] Finally, ISOs, like all options, have inherent leverage whereby changes in the price of the underlying stock cause greater changes in the value of the option.

How Do Companies Use ISOs?

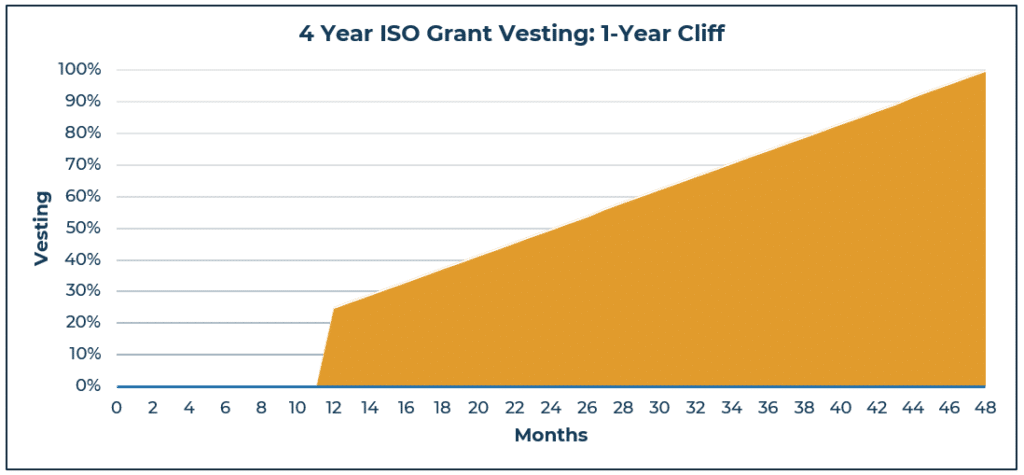

ISOs are often part of a pre-IPO company’s compensation package because issuing them conserves cash, which can be a scarce resource, and is a valuable employee retention and motivation tool. A common vesting schedule for an ISO grant is over four years, with a 1-year cliff. With this schedule, 25% of the shares vest after the first year (this is the “1-year cliff”) and the remaining 75% vest over the remaining three years, often on a monthly basis. You will have a maximum of 10 years to exercise ISOs, but typically only 90 days to do so upon separation from the company. That 90-day period can be extended, but often needs to be negotiated by the employee and does change the tax treatment of the ISOs.

How Are ISOs Taxed?

How Are ISOs Taxed?

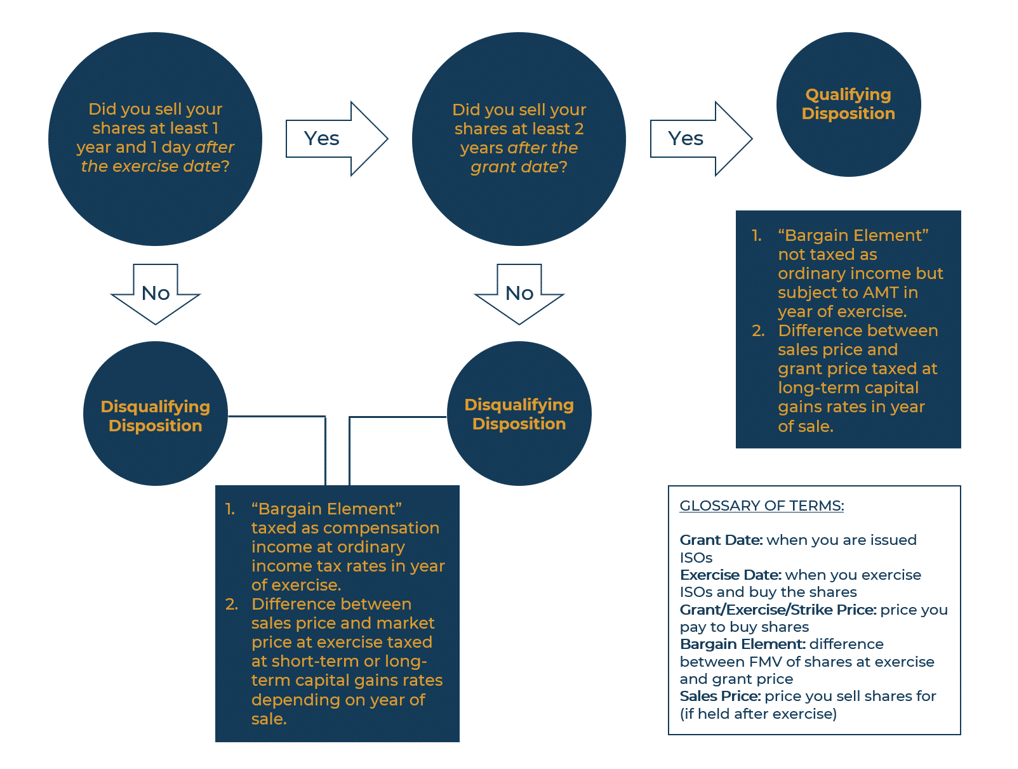

ISOs are not taxed as ordinary income upon exercise, but the bargain element is included as part of the Alternative Minimum Tax when exercised shares are held through the end of the calendar year. AMT can particularly impact higher income earners and ISO grants with a large bargain element. The full tax implication for ISOs depends on whether the exercise and eventual sale is a “qualifying disposition”, or “disqualifying disposition” summarized in the flowchart below:

- A ‘qualifying disposition’ is a sale of shares greater than two years after the ISO grant date and one year after the exercise date.

- A ‘disqualifying disposition’ is any sale of shares that does not meet both criteria above.

Qualifying vs. Disqualifying Disposition – Cash Flow

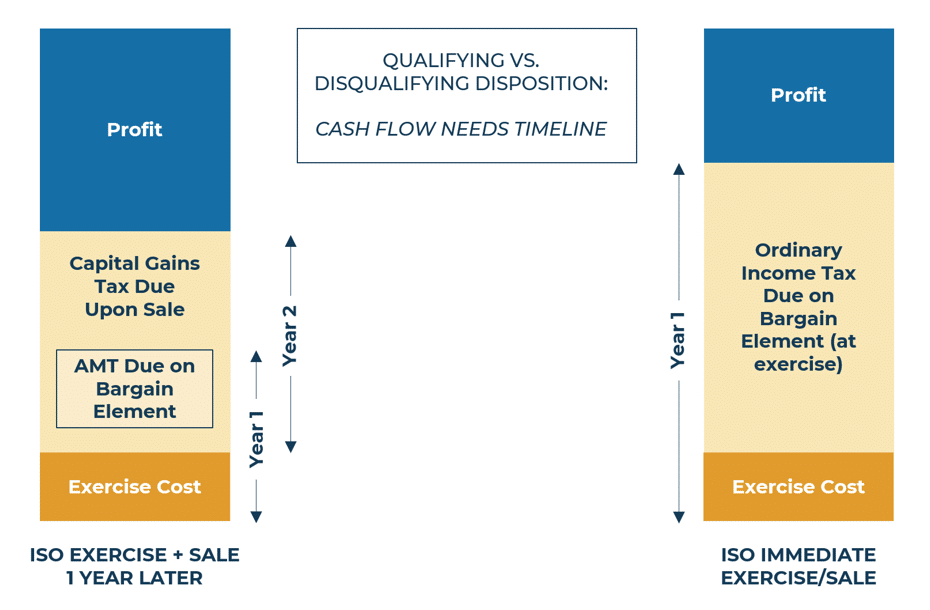

Below is an illustration of the timeline for an ISO qualifying disposition (left) compared to a disqualifying disposition (right). Note that the left side assumes shares are exercised in year 1 then sold the following year after meeting all holding requirements, versus the right side which assumes an immediate full sale upon exercise in year 1.

Qualifying Disposition – Exercise and Sell 1 Yr. Later

- Exercise Cost – (grant price x number of shares exercised) due in year 1

- The shares themselves must be purchased. This cost can be significant, and the cash must come from outside sources if shares themselves are not sold to provide liquidity.

- AMT Due on ISO Bargain Element – (AMT tax rate x bargain element) in year 1

- Generally, the AMT rate is 26-28% but most taxpayers do receive an AMT exemption amount that reduces the liability. Still, for deep “in the money” ISOs, this bill can be significant.

- The tax would be payable at the tax filing deadline of the following year.

- Long Term Capital Gains Tax [(sales price – grant price) x number of shares sold] due in in year 2

- Thankfully, this can be paid using the share proceeds themselves but would be available in a different tax year than the AMT.

- Astute readers might wonder why there appears to be a “double-tax” of both AMT and capital gains tax. But the payment of AMT in year 1 would generate a credit that can be carried forward and applied to the tax liability due in year 2 from the sale of shares.

Disqualifying Disposition – Exercise and Sell Immediately

- Exercise Cost – due in year 1.

- Again, the shares must be first purchased, but in a disqualifying disposition the immediate sale after exercise provides the liquidity needed.

- Ordinary Income Tax Due on Bargain Element – (Federal marginal tax rate x bargain element) due in year 1.

- Since the shares are sold immediately, there is no AMT liability, but the shares are now included on a W-2 as compensation income and taxable at ordinary income rates. This will usually result in more total taxes paid than a qualifying disposition.

Final Words of Caution

It is important to emphasize that while a qualifying disposition of ISOs will often lead to the most tax-efficient result, it is not without risks and very well might not be the right choice for you, so it’s crucial to consult your accountant or tax attorney about your specific situation. During the year between exercise and sale, the holder is fully exposed to the investment risk of the underlying stock. This is exacerbated if he or she is counting on selling the shares the following year to get capital gains tax treatment and pay AMT tax owed from the prior year. What happens if the stock price plummets? The holder might not have the expected liquidity to pay the tax.

Exercising ISOs late in a calendar year without selling the shares can compound these issues, potentially leading to the AMT tax bill due only months later in April. This could drive a need to sell shares earlier than otherwise planned. Importantly, a qualifying disposition need not be an all or nothing decision. Some ISO shares could be exercised and held, while enough are sold immediately to cover the projected tax bill. Selling shares to cover the costs of an ISO exercise can be a viable alternative but is complex or unavailable for pre-IPO companies.

Finally, companies are not required to withhold taxes for employees when ISOs are exercised, no matter what the type of ISO disposition. And while there is no Federal income tax liability due upon exercise, if AMT is owed, this can lead to some unpleasant surprises the following year. It will likely be prudent to consult a tax advisor to either increase W-2 withholding or make quarterly estimated tax payments to compensate for the additional tax owed. If this is not done, you could face a sizable underpayment tax penalty.

Conclusion

Most employees who have ISOs often have other forms of equity-based compensation like non-qualified stock options (NQSOs), restricted stock/restricted stock units (RSUs), and/or employee stock purchase plans (ESPPs). Incorporating these into a broader equity liquidation and tax planning strategy that considers your financial goals is important and part of what Wealthspire Advisors does for our clients. Contact us today.

How Are ISOs Taxed?

How Are ISOs Taxed?