Expected future returns for the prototypical equity/fixed income portfolio have been coming down for the last few years as valuations of each of the two asset classes therein have become increasingly expensive. For fixed income investors, this has merely been an extension of a longstanding bull market which has seen the yield on the 10-Year U.S. Treasury Note decline from over 15% in the early 1980s to as low as 0.52% in August of 2020. Since that time however, improving prospects for economic growth, largely driven by the successful development of multiple COVID-19 vaccines, have driven bond yields higher by a factor of 2-4x (depending on tenor). Since bond yields and prices move in opposite directions, this has led to recent headlines around a “bond bear market”, as the increase in yields has caused a 20% price decline in long dated U.S. Treasuries. These headlines, along with some common misconceptions around long-term fixed income investing, have understandably caused some investors to begin questioning the role of fixed income within their portfolios. We attempt to address some of these misconceptions and provide context around the implications of rising rates for fixed income investments.

Bond Math – The Basics

For many, the inverse relationship between a bond’s price and yield can seem a bit counter-intuitive. However, an understanding of how bonds are priced in the open market is essential to appreciating how they behave within a broader investment portfolio. At the simplest level, a bond represents a contract between a lender and a borrower, in which the borrower (usually a corporation or government entity) agrees to pay the lender an agreed upon interest rate and return the principal at the conclusion of the term of the agreement. The agreed-upon interest rate (referred to in bond speak as the “coupon”) reflects the broader market environment at the time the bond is issued (with the most important factor being the rates available on bonds issued by borrowers of equivalent creditworthiness).

After a bond is issued, the terms remain constant, but the market dynamics evolve. As time passes, the rates available in the market may diverge meaningfully from that which was agreed upon in the past. As such, the market value of a given bond must adjust to reflect the new market environment. If rates have increased since the initial issuance of the bond, its (relatively lower) coupon rate will appear less attractive in the open market, and the bond’s price will decline as a result.

Despite all the noise however, it is important to note that while the market value of the bond will rise or fall over time because of the ever-changing market environment, it will eventually mature and repay the investor their principal value at that time (assuming the borrower does not default).

What Do Rising Rates Mean for Long-Term Investors?

Nobody likes to see the value of their investments decline, and so whenever interest rates begin to rise, much is made about the mark to market losses experienced by bond investors. But what are less understood and significantly less appreciated are the benefits that accrue for long-term investors as rates move higher. It is our contention that to the extent an investor’s time horizon is longer than the duration[1] of his/her fixed income portfolio, rising rates should actually be a welcomed development. There are multiple reasons for this, but the most profound is that as yields rise, an investor can now begin reinvesting the coupon payments from their existing bond holdings into new, higher yielding, bonds.

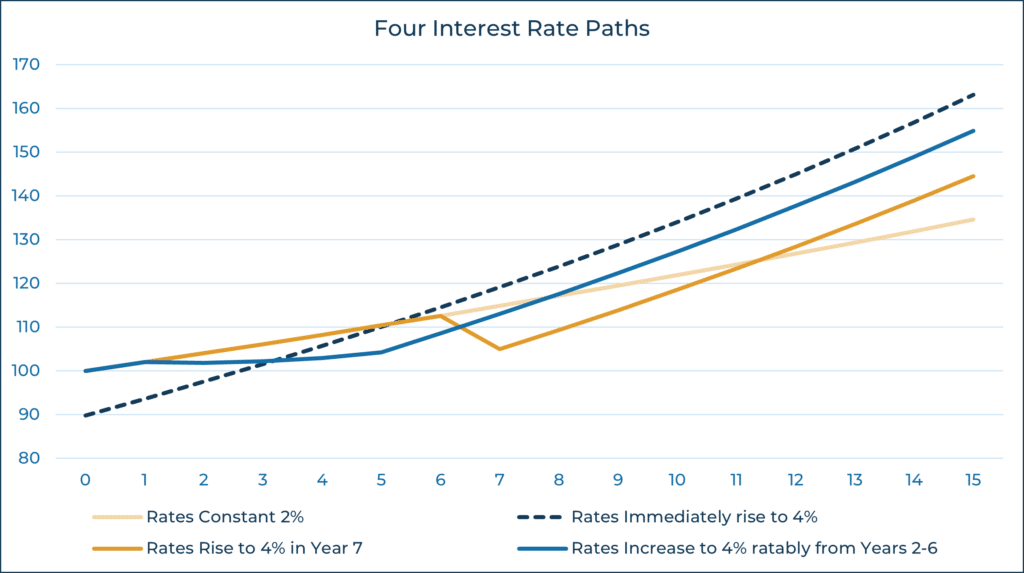

To illustrate this point, below is a simple set of simplified representations showing four paths of interest rates: one in which rates stay constant at 2% and three depicting various paths of a rise from 2% to 4%. The portfolio represented here is assumed to have an interest rate duration[2] of approximately 5 years, in line with the duration of a typical Wealthspire model portfolio fixed income exposure. We also assume a 15-year investment horizon.

Point A – Represents the immediate decline in the portfolio’s value due to the rise in rates to from 2% to 4%.

Point B – Illustrates that in Year 5 (approximately the original duration of the bond/fixed income portfolio), the portfolio’s value has fully recovered the initial price declines as a result of earning the now higher 4% interest and reinvesting at this level.

Point C – Shows the decline in the fixed income portfolio due to the assumed rise in rates to 4% in Year 7.

Point D – Illustrates the key takeaway from this exercise, which is that all three scenarios exhibiting a rise in rates outperform the scenario with no rise in rates over the full measurement period. Additionally, the earlier in the investment period that rates rise, the higher the terminal value of the portfolio.

| Year | 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| Rates Constant 2% | 100.00 | 102.00 | 104.04 | 106.12 | 108.24 | 110.41 | 112.62 | 114.87 |

| Rates Immediately Rise to 4% | A 89.83 | 93.62 | 97.54 | 101.57 | 105.74 | B 110.05 | 114.51 | 119.13 |

| Rates Rise to 4% in Year 7 | 100.00 | 102.00 | 104.04 | 106.12 | 108.24 | 110.41 | 112.62 | C 104.96 |

| Rates Increase to 4% ratably from Years 2-6 | 100.00 | 102.00 | 101.86 | 102.17 | 102.96 | 104.25 | 108.56 | 113.01 |

| Year | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 |

| Rates Constant 2% | 117.17 | 119.51 | 121.90 | 124.34 | 126.82 | 129.36 | 131.95 | D 134.59 |

| Rates Immediately Rise to 4% | 123.92 | 128.88 | 134.04 | 139.40 | 144.98 | 150.78 | 156.81 | 163.084 |

| Rates Rise to 4% in Year 7 | 109.36 | 113.89 | 118.58 | 123.42 | 128.42 | 133.61 | 138.98 | 144.551 |

| Rates Increase to 4% ratably from Years 2-6 | 117.61 | 122.37 | 127.30 | 132.42 | 137.73 | 143.24 | 148.97 | 154.929 |

As can be observed in the chart, the immediate increase in interest rates yields the most significant benefit to long-term portfolio value. This is because the income from the bond can be reinvested at higher rates over a longer period of time.

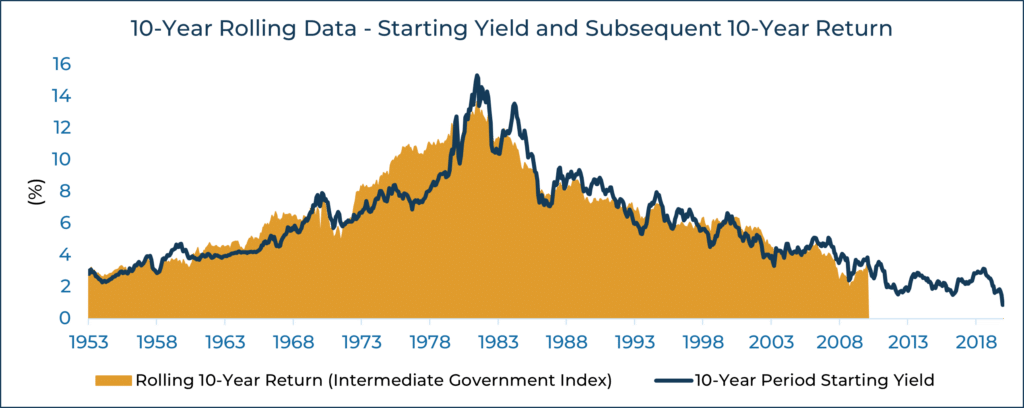

Another way to illustrate the temporary nature of mark to market bond losses is through an analysis of historical returns in the bond market. The chart below shows the relationship between bond yields and subsequent long-term returns.

Yield Curve Shape – Another Important Consideration

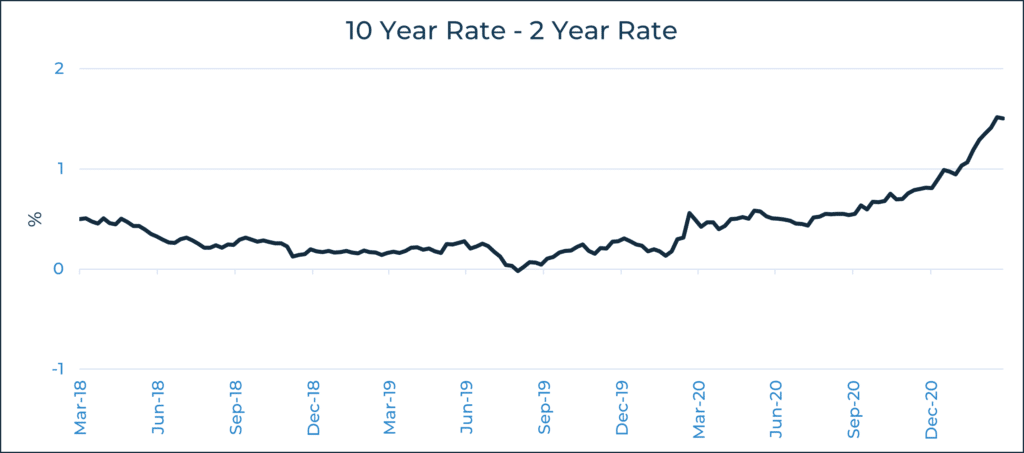

Interest rates of varying maturities do not typically move in tandem, and so fluctuations in the rate markets often lead to changes in the shape of the yield curve. The below chart illustrates the “steepness” of the yield curve (represented by the difference between the 10 Year and 2 Year Treasury rates) over the past three years ending in March 2021. The chart nicely illustrates that the recent upward move in interest rates was accompanied by a steepening, where longer term rates moved higher at a faster rate.

Risk Management & Fixed Income

Given that most investors hold a diversified portfolio containing both stocks and bonds, it is also important to consider the relationship between the two asset classes and the diversification benefits that bonds provide as a result. For balanced portfolios, a high-quality and diversified bond allocation plays a critical role in managing portfolio risk, regardless of the prospects for future returns. The primary reason for this is that high-quality bonds are traditionally viewed as a “safe haven” asset, which tends to enjoy strong inflows of capital during periods of market stress. As a result, high-quality bonds tend to rise in value during equity market downturns and have historically exhibited very low to negative correlation to equities; a characteristic that helps to mitigate portfolio volatility over time.

Bonds with longer duration will naturally benefit more from the flow of capital into fixed income, so to the extent that investors reduce duration in an effort to avoid the mark to market losses experienced in a rising rate environment, they sacrifice some of the most important risk mitigating characteristics of their bond holdings.

Conclusion

In one of the longest bull markets in history, interest rates in the United States have been on a one-way decline for 40 years. This has resulted in the most commonly cited fixed income index, the Bloomberg Barclays U.S. Aggregate Total Return index (the “Agg”), to record annualized gains of 7.50% over this timeframe. Yet over the last few months, interest rates have risen 2-4x (depending on tenor) albeit off historically very low levels. This has led to recent headlines around a “bond bear market” as on a price basis, the increase in yields has caused a 20% decline in long dated U.S. Treasuries.

Many investors have become too focused on the temporary losses exhibited by bonds because of the recent move in interest rates. However, as interest rates move higher, so do the expected long-term returns for bond investors. Additionally, those who adjust their fixed income holdings in an attempt to protect against near-term price volatility may be opening themselves up to unintended long-term consequences. Proper perspective is needed in order to assess how such changes may alter the balance of risk and return within a diversified portfolio. Near-term price declines can make it tempting for investors to shy away from their bond allocation, but the mathematics of fixed income investing show that this is likely a mistake.

[1] Duration measures how long it takes, in years, for an investor to be fully repaid the price paid for a bond using that same bond’s total cash flows.

[2] Interest rate duration is a measure of the sensitivity of a bond’s price to a change in interest rates. In general, the higher a bond’s interest rate duration, the more its price will decline due to an increase in interest rates.

2024 1st Quarter Commentary: “In a world drenched in pessimism, it pays to be optimistic.”

With so much emphasis placed on negative headlines, negative developments globally, and the ability to embrace one’s inner negativity, it ...