2022 has been a challenging year for investors. Although this type of drawdown in equity markets is not uncommon, what happened in bonds has been unusual. In times like these, or any time we experience market volatility, the natural reaction is feeling the need to “do something.” What we have seen time and time again though, is that doing something when markets are causing the greatest pain is rarely productive when it comes to meeting long-term planning needs. Below are four reasons why staying invested for the long run is a strategy you may want to consider.

1. Market timing is almost impossible over extended periods.

In theory, timing the market could work, but you must accurately predict many unpredictable variables. You would need to 1) identify an event, 2) call the timing, 3) call the result, 4) call the market reaction, 5) call the magnitude of the reaction, and finally, 6) call how long it takes to develop.[i] As much as we would like to avoid market downturns, to do so means exiting at the right time, and more importantly, knowing exactly when to get back in. While it is easy to look back and identify the right market timing moments, it is almost impossible to consistently predict six different variables.

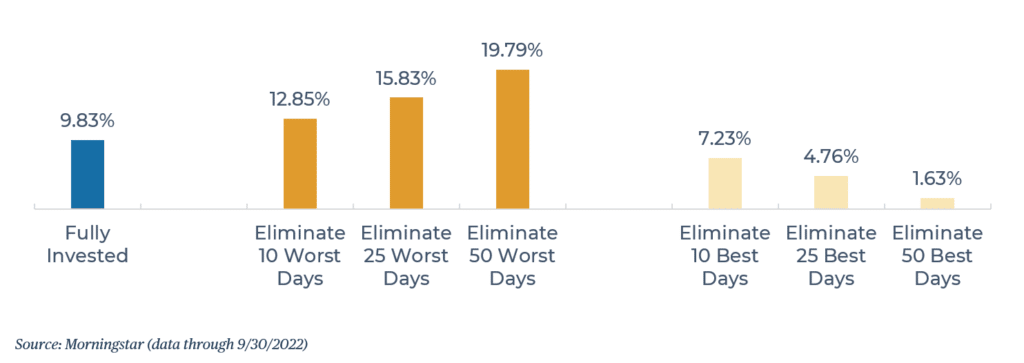

Another factor that complicates market timing is that the best and worst days of market performance tend to fall within close proximity of each other. Between January 1990 and September 2022, eight of the 10 worst days occurred within two weeks of the 10 best days. As the chart below shows, eliminating the best days reduces portfolio performance below a fully invested portfolio over the same period.

Additionally, no market cycle is the same, so you can’t anticipate market movements no matter how easy it seems with hindsight. There are many factors, political conditions, monetary policies, and sudden international shocks (like a global pandemic) that can spark a market reaction. If your timing isn’t perfectly accurate, your returns will suffer, and often significantly.

2. The cost of waiting to invest exceeds the benefits.

A question we often hear is, “Why would I invest if I know that a recession is on the horizon?”. Our response is:

- No one can precisely predict when we will see the next market drawdown and what it will look like.

- Even if you could time the bottom perfectly, you are not that much better off. The stress of trying to predict variables might not outweigh the benefit.

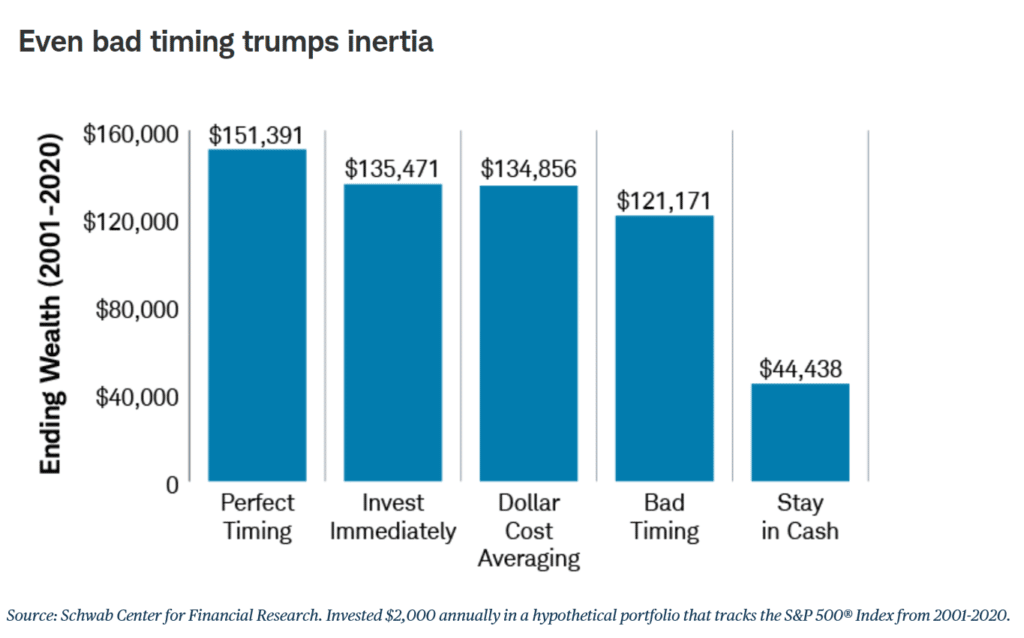

In a 2021 Schwab study, five different investment strategies were compared from perfect market timing to staying out of the market in cash. Although the perfect market timing garnered the best result, it wasn’t that much better than investing immediately, dollar cost averaging, or investing at the bottom each time. What might surprise people though, is that waiting to invest in the markets was far worse than having poor market timing.

3. Selling during a correction is betting against history.

History suggests that periods of drawdowns like we have seen in 2022 have often been followed by more favorable returns over the subsequent 3-year and 5-year horizons.

Pulling back on equity market exposure when markets are volatile can lock in losses and most likely lead to missing out on any subsequent rally.

While periods of down markets are painful, they need to be contextualized in the history of the market.

Between 1926 and 2021, the S&P 500 experienced 17 bear markets, lasting on average a period of 10 months, with a fall of at least 20% from a previous peak. During the same time period, the S&P 500 experienced 18 bull markets that lasted on average 55 months and saw gains of at least 20%.[ii]

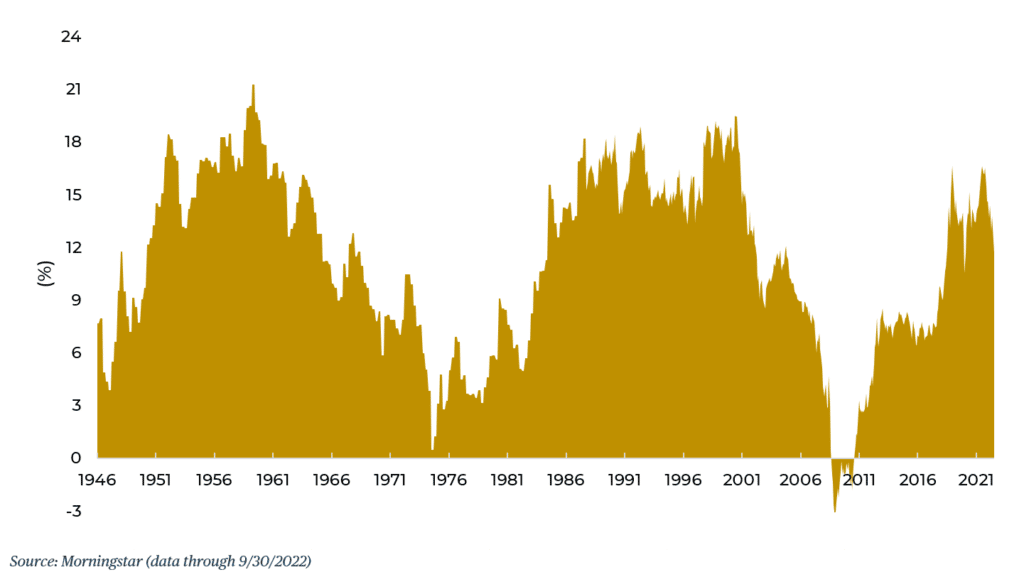

4. The likelihood of long-term negative returns for a diversified portfolio is extremely low.

A balanced portfolio of global stocks and bonds has not produced a negative return over any 5-year rolling period since the late 1970s.

When looking at the S&P 500 10-year rolling returns dating back to 1936, there has only been one instance of negative returns for large cap U.S. stocks during a 10-year period. That does not mean it cannot happen, but instead suggests such outcomes are rare.

We cannot control when the next market drawdown will occur or what it will look like, but what we can control our behaviors. At Wealthspire Advisors, we believe that a strategic allocation will outperform over time. Although we can never predict how long challenging market cycles will persist, we want to avoid drastic rebalancing that would require selling at depressed levels and trying to time an ever-unpredictable market. Sometimes, doing nothing and staying fully invested can be the best thing you can do to meet your long-term goals.

[i] Source: https://www.advisorperspectives.com/commentaries/2017/01/19/choose-your-own-misadventure-bronfman-e-l-rothschild-2016-q4-review

[ii] Source: https://my.dimensional.com/dfsmedia/f27f1cc5b9674653938eb84ff8006d8c/39603-source

2024 1st Quarter Commentary: “In a world drenched in pessimism, it pays to be optimistic.”

With so much emphasis placed on negative headlines, negative developments globally, and the ability to embrace one’s inner negativity, it ...