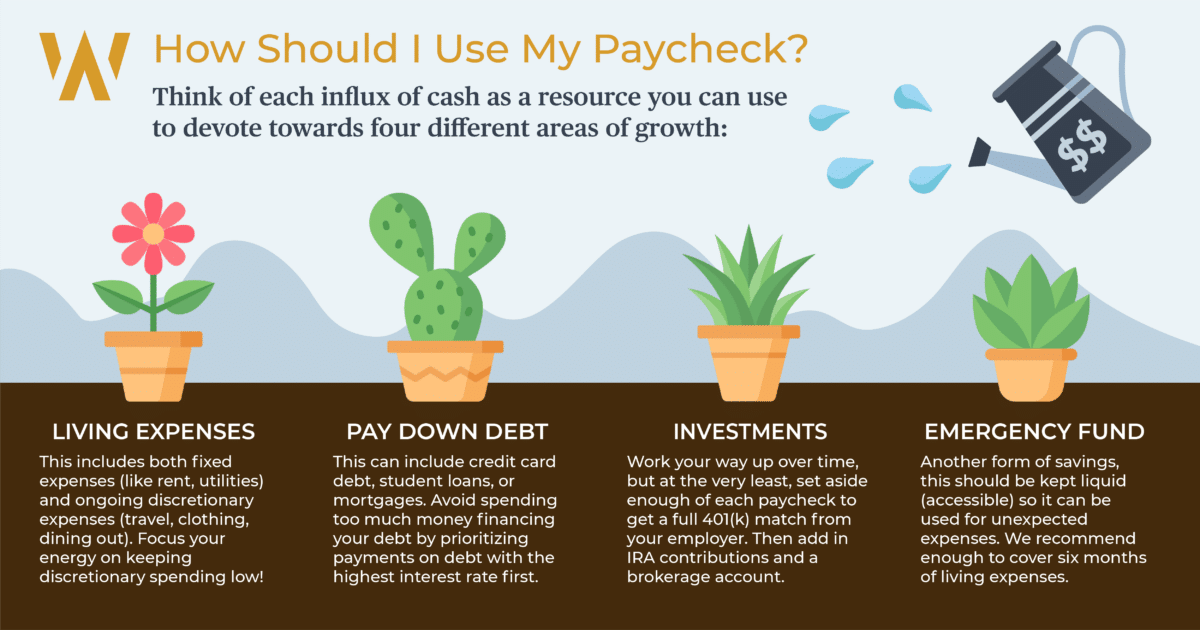

3 Financial Skills for Investors Who Are Just Starting Out

When starting out, knowing how to manage your money can feel daunting. In this post, we will offer simple steps ...

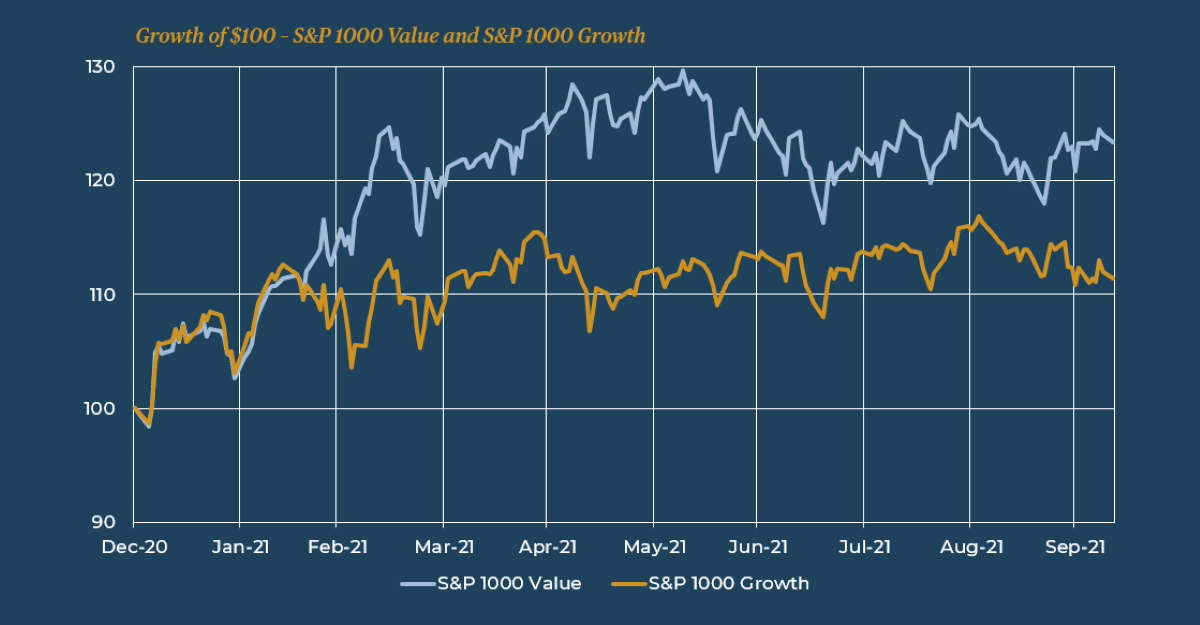

Markets in 2 Minutes – October 2021

Small cap performance has been pretty quiet in the last several quarters. In this month’s edition of Markets in 2 ...

Fixed Income Investment

What are Fixed Income Investments? A fixed income investment is a fund or portfolio in which bonds are primarily purchased ...

Share Classes

What are Share Classes? Share classes represent ownership in the same fund that charge different fees. This can enable shareholders ...

Capital Gains

What are Capital Gains? Capital gains are the difference between a security’s purchase price and its selling price, when the ...

Money Market Fund

What is a Money Market Fund? A money market fund is a mutual fund with investments in high-yield money market ...

Small Cap

What is a Small Cap Stock? Small cap refers to the market capitalization of stocks of companies with market values ...

Mid-Cap

What is a Mid-Cap Stock? Mid-cap refers to the market capitalization of stocks of companies with market values between $2 ...

Asset Class

Asset Class Definition Asset classes are securities with similar features and financial structure. These securities are also held to the ...

2021 3rd Quarter Commentary: “Updating an Outdated Jigsaw Puzzle”

In this letter: We take a break from the U.S. to focus on markets overseas by looking at a dated ...