Annuity

What Is an Annuity? An annuity is a contract with an insurance company that guarantees current or future payments in ...

What to Do If You Inherit an IRA Post SECURE-Act

Introduction If you inherited all or part of an individual retirement account (IRA) or a qualified retirement plan, you may ...

The Case for Exit Planning & Why I Earned My Certified Exit Planning Advisor (CEPA) Credential

In my wealth management practice, I focus on helping business owners and corporate executives achieve quality of life and financial ...

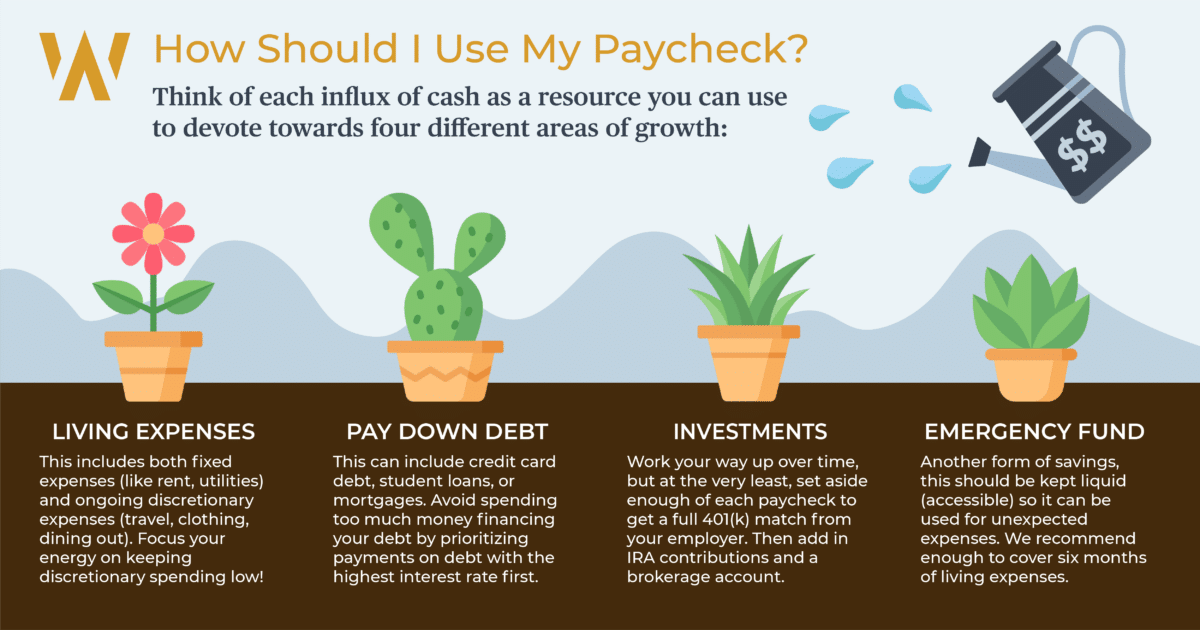

3 Financial Skills for Investors Who Are Just Starting Out

When starting out, knowing how to manage your money can feel daunting. In this post, we will offer simple steps ...

Capital Gains

What are Capital Gains? Capital gains are the difference between a security’s purchase price and its selling price, when the ...

Money Market Fund

What is a Money Market Fund? A money market fund is a mutual fund with investments in high-yield money market ...

Mid-Cap

What is a Mid-Cap Stock? Mid-cap refers to the market capitalization of stocks of companies with market values between $2 ...

Exchange Traded Funds (ETFs)

What Is an ETF? Exchange-traded funds are very similar to mutual funds, except that they trade throughout the day on ...