After peaking in 1971, the percentage of families covered by life insurance has dropped steadily, from a high of 85.4% to 59.4% in 2019. Financial experts say life insurance is still a “huge need.” So why don’t more people buy it?

Changes in demographics

Older households have a disproportionate amount of wealth in the United States. [1] And older, wealthier households don’t need as much life insurance because they have more savings and don’t need it to stretch as far, says Puneet Prakash, professor and chair of the risk management and insurance program at Missouri State University.

On the other hand, many younger people are struggling with student debt and affording homes, making life insurance less of a priority. [2]

“Young folks typically don’t have the money,” Prakash says.

Having children is one of the biggest triggers for buying life insurance, but young people are putting that off. Census data shows many Americans are having children later. [3]

Changes in tax laws

In its heyday, life insurance was a popular vehicle for tax-advantaged savings. “People used to have life insurance for purposes of estate planning,” Prakash adds.

Life insurance proceeds are typically not subject to taxation. But the size of the exemption from the estate tax increased drastically in 2018, meaning only the wealthiest estates have to pay.

And since the 1970s, new ways of saving money without paying taxes have emerged, like 529 plans, health savings accounts, and Roth individual retirement accounts, giving people specialized ways to save tax-free for education, medical expenses, and retirement, respectively.

Changes in how life insurance is sold

A large and growing percentage of life insurance sales are handled by independent agents, [4] meaning agents who can sell products from multiple insurance companies. Most of the population, Prakash says, “doesn’t have access to these agents, or brokers, or financial planners.”

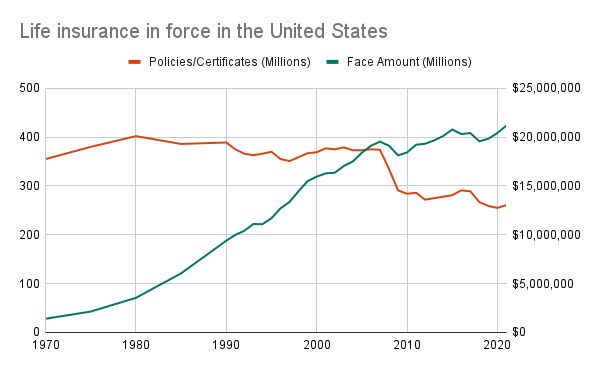

These agents tend to work with wealthier clients. That explains why, even as the percentage of the population covered by life insurance has dropped, the face value of active life insurance policies has held steady, hitting a high of $21.2 trillion in 2021. [5]

“Even though the number of policies sold has steadily declined, the dollar amount of coverage has actually gone up,” Prakash says. “That tells you it’s only the high-net-worth individuals who are buying this.”

Even as the number of active life insurance policies has dropped, their face value has reached new heights, as data from the American Council of Life Insurers shows.

Why you need life insurance — even if you’re not rich

Many people don’t grasp the repercussions of going without life insurance, says Anna Sergunina, a certified financial planner and CEO of MainStreet Financial Planning.

“In my experience working with clients, I have observed that many individuals lack a clear understanding of the reasons why they need insurance, how insurance functions, and what type of life insurance policy is most suitable for them,” she says.

Many people end up settling for “bare minimum” policies provided by their employers, which are often limited in their coverage amounts. You also probably won’t get to keep it if you lose your job.

In general, anyone who has shared debts or has someone who depends on their income should consider getting life insurance coverage. Delaying can be costly, since life insurance rates tend to increase with age.

Kevin Brady, a certified financial planner and vice president of Wealthspire Advisors, agrees that insurance agents have gone away from selling cheaper term life policies and toward selling more expensive whole life policies to wealthier clients.

“However, that is not to say that life insurance is not needed,” Brady says. “I do believe that there is a huge need for the death benefit protection it provides; it’s just that the coverage is often best provided by cheaper term life insurance.”

High-net-worth households aren’t the only ones that can benefit from life insurance. In fact, people with less wealth should probably have more insurance coverage because they aren’t as able to deal with financial risks. Brady says anyone who is the breadwinner in a single-income household, and who has dependent children needs to have life insurance.

Even younger couples without children should consider buying term life insurance, Brady says.

“Everyone is different, but health issues can pop up out of nowhere,” he says.

Image: Cavan Images / Getty