Understanding New York’s Estate Tax “Cliff” – 2024 Update

In 2014, dramatic changes were made to New York’s gift and estate tax law. For many clients, the subject of …

Spousal Lifetime Access Trusts (SLATs): FAQs – 2024 Update

What is a Spousal Lifetime Access Trust (SLAT)? It is a trust that you (the grantor) set up for the …

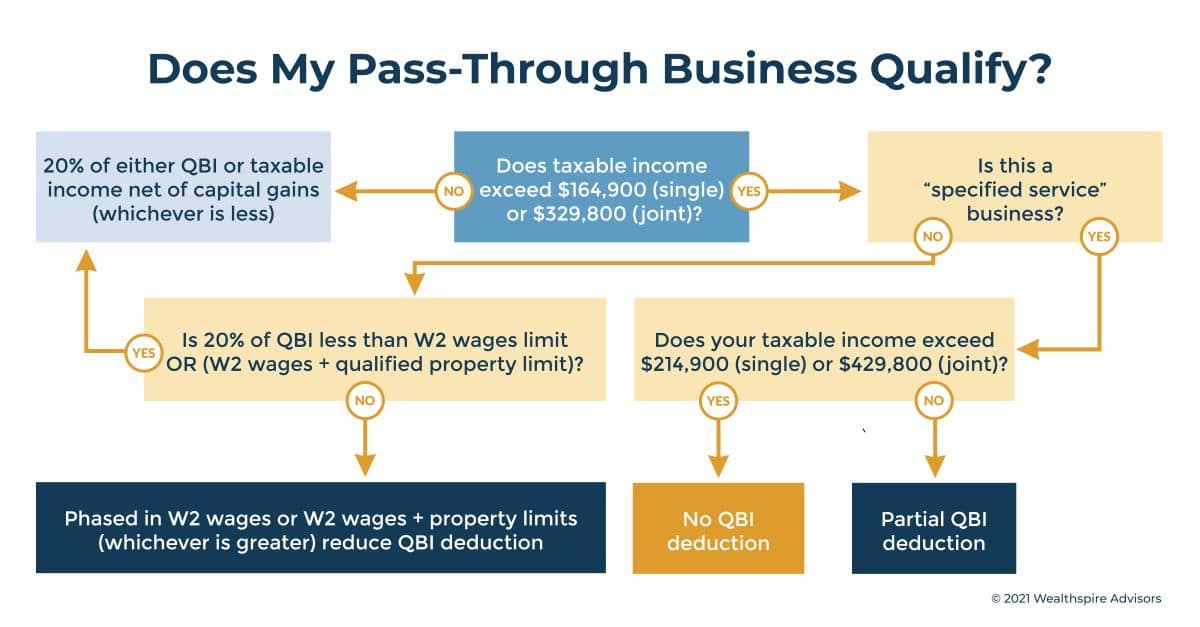

Qualified Business Income (QBI): Deduction May Create New Planning Strategies for Some Business Owners

The Tax Cuts and Jobs Act of 2017 introduced a 20% tax deduction focused on pass-through businesses. While the deduction …

‘Tis the Season for Cyber Thievin’

The holidays provide a great opportunity for fraudsters to unleash their schemes, knowing that we are busy traveling, shopping, and …

Fireside Chat: The Last 5 Years in Review

Despite EVERYTHING that has gone wrong in the past 5 years – wars, pandemic, inflation, political unrest, bull markets, bear …

So You’re a New BigLaw Associate

You’ve done it! Three years of law school, a summer internship or two, several grueling months of bar exam prep, …

The Corporate Transparency Act: What Business Owners, LLCs, and FLPs Should Know

As we step into 2024, entity owners are facing a new regulatory landscape, significantly shaped by the Corporate Transparency Act …

RSUs vs. ISOs: Equity Compensation 101

Chances are that if you’ve reached a point in your career where your employer has granted you Incentive Stock Options …

Maximizing Earnings Through NIL Contracts: A Guide for College Athletes

The recent introduction of the Name, Image, and Likeness (NIL) policy has revolutionized the world of college sports. Now, student …

The Impact of Artificial Intelligence on Financial Advisors and RIAs

Technology has been exponentially growing since the 60s, doubling every one and a half to two years.[i] Each technological innovation …

Year-End Planning Tips 2023

As we approach the end of 2023, you should aim to maximize your opportunities to transfer wealth to your children …

Talking About Money: Navigating Wealth Transfers Across Generations

As financial advisors, we have the privilege of working with numerous families, witnessing their triumphs, heartbreaks, milestones, and life transitions. …

Why the Self-Employed Should Consider a Solo 401k

Self-employed individuals have multiple options to save for retirement and invest in a tax-efficient manner. One of those options, the …

A “How To” Guide to Retirement Savings for the Self-Employed

In the past, I’ve received calls from clients who had already retired but decided to get back into the game …

A Summer Internship at Wealthspire Advisors

Written and compiled by 2023 Summer Marketing Intern Juliana Tabback For several years now, Wealthspire Advisors has hosted an 8-week …

The Top 5 Medicare Mistakes

Written in partnership with Chapter Medicare Medicare can be quite daunting. There are thousands of supplemental plans, many different enrollment …

Financial Moves for New Parents: A 5-Point Checklist

Becoming a parent is an exciting phase in life’s journey. Suddenly, you’re responsible for another tiny human being. Amid the …

First Time Homeowners: Have You Thought of Everything?

My wife and I purchased our first home seven years ago, which was not nearly as fun as an episode …