It is no secret that many Americans are ill prepared for retirement (excluding our clients, of course). With the continued disappearance of defined-benefit pension plans (apart from public sector employees), inadequate savings, and low interest rates, people are depending on Social Security now more than ever before. Despite these facts, billions of dollars in lifetime benefits are lost each year because retirees make uninformed decisions about claiming Social Security benefits. This white paper will discuss various concepts to consider in order to help maximize lifetime Social Security benefits.

Regardless of whether you feel Social Security will be a major factor in your retirement or not, leaving money on the table is not an ideal strategy. According to the Annual Statistical Supplement to the Social Security Bulletin(1), about 70% of all retired workers started taking benefits before their normal retirement age. For some it was the correct decision, but for most, claiming benefits early will result in the forfeiture of tens, if not hundreds of thousands of dollars over their lifetime.

A few items to note from the start: first, this material is not very exciting (in fact, it is rather boring), so we will do our best to keep it interesting, and second, the Social Security Administration is not running out of money anytime soon. Actuarial projections predict that current amounts in the Old-Age and Survivors Insurance (OASI) Trust Fund are adequate to provide full benefits to all through 2037. This should help ease the minds of those who want to take benefits as soon as possible to get what they can before the system potentially goes broke. Also, for the sake of brevity, this white paper does not address benefits for qualifying children, disability, divorce, or the taxation of Social Security benefits. So, let’s get started.

Important Social Security Definitions and Benefits

Social Security benefits are based on retirement credits. Currently, one retirement credit is received for each quarter worked where at least $1,260 is earned. To qualify for benefits, you must accrue at least 40 credits (10 years of cumulative work history).

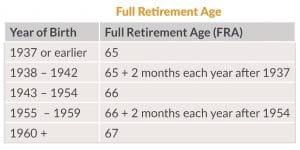

Full Retirement Age (FRA), often referred to as normal retirement age, falls between 65 and 67 depending on the year you were born. At FRA, you are eligible to file for Social Security benefits and receive full or unreduced benefits. Regardless of your FRA, you may begin claiming benefits as early as age 62 or as late as age 70.

The Primary Insurance Amount (PIA) is your full retirement benefit and is calculated using your Average Indexed Monthly Earnings (AIME). AIME is based on your 35 years of highest earnings (calculated monthly). The maximum monthly benefit, or PIA, for an individual at Full Retirement Age (FRA) in 2019 is approximately $2,800. Monthly benefits may be estimated using the Social Security Administration’s online Retirement Estimator (2).

Claiming Social Security Benefits Before FRA

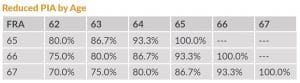

For those who choose to claim Social Security benefits early, their benefits will be permanently reduced by as much as 20% – 30%, depending upon their FRA. The benefit reduction factor is 5/9 of one percent per month for each of the first 36 months, and 5/12 of one percent for each additional month thereafter.

Delaying your Social Security Benefits

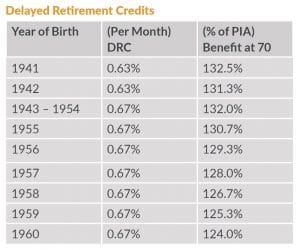

In contrast to the reduced benefits shown above due to early retirement, the Social Security Administration will add Delayed Retirement Credits (DRC) to your PIA every month that you defer benefits past your FRA up to age 70.

These credits add approximately 2/3 of one percent per month to your benefit. The exact amount depends on your date of birth.

Spousal Benefits

Spousal benefits are benefits you receive based on the earnings record of your spouse (while they are still living). Spousal benefits are available to either spouse, even if you have never generated income and paid into the system. Some general rules for spousal benefits include:

- You are entitled to the greater of (1) benefits based upon your earnings record (if any), or (2) 50% of your spouse’s PIA.

- To qualify for spousal benefits, you must be at least age 62 or have a qualifying child in your care.

- In order to collect spousal benefits, the other spouse must first file for their benefit (so they must be at least age 62).

- You and your spouse may not receive spousal benefits at the same time.

- Spousal benefits are not eligible for DRCs.

Survivor Benefits

Survivor benefits are calculated similarly to spousal benefits; however, they do factor in DRCs. In the event of your spouse’s death, you, as the surviving spouse, have the ability to receive the benefit of your deceased spouse (only important if their benefit is greater than your own). You may begin collecting survivor benefits as early as age 60, but claiming benefits prior to your FRA will result in a permanent reduction of benefits. Please note that the collection of survivor benefits is not automatic. You must contact the Social Security Administration and apply for survivor benefits.

COLAs

In an effort to ensure the purchasing power of Social Security benefits are not eroded by inflation, benefits are subject to an annual Cost-of-Living Adjustment (COLA). Over the past ten years, COLAs have averaged around 1.4% annually.

Strategies

The primary goal of any Social Security optimization strategy is to maximize expected cumulative lifetime benefits. Please note that recent changes in law have changed or removed some of the strategies, and this paper focuses only on options that are still currently available as of late.

Individuals

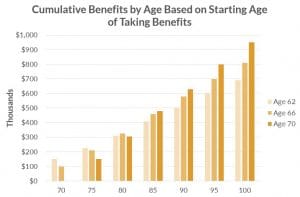

For individuals, the answer is fairly straightforward and almost entirely based upon life expectancy. If you expect to live exactly to age 80, then believe it or not, it is not terribly important when you begin collecting your benefit. However, if you have a shorter life expectancy, the earlier the better in claiming benefits. If you have longevity on your side, deferring benefits until age 70 is best. For example, if your PIA is $2,000 per month, with an FRA of 66, depending upon the age you begin benefits, your cumulative lifetime benefits are approximated in the graph on the right.

Married Couples

Marriage offers several options in terms of Social Security benefits, specifically spousal and survivor benefits. The most important consideration remains the timing of when each spouse begins taking benefits.

A few basic points for all married couples to keep in mind are: (1) coordinate the start dates of your benefits, (2) consider delaying benefits for the higher earner until age 70 (maximizing the surviving spouses lifetime benefit), (3) utilize the spousal benefit if possible, and (4) apply for survivor benefits as soon as possible after the death of your spouse (if applicable).

Spouses with Similar Benefit Amounts

When both spouses have similar earnings history and are thus entitled to benefit amounts that are not drastically different from each other, each spouse will take their own benefit (rather than one taking a smaller spousal benefit). The most common options in this situation are:

- Both spouses begin taking their benefits at FRA.

- One spouse delays benefits and allows their future benefit to increase until age 70. Meanwhile, the other spouse takes their own benefit at FRA.

- Both spouses delay taking their own benefits and allow their future benefits to increase until age 70.

Spouses Not Entitled to Own Benefits or Spouses with Lower Benefit Amounts

If one’s benefit is less than 50% of their spouse’s benefit, the decision is similar to that of individuals. The spouse with the highest benefit can either begin taking benefits at FRA or delay and grow their future benefit until age 70. Either way, no spousal benefits can be paid until the higher earning spouse begins receiving their own benefit. However, the lower earning spouse can take their own benefit while the higher earning spouse takes advantage of delayed retirement credits. Once the higher earning spouse begins taking their benefits, the lower earning spouse can then switch to taking the spousal benefit (if it is higher than their own benefit).

Additional Notes for all Married Couples

- As mentioned above, one can delay taking benefits to increase their future benefits payable. The spousal benefit will not also increase, however, and will remain fixed at 50% of the benefit amount available at FRA.

- The spousal benefit will decrease, however, if taken before FRA.

- In the past, one spouse could delay taking benefits to increase their future benefits payable while the other spouse began taking spousal benefits immediately. This option is no longer available, and spousal benefits can only be taken once the other spouse is also taking their own benefit.

The “Reset” Button

There is a one-time “reset” available if you elected to receive benefits early and wish to change your election. However, the change must be made within 12 months of your initial election, and you will be required to pay back all benefits received during that time.

If you have taken benefits early, but are outside the 12 month “reset” window, you may elect to suspend benefits at FRA, without paying anything back. Your benefit amount will continue to grow until age 70, at which time you may begin collecting benefits again (as much as 99% of PIA if your FRA is 66). While this option may not make the most sense if you are single, for a married couple where there is a significant age gap and a younger spouse who will not qualify for full benefits on their own, this option may help maximize your survivor benefits.

Conclusion

While we have covered the basics of Social Security retirement benefits and discussed several claiming strategies in order to maximize your lifetime benefits, the examples provided in this white paper are just that, examples. Additionally, the concepts covered in this paper are subject to change as legislation relating to Social Security benefits could pass at any time. We encourage you to reach out to your Bronfman Rothschild team or contact the Social Security Administration at (800) 772-1213 or www.ssa.gov for a more thorough analysis of your options to develop a sound plan.

1 Annual Statistical Supplement, 2020: https://www.ssa.gov/policy/docs/statcomps/supplement/.

2 Social Security Administration Retirement Estimator: http://www.socialsecurity.gov/estimator/.