Americans are living longer and healthier lives than at any other time in history. Average life expectancy in the US is 78.7 years and continues to rise. For those without chronic illness, it is realistic to plan to live well into the 90’s. Longer lifespans come with a higher likelihood that aging adults will eventually need some sort of help with the daily functions of living. In fact, 7 out of 10 will need help in some form – either from a family member or a paid caregiver – and 9 out of 10 who receive that care will not fully recover their independence. The lifetime probability of needing care in at least two functions of daily life or of being cognitively impaired is 68%. Three-quarters of care will take place in private homes, often by other family members, over 75% of whom are female and 40% of whom will predecease the person they care for. Everyone’s circumstances are different, but the common denominator is a high likelihood that some sort of long term care will be needed. How can you plan for this likely event? Care needs can develop over multiple years. Postponing care decisions, while common, is itself problematic. Trying to address these issues after one is already beginning to experience physical or mental compromise is difficult. Waiting lists on quality care facilities are common. For many reasons, crafting a plan well before you need it is a must.

Creating a long-term care plan is a two-part process. The first part entails understanding and defining how you would like to see care provided. Once you have a vision for your own long-term care, the second part is to formulate the financial plan to pay for it. This two-part series is designed to address both parts of a long-term care plan. In the first part, we will provide a roadmap to define your own desires and goals for long term care. Then in Part Two, we will explore the financial variables: estimating costs and payment methods for long-term care, including a look at long-term care insurance as well as other alternatives. We will also discuss the pros and cons of these various options.

When to Start Planning

We often start talking with clients about long-term care planning once they reach their mid to late 50’s. This can be a time when some begin caring for their own parents, when they’ve finished raising kids and paying for college, and when they begin to think about their own twilight years.

Like many significant events in our lives, long-term care can play out over multiple years and can involve a significant financial commitment. Anticipating and specifically identifying the financial components can help you have a realistic view of what you can or cannot afford. Knowing the potential costs of your desired long-term care goals can help you allocate sufficient funds or fund the appropriate insurance over multiple years. Many find peace of mind by simply knowing they have a plan and will have the means to pay for their own long-term care.

What to Consider When Planning

Start by identifying personal desires about how you would like to be cared for at a time when you can no longer live independently. While a sudden health event or accident may require a need for around-the-clock care, care needs can also evolve over time. For example, you may find it harder to complete physical tasks like home repairs or yard maintenance. Cognitive decline can happen over many years starting with forgetfulness or difficulty completing complex tasks. It may be necessary to enlist someone’s help to make sure all the bills get paid and things aren’t falling through the cracks. As care needs increase, your long-term care plan should address these bigger questions:

Where do you expect to live?

A large majority prefer to stay in their own home. Thought must be given to whether living independently will be physically safe and mentally healthy. Take time to think about your home through the lens of someone with more limited mobility. Are there a lot of stairs? Are laundry facilities in the basement? Are there walk-in showers or traditional bathtubs? Will there be significant costs to make the home accessible? Could there be a need for supervision or on-site assistance? What is plan B if your home will be inaccessible as you age? Are you familiar with the quality of care giving facilities near you? Will you hope to live with other family members?

Increasingly, senior living situations that include a progression of care are available. Here retirees take a first step into senior apartments in a community with other healthy seniors before any care is needed. Not only do Continuing Care Retirement Communities (CCRCs) require that you are fully independent when you move in, many find that joining such a community when they still feel vital and active a good idea because they can develop a sense of community as they age.

Moving at a time when you are physically or mentally compromised is much more challenging for all involved, as it limits the types of places you can qualify for and makes it harder to acclimate and build relationships once you’re there. If a CCRC appeals to you, it can be a good idea to get on a waiting list for a desired location. A modest deposit is often required, but if your name comes up and you aren’t ready to make the move, you may have the opportunity to pass two or three times before being dropped from the list. Thus the adage: “Better five years too early than five minutes too late”

The True Impact of Long-Term Care

- “My husband had to take time off from his job to help me, more than we expected. And he was frustrated that I had so much pain and felt like he wasn’t helping enough. I hated asking from so much assistance”

- “It’s just hard between us. My wife still has to work to keep up the insurance. She also became my chauffeur and needed to help me shower and dress. We thought this time of our lives would be different”

- “We expected things to change… But the reality of caring for someone is nothing like I imagined”

- “In theory, I believed I could take care of my Mom, keep up with her home, and take care of my family, my kids and myself. In reality, I am constantly torn, feeling guilty that I’m not doing enough for anyone”

Source: Genworth

Answers to the following questions can help you frame your long-term care plan:

- What is my health status and how long am I likely to live?

- Where do I want to live?

- If I live at home, is my home safe as I age? Will I be able to do required upkeep?

- If I stay at home, who should provide care? Do I have family or friends who can help me? Am I comfortable with asking them for help? Whom do I not want to ask?

- Are there quality facilities in my community that provide a continuum of care? Do they have a waiting list?

- Who is the right family member or trusted contact with whom I can share my plan and who will help execute it?

- What are my end of life directives and have I included those as part of my long-term care plan?

Who will provide the care?

Many expect and receive care from a spouse. But the stress of caregiving can be both physically and mentally hard, and it isn’t uncommon for the provider of care to predecease the person they are caring for. Family members – a sibling or a child – are often expected to step in to help. Children often share care giving duties and play different roles depending on their respective skills and abilities. Consider carefully what and how much you will want to ask of your children and at what cost it will be to them. Many second-generation caregivers are effectively asked to put their own lives on hold – jeopardizing their own careers, personal relationships, physical and financial health. Additionally, you may need to think about which family members should not be asked to provide care.

Paid professional care givers – either with or without medical training – can provide care in home or in a facility. Care can also be provided by a combination of caregivers – a spouse may provide care and augment that care with part-time help from family or paid providers.

What kind of care will I need? What can I afford?

Your own plan will be affected by multiple factors including your own financial situation, your health status and your health history. Are you likely to deal with chronic health issues like diabetes, high blood pressure, or obesity? One in three seniors dies with Alzheimer’s and other dementias, and the number of Americans living with Alzheimer’s is expected to increase further from 5.7 million to 14 million in 2050. How might this impact your family? Will I be able to get into a care facility if needed? While many desire to stay at home, some health circumstances may require a professional care facility. But don’t be surprised to find that quality facilities often have waiting lists and /or require future residents to demonstrate the financial ability to cover at least two years of care before relying on Medicaid.

Will I be able to get into a care facility if needed?

While many desire to stay at home, some health circumstances may require a professional care facility. But don’t be surprised to find that quality facilities often have waiting lists and/or require future residents to demonstrate the financial ability to cover at least two years of care before relying on Medicaid.

Do I have my health care directives and a power of attorney for health care in place?

We’ve written separately about the importance of establishing powers of attorney for both finances and health care. Take time to create specific directives about end of life care. It is an important component of a complete long-term plan.

Share Your Plan

Once you and your spouse have answered these questions and created a plan for your long-term care, keep a copy of your plan with your important papers. Take time at least annually to review the plan and make sure it still reflects your wishes. Also, share your plan with family members or a trusted contact to make sure your desires are known. While it is good to communicate with your whole family, identify one person to execute the plan for you. It can be hard for multiple siblings to agree; identify the one person who is in the best position to put your plan in place. If you don’t have kids or siblings, be sure to identify a friend or other trusted contact.

Establishing and communicating your desires is the first step in planning for care as you age. In our next segment, we will discuss the financial components of your long-term care plan – how to estimate the cost of care and a financial plan to pay for it.

Putting a Financial Plan in Place

We aren’t getting any younger. Baby Boomers, the demographic cohort that has impacted every major institution, is now making its way into and through retirement. The early years of retirement – the so-called “go-go” years – are active and filled with paid or volunteer work, travel, and lots of activities. Next come the “slow go” years when they continue to live independently but find they can do fewer things. Ultimately, they move into the “no-go” years when physical or cognitive health begins to decline, and some sort of care may be needed.1

The U.S. Dept. of Health and Human Services projects that the number of people needing long-term care will double by 2050, and that nearly 70% of people turning age 65 will need long-term care at some point.2 Recognizing the potential need and establishing your own vision for how you would like to receive long-term care is the first step. We addressed establishing a vision for your own care in part one of this series. The second step is to determine how you plan to pay for that care.

How much money you will need to cover long-term care will be impacted by many factors, not the least of which is your own health status and family history. How you pay for it depends on your own financial situation and access to liquid assets.

Estimating Potential Costs

Like any financial plan, you should build an estimate of what your annual expenses could be. This can be a challenge for one person, let alone a couple. A few questions to consider when making those estimates:

- What is your general family health history? How likely is it that you will face a chronic health situation? How long do you expect to live? Most of us are in denial about our likely longevity. There are several good Longevity Calculators available to help us face reality, such as https://media.nmfn.com/tnetwork/lifespan/#0

- Do you expect to secure private, in-home care? A Genworth study found that 80% of Americans underestimate the cost of in-home long-term care. Using widely available statistics from long-term care providers, aging adults who use long-term care services should expect to do so for as much as 4 or 5 years. Other costs to consider include expenses to make your home safe as you age, such as retrofitting bathrooms with walk-in showers and other home modifications to be more accessible.

- Would you prefer to move into a retirement community that offers a continuum of care, including independent senior apartments, assisted living, memory care, or even skilled nursing services? These communities appeal to many, especially those without family members living close by. To estimate these costs, survey the retirement communities in your area. Many have monthly fees plus an upfront buy-in with 80% or more guaranteed to go back to your estate.

- If you need to access a higher quality skilled care facility, you may need to demonstrate an ability to fund at least two years of care.

For many, estimating the costs of private in-home care or a retirement community in the community you want to live can feel overwhelming. Organizations like AARP offer online tools to identify caregiving resources in your local community. There are also some private care managers and planners such as Care Right Inc. that seek to help you sort through the maze of choices. Individual facilities may also have care managers offering to help, but hiring your own care manager assures that you receive advice from someone who is representing your interests alone. You can also ask people in your community who may have a family member receiving care or are familiar with providers.

Ideally you want to have a solid idea of the type of care you desire well before it is needed. In order to become familiar with local resources and costs, I’ve encouraged my healthy clients to explore one care provider per month; schedule an individual visit ahead of time or attend a group presentation. The more of them you see, the better your own questions will become.

Understanding the vast range of preferences, resources, and health issues, some recommend that a 60-year-old should have a pool of $350K earmarked to cover a claim beginning at age 80, and $375K should the claim begin at 85. For a 65-year-old, those figures move to $325K for a claim at age 80 and $350K beginning at 85.

Ways to Fund Long-Term Care

After considering the potential costs of long-term care (LTC), the next step is to determine how you will fund that care. It’s important to remember that this is not covered by Medicare. Generally, clients tend to take one of three approaches:

- Self-Fund—Do you have enough assets to self-fund long-term care costs? If retirement is still a few years away, how much more will you need to save to cover these costs? Consider how to identify and segregate those funds identified for long-term care and how to invest those funds so they will be available to be used for that purpose when the time comes.

- Insure – Traditional long-term care or new hybrid policies that combine long-term care “riders” with a life insurance policy or an annuity are available.

- Combination – Many choose a combination of self-funding and insurance to cover long-term care. Those with liquid assets to cover a significant portion of their costs may purchase an LTC policy with a modest benefit amount covering just part of the costs. This approach can also be attractive to those who want to preserve more assets to pass on to their heirs.

Deciding to insure all or part of long-term care expenses is a complex decision. LTC insurance can be expensive, and many find it difficult to commit to paying premiums of $4,000 or more per year for insurance they hope not to use (like all insurance).

Today’s LTC Policies – Evolving Policies and Features

Today, insurance companies serving the long-term care market now have longer history and better information on actual use and have designed policies and pricing based on this experience. When selecting a policy, the cost will depend on factors including the client’s current health status, how long a user anticipates needing care, and the length of the waiting period before benefits begin to be paid. For example, a policy may cover four years of shared care for a couple. That care can be split up however it is needed. Both may receive benefits covering two years of care or one spouse may receive three years of care and the other one. Policies generally include a deductible/waiting period – say 100 days – before policy benefits begin to be paid.

Ideally, policies are priced to avoid future rate increases, but when conditions warrant, consumers now have options to accept premium increases or to pass and lock in a lower benefit. These elements of policy design can help to prevent someone from having to abandon a policy after paying in for many years.

For many, paying for an insurance policy they may never need can be a difficult pill to swallow. Insurance companies increasingly are creating hybrid policies just for this reason – that is, life insurance and annuities that include long-term healthcare riders. For example, the policy may cover a set benefit that can be used for long term care, and if LTC isn’t needed, that benefit becomes part of the life insurance’s death benefit. These options can be a valuable opportunity to repurpose an existing insurance policy or annuity that isn’t needed for its original goal any longer.

Others may purchase a “longevity policy.” Like its name suggests, these policies are designed for those who may live well beyond normal life expectancies. With a longevity policy, you can plan to cover expenses up to a certain age, say age 90. Then if you live beyond that, the policy kicks in so you don’t have to worry about running out of money.

To navigate the various options for a combination that truly meets your needs and priorities, be sure you are working with a Long-Term Care Insurance expert. Independent agents can compare a variety of companies and help you understand the options that are truly of value to you and will work closely with your Financial Advisor who can help you understand how a long-term care event can derail an otherwise healthy retirement plan.

Planning = Peace of Mind

In one study, 87% of survey respondents thought that long-term care was a big problem in the U.S. Eighty percent felt it irresponsible not to plan for it, but only 12% believed they had adequately done so.3 Planning for care as you age can involve some difficult questions. People tend to not want to think about it. But not planning has dire consequences – decisions may end up being made for you, you may not be able to afford the care you want, or you may end up burdening others with your care. Creating your own long-term care plan, thinking about how you will pay for it, and regularly updating your plan can provide significant peace of mind.

Case Study

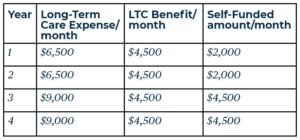

A couple decides to move into a retirement community. After living independently, one spouse passes away. The surviving spouse later moves into assisted living with costs of $6,500/month. After two years in assisted living, she needs memory care services and lives an additional 2 years with costs of $9,000/month.

The couple chooses to fund their long-term care with a combination of self-funding and an LTC policy. They purchase a policy with a maximum daily benefit of $150 or about $4,500 per month. The cost of this policy was roughly $4,000/year.