Medicare: The Basics

Medicare is the Federal health insurance program for people ages 65 and older. The program helps pay for various medical expenses including hospital stays, physicians, prescription drugs, and more. The number of people enrolled in Medicare has tripled since 1970, climbing from roughly 20 million in 1970 to 60 million today, and is projected to reach almost 90 million in another 30 years.

A common misconception about Medicare is that it is self-financed through premiums paid by current beneficiaries and payroll taxes by future beneficiaries. Unfortunately, payroll taxes and premiums only cover about half of the programs cost. Medicare is one of the largest programs in the Federal budget, costing roughly $582 billion (in 2018), or 14% of total Federal spending (to give you some perspective, the Defense Department budget was roughly $693 billion, or 17% of total Federal spending, and interest on our national debt was roughly $325 billion, or 8% of total Federal spending).

History

Medicare’s history began in 1915, when the American Association for Labor Legislation (AALL, whose members included Louis Brandeis and Woodrow Wilson) introduced a model health insurance bill to be used by state legislatures around the country, but it never gained momentum. However, health care returned as an issue during the 1930s. The 1935 Social Security Act initially provided for a study of national health insurance, prompting protests from many, including the American Medical Association (AMA), which believed government run health insurance threatened the “organizational, financial, and clinical autonomy of physicians” (how prescient of them). President Franklin Delano Roosevelt, fearing this would jeopardize the enactment of Social Security, ordered the study removed from the bill. His successor, Harry Truman, in 1945 became the first American president to formally endorse national health insurance, although he also was not successful in moving it forward. Continued opposition to national health insurance, as well as the stigma of “socialized medicine” that resonated strongly during the Cold War, discouraged any progress.

Advocates for national health insurance within the Truman administration sought a new strategy. There was a case to be made for national health insurance for “the aged” (as older adults were termed back then). Although seniors required more medical services than younger Americans (still do), they were more likely to be uninsured and had low or no income. Once retirees left employer-sponsored insurance, they had a difficult time obtaining affordable coverage because private insurers saw them as high risks. Before Medicare’s enactment, only about half of older Americans had any health insurance coverage at all, and many of those policies had limited benefits. Still, the primary rationale for focusing on the elderly was political. Medicare advocates wanted to capitalize on the sympathetic reputation of the elderly as a group deserving of government help and in need through no fault of their own.

Leveraging the political association with Social Security was also identified as a winning strategy. Social Security paid out benefits to retirees who had contributed payroll taxes to the program during their working lives. It was a social insurance program characterized by required payroll taxes, federal administration, and universal eligibility (its benefits available to all Americans regardless of income). The architects of Medicare attributed Social Security’s political success and popularity to these social insurance arrangements, and they wanted to enact national health insurance along the same lines. What came to be called Medicare was built on the Social Security model in its eligibility rules, financing, and administration.

Since the AMA’s intense opposition had contributed to the defeat of national health insurance during the Truman administration, original Medicare included only hospital insurance (omitting benefits for physicians to appease the AMA).

The Medicare strategy worked, but not immediately. Although Medicare attracted substantially more support in Congress than prior national health insurance proposals, it still fell short of garnering enough votes to pass Congress. In 1964, Democrat Lyndon Johnson won the presidency while Democrats gained wide majorities in both the House and Senate, leading to its 1965 enactment.

On July 30, 1965 President Lyndon B. Johnson made Medicare law by signing H.R. 6675, with former President Truman being issued the very first Medicare card during the ceremony. The initial budget for Medicare was around $10 billion.

In 1972, President Richard M. Nixon signed into law the first major change to Medicare. The legislation expanded coverage to include individuals under the age of 65 with long-term disabilities. Over the following years, additional changes were made to Medicare:

- Home health services were included in eligible benefits.

- Medicare supplement insurance (Medigap, which will be defined later) was brought under federal oversight.

- Hospice services for the terminally ill were added as eligible benefits.

- The Medicare Catastrophic Coverage Act was passed, adding a limit to Medicare’s total out-of-pocket expenses for Part A and Part B (which will be defined later), along with a limited prescription drug benefit. Most of the Catastrophic Coverage Act was repealed less than a year later after opposition from seniors over the program’s higher premiums (to this day, there continues to be no cap on out-of-pocket costs for Medicare A and B).

- States were required to “buy-in” to the Medicare system by using Medicaid funds to cover Medicare premiums and cost-sharing for impoverished Medicare beneficiaries.

- Medicare coverage through the private market was expanded by Medicare Part C – Medicare Advantage Plans (which will be defined later).

- President George W. Bush signed into law the Medicare Prescription Drug Improvement and Modernization Act of 2003, adding an optional prescription drug benefit known as Part D, which is provided only by private insurers. Until this time, about 25% of those receiving Medicare coverage did not have a prescription drug plan.

Components of Medicare

Medicare consists of four parts:

- Part A – Hospital Insurance

- Part B – Medical Insurance

- Part C – Medicare Advantage

- Part D – Prescription Drugs

Part A – Hospital Insurance

You usually do not pay a monthly premium for Part A coverage if you or your spouse paid Medicare taxes while working (if you did have to buy it, the 2019 premium would be $437 per month).

Medicare Part A helps cover:

- Blood – If a hospital buys blood, you must cover the costs for the first three units of blood.

- Home Health Services – This could include medically necessary part-time skilled nursing care, physical therapy, speech-language pathology services, occupational therapy services, durable medical equipment, medical supplies to be used at home, and more.

- Hospice Care – Upon certification by a doctor of a terminal condition (six months or less of life expectancy), coverage would include items and services needed for pain and/or symptom management, nursing and social services, durable medical equipment, grief counseling, and more.

- Hospital Care – Medicare covers semi-private rooms (but not TV or phone charges), meals, general nursing, drugs and supplies as part of your inpatient treatment.

You pay a deductible in 2019 of $1,364 and no coinsurance for days 1-60 of each benefit period (begins the first day of a hospitalization and ends 60 days after your stay). You pay a coinsurance amount of $341 per day for days 61-90 of each benefit period. You pay a coinsurance amount of $682 per “Lifetime Reserve Day,” which is an additional 60 days of coverage over your lifetime. You pay all costs thereafter (with no cap).

Part B – Medical Insurance

The standard Part B premium amount in 2019 is $135.50 per month. Most people will pay the standard Part B premium. If you decide not to enroll in Part B when you are first eligible, you will likely pay a late enrollment penalty if you join later (the penalty is paid monthly and is roughly 10% for each full 12-month period that you were eligible but did not elect Part B).

Part B premiums are often paid as a withholding from your Social Security benefits. However, if you are currently not receiving benefits, you can pay by check, credit/debit card, direct debit from your checking/savings account, or via online bill payment.

Medicare Part B helps cover medically necessary doctor’s services, outpatient care, mental health services, and more. For example, the following is a partial list of covered services:

- Alcohol Misuse Screening and Counseling

- Ambulance Services

- Behavioral Health Integration Services (depression, anxiety, etc.)

- Blood

- Bone Mass Measurement

- Breast Cancer Screening

- Cardiac Rehabilitation

- Cardiovascular Disease Screenings

- Cervical and Vaginal Cancer Screenings

- Chemotherapy

- Chiropractic Services

- Defibrillator

- Diabetes Screening and Supplies

- Doctor Services

- Durable Medical Equipment

- Flu Shots

- Hepatitis B and C Screening and Treatments

- HIV Screening

- Home Health Services

- Dialysis Services and Supplies

- Lab Services

- Lung Cancer Screening

- Mental Health Care

- Obesity Screening and Counseling

- Pneumococcal Shots

- Prostate Cancer Screening

- Prosthetics

- STD Screening and Counseling

- Transplants and Immunosuppressive Drugs

- Yearly “Wellness” Visit

Although the list of covered medical expenses is substantial, Medicare does not cover everything. Some of the items and services that are not covered by Part A or Part B include:

- Dental Care

- Eye Examinations (related to prescribing glasses or any corrective lenses)

- Dentures

- Cosmetic Surgery

- Massage Therapy

- Acupuncture

- Hearing Aids

- Long-Term Care

For Part B covered services, you usually pay 20% of the Medicare-approved amount after you meet your deductible with no yearly limit on what you pay out-of-pocket. That is why many people choose Part C – Medicare Advantage plans (which will be defined below) or purchase Medicare Supplement Insurance (or Medigap plans, which will be defined later).

Part C – Medicare Advantage

A Medicare Advantage Plan is another way to get your Medicare coverage. These plans, sometimes called “Part C,” are offered by Medicare-approved private insurance companies that must follow rules set by Medicare. If you join a Medicare Advantage Plan, you still have Medicare, but you will get your Part A and Part B from the plan, not the government. In most cases, you will need to use health care providers who participate in the plan’s network.

Some Medicare Advantage Plans cover things that are not covered by Part A or Part B, like vision, hearing, dental and other health and wellness programs. Most also include prescription drug coverage under Part – D (which will be defined later). Because of these added coverages, you generally will pay an additional monthly premium (in addition to your Part B premium) for a Medicare Advantage Plan.

Part D – Prescription Drug

Medicare prescription drug coverage is an optional benefit. Even if you do not need medications currently, you should consider joining a Medicare drug plan. If you decide not to join a Medicare drug plan when you are first eligible, and you do not have other creditable prescription drug coverage, you will likely pay a late enrollment penalty if you join later (the penalty is paid monthly and is roughly 1% of the national base beneficiary premium ($33.19 in 2019) multiplied by the number of months you were eligible but did not elect a Medicare drug plan).

There are two ways to get prescription drug coverage:

- Medicare Prescription Drug Plan (Part D). These plans (sometimes referred to as “PDPs”) add drug coverage to original Medicare.

- Medicare Advantage Plan (Part C). Like an HMO or PPO, you get all your Part A, Part B and prescription drug coverage (Part D) through these plans.

Medicare Supplement Insurance (Medigap)

Although Medicare pays most of the costs of covered health care services, it does not pay all. Therefore, Medicare Supplement Insurance policies, sold by private insurance companies, can help pay for the remaining costs (like copayments, coinsurance, and deductibles. These policies are also called Medigap policies.

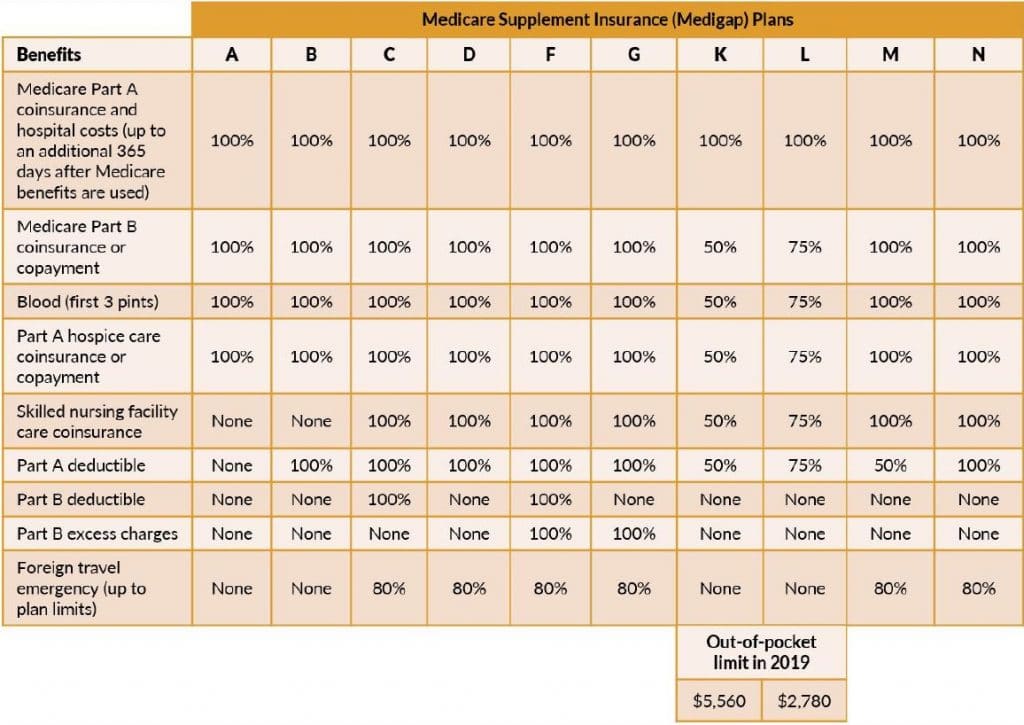

Medigap policies are standardized and are identified in most states by letters A through D, F and G, and K through N. All policies offer the same basic benefits, but some offer additional benefits at additional costs. The chart below provides basic information about the different benefits:

Starting in 2020, Medigap plans will not be allowed to cover the Part B deductible. Because of this, plans C and F will no longer be offered to new participants, but those already covered by one of these plans will be able to keep the plan.

Other important facts regarding Medigap plans:

- You must have both Medicare Part A and Part B

- You pay the private insurer a monthly premium for the Medigap coverage in addition to your monthly Part B premium.

- A Medigap policy only covers one person, so a spouse would have to buy a separate policy.

- You cannot have prescription drug coverage in both a Medigap policy and a Medicare drug plan.

- It is important to compare policy costs between insurance companies, as they could vary for the exact same coverage.

How Does Other Health Insurance Work with Medicare?

When you have other insurance and Medicare, there are rules for whether Medicare or your other insurance pays first:

Note that the insurance that pays first (primary payer) pays up to the limits of coverage, while the insurance that pays second (secondary payer) only pays residuals. It is possible that the secondary payer (which may be Medicare) might not pay all the uncovered costs.

Signing Up

If you are already receiving Social Security benefits, you will automatically be signed up for Medicare Part A and Part B the first day of the month you turn 65. As such, you would receive your Medicare card in the mail three months before your 65th birthday.

If you are not yet receiving Social Security benefits, the first time you can enroll is called the Initial Enrollment Period (clever). This begins three months prior to the month you turn 65, includes your birthday month, and ends three months after the month you turn 65.

If you do not enroll during this initial period, you may have to pay a Part B late enrollment penalty and have a gap in coverage when you do apply.

You can apply for Medicare online (www.ssa.gov/benefits/medicare/) or in-person at your local Social Security office.

In Closing

If you need further help with Medicare, please visit www.Medicare.gov. For more personalized information, you can call 1-800-MEDICARE (1-800-633-4227) or register at www.MyMedicare.gov.