Beyond Wealth: Integrating Financial Planning and Investor Behavior

As financial advisors, our purpose is to increase the financial well-being of our clients. And, although I believe we add ...

The Powerful Tax Savings of “Qualified Small Business Stock”

IRC Section 1202 provides one of the most powerful tax benefits in the U.S. Internal Revenue Code (IRC) to entrepreneurs ...

Estate Planning in Light of Current Law: Your Questions and Our Answers – 2024 Update

This post will help you consider estate planning strategies in light of the current federal estate, gift and generation skipping ...

What is an Intentionally Defective Grantor Trust (IDGT)?

Intentionally Defective Grantor Trusts (“IDGTs”) are a commonly used estate planning vehicle to transfer wealth to family members during the ...

Basics of Federal Estate, Gift, and Generation-Skipping Transfer (“GST”) Tax – 2024 Update

The bad news is that there is a federal transfer tax on assets that you give away during life, at ...

Mitigate New York’s Estate Tax Cliff with Smart Estate Planning and Gifting Strategies – 2024 Update

While the large increase in the federal estate tax exemption has provided many with federal estate tax relief, New Yorkers ...

Understanding New York’s Estate Tax “Cliff” – 2024 Update

In 2014, dramatic changes were made to New York’s gift and estate tax law. For many clients, the subject of ...

Spousal Lifetime Access Trusts (SLATs): FAQs – 2024 Update

What is a Spousal Lifetime Access Trust (SLAT)? It is a trust that you (the grantor) set up for the ...

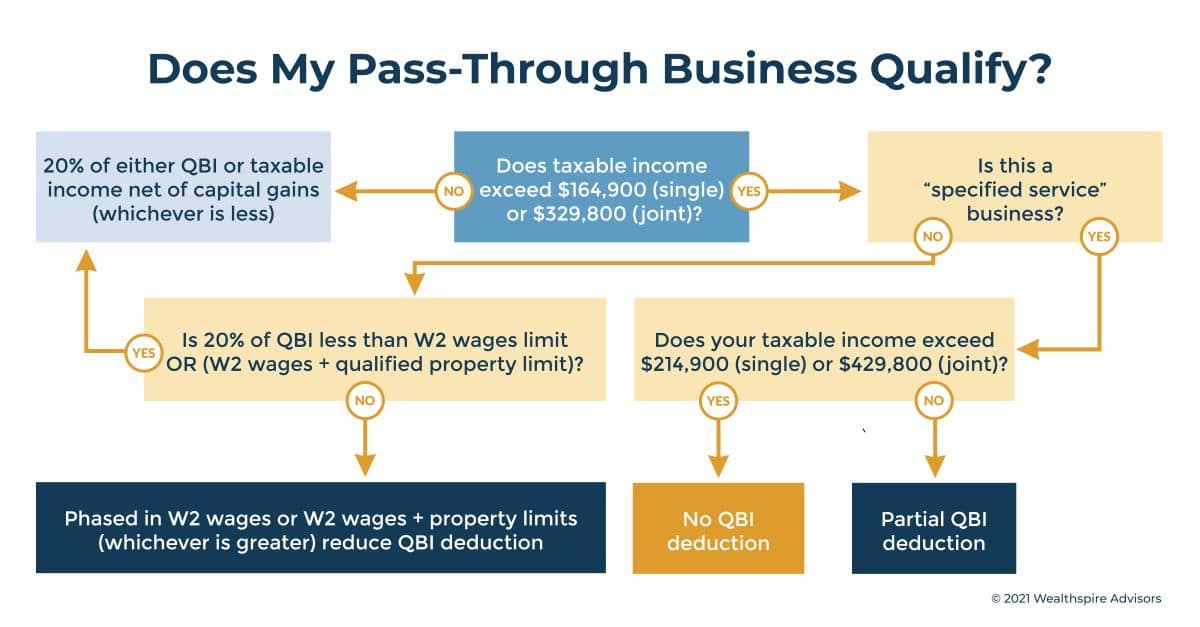

Qualified Business Income (QBI): Deduction May Create New Planning Strategies for Some Business Owners

The Tax Cuts and Jobs Act of 2017 introduced a 20% tax deduction focused on pass-through businesses. While the deduction ...

‘Tis the Season for Cyber Thievin’

The holidays provide a great opportunity for fraudsters to unleash their schemes, knowing that we are busy traveling, shopping, and ...

Fireside Chat: The Last 5 Years in Review

Despite EVERYTHING that has gone wrong in the past 5 years – wars, pandemic, inflation, political unrest, bull markets, bear ...

So You’re a New BigLaw Associate

You’ve done it! Three years of law school, a summer internship or two, several grueling months of bar exam prep, ...