A few years ago, I was out on a hike with my friend when she asked me a question: “Are you on track to have enough money in your 401(k) by the time you are in your mid-50s to retire when you are ready?”

I asked her why she was asking. She said she wanted to know that if I was on track, how did I get there? If I wasn’t, what choices had I made that had prevented me from reaching that number?

Her questions weren’t about my “number” – the amount I had saved so far – they were about my strategy. We went on to hike and talk for the next two hours. We shared stories and ideas about how we saved, invested, and spent our money. We talked about our parents and their money patterns and how we each came to work in finance. I came away with some good ideas about what I could do differently, and I know she did too. My friend told me she felt better comparing notes with me; she realized she was getting some things right and got some insight into what she could do better. She felt less alone.

I’ve spent my entire career working for financial institutions—understanding how money works has always been my passion. Yet, in my early years, I made my fair share of personal financial missteps. In the late 1980s when the financial markets crashed, I lost my job, along with thousands of other people. I made a good salary but was living hand to mouth. I saved in my 401(k) but did not have an emergency fund. I ended up having to cash out my 401(k) to meet my expenses. That was a huge mistake.

In fact, not having an emergency fund, and cashing out your 401(k) ranks very high among the worst financial mistakes a person could make. I had to pay a penalty and I was taxed on the amount I received. The net amount was not meaningful compared to what it would be worth today if I’d kept the money invested.

Once I landed a new job, I decided to educate myself. Keep in mind, I worked in finance. I was surrounded by money talk all day. However, my area of focus was the Asian stock markets and I worked with large institutional clients. My market knowledge had little overlap with personal financial knowledge. I wanted to achieve financial independence, which I define as being in a position financially to live the life you want to live, whatever that looks like for you and for the people who rely on you.

We Need to Talk About Money

Many of us are raised to believe that money is not an acceptable topic of polite conversation. We often learn from our parents that it is a taboo subject. Maybe when you were young, you asked your dad how much money he made or how much the house cost, and you were shot down for asking. Perhaps your parents were uncomfortable about their money because they had a lot (or not enough), and didn’t want to talk about it, let alone teach you how to manage it.

Having spent most of my career on a trading floor, I can say that men who work there talk about four things – what to have for lunch, relationships, sports, and money (not necessarily in that order!). It’s a fluid conversation. If they don’t know the answer to a money question, they’ll ask their buddy or their financial advisor. Not knowing or not understanding is not a slam on their manhood-no shame. As a result, they routinely ask the questions they need to ask, and they are comfortable with taking a stab at trying to manage their money.

Most women are very comfortable talking about their children or marriage at some level. We commiserate, we share stories and solutions. We hold each other up through tough times. We know it takes a village.

However, we rarely share how we manage our financial lives. We are often entirely in the dark on how our parents are planning to fund their retirement. Some of us don’t really know how much we have for retirement because we’ve let our spouses manage it. We wonder how our friends are funding their kids’ college plans. How do they manage their family finances – do they have a joint account, or separate accounts? We need to ask these questions and hear the answers because if we don’t, we can be blindsided by events.

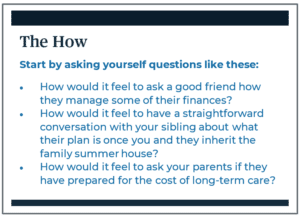

Note: none of these questions are about how much money anyone has. You’re not asking for numbers; you’re sharing strategies and knowledge.

How to Get Started

S

A few starter questions:

- Can I ask you a personal question about how you manage your family finances?

- How are you and your partner thinking about retirement?

- Do you have individual IRAs and 401(k) plans? How do you talk about it? Have you shared your numbers with each other? Do you have a coordinated plan?

- How are you managing saving for retirement and college? Are you expecting your kids to contribute to their college education or will others in your family help out?

Consider Practicing with a Coach

Last fall, a woman came to me because she had no idea how much she and her husband had saved for retirement. She was anxious because her husband kept putting her off whenever she asked about it. We worked together to come up with a list of questions and practiced some responses so she could get comfortable.

Her initial questions to him were met with a bit of hostility. His first response had been, “Why the sudden interest?”. Then, “Why are you asking?”. Other responses from other women I’ve coached include things like, “You wouldn’t know what I was talking about anyway,” or “Why do you want to know now after all these years?” and “Don’t you trust me?”.

We practiced responses together. After some practice she was able to respond with, “I’m asking because I’d like to understand our finances better. You’ve done all the work for a long time, and I’d like to help share the responsibility of managing our money.”

This is about opening up the money conversation so you can begin to fully engage in your financial life. You have the ability to take control of your financial life and seek what wealth means to you. It begins with this conversation.