I am writing this from my laptop, while attending a conference on “Artificial Intelligence in Financial Technology” at Stanford University on Friday, June 17, 2022. I must admit there is a feeling that I am, along with professors, grad students, and former colleagues, fiddling with far-out finance topics whilst very immediate and practical issues face our investors.

Why go, then? One reason is that this conference had been paused for three years due to COVID shutdowns. Further, now more than ever, it is important to interact with colleagues on the leading edge as one may find new ideas and opportunities.

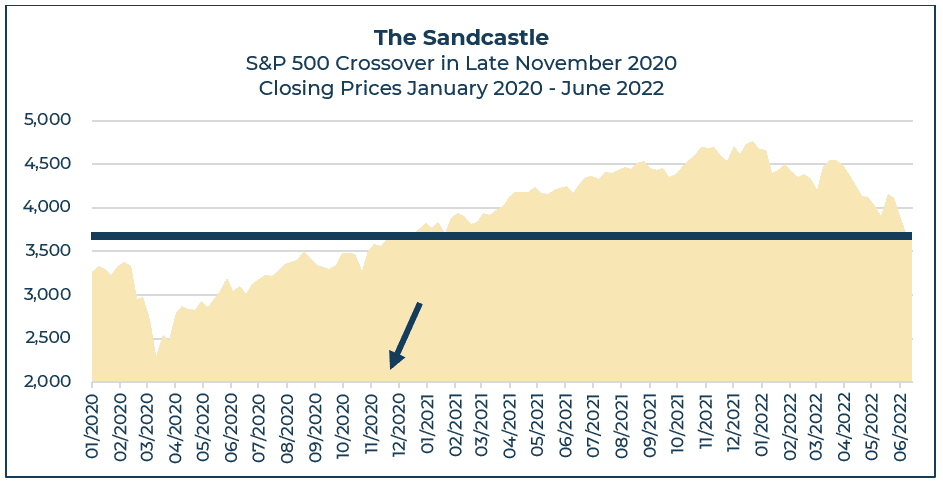

When we think about our portfolios this year so far, an unusual aspect is how much the stock market has been down this year in comparison to how much the market was up in prior years, including during COVID lockdowns. What came “easily” – with S&P 500 up 28% in 2019, up 16% in 2020, up 27% in 2021 – was partially washed away, with S&P 500 down 23% in 2022 year-to-date. It is as if a toddler had built a remarkable sandcastle on the beach, and now a sneaker wave had come in to flatten part of it, and the toddler is now having a fit. My chart, “The Sandcastle,” shows how much of a setback we have experienced, indicated by the horizontal navy-blue line. Where we are now corresponds to where we were back around Thanksgiving 2020 – roughly speaking, an eighteen-month setback.

Source: Yahoo Finance

Source: Yahoo Finance

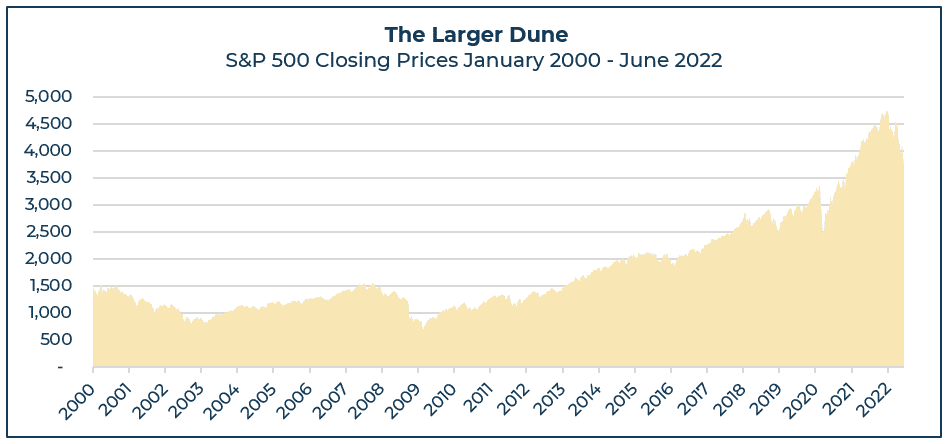

Back to the sandcastle metaphor, we see that beyond our flattened sandcastle, there is a large dune built up in our favor by persistent waves washing in the sand over time. Over the last ten years, the U.S. stock market has grown to 2.75x what it was, for a compounded annual return of approximately 10.7%. Our current emotion about the destruction of the sandcastle is important, but less painful in this broader context. The dune will build itself back again, as it is the nature of our investments to adapt and grow. In the shorter term, I must caution that we are at “high tide” in terms of global market conditions, and present conditions imply more risk than usual; there could be more storms ahead that would erode a part of the dune. We continue to monitor and assess our portfolios’ asset allocation and strategy selection. Thus far, our portfolios are down of course, but overall, our style of investing has recently performed better than portfolios of average investors.

Source: Yahoo Finance

Source: Yahoo Finance

I can hear chatter from many young financial engineers here at this conference who have been devastated by the destruction in value of their cryptocurrency investments (e.g., Bitcoin), some down about 80% year-to-date. This kind of investing is highly speculative, and this type of investor typically does not have a financial plan. Instead, our clients have been smarter by investing in a portfolio with diversified exposures that we expect to earn a satisfactory return over the long term, building upon that metaphorical dune, and helping attain their financial goals.

As always, we invite you to reach out to your advisor to review your portfolio and financial projections. We are here for you.

Source: Yahoo Finance

Source: Yahoo Finance Source: Yahoo Finance

Source: Yahoo Finance

2024 1st Quarter Commentary: “In a world drenched in pessimism, it pays to be optimistic.”

With so much emphasis placed on negative headlines, negative developments globally, and the ability to embrace one’s inner negativity, it ...